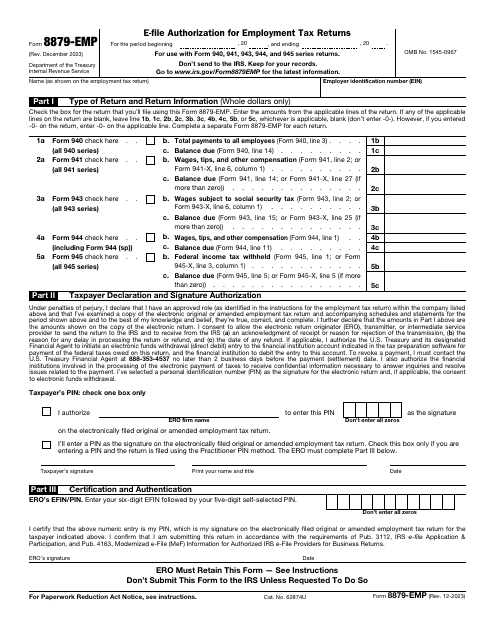

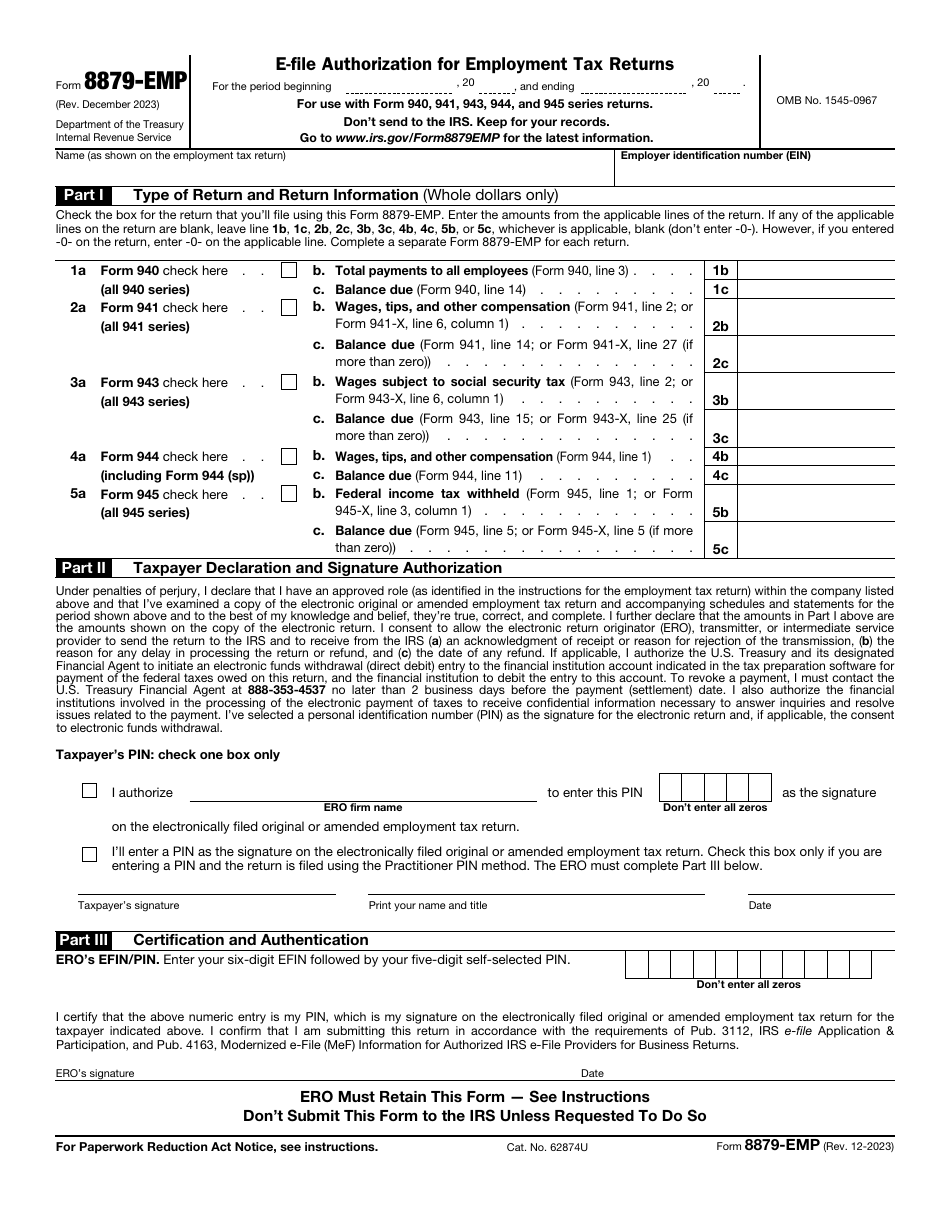

IRS Form 8879-EMP E-File Authorization for Employment Tax Returns

What Is IRS Form 8879-EMP?

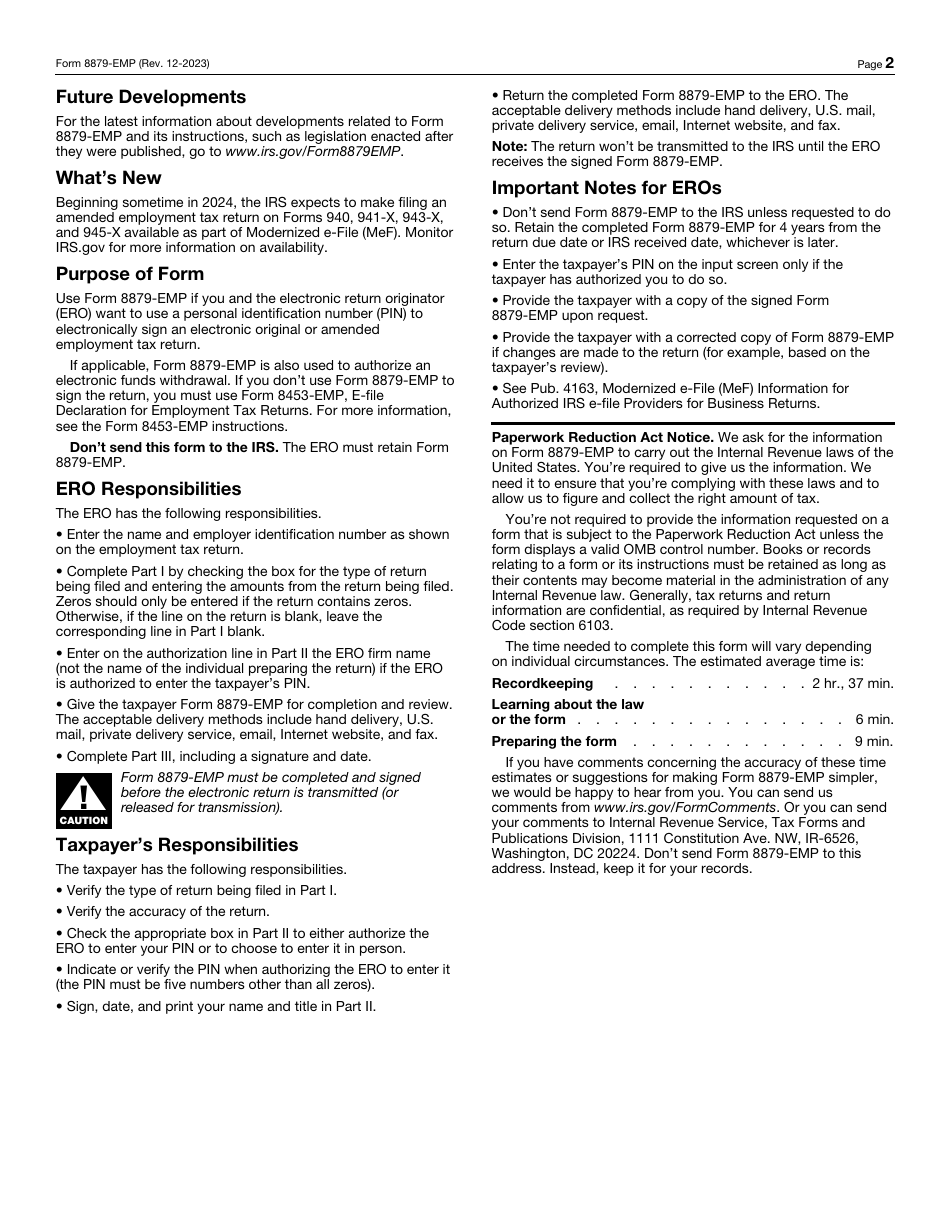

IRS Form 8879-EMP, IRS E-File Signature Authorization for Forms 940, 940 (PR), 941, 941 (PR), 941-SS, 943, 943 (PR), 944, and 945 , is a supplementary instrument taxpayers may sign if they want to confirm their willingness to utilize a personal identification number that will allow them to provide an electronic signature when certifying employment tax returns or asking for a filing extension.

Alternate Name:

- Tax Form 8879-EMP.

This number is shared with the electronic return originator; additionally, you can grant them your permission to withdraw electronic funds on your behalf.

This authorization was issued by the Internal Revenue Service (IRS) on December 1, 2023 , with all previous versions of the document obsolete. You can download an IRS Form 8879-EMP fillable version through the link below.

To fill out the instrument correctly, you need to write down the name of your organization and its employer identification number, specify the type of tax return you are going to submit with the help of this form, acknowledge your readiness to permit an e-file provider to use a particular number as your signature, enter your name and title, sign and date the papers. The document is then authenticated by the electronic return originator - there is no obligation to file the authorization with the IRS unless you received a request to do so, simply keep the document in your records for at least four years.