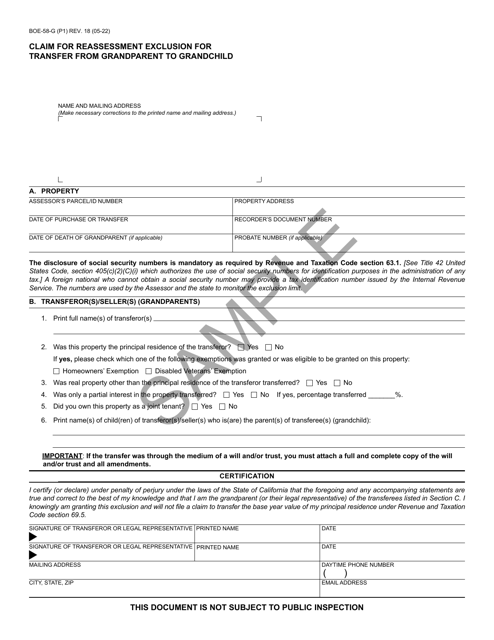

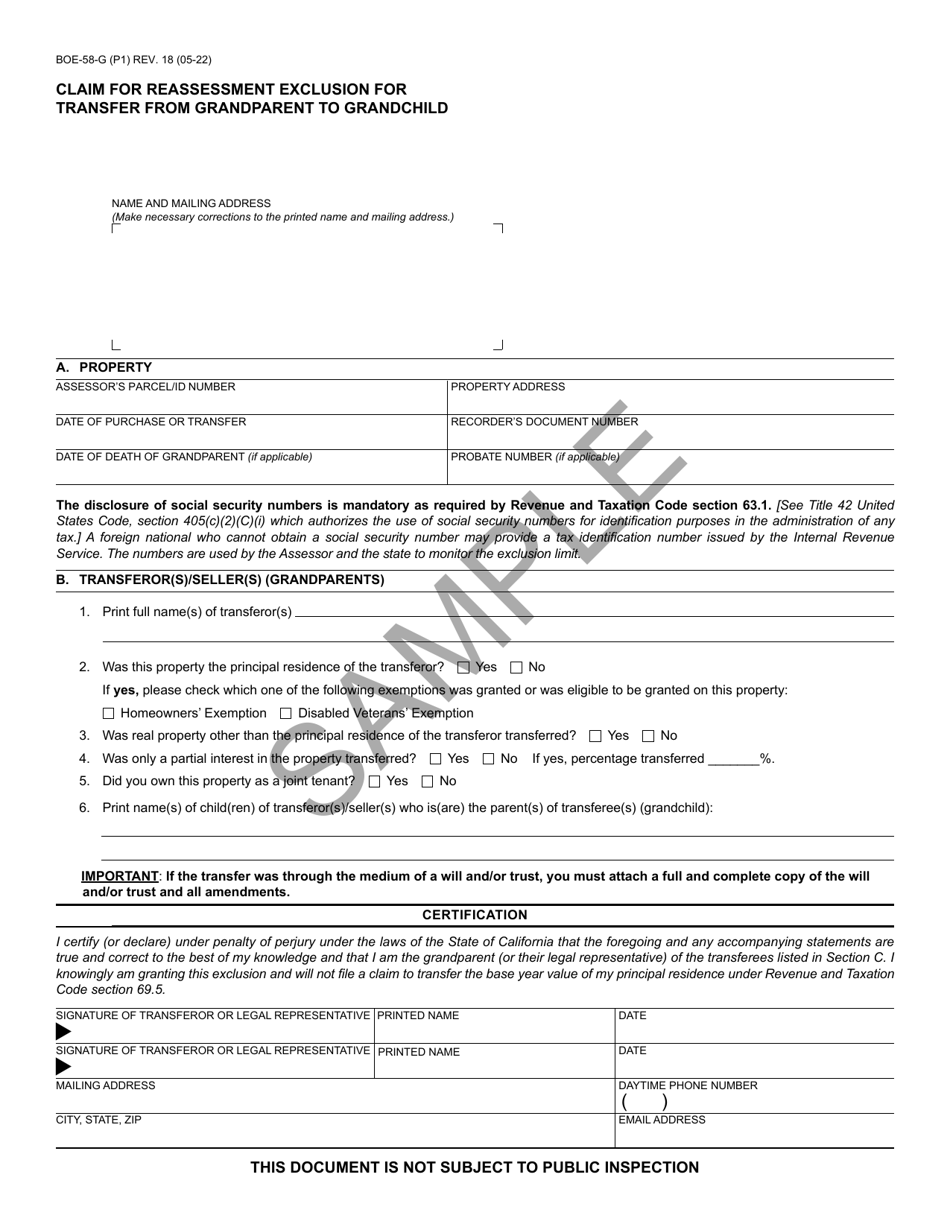

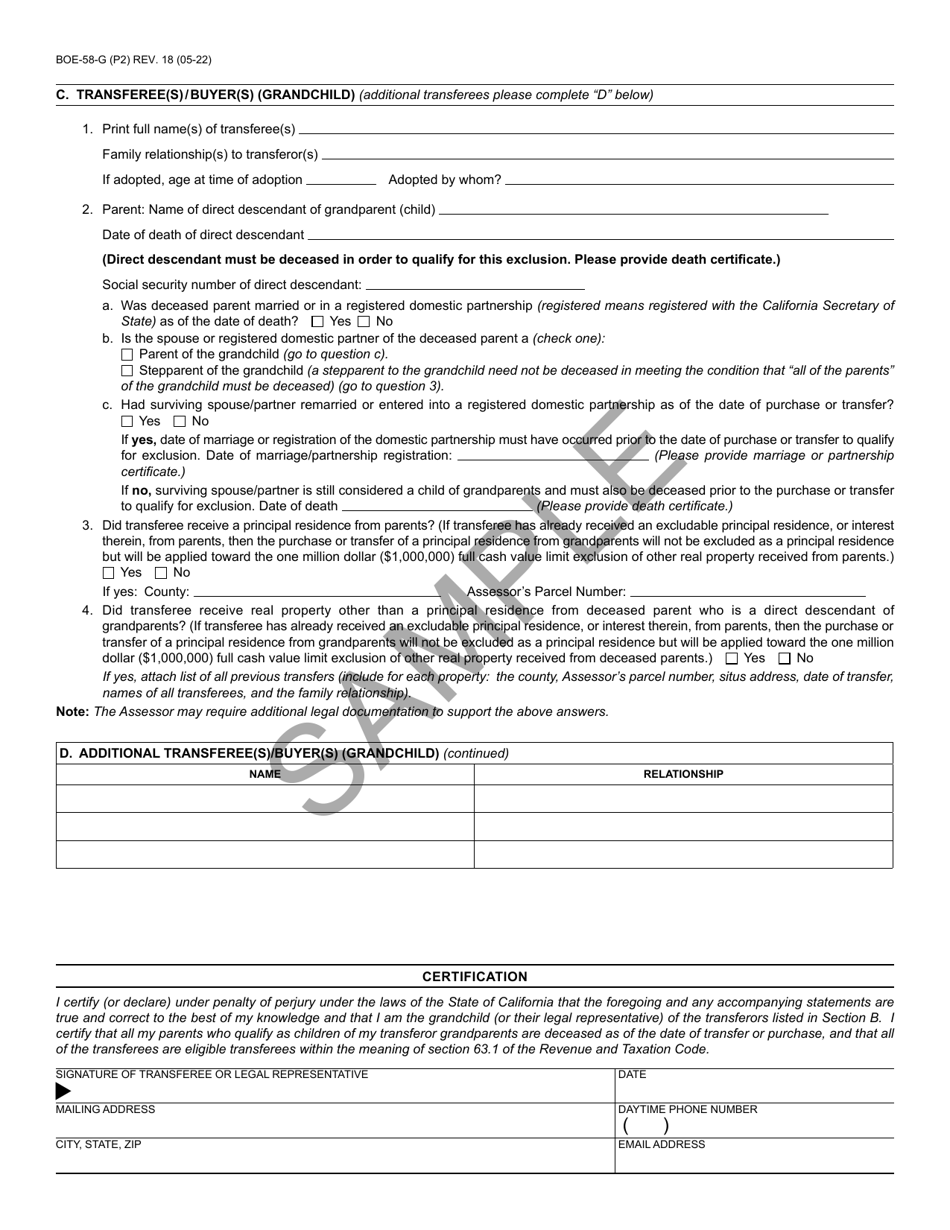

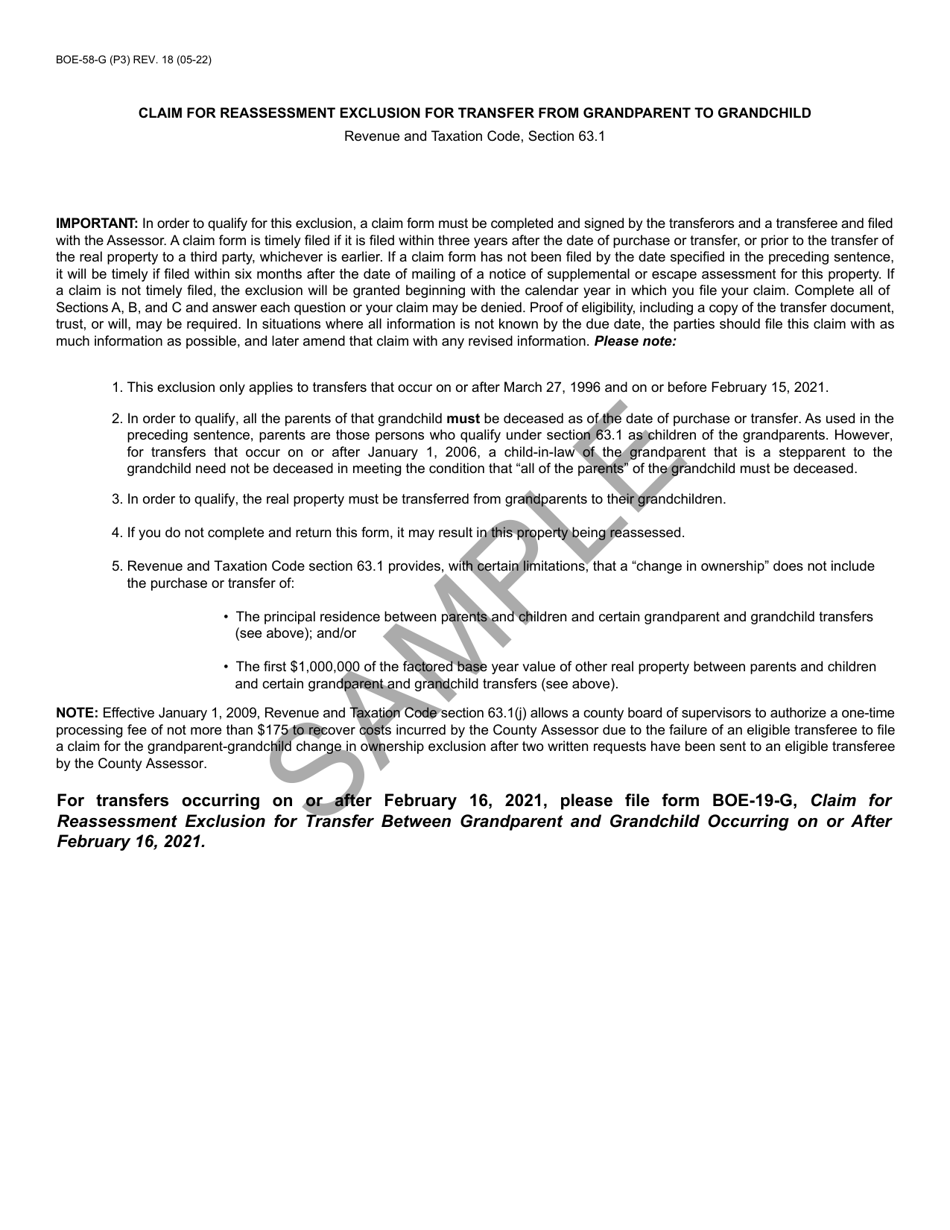

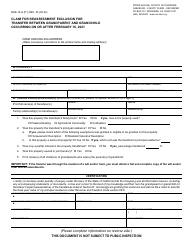

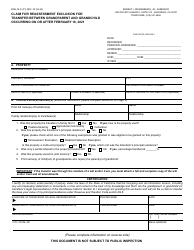

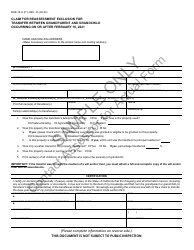

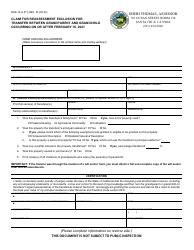

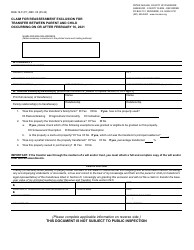

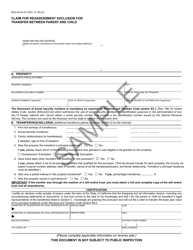

Form BOE-58-G Claim for Reassessment Exclusion for Transfer From Grandparent to Grandchild - Sample - California

What Is Form BOE-58-G?

This is a legal form that was released by the California State Board of Equalization - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

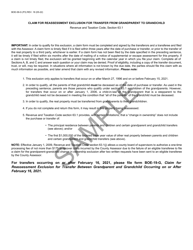

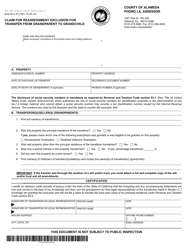

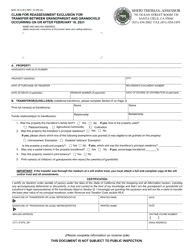

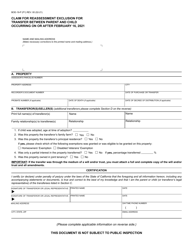

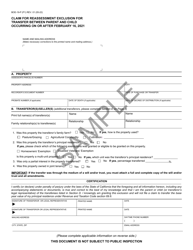

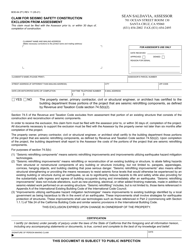

Q: What is BOE-58-G?A: BOE-58-G is a claim form for reassessment exclusion for transfer from grandparent to grandchild.

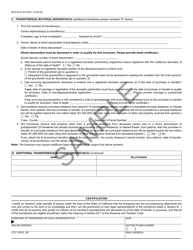

Q: What does the reassessment exclusion mean?A: The reassessment exclusion allows for the transfer of property from a grandparent to a grandchild without triggering a reassessment of the property's value for property tax purposes.

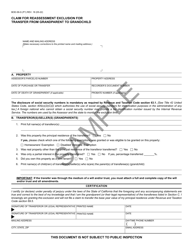

Q: Who is eligible to file the BOE-58-G form?A: Grandchildren who inherit property from their grandparents can file the BOE-58-G form to claim the reassessment exclusion.

Q: What are the requirements for filing the BOE-58-G form?A: The property must be eligible for the reassessment exclusion, and certain conditions such as ownership time and use may need to be met.

Q: Are there any fees associated with filing the BOE-58-G form?A: There is no fee for filing the BOE-58-G form.

Q: What is the purpose of the BOE-58-G form?A: The purpose of the BOE-58-G form is to claim a reassessment exclusion for the transfer of property from a grandparent to a grandchild.

Q: What happens if the BOE-58-G form is approved?A: If the BOE-58-G form is approved, the property will not be reassessed, and the property tax liability will not increase as a result of the transfer.