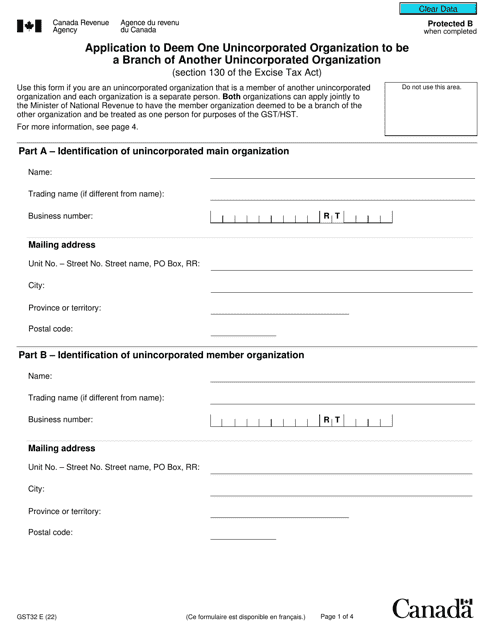

Form GST32 Application to Deem One Unincorporated Organization to Be a Branch of Another Unincorporated Organization - Canada

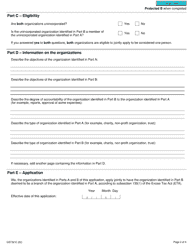

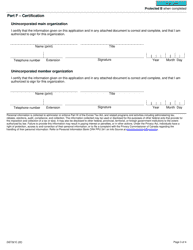

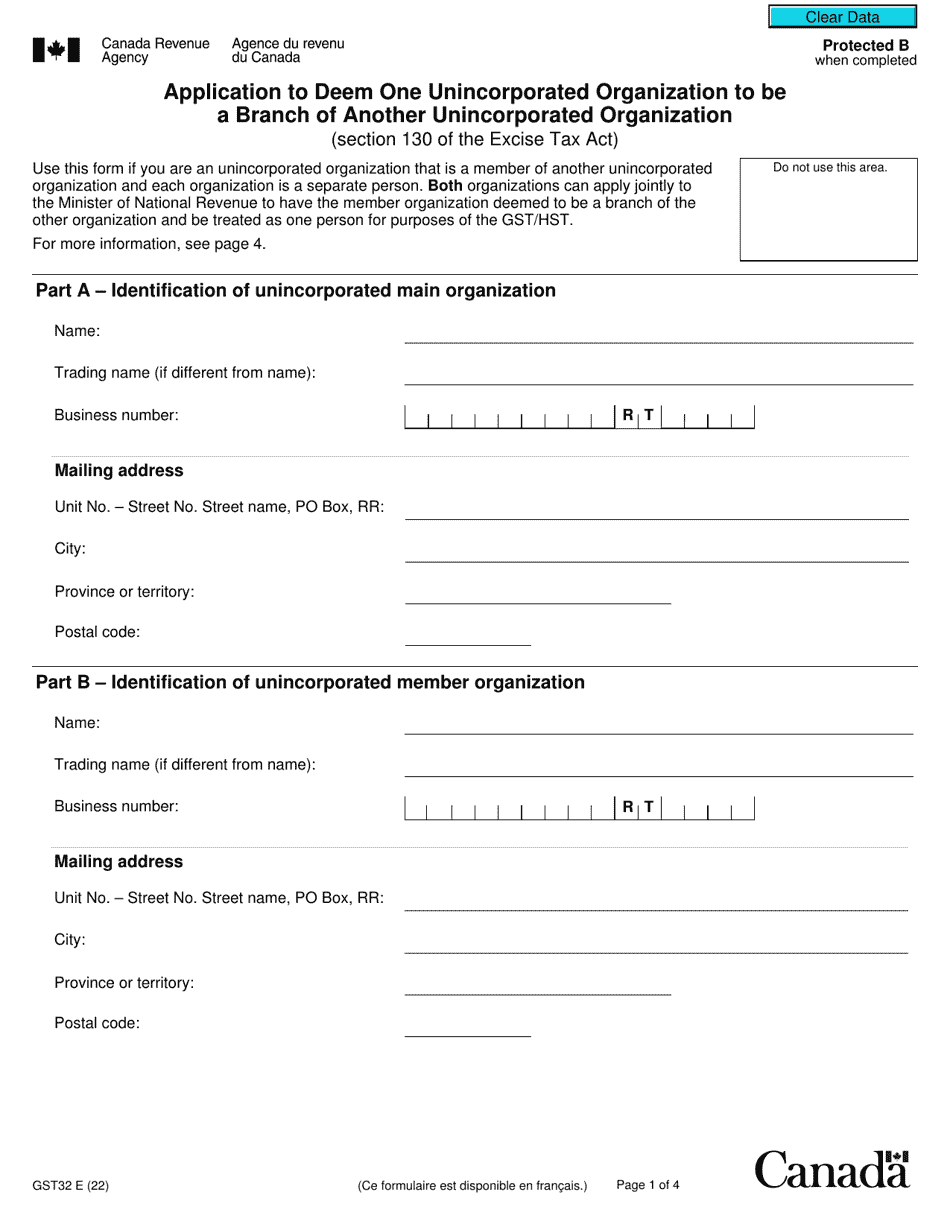

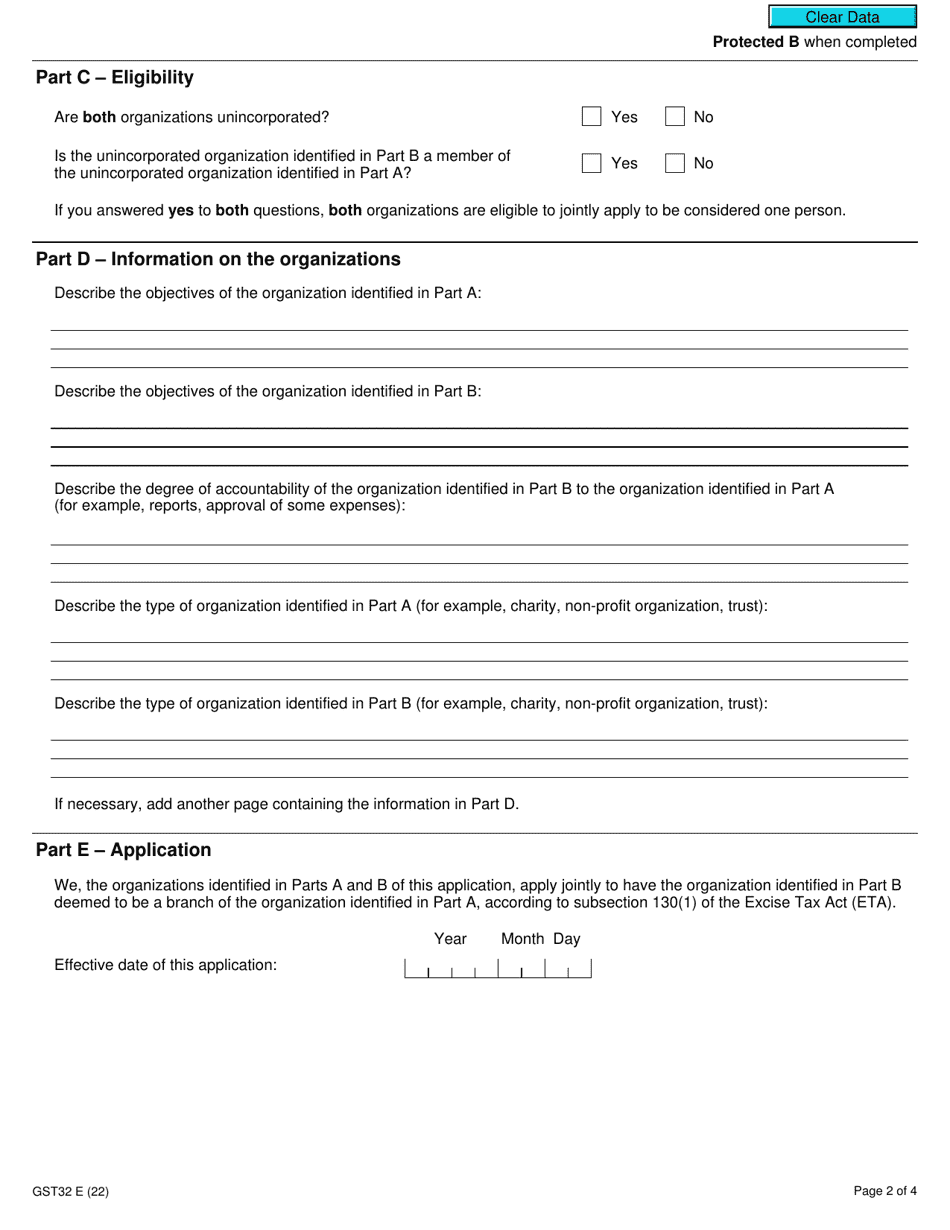

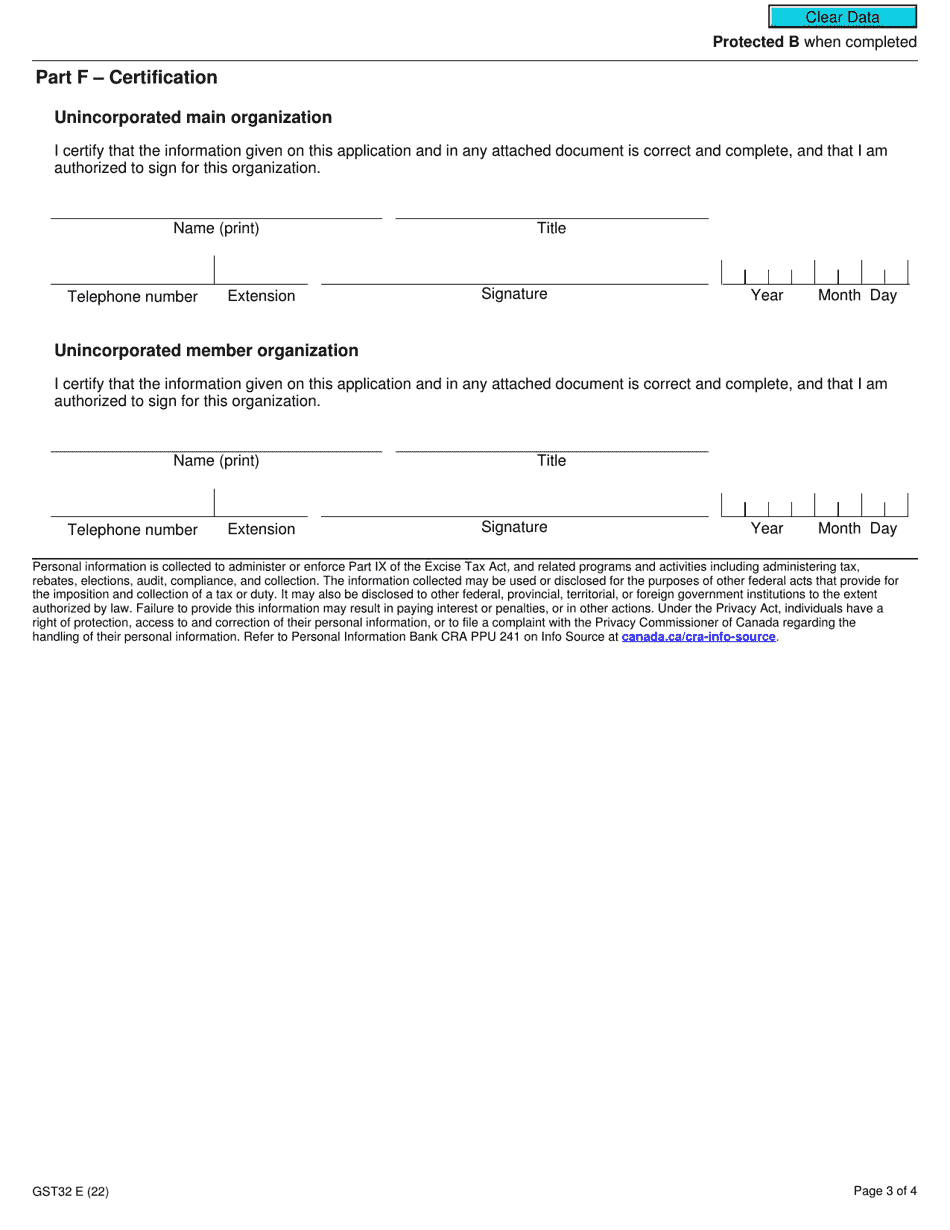

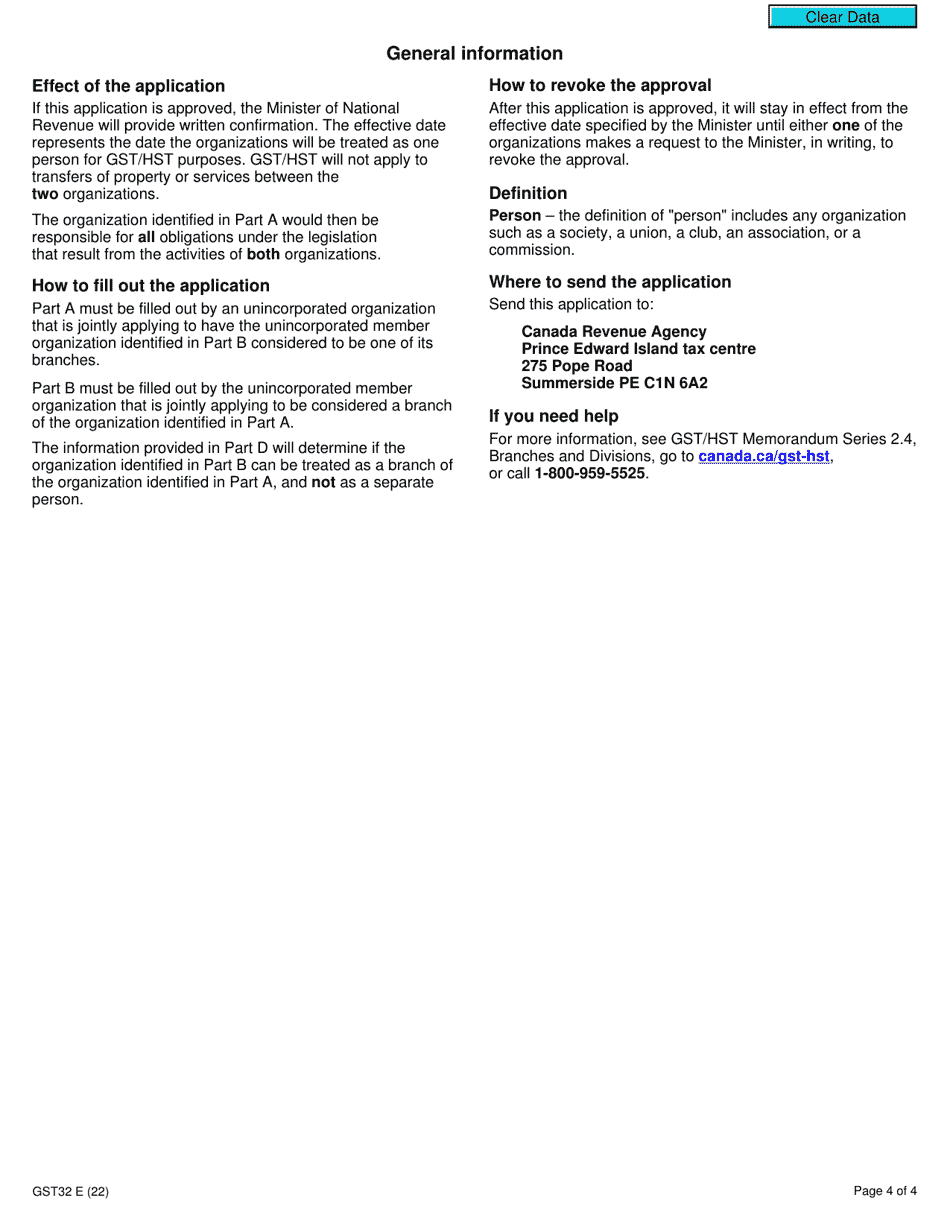

Form GST32 Application to Deem One Unincorporated Organization to Be a Branch of Another Unincorporated Organization in Canada is used for GST/HST purposes. It allows one unincorporated organization to be considered a branch of another unincorporated organization for tax purposes.

Form GST32 Application to Deem One Unincorporated Organization to Be a Branch of Another Unincorporated Organization - Canada - Frequently Asked Questions (FAQ)

Q: What is GST32? A: GST32 is an application form in Canada.

Q: What does GST32 application do? A: GST32 application is used to deem one unincorporated organization to be a branch of another unincorporated organization.

Q: Who can use GST32 application? A: Any unincorporated organization in Canada can use the GST32 application.

Q: Are there any fees for submitting GST32 application? A: No, there are no fees for submitting the GST32 application.

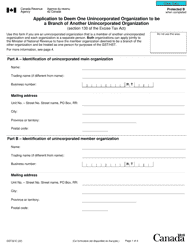

Q: What information is required in the GST32 application? A: The GST32 application requires information about both the original unincorporated organization and the new branch, including their names, addresses, and GST/HST registration numbers.

Q: What is the processing time for GST32 application? A: The processing time for GST32 application can vary, but you should expect a response from the CRA within a few weeks.

Q: Is GST32 application specific to Canada? A: Yes, GST32 application is specific to Canada and is used for GST/HST purposes within the country.