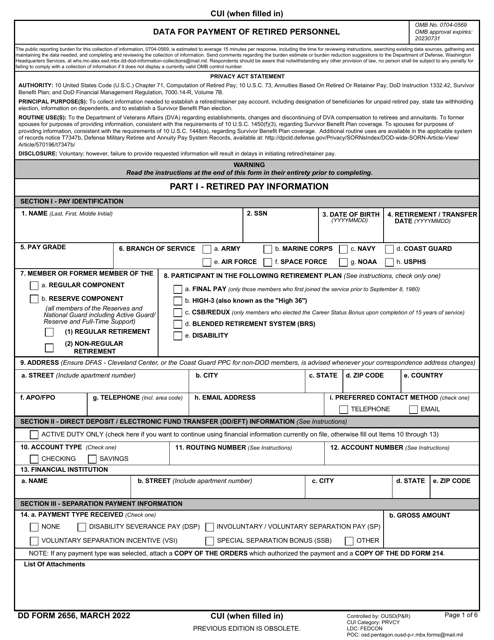

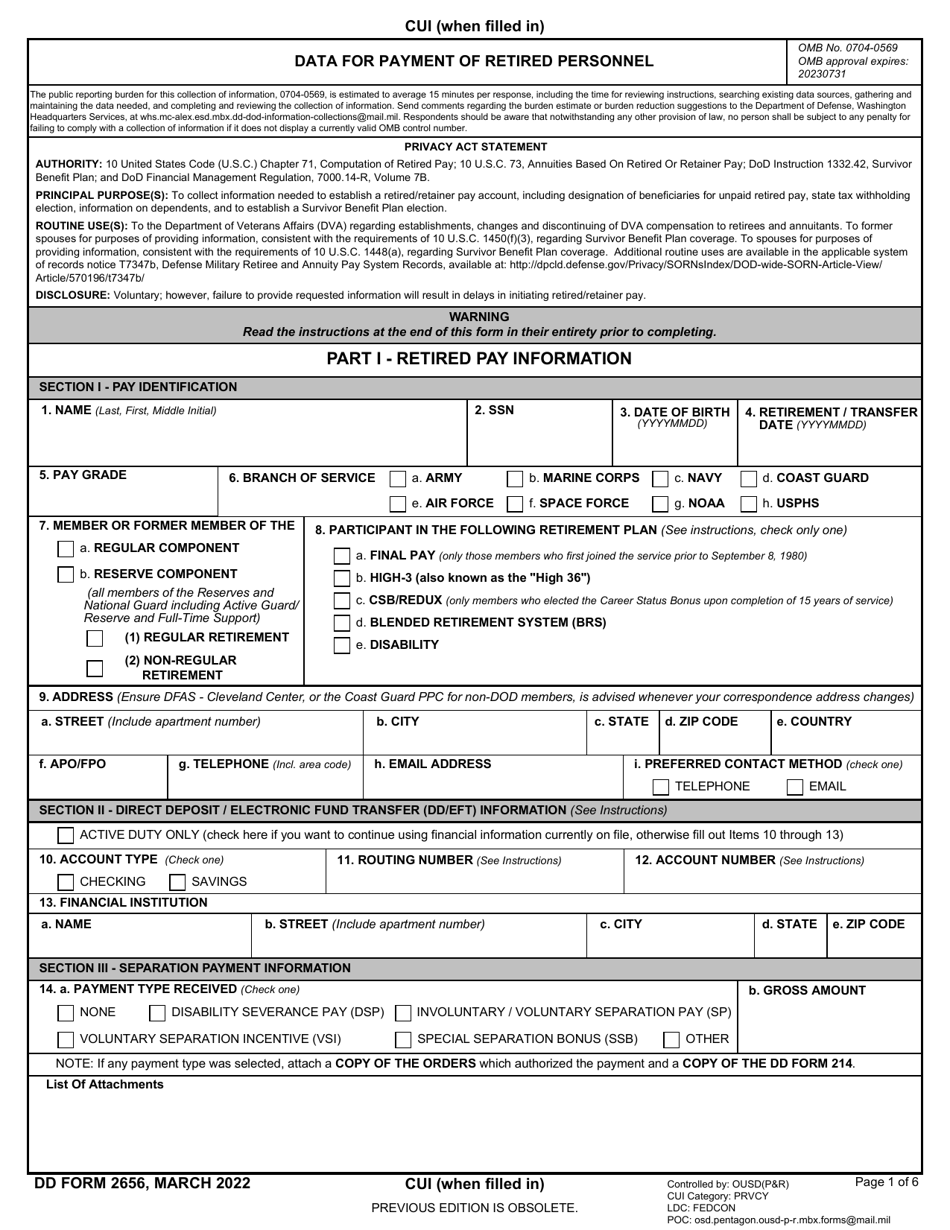

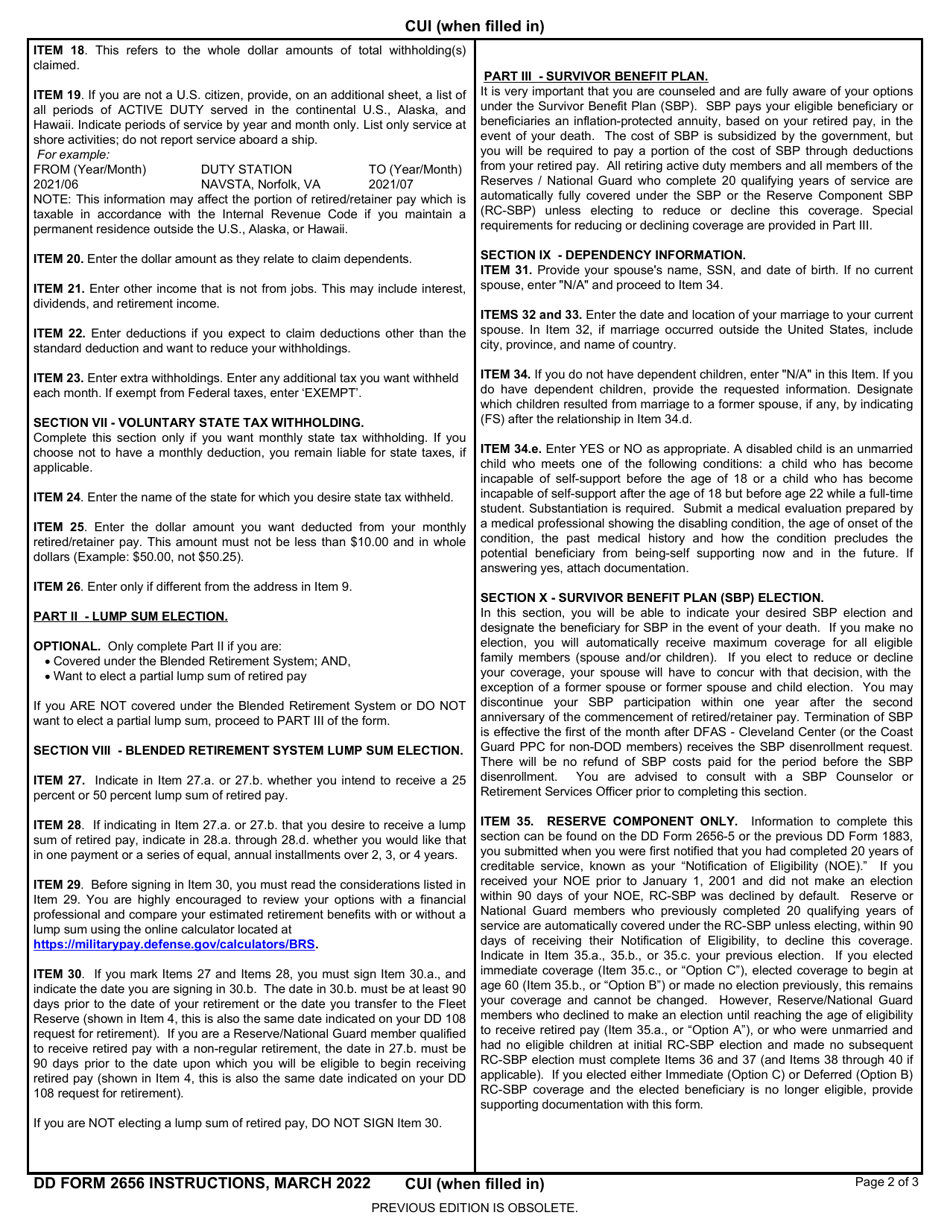

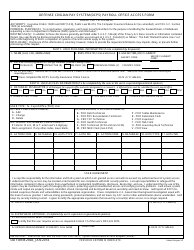

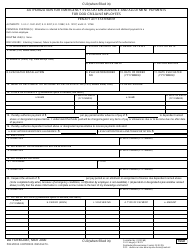

DD Form 2656 Data for Payment of Retired Personnel

What Is DD Form 2656?

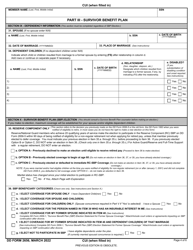

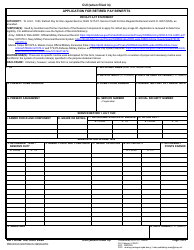

DD Form 2656, Data for Payment of Retired Personnel, is used to elect an SBP and designate beneficiaries for retired pay. A fillable DD Form 2656 is available for download and digital filing below or can be accessed through the Executive Services Directorate website.

The latest edition of the form - sometimes incorrectly referred to as the DA Form 2656 - was issued by the Department of Defense (DoD) on March 1, 2022 , and provides relevant information needed to establish a retainer or retired pay account and gathers information on any dependents the retiree may have.

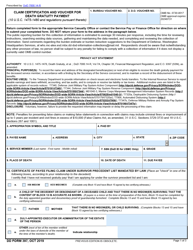

Where Do I Submit DD Form 2656?

There is no mailing address for DD Form 2656. Once you have completed the form, your Branch of Service will send it along with all supporting documentation to DFAS Retired and Annuitant (R&A) Pay for processing.

DD Form 2656 Instructions

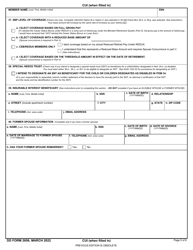

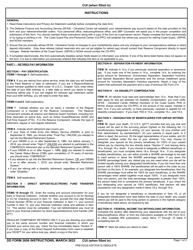

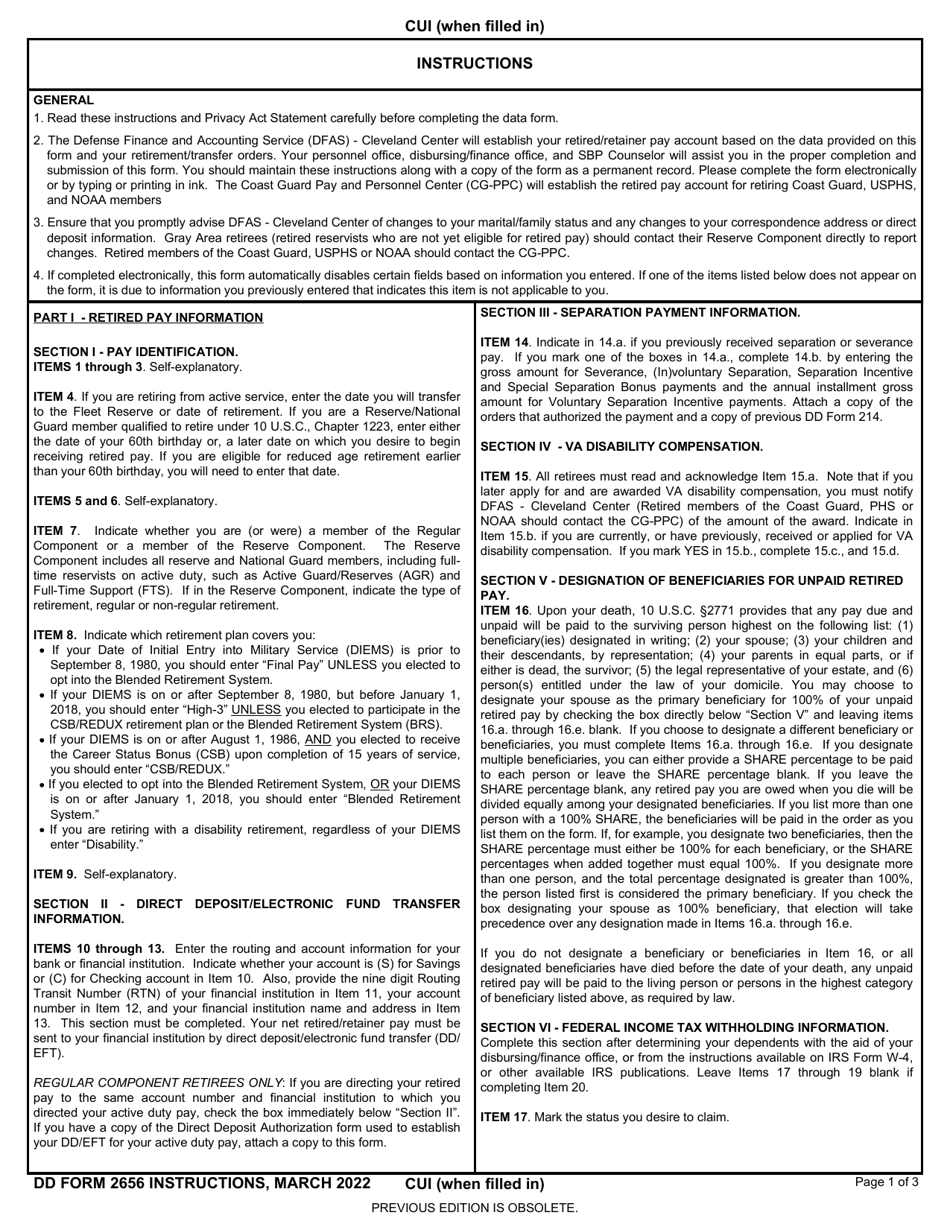

The form is divided into five parts with each providing specific data about the retiree, their dependents, and applicable benefits needed for establishing a retired or retainer pay account.

-

Part I gathers retired pay information and consists of Sections I through VII.

-

Items 1 through 3 identify the applicant. Item 4 is for entering the date of retirement or transfer to Reserve.

-

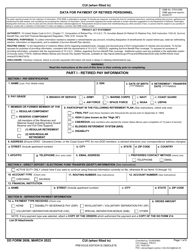

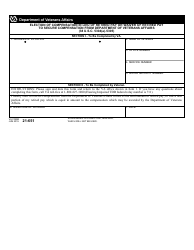

Item 7 is used to indicate whether the applicant is or was a member of the Active or Reserve Component. Item 8 identifies the retirement plan that covers the retiree. Items 5, 6, and 9 are self-explanatory. Items 10, 11, 12, and 13 describe the bank account information of the retiree and the type of account. Item 14 is for identifying any previous separation or severance pay. Item 15 covers VA disability compensation and the monthly amount of award.

-

Item 16 is for designating beneficiaries for unpaid retired pay. If the retiree does not designate a beneficiary in Item 16 any unpaid retired pay will be paid to the surviving person highest on the following list:

- The retiree's spouse;

- Their children or descendants;

- To both parents in equal parts;

- To the legal representative in their estate.

-

Section VI of Part I consists of Items 17 through 21 and provides federal tax withholding information. Section VII - Items 22, 23, and 24 - covers voluntary state tax withholding.

-

-

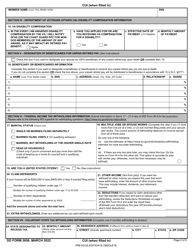

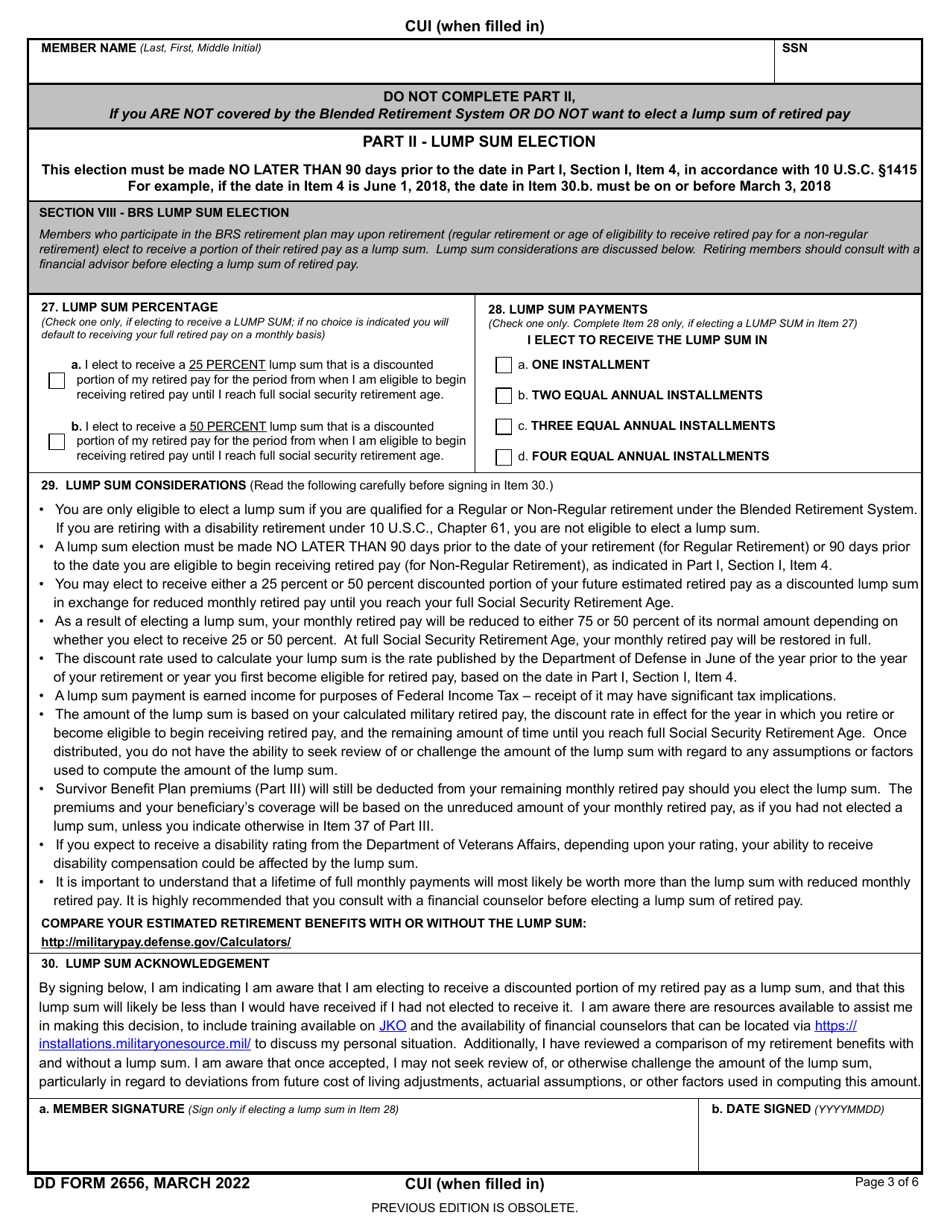

Part II, Lump-Sum Election is optional. Items 25 through 28 in Section VIII are only filed if the retiree is covered under the Blended Retirement System and wants to elect a partial lump-sum of retired pay.

-

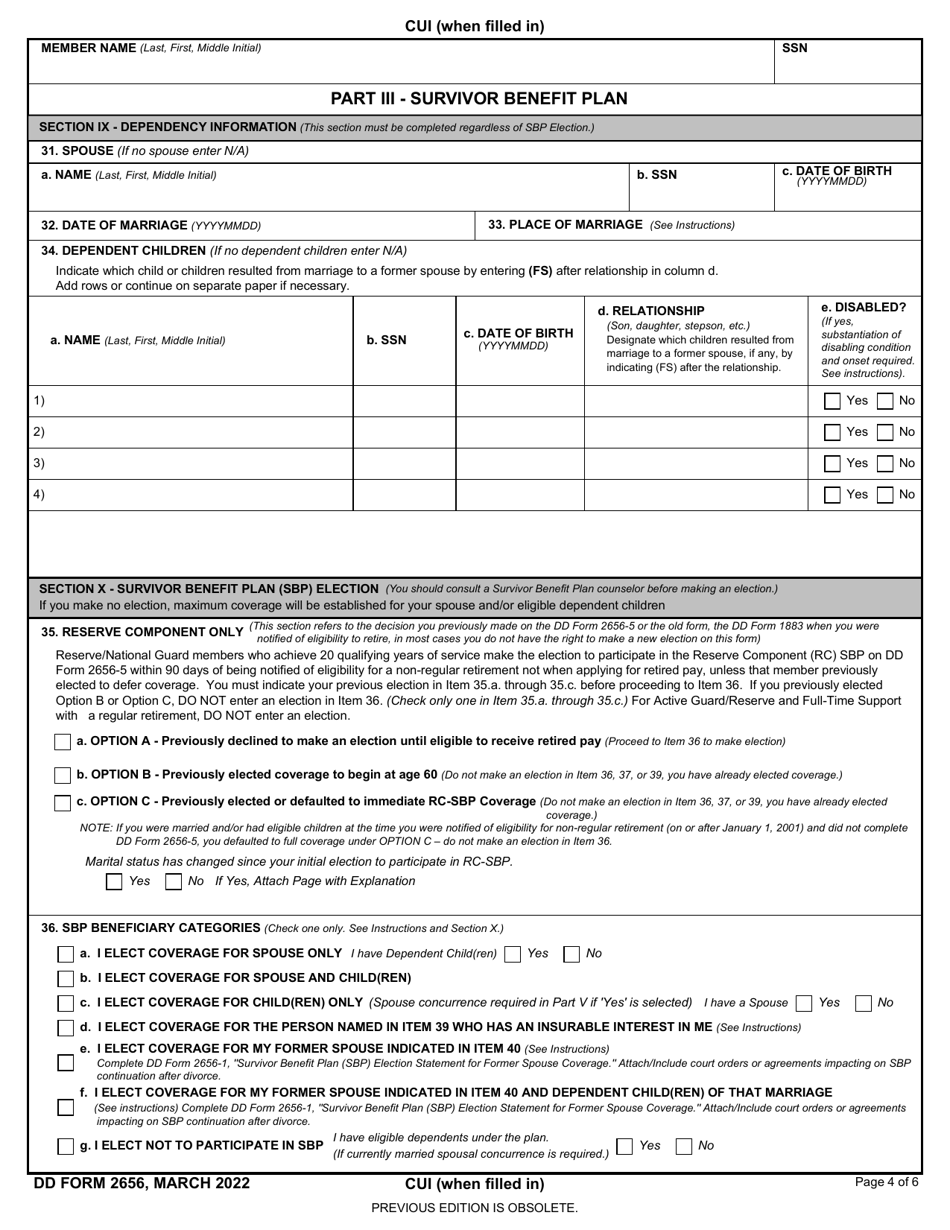

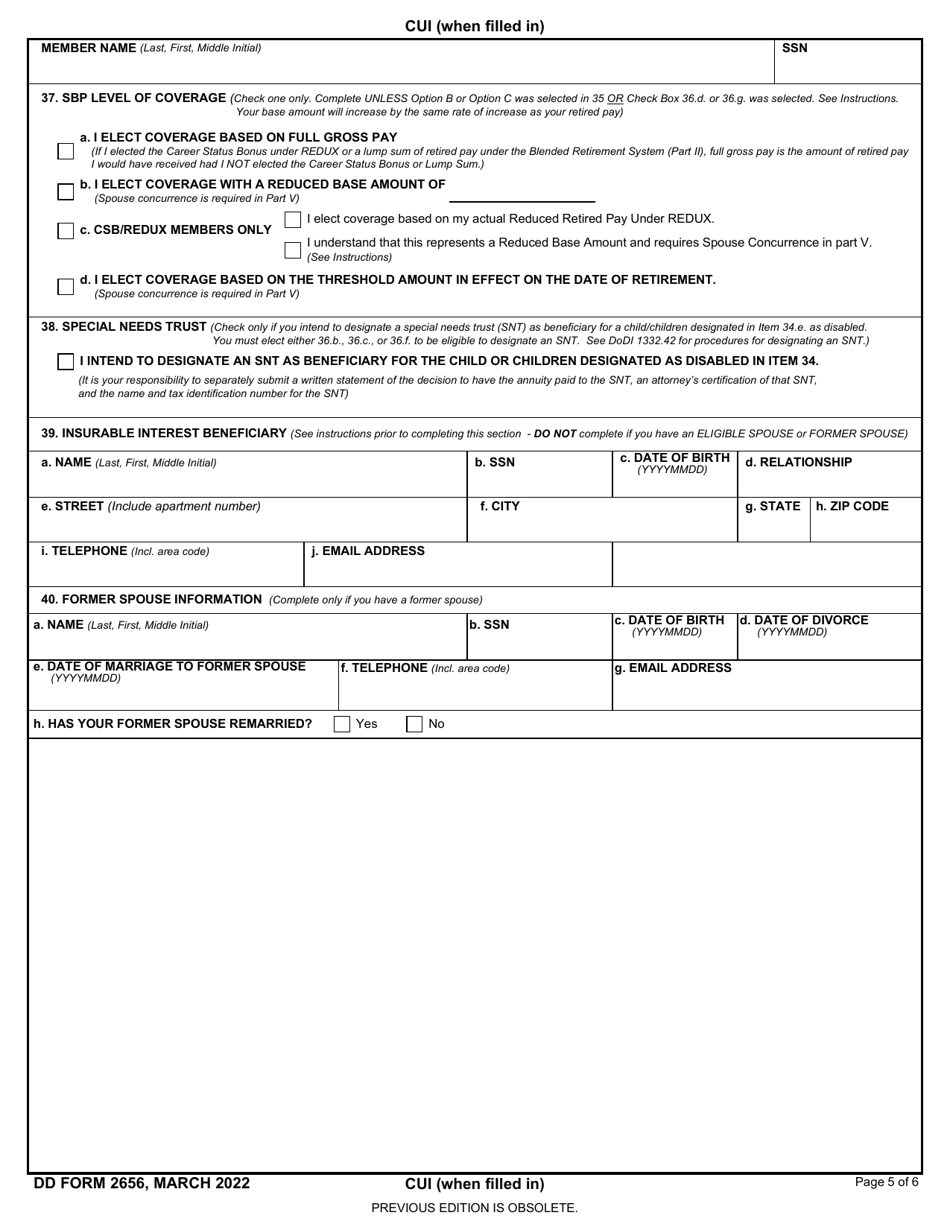

Part III is the Survivor Benefit Plan . The SBP pays an inflation-protected annuity to the eligible beneficiary in the event of the retiree's death. Items 29 through 32 provide information about the retiree's spouse and children as well as information about any disabled dependents. The retiree indicates their desired SBP election and designates beneficiaries for SBP in event of death in Section X (Items 33 through 38).

-

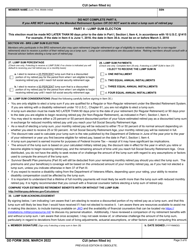

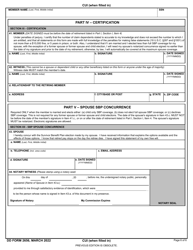

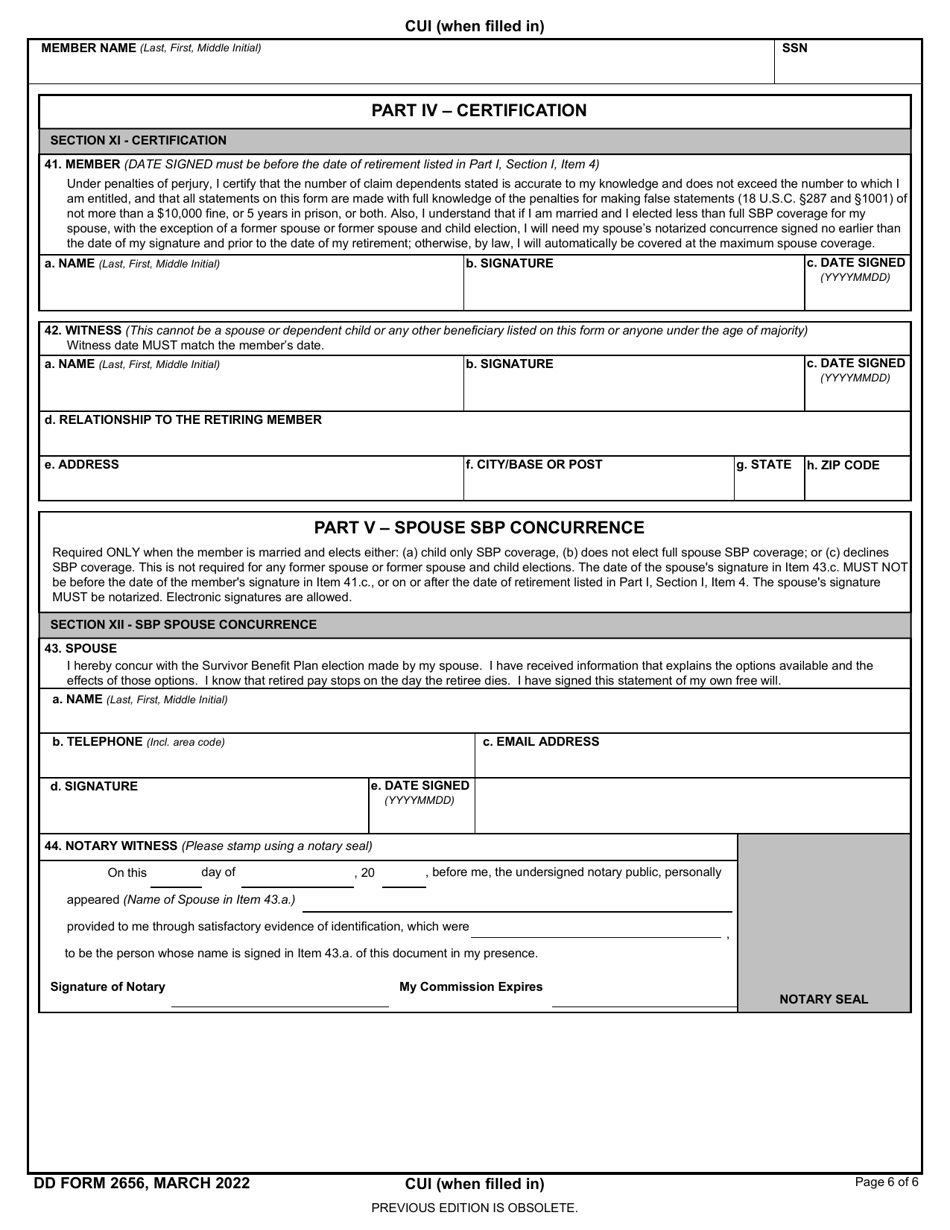

Part IV - or Section XI - consists of Items 39 and 40. The retiree and a witness must certify that the number of withholding exemptions claimed do not exceed the number to which the retiree is entitled by signing the appropriate lines.

Who Qualifies for Section V of the DD Form 2656?

Completing Part V, Spouse SBP Concurrence is required only if the retiree declined to elect SBP coverage, elected less than the maximum coverage or elected child-only coverage while having a spouse. Item 41 is signed by the spouse to signify concurrence with the SBP election made by the retiree. Item 42 is signed by a Notary Witness.

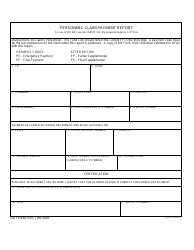

DD 2656 Related Forms:

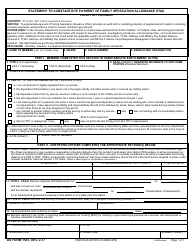

- DD Form 2656-1, SBP Election Statement for Former Spouse Coverage, is a form used by spouses and former spouses of servicemen for purposes of providing information regarding SBP benefits. The election is considered invalid if not mailed to and received by the Defense Finance and Accounting Service within a year after the date of the divorce;

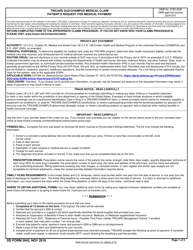

- DD Form 2656-2, SBP Termination Request, is used to voluntarily discontinue participation in the Uniformed ServicesSurvivor Benefit Plan;

- DD Form 2656-5, RCSBP Election Certificate, is a form used by RC Members to make an election for the Reserve Component SBP during a period of 90-days after receiving notification of eligibility to claim Reserve retired pay;

- DD Form 2656-6, SBP Election Change Certificate, is used by retired service members to make changes to their Survivor Benefit Plan election;

- DD Form 2656-7, Verification for Survivor Annuity, is used by a surviving spouse, a former spouse, or dependent children of retirees to verify annuity eligibility under the Survivor Benefit Plan, Retired Servicemen Family Protection Plan or RC Survivor Benefit Plan;

- DD Form 2656-8, SBP Automatic Coverage Fact Sheet, is a form used for determining the marital and dependency status or retirees in order to establish and maintain an accurate accounting of the retired pay account;

- DD Form 2656-10, SBP/RC SBP Request for Deemed Election, is used for providing information related to SBP coverage by former spouses;

- DD Form 2656-11, Statement Certifying Number of Months of SBP Premiums Paid, is a form used to contest the number of months credited toward Paid-up SBP by the Defense Finance and Accounting Service.