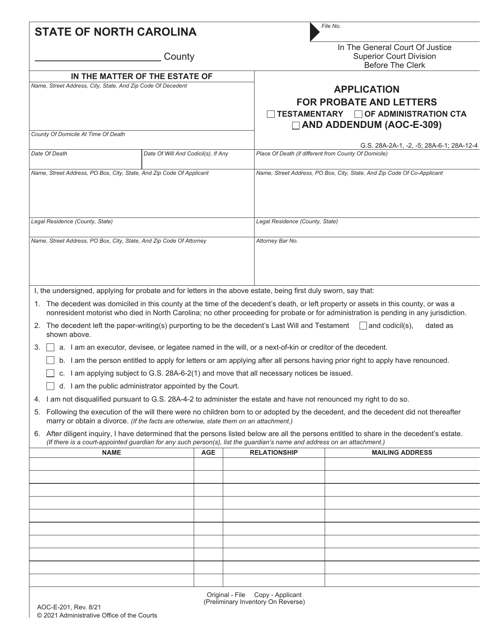

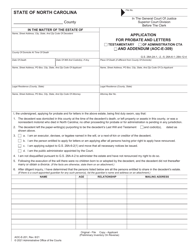

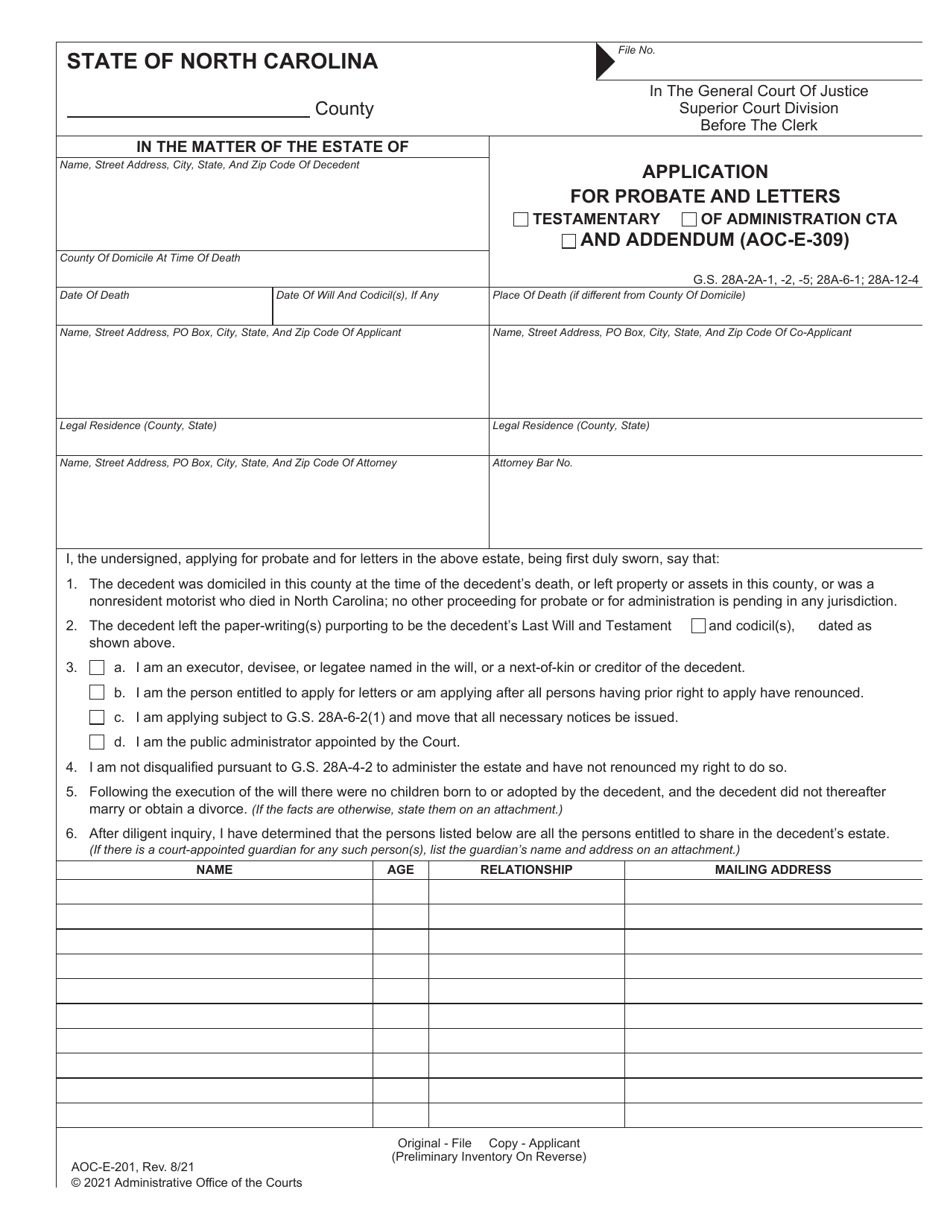

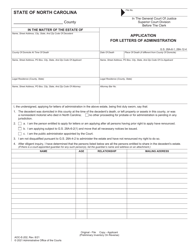

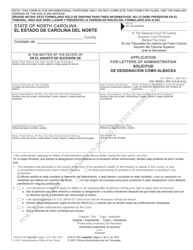

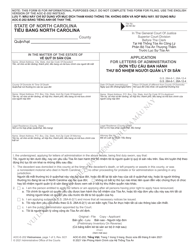

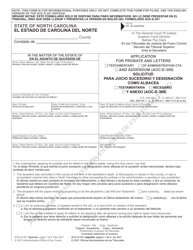

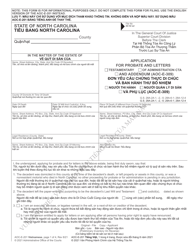

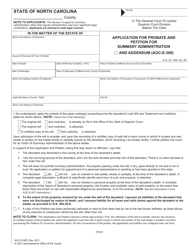

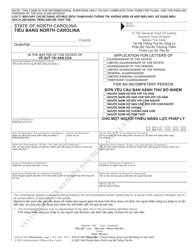

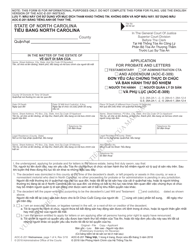

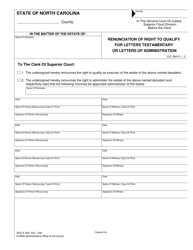

Form AOC-E-201 Application for Probate and Letters Testamentary / Of Administration Cta - North Carolina

What Is Form AOC-E-201?

This is a legal form that was released by the North Carolina Superior Court - a government authority operating within North Carolina. Check the official instructions before completing and submitting the form.

FAQ

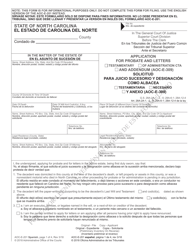

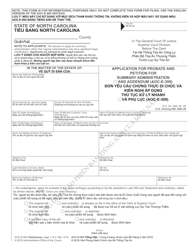

Q: What is form AOC-E-201?A: Form AOC-E-201 is an application for probate and letters testamentary/of administration Cta in North Carolina.

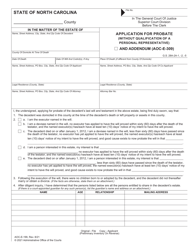

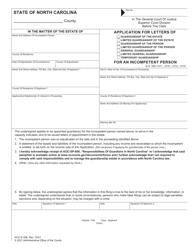

Q: What is the purpose of form AOC-E-201?A: The purpose of form AOC-E-201 is to apply for probate and request letters testamentary or letters of administration Cta in North Carolina.

Q: Who is eligible to use form AOC-E-201?A: Executors or administrators of an estate who are applying for probate and letters testamentary/letters of administration Cta in North Carolina can use form AOC-E-201.

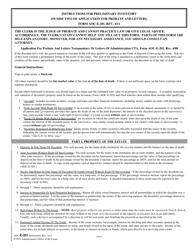

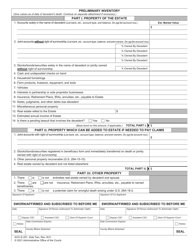

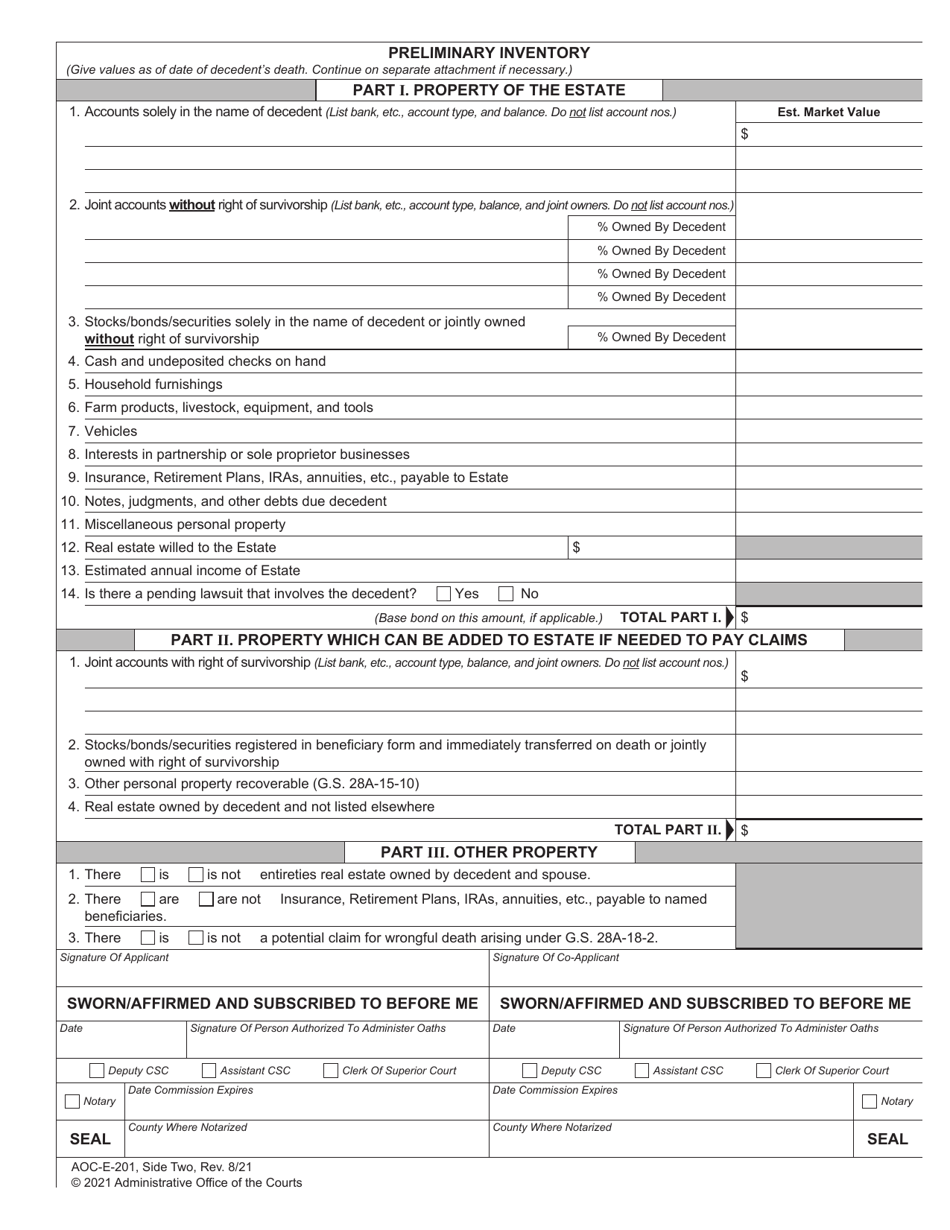

Q: What should be included in form AOC-E-201?A: Form AOC-E-201 should include details about the deceased person, the executor/administrator, the estate assets, and other required information as specified in the form.

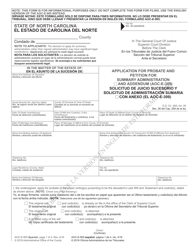

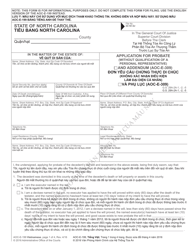

Q: Are there any fees associated with form AOC-E-201?A: Yes, there may be filing fees associated with form AOC-E-201. The fees vary by county, so it is advisable to check with the local county probate court for the exact fee amount.

Q: Is legal assistance required to fill out form AOC-E-201?A: While legal assistance is not required, it is recommended to consult with an attorney or seek legal advice when filling out form AOC-E-201 to ensure accuracy and compliance with North Carolina probate laws.

Q: What is the deadline for submitting form AOC-E-201?A: There is no specific deadline mentioned for submitting form AOC-E-201. However, it is recommended to file the application for probate and letters testamentary/letters of administration Cta as soon as possible after the death of the decedent.

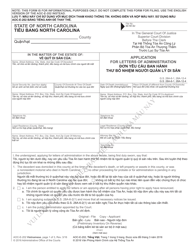

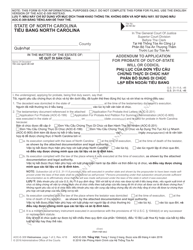

Q: What happens after submitting form AOC-E-201?A: After submitting form AOC-E-201, the probate court will review the application, and if approved, issue the letters testamentary or letters of administration Cta to the executor/administrator, granting them the authority to administer the estate.