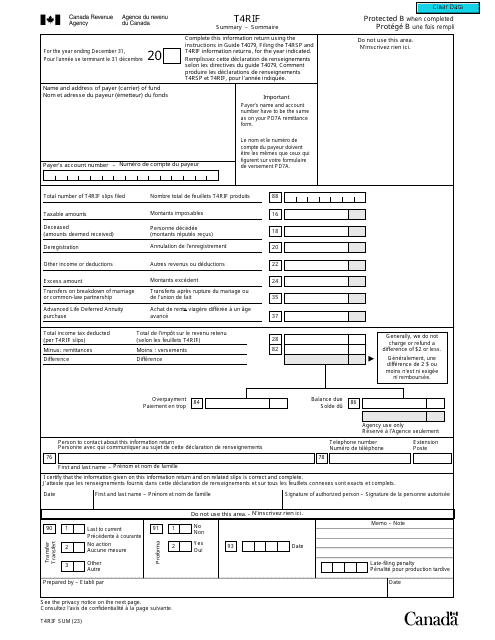

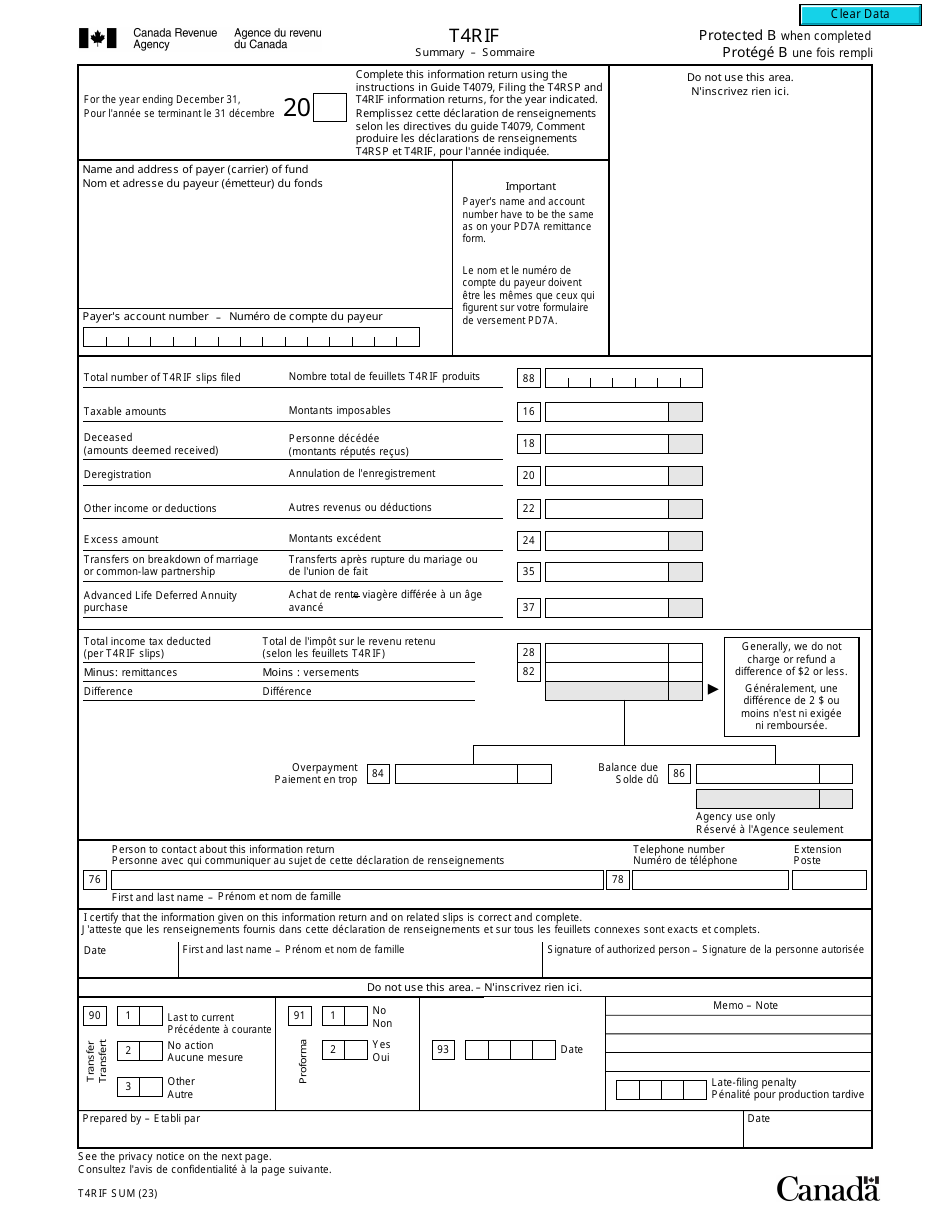

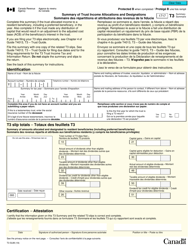

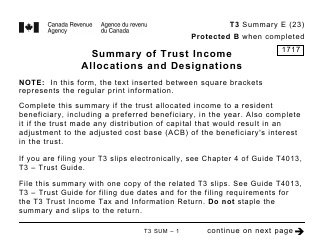

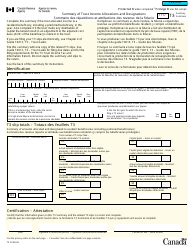

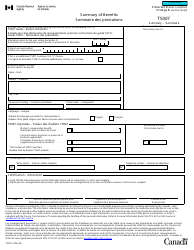

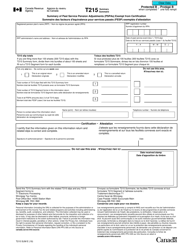

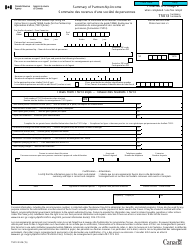

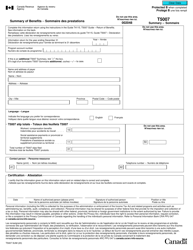

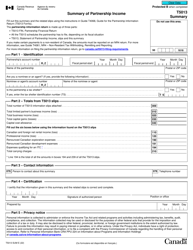

Form T4RIF SUM Summary - Canada (English / French)

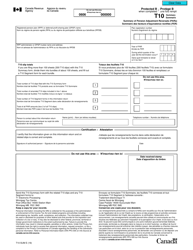

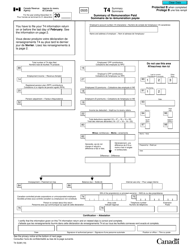

The Form T4RIF SUM Summary in Canada is used to report the total amounts paid from a Registered Retirement Income Fund (RRIF) to a resident of Canada. It summarizes the income received from the RRIF during the tax year. The form is available in both English and French.

The Form T4RIF SUMMARY is filed by the payer of the income in Canada.

Form T4RIF SUM Summary - Canada (English/French) - Frequently Asked Questions (FAQ)

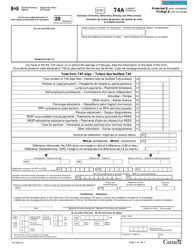

Q: What is a T4RIF? A: A T4RIF is a tax form that reports income received from a Registered Retirement Income Fund (RRIF).

Q: Why is the T4RIF important? A: The T4RIF is important because it helps taxpayers report their RRIF income to the Canada Revenue Agency (CRA) and determine their tax liability.

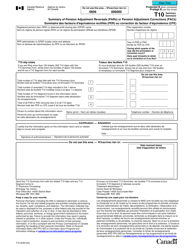

Q: What information does the T4RIF contain? A: The T4RIF contains information about the RRIF income received, withholding taxes deducted, and any pension adjustments.

Q: When should I receive my T4RIF form? A: Your financial institution should provide you with your T4RIF form by the end of February.

Q: Do I need to include my T4RIF form with my tax return? A: Yes, you should include your T4RIF form with your tax return when filing with the CRA.

Q: What should I do if I did not receive a T4RIF form? A: If you did not receive a T4RIF form, you should contact your financial institution to request a copy.

Q: What happens if I make a mistake on my T4RIF form? A: If you make a mistake on your T4RIF form, you should contact the CRA to correct the error.

Q: Do I need to keep a copy of my T4RIF form? A: Yes, you should keep a copy of your T4RIF form for your records and to support any future tax claims.