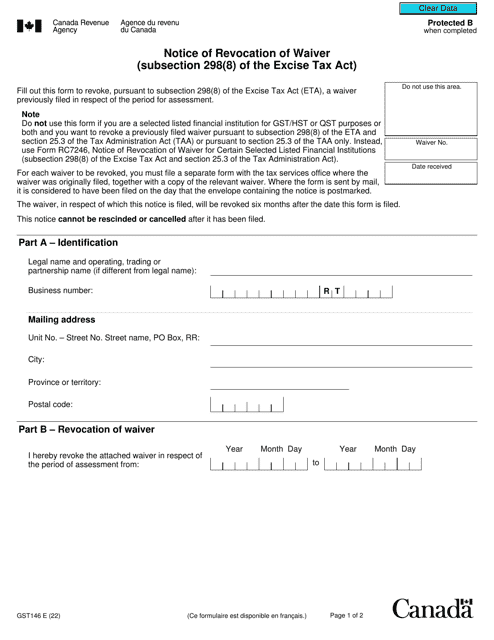

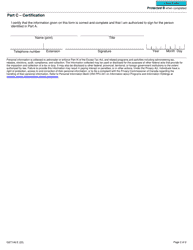

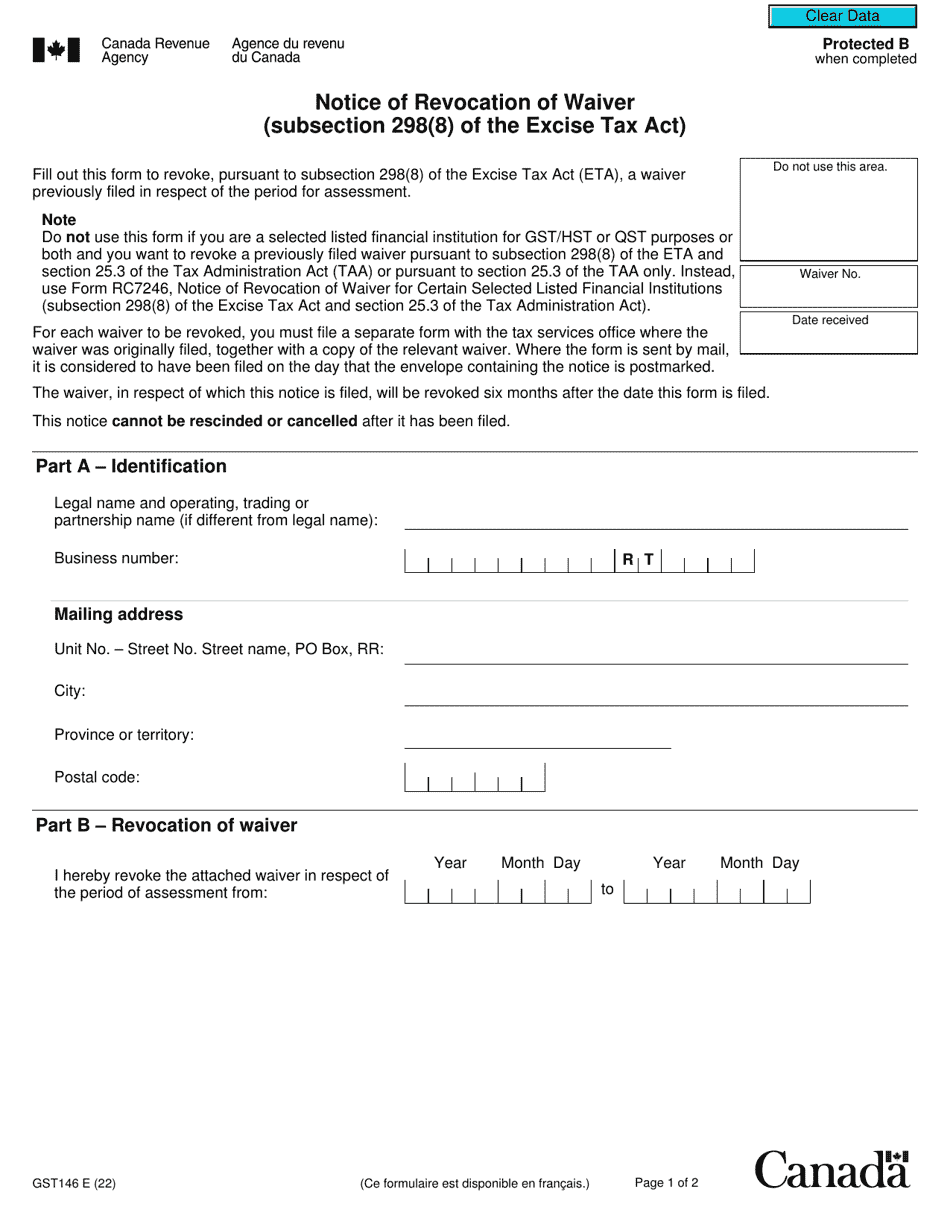

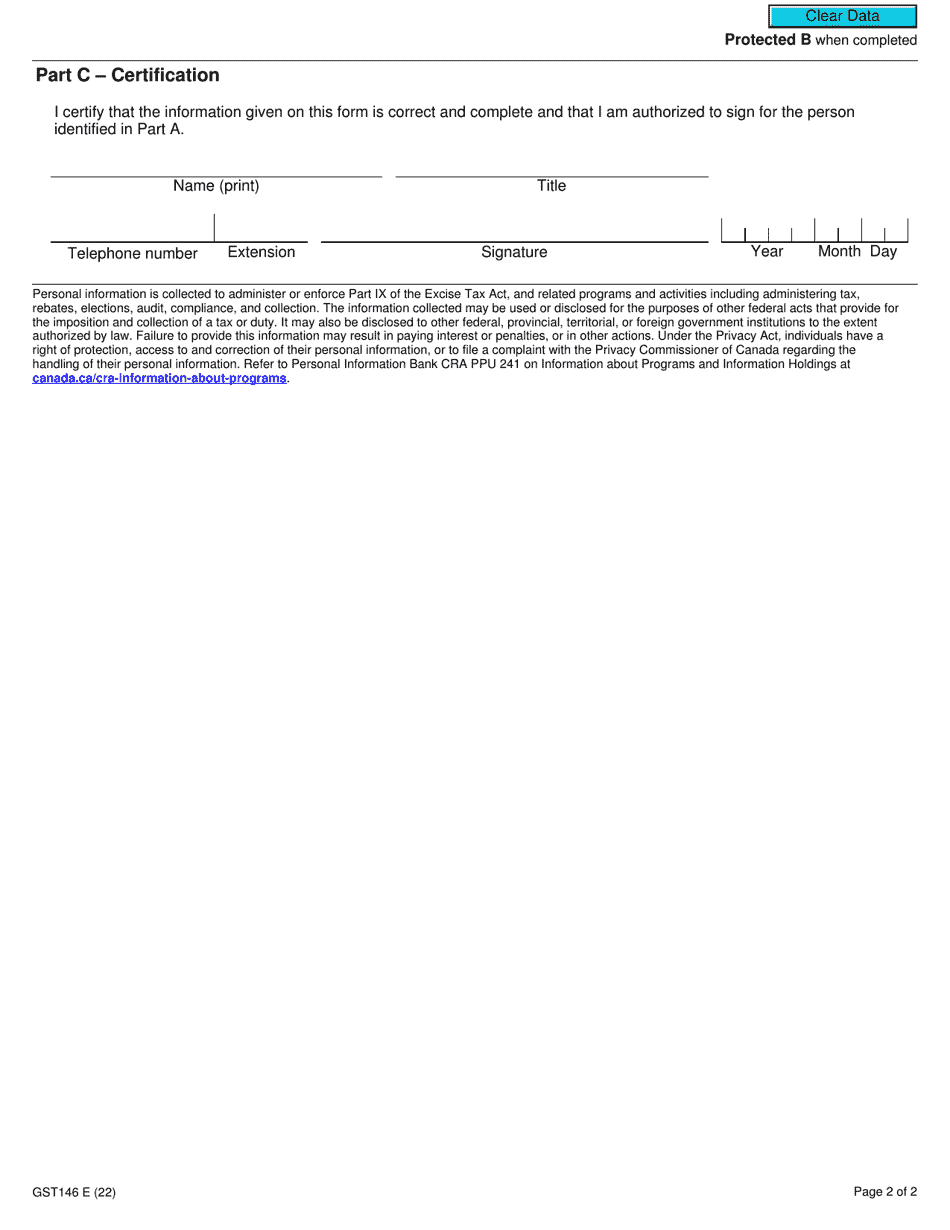

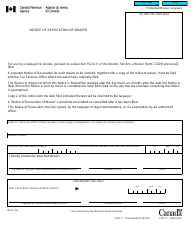

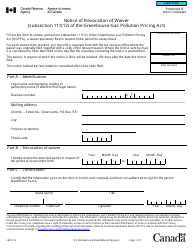

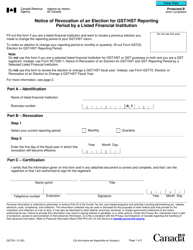

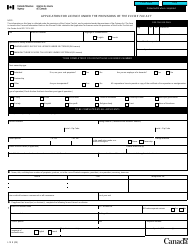

Form GST146 Notice of Revocation of Waiver (Subsection 298(8) of the Excise Tax Act) - Canada

Form GST146 Notice of Revocation of Waiver is used in Canada to notify individuals or businesses of the cancellation or revocation of a previously granted waiver. This form is specifically related to Subsection 298(8) of the Excise Tax Act.

The taxpayer or their representative files the Form GST146 Notice of Revocation of Waiver in Canada.

Form GST146 Notice of Revocation of Waiver (Subsection 298(8) of the Excise Tax Act) - Canada - Frequently Asked Questions (FAQ)

Q: What is the Form GST146? A: Form GST146 is the Notice of Revocation of Waiver under subsection 298(8) of the Excise Tax Act in Canada.

Q: When should Form GST146 be used? A: Form GST146 should be used when you want to revoke a waiver that you previously provided for the payment of goods and services tax/harmonized sales tax (GST/HST) under subsection 298(2) of the Excise Tax Act.

Q: What is the purpose of Form GST146? A: The purpose of Form GST146 is to notify the Canada Revenue Agency (CRA) that you are revoking a waiver that you previously provided for the payment of GST/HST.

Q: Do I need to include any supporting documents with Form GST146? A: No, you do not need to include any supporting documents with Form GST146. However, you should keep any relevant documents for your records.

Q: When should I submit Form GST146? A: You should submit Form GST146 as soon as possible after you decide to revoke the waiver.

Q: What happens after I submit Form GST146? A: After you submit Form GST146, the CRA will update your account to reflect the revocation of the waiver.

Q: Is there a deadline for submitting Form GST146? A: There is no specific deadline for submitting Form GST146, but you should submit it as soon as possible.

Q: What if I made a mistake on Form GST146? A: If you made a mistake on Form GST146, you should contact the CRA as soon as possible to correct the error.

Q: Can I revoke a waiver more than once? A: Yes, you can revoke a waiver more than once if necessary.