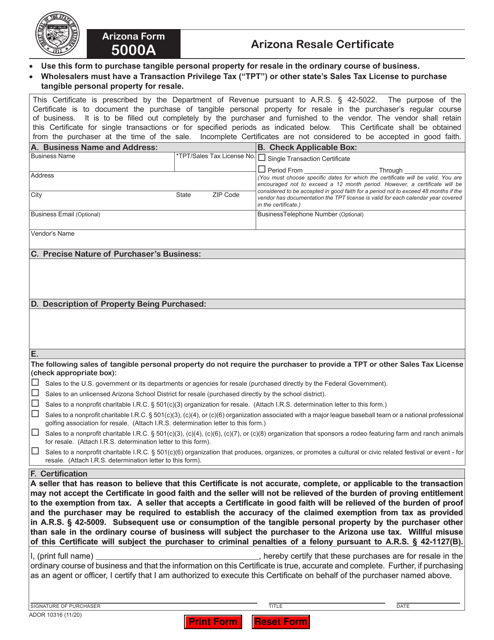

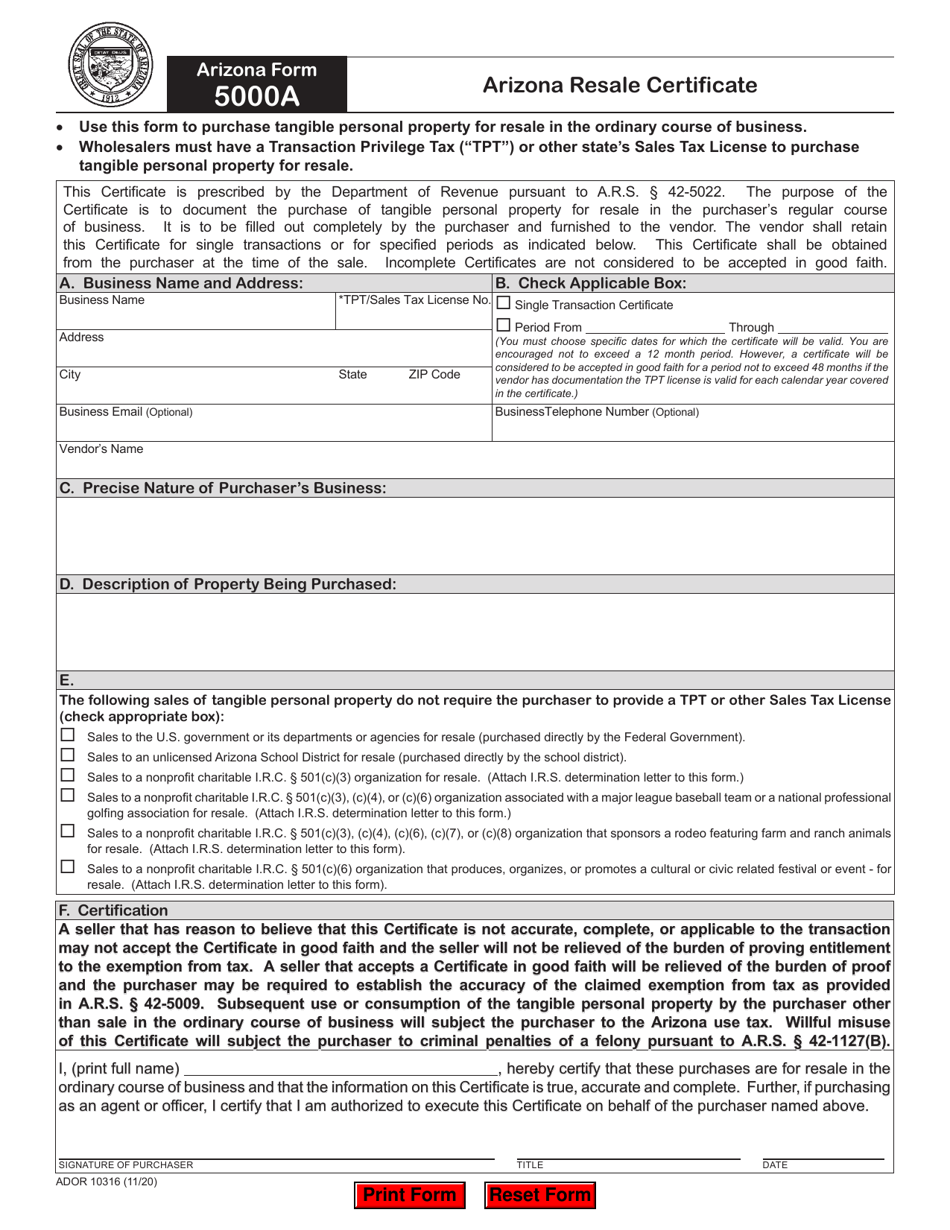

Arizona Form 5000A (ADOR10316) Arizona Resale Certificate - Arizona

What Is Form 5000A?

Arizona Form 5000A, Arizona Resale Certificate is a document released by Arizona's Department of Revenue . The application is supposed to be completely filled out and signed by a purchaser, and provided to a seller in order to document the purchase of a physical piece of personal property for resale. Sellers use Form 5000A for single transactions or for periods of time as stated in the application itself. A vendor should take it from a buyer at the time of a sale.

Alternate Name:

- AZ 5000A Form.

The state of Arizona has a Transaction Privilege Tax (TPT), a tax on sellers for the privilege of doing business in Arizona. Presenting an AZ 5000A Form allows wholesalers to avoid paying TPT on some items. In other words, an Arizona Resale Certificate is used to claim TPT exemptions from a vendor when making purchases for resale so the document is applicable only for those vendors who have an Arizona TPT License or another state's sales tax License.

Arizona Form 5000A was last published on November 1, 2020 , and this version is still in use. A fillable version of the form is available for download below.

What Is the Difference Between AZ Form 5000 and 5000A?

Arizona Form 5000A may be confused with Arizona Form 5000, TPT Exemption Certificate, the purpose of which is to document and establish a base for state and city tax deductions or exemptions. Two general features of the application are:

- Form 5000 must not be used to claim sale for resale.

- Form 5000 must not be used if you don't have a TPT license.

How to Get a Resale Certificate in Arizona?

The Arizona Department of Revenue created certificate forms, including AZ 5000A, which contains certain types of information. However, a purchaser may use an alternative (or non-department) certificate form of an Arizona Resale Certificate, but only if it was created in accordance with the Arizona Transaction Privilege Tax Procedure TPP 17-1 (an instruction that provides general guidance for taxpayers). The certificate must contain the following information:

- The purchaser's name and address;

- The precise nature of the purchaser's business;

- The purpose for which the purchase was made (or the purpose for which thebusiness activity was conducted);

- The necessary facts to establish an appropriate exemption ( e.g. , a description ofthe property purchased and its use);

- If applicable, the purchaser's TPT license number;

- A certification that the person executing the certificate is authorized to do so onbehalf of the purchaser, including that person's signature.

When a vendor gets an AZ 5000A Form from a purchaser they may require any additional documents to verify that the information presented in the application is valid. A document must be accepted by a vendor in good faith, meaning with honesty and with no knowledge of any circumstances that should cause the seller to deny the exemption claimed on the certificate.

How to Fill Out Arizona Form 5000A?

-

An Arizona Resale Certificate follows the common structure of most government applications. After an introduction stating the authority and purpose of the application comes a section that is to be filled with personal information called "Business Name and Address." Besides the name and the full address, the section includes a location for a TPT License number or Sales Tax License number.

-

The next section consists of two checkable boxes where an applicant must choose either of the following:

- The document will be valid for a single transaction;

- The document will be valid for a certain period of time (you are obliged to state the period of time if applicable).

-

The Precise Nature of the Purchaser's Business section and Description of Property Being Purchased section present empty boxes which need to be filled out accurately, so the vendor wouldn't have a reason to question the information in it. The applicant should describe the nature of the business clearly and transparently. The property should be described precisely, including identifying features.

-

The last part of Arizona Form 5000A is called Certification. Here, an applicant certifies that:

- The purchases are for resale only;

- The certificate contains valid and complete information;

- The representative is authorized to issue the certificate on behalf of the purchaser named in the application (agent or officer).

-

The document ends with the signature of an applicant and a date. When a purchaser presents the filled out application, a vendor is supposed to value the information presented and accept it if the certificate is:

- Complete;

- Contains all of the required information;

- The information appears to be accurate.