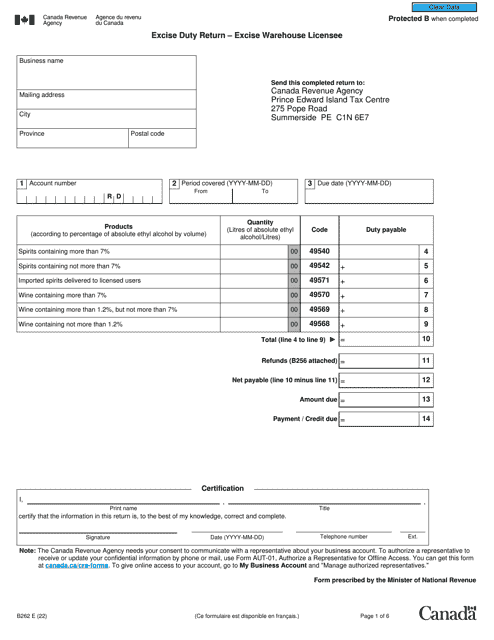

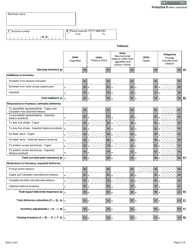

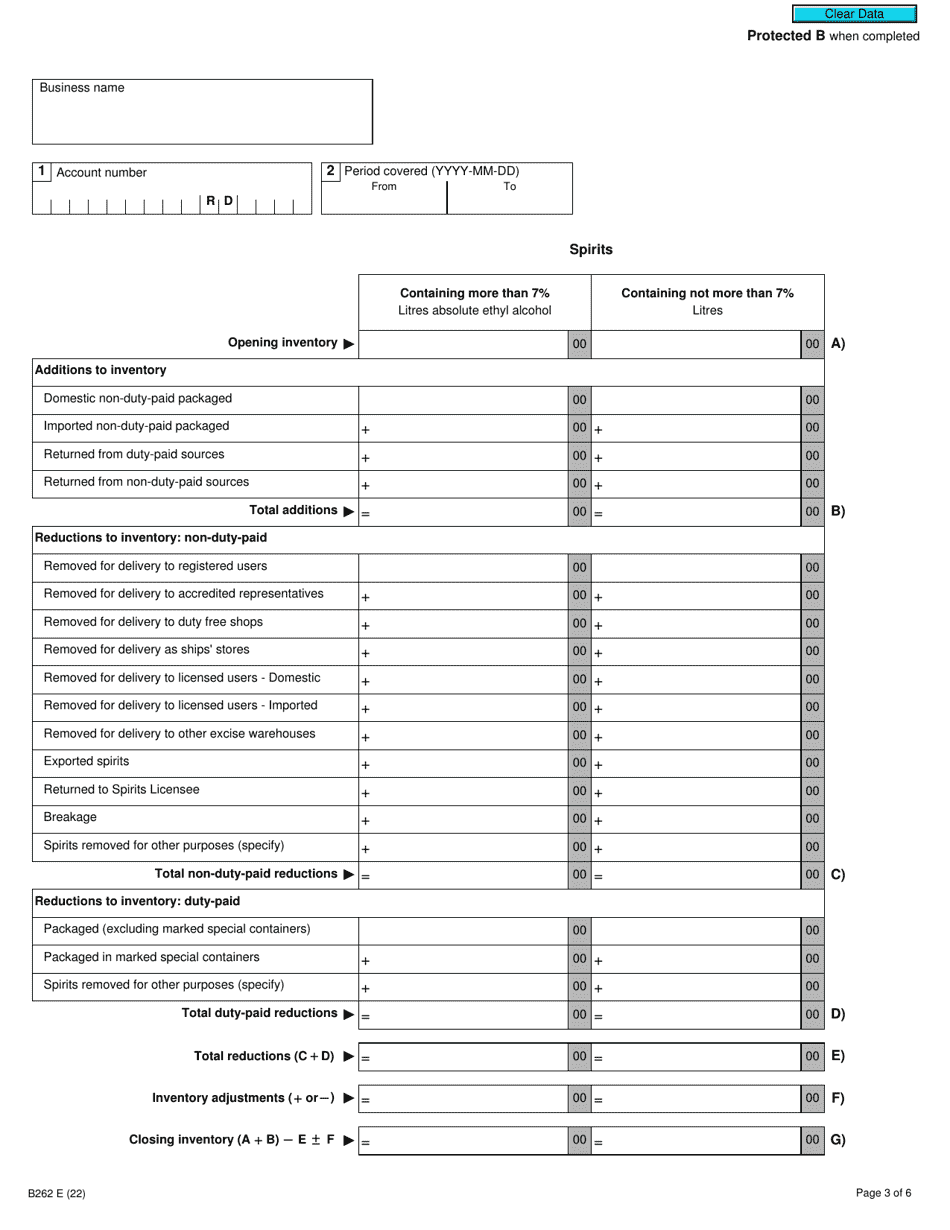

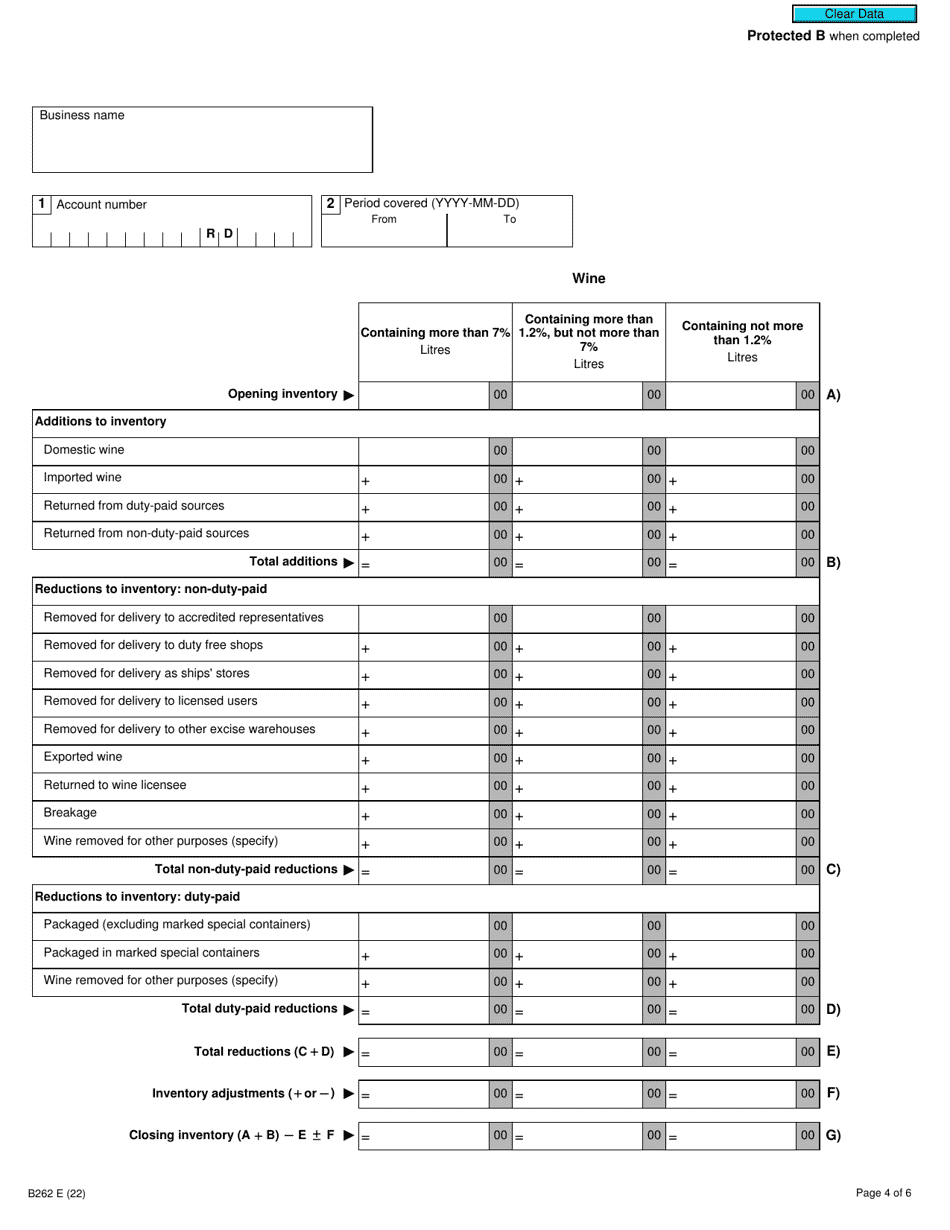

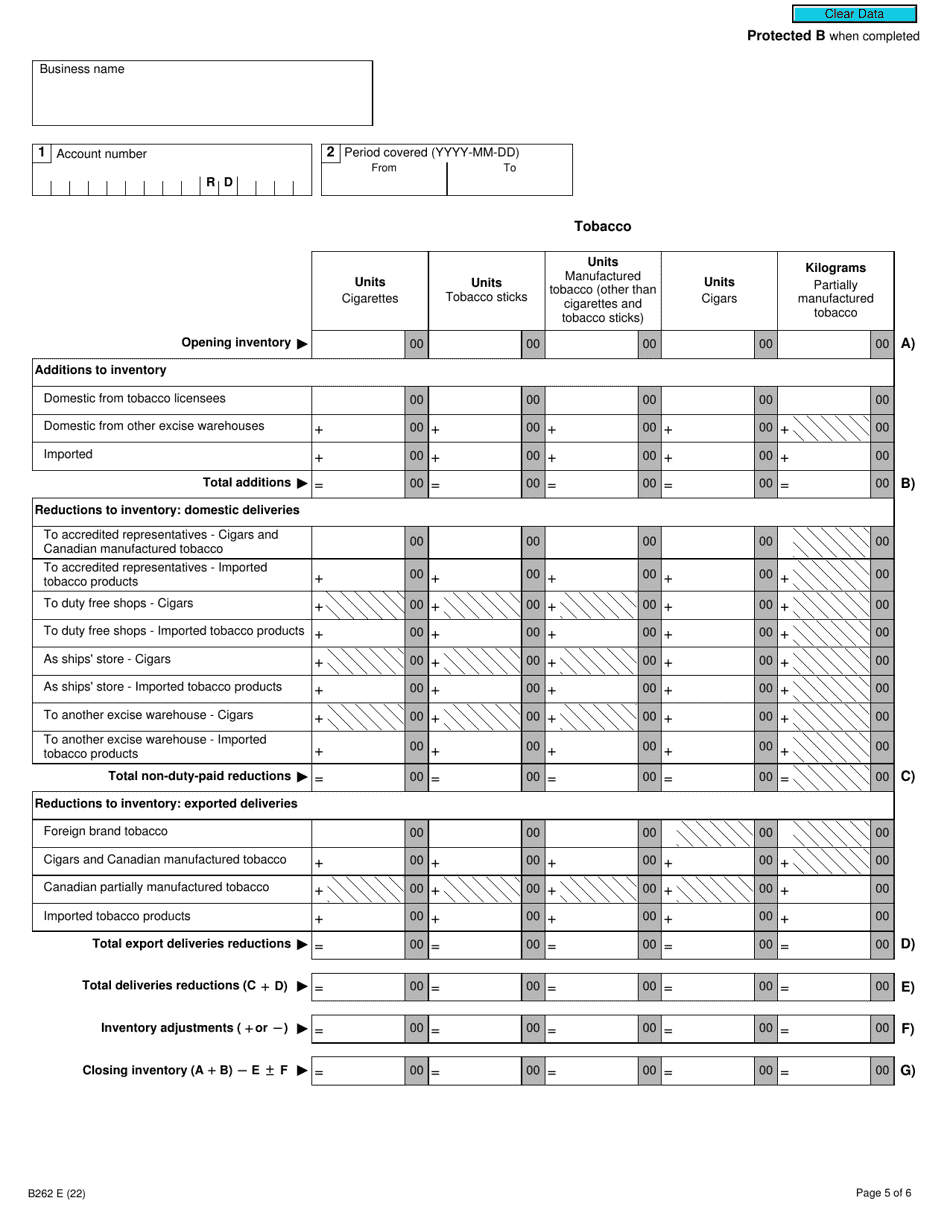

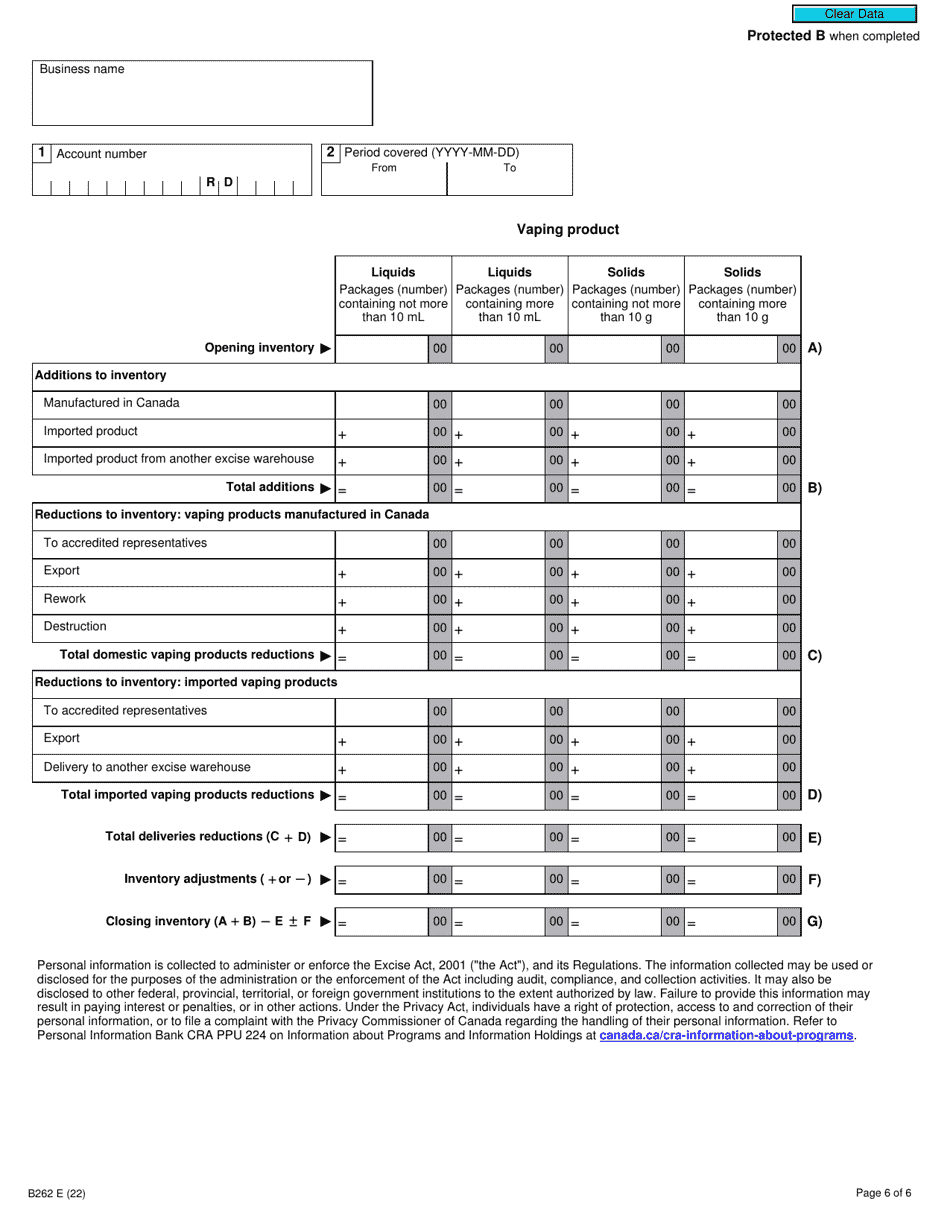

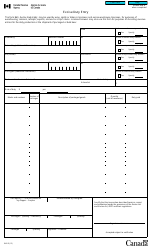

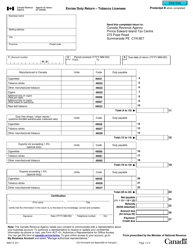

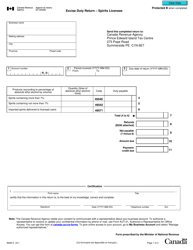

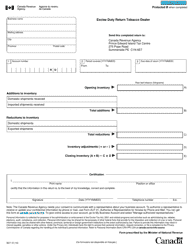

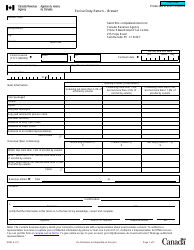

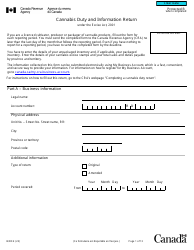

Form B262 Excise Duty Return - Excise Warehouse Licensee - Canada

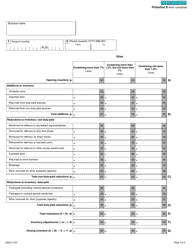

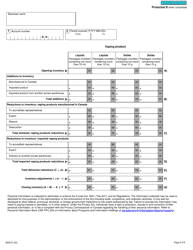

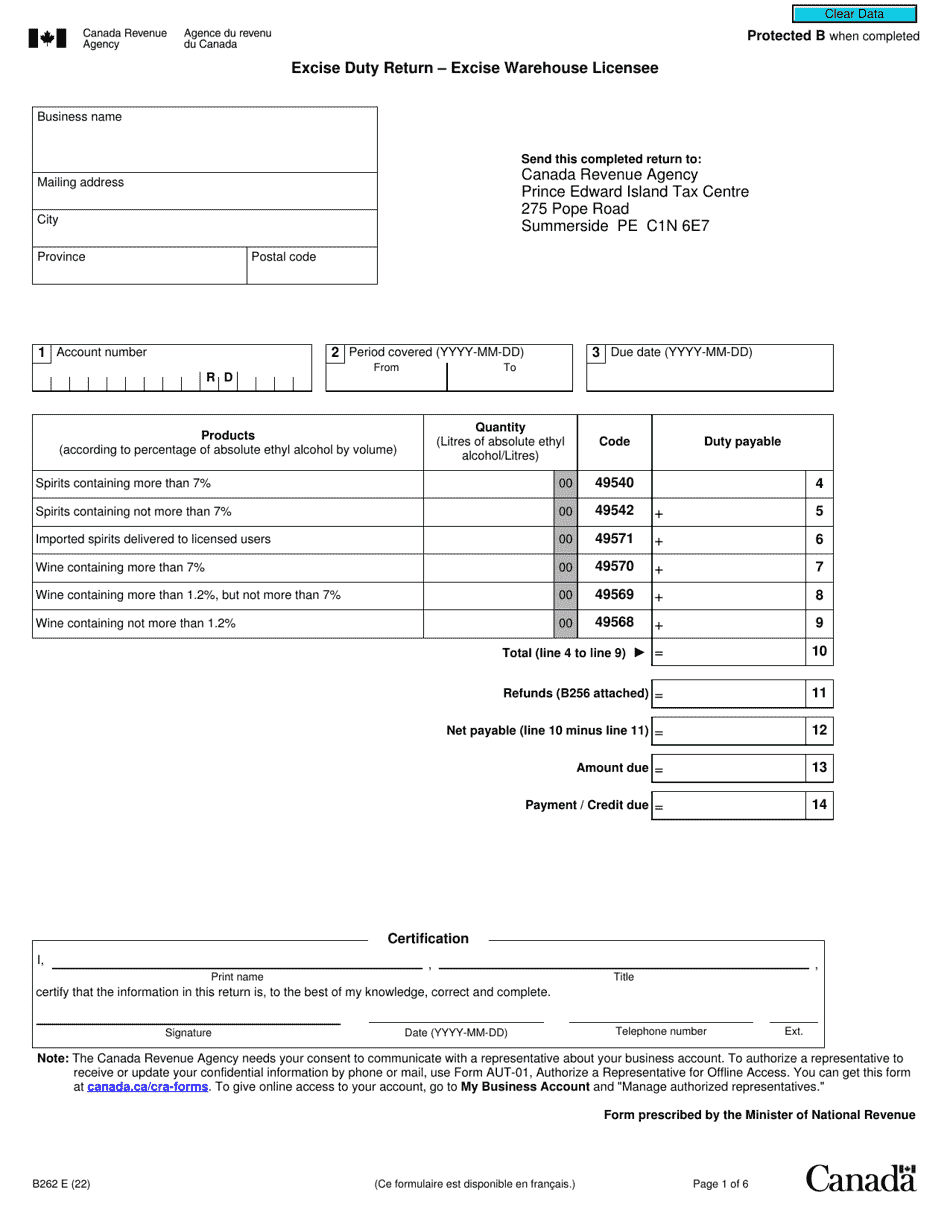

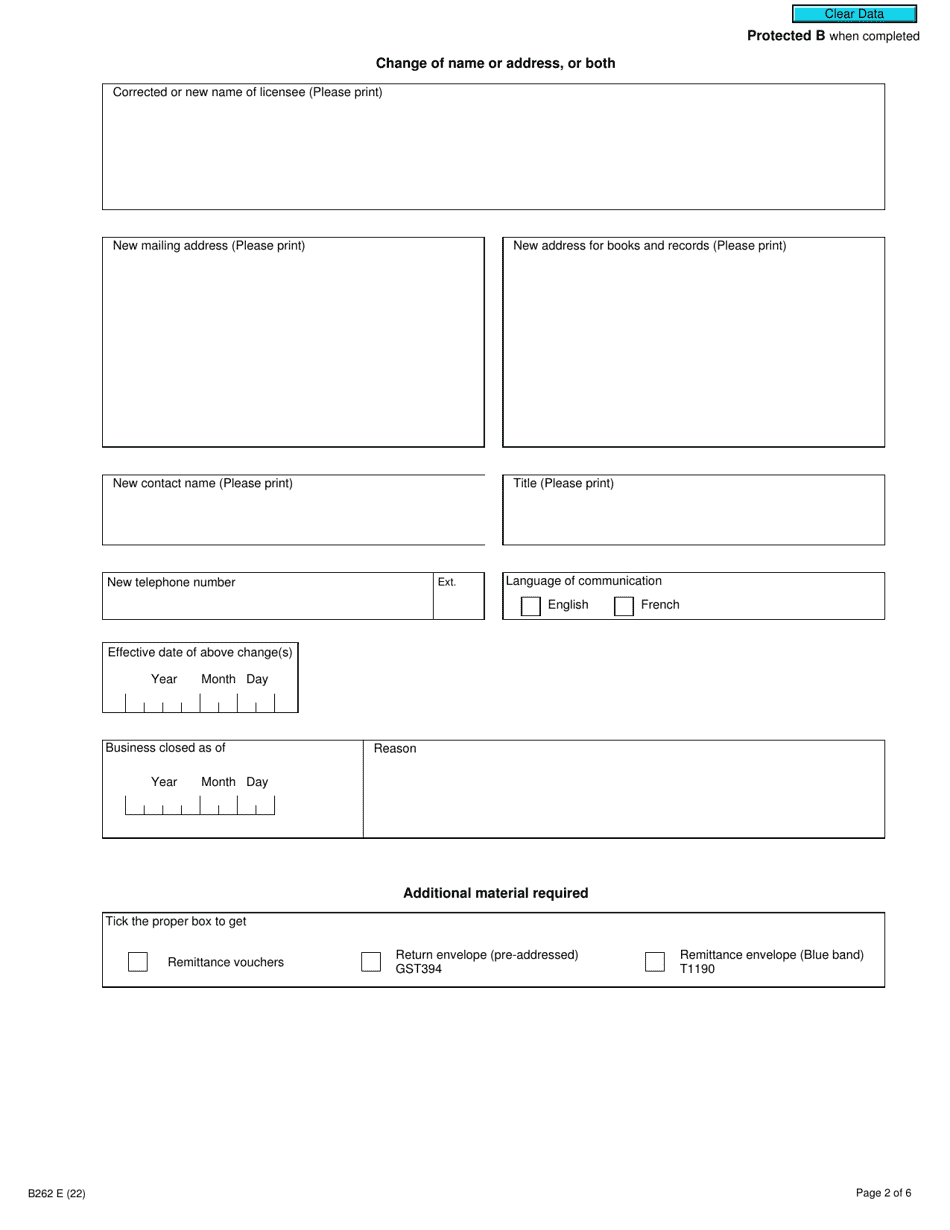

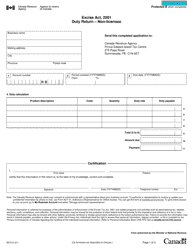

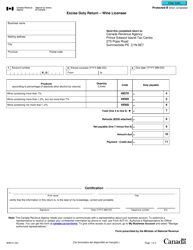

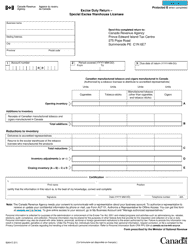

Form B262 Excise Duty Return - Excise Warehouse Licensee is used in Canada for reporting and paying excise duties by businesses holding an excise warehouse license. This form is filled out to declare the quantities of excise goods held in the warehouse and to calculate and remit the applicable excise duties to the Canada Revenue Agency (CRA).

The Form B262 Excise Duty Return is filed by the Excise Warehouse Licensee in Canada.

Form B262 Excise Duty Return - Excise Warehouse Licensee - Canada - Frequently Asked Questions (FAQ)

Q: What is Form B262? A: Form B262 is an Excise Duty Return for Excise Warehouse Licensee in Canada.

Q: Who is required to file Form B262? A: Excise warehouse licensees in Canada are required to file Form B262.

Q: What is the purpose of Form B262? A: Form B262 is used to report and pay excise duties on goods held in an excise warehouse in Canada.

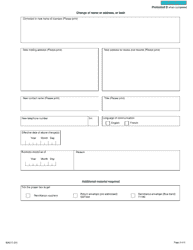

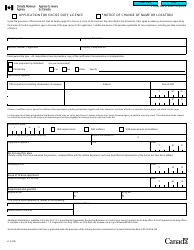

Q: What information is required to complete Form B262? A: The form requires information about the types and quantities of goods held in the warehouse, as well as the calculation of excise duty owed.

Q: When is Form B262 due? A: Form B262 is due on the last day of the month following the reporting period.

Q: Are there any penalties for late filing of Form B262? A: Yes, there are penalties for late filing, including monetary fines and potential license suspension or cancellation.