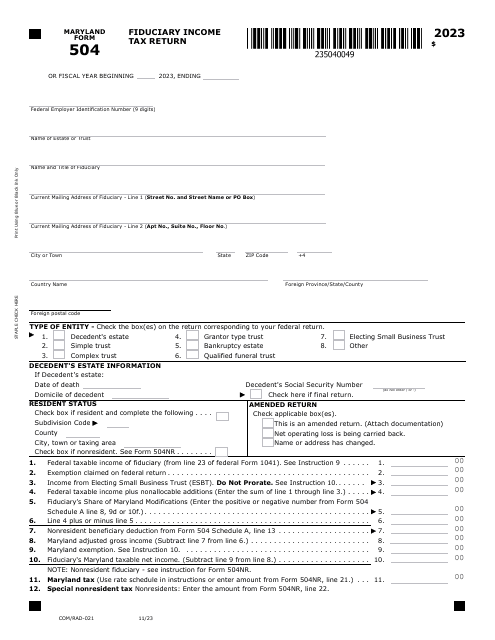

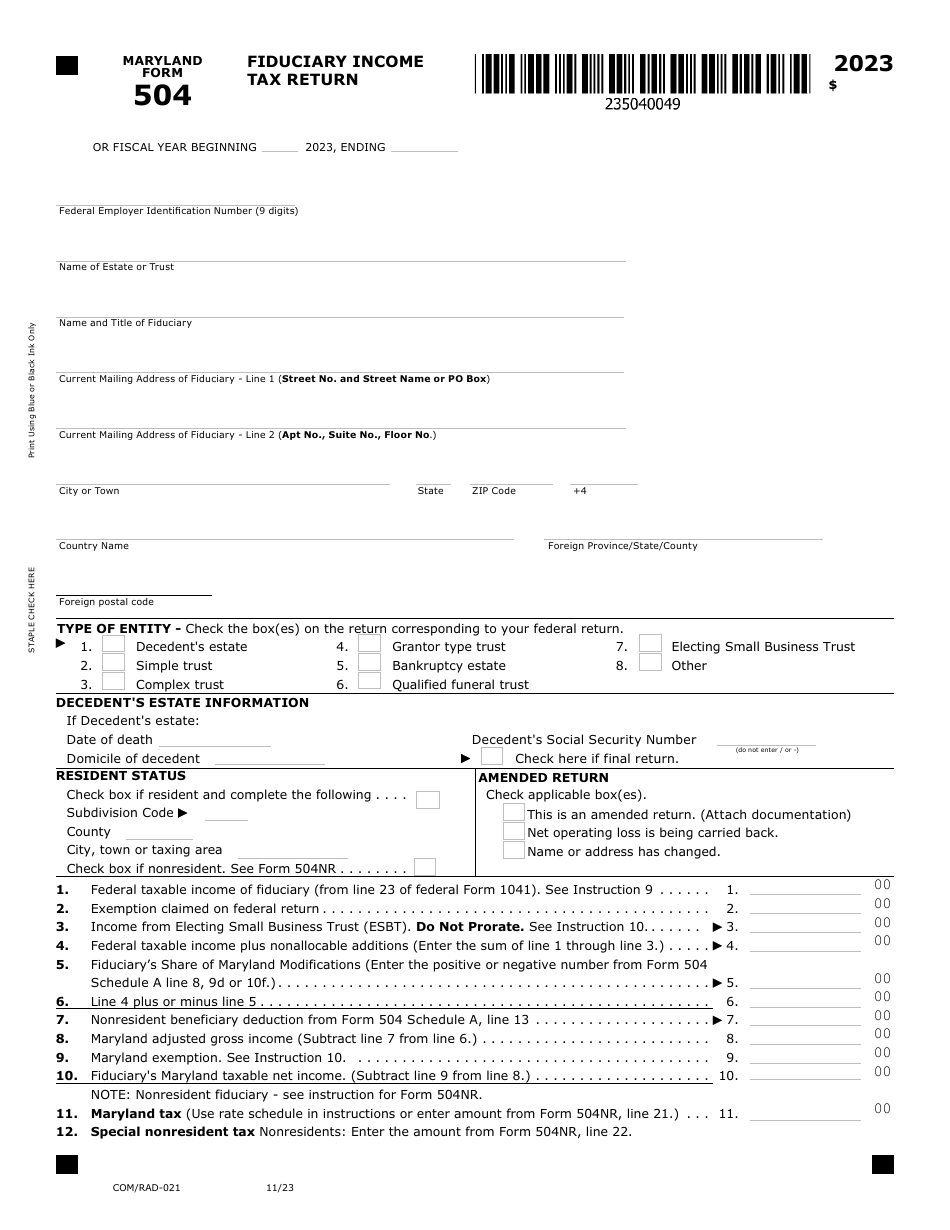

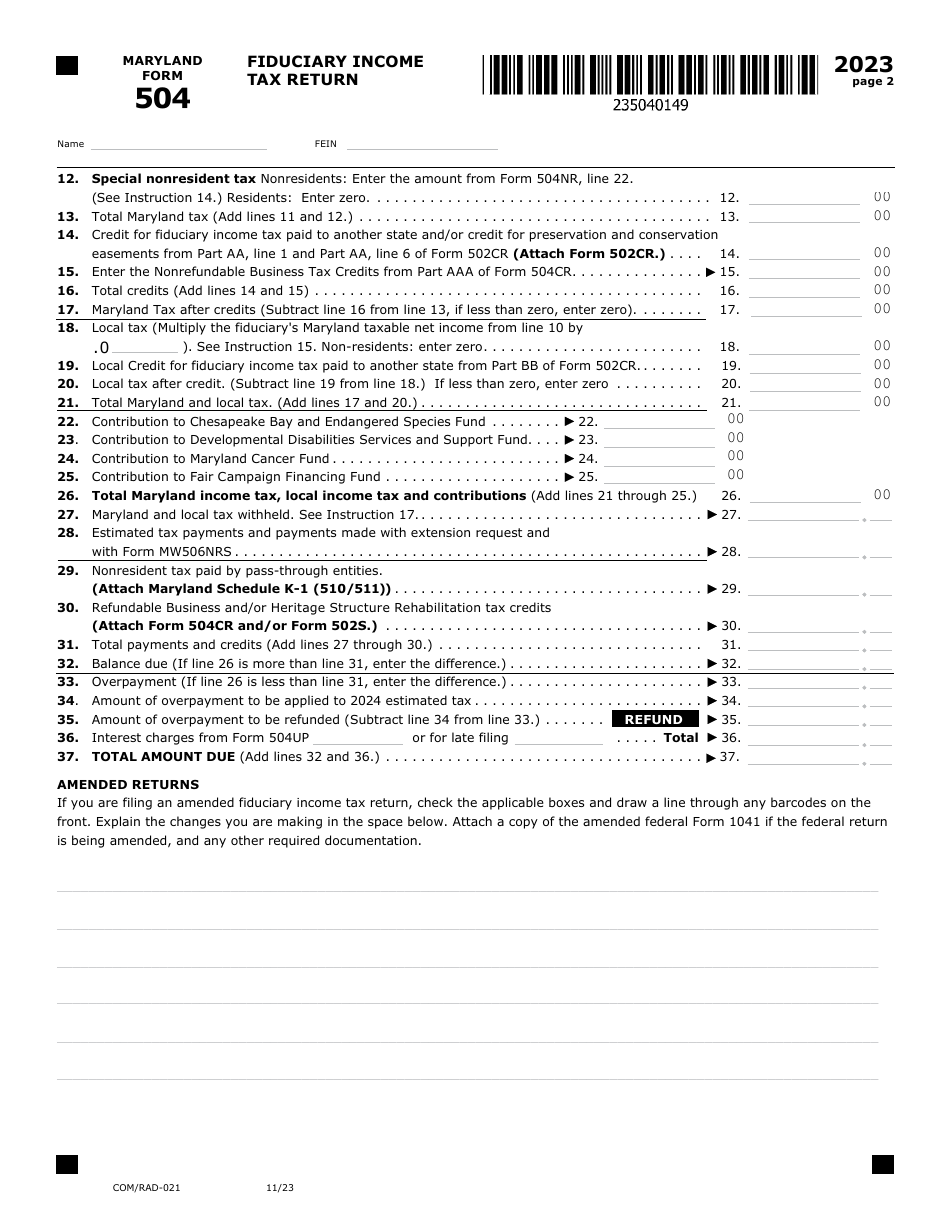

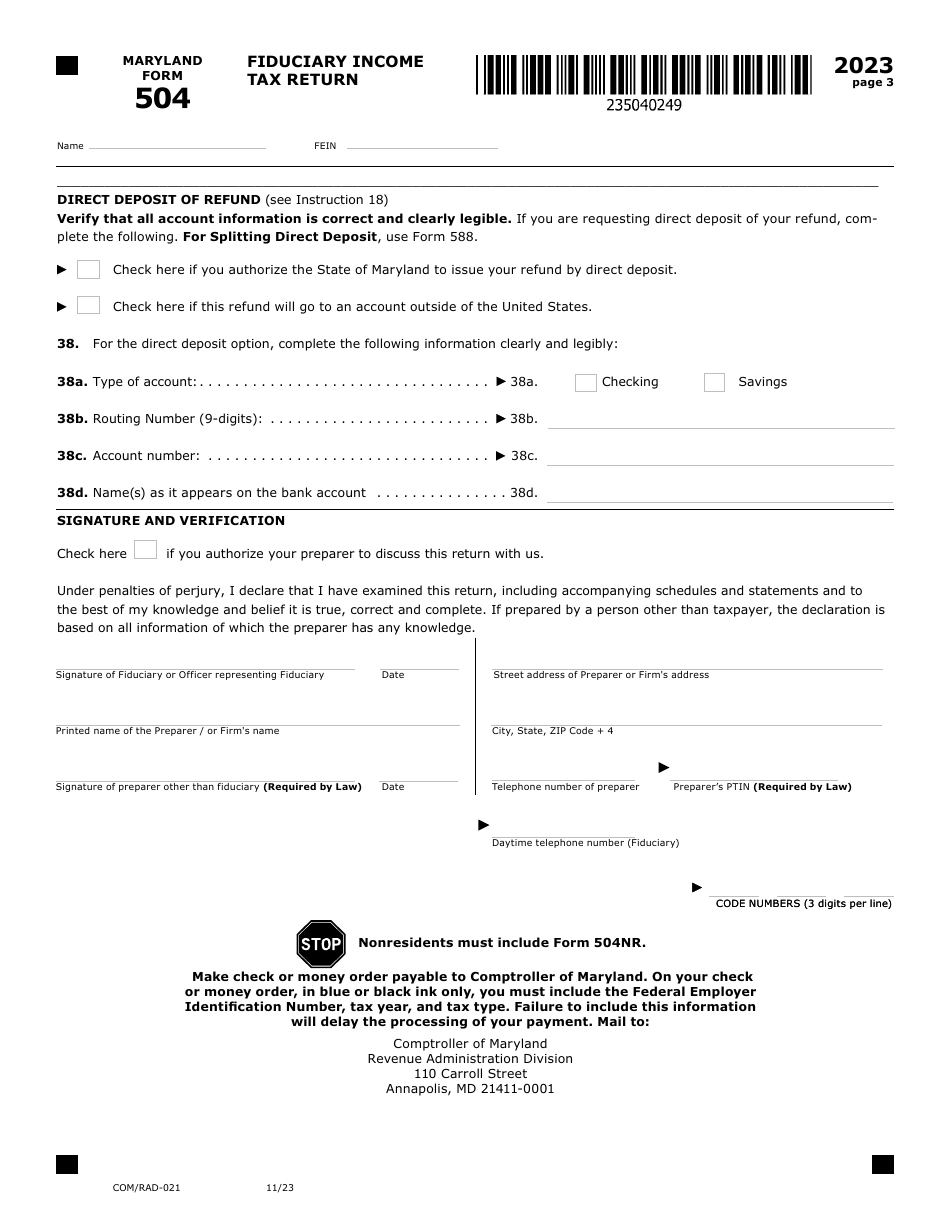

Maryland Form 504 (COM / RAD-021) Fiduciary Income Tax Return - Maryland

Fill PDF Online

Fill out online for free

without registration or credit card