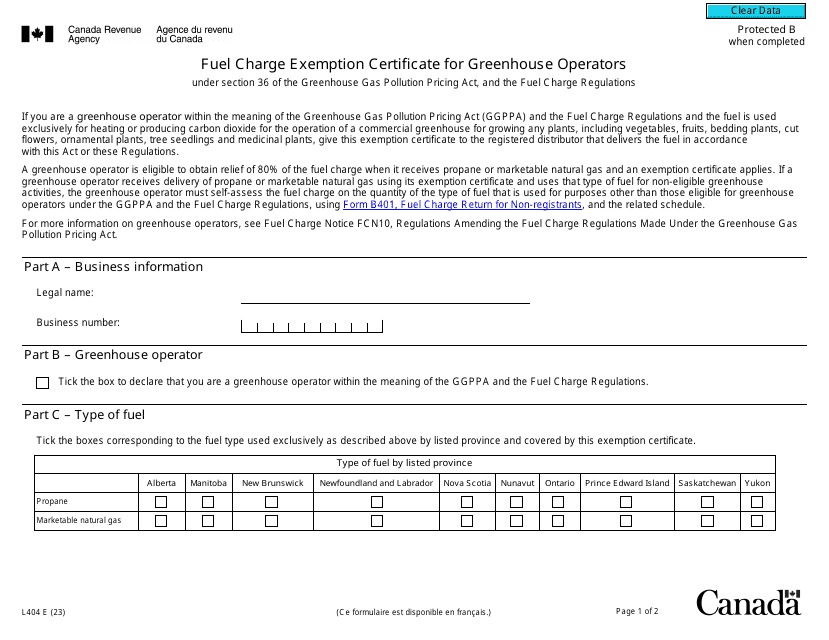

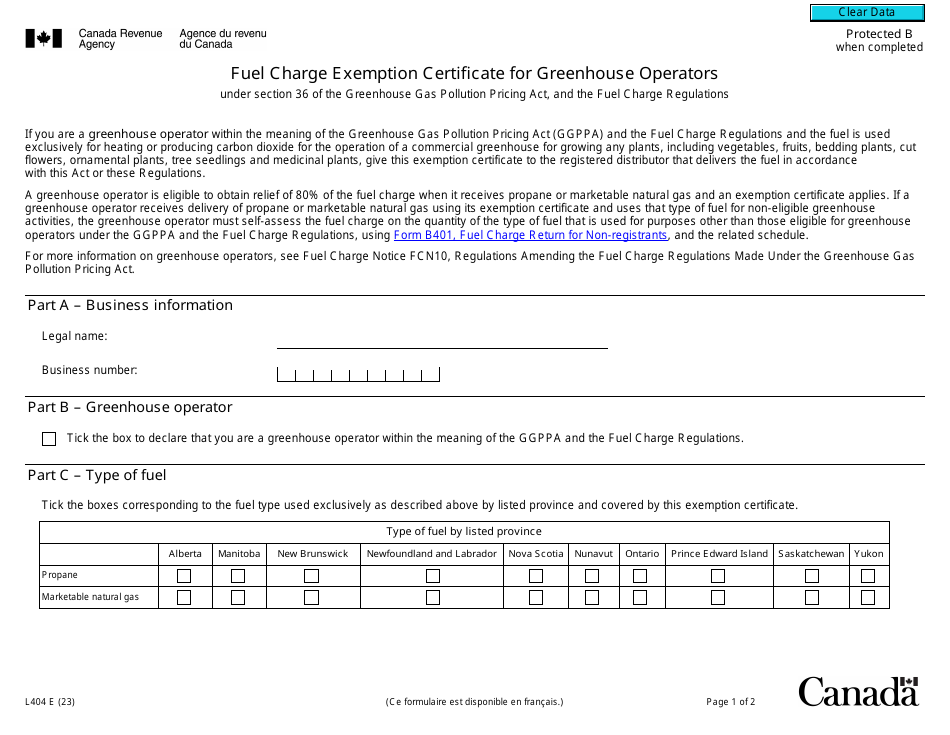

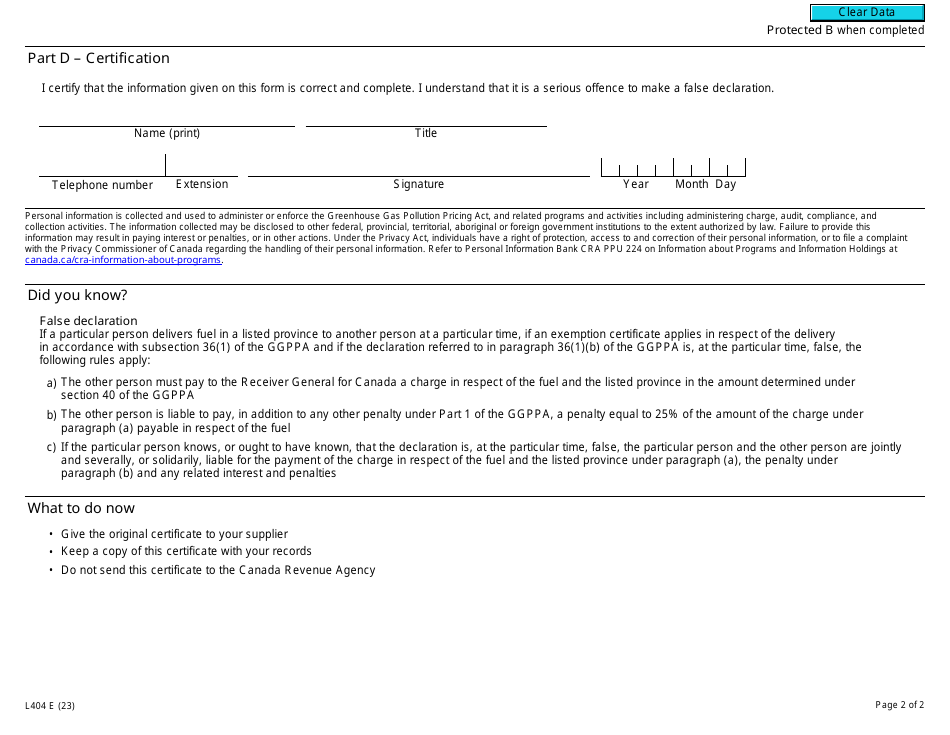

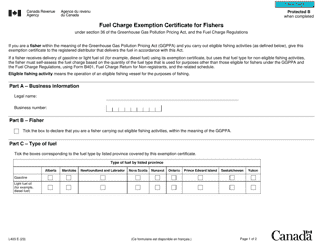

Form L404 Fuel Charge Exemption Certificate for Greenhouse Operators - Canada

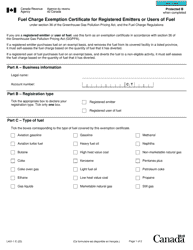

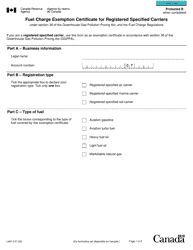

Form L404 Fuel Charge Exemption Certificate for Greenhouse Operators in Canada is used to claim an exemption from the federal fuel charge on certain fuels used by greenhouse operators in eligible activities.

In Canada, greenhouse operators are responsible for filing the Form L404 Fuel Charge Exemption Certificate.

Form L404 Fuel Charge Exemption Certificate for Greenhouse Operators - Canada - Frequently Asked Questions (FAQ)

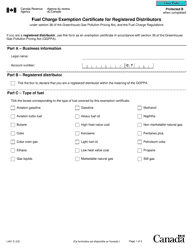

Q: What is Form L404? A: Form L404 is a Fuel Charge Exemption Certificate for Greenhouse Operators.

Q: Who is eligible to use Form L404? A: Greenhouse operators in Canada are eligible to use Form L404.

Q: What is the purpose of Form L404? A: The purpose of Form L404 is to claim exemption from fuel charges for greenhouse operators.

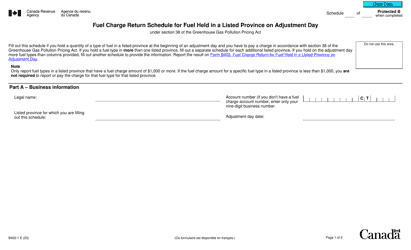

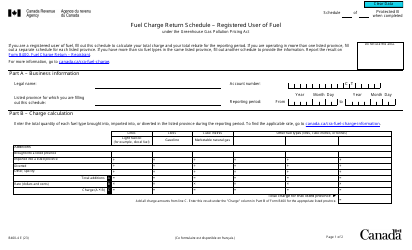

Q: What is a fuel charge? A: A fuel charge is a tax on fossil fuels that are used or consumed in a listed province or territory.

Q: What are the listed provinces and territories for the fuel charge? A: The listed provinces and territories for the fuel charge are New Brunswick, Ontario, Manitoba, and Saskatchewan.

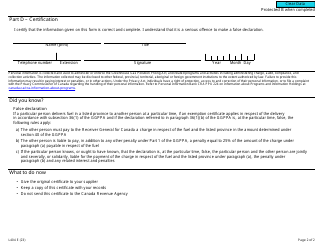

Q: How do greenhouse operators claim exemption using Form L404? A: Greenhouse operators can claim exemption by completing and submitting Form L404 to the Canada Revenue Agency (CRA).

Q: Is Form L404 specific to greenhouse operators only? A: Yes, Form L404 is specifically for greenhouse operators and cannot be used by other types of businesses.