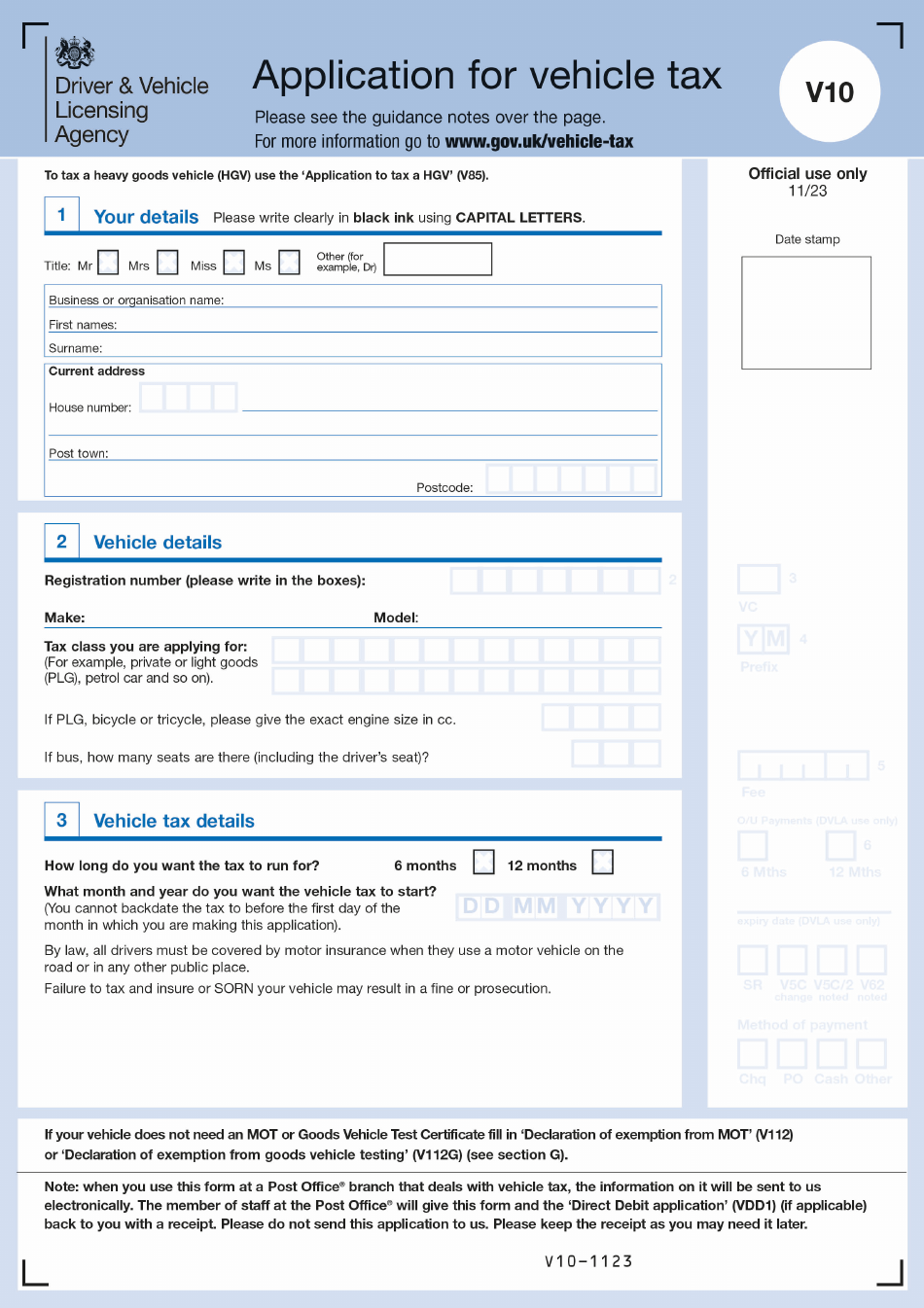

Form V10 Application for Vehicle Tax - United Kingdom

What Is V10 Form?

Form V10, Application for Vehicle Tax , is a document prepared by vehicle owners to tax their vehicles. The form was issued by the United Kingdom Driver & Vehicle Licensing Agency (DVLA). The latest version of the document became available on November 1, 2023 , with all previous editions obsolete. You may download a printable V10 Form via the link below.

Alternate Names:

- Car Tax Form;

- V10 Tax Form.

If your car was registered in the United Kingdom, it is your responsibility to pay car tax. You can do it two months in advance whether it is your first application or your current tax expires while you are unable to send the application. The amount of tax you have to pay will depend on the year your vehicle was bought.

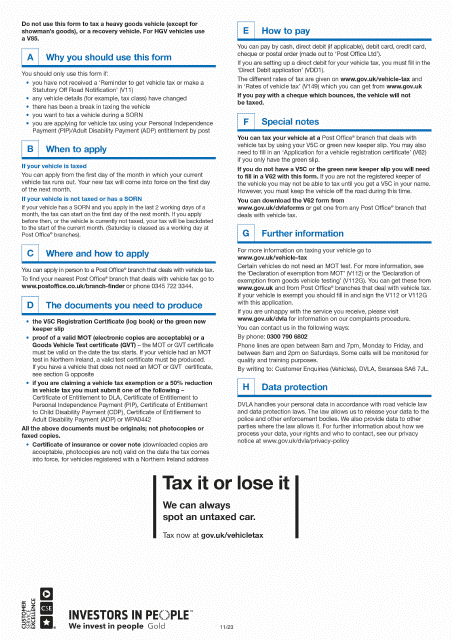

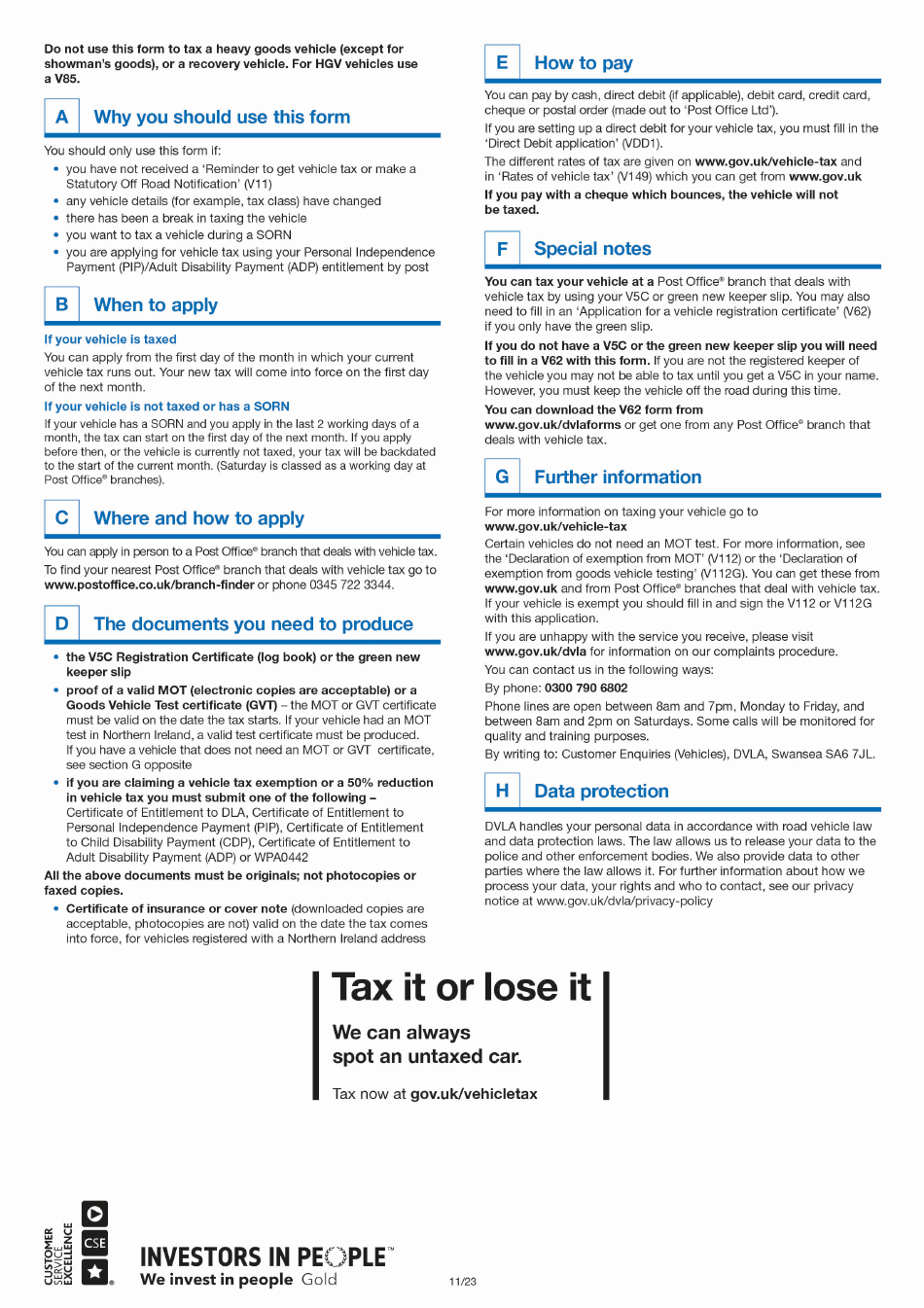

Do not fill out this application if you did not receive Form V11, Tax Reminder . It is only necessary if any vehicle details have been modified, there has been a taxing break, the vehicle cannot be parked or driven on a public road yet you want to tax the vehicle, or you are making an application while using your personal independent payment entitlement by post.

How to Fill Out V10 Form?

Here is how you need to complete the V10 Tax Form:

- Start with your personal details. Write down your title and full name. If you are preparing this document on behalf of the business, indicate its name instead. Add your current mailing address - this information must be relevant so you will be able to receive correspondence.

- Describe your vehicle - state its registration number, make, and model. Record the tax class you are requesting with this application. If you own a bicycle, tricycle, private car, or a light goods vehicle, indicate its engine size in cubic centimeters. In case you are filling out an application for a bus, you have to write down the number of seats it has - note that you must include the driver's seat as well.

- Tick the appropriate box to select the preferred option - how long will the tax cover your vehicle, for 6 or 12 months. When you apply for the vehicle registration, the tax runs for 12 months; after that, it is up to you to choose a rate.

- Write down the date you want the vehicle tax to start. The tax will start on the first day of the next month if you are applying in the last two days of the month. In all other instances, the coverage will be backdated to the first day of the month in which you are submitting this form.

Once you have completed the application, you can present it in person at your local Post Office that handles vehicle tax. The information you provide in the document will be sent to the DVLA in electronic form and you will obtain a receipt.