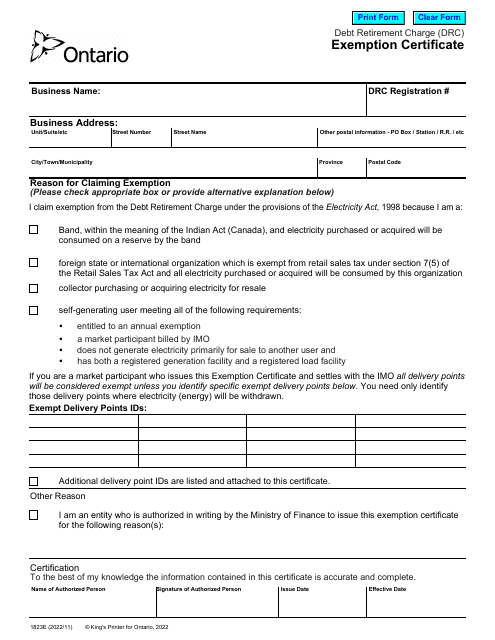

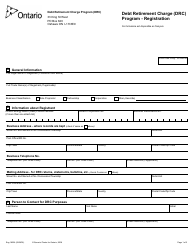

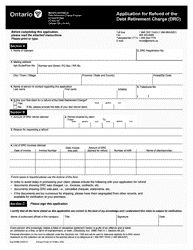

Form 1823E Debt Retirement Charge (Drc) - Exemption Certificate - Ontario, Canada

Form 1823E Debt Retirement Charge (DRC) - Exemption Certificate is used in Ontario, Canada for claiming exemption from the Debt Retirement Charge. The Debt Retirement Charge was a fee imposed on electricity users in Ontario to retire electricity sector debt. This form allows individuals or businesses to apply for an exemption from paying this charge.

Form 1823E Debt Retirement Charge (Drc) - Exemption Certificate - Ontario, Canada - Frequently Asked Questions (FAQ)

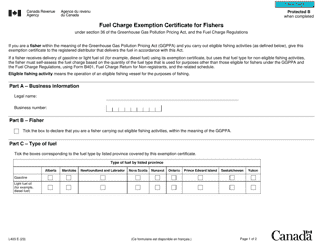

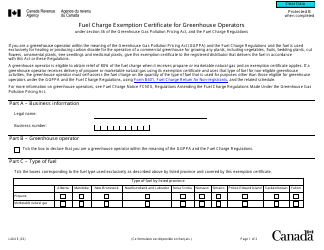

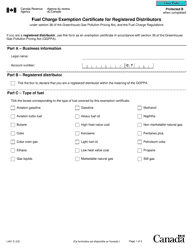

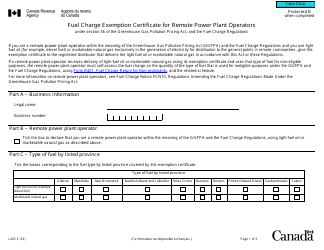

Q: What is Form 1823E? A: Form 1823E is the Debt Retirement Charge (DRC) - Exemption Certificate specifically for Ontario, Canada.

Q: What is the Debt Retirement Charge (DRC)? A: The Debt Retirement Charge (DRC) is a fee levied on electricity bills in Ontario, Canada.

Q: What is the purpose of Form 1823E? A: Form 1823E is used to apply for an exemption from paying the Debt Retirement Charge (DRC) on electricity bills in Ontario.

Q: Who can use Form 1823E? A: Any individual or organization that qualifies for an exemption from the Debt Retirement Charge (DRC) in Ontario can use this form.

Q: What information is required on Form 1823E? A: Form 1823E requires the applicant's personal information, electricity account details, and supporting documentation to prove eligibility for the exemption.