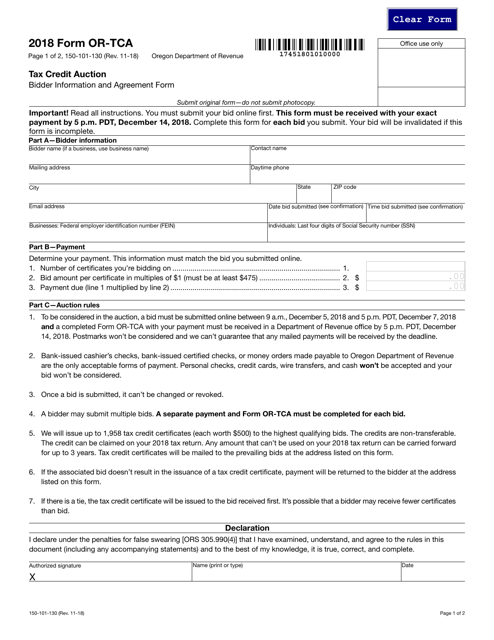

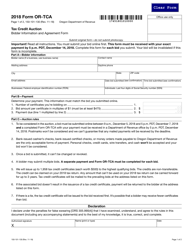

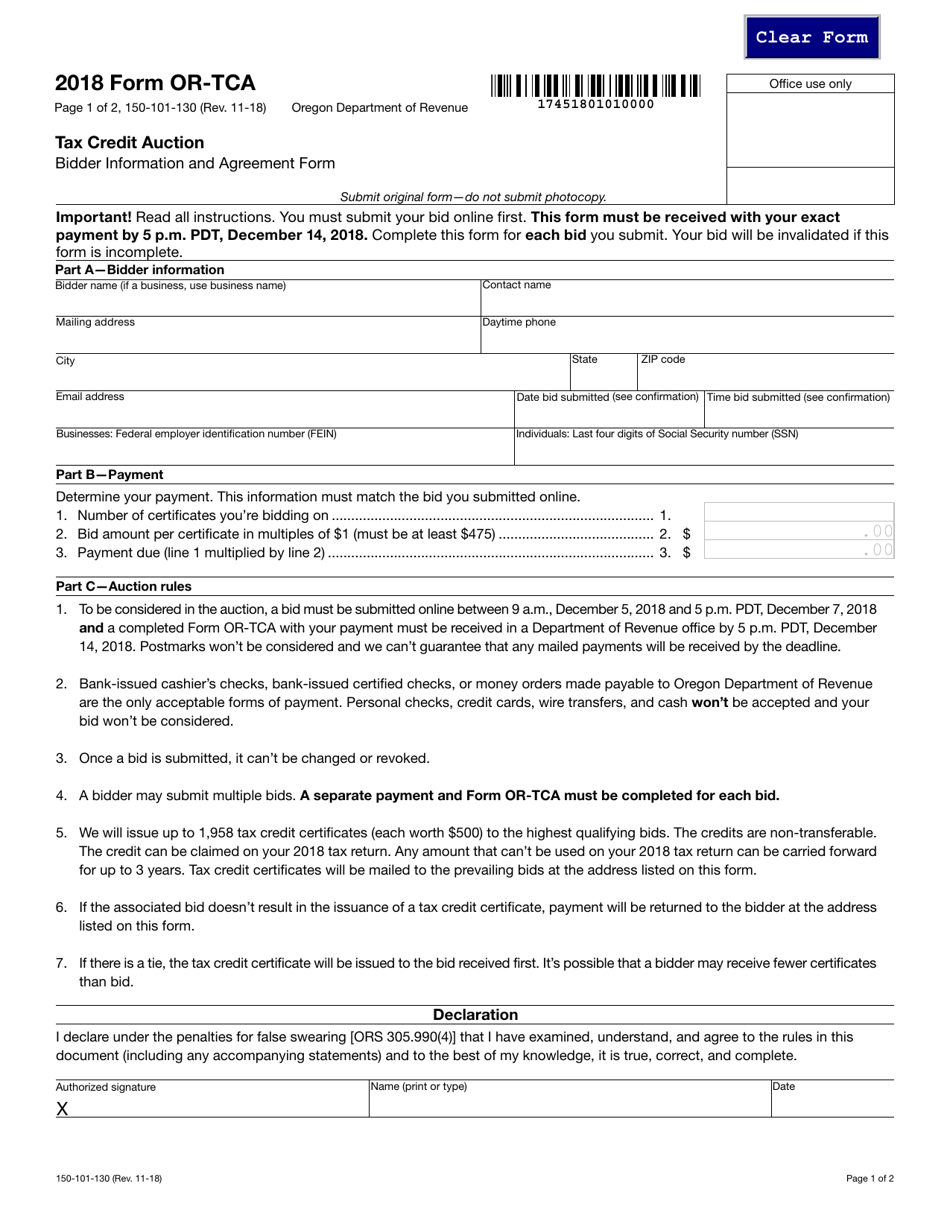

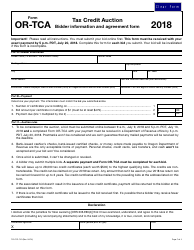

Form 150-101-130 (OR-TCA) Tax Credit Auction - Oregon

What Is Form 150-101-130 (OR-TCA)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-101-130 (OR-TCA)?A: Form 150-101-130 (OR-TCA) is a form used for participating in the Tax Credit Auction (TCA) in Oregon.

Q: What is the Tax Credit Auction (TCA)?A: The Tax Credit Auction (TCA) is a program in Oregon where individuals and businesses can bid on tax credits offered by the state.

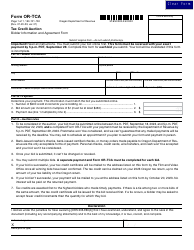

Q: Who can participate in the Tax Credit Auction?A: Both individuals and businesses can participate in the Tax Credit Auction.

Q: What is the purpose of the Tax Credit Auction?A: The purpose of the Tax Credit Auction is to provide a way for the state of Oregon to raise funds by selling tax credits to bidders.

Q: How does the Tax Credit Auction work?A: During the Tax Credit Auction, bidders submit offers to purchase tax credits. The highest bidders are awarded the credits.

Q: What can the tax credits be used for?A: The tax credits obtained through the Tax Credit Auction can be applied towards reducing a taxpayer's liability on their Oregon tax return.

Q: Are there any eligibility requirements for participating in the Tax Credit Auction?A: Yes, there may be eligibility requirements to participate in the Tax Credit Auction. It is recommended to review the specific requirements outlined by the Oregon Department of Revenue.