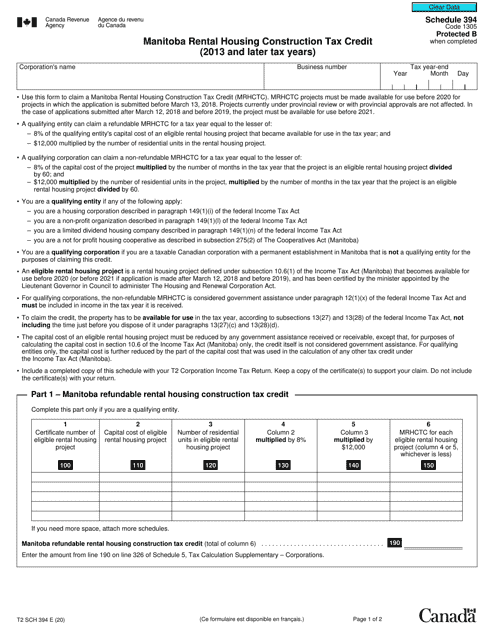

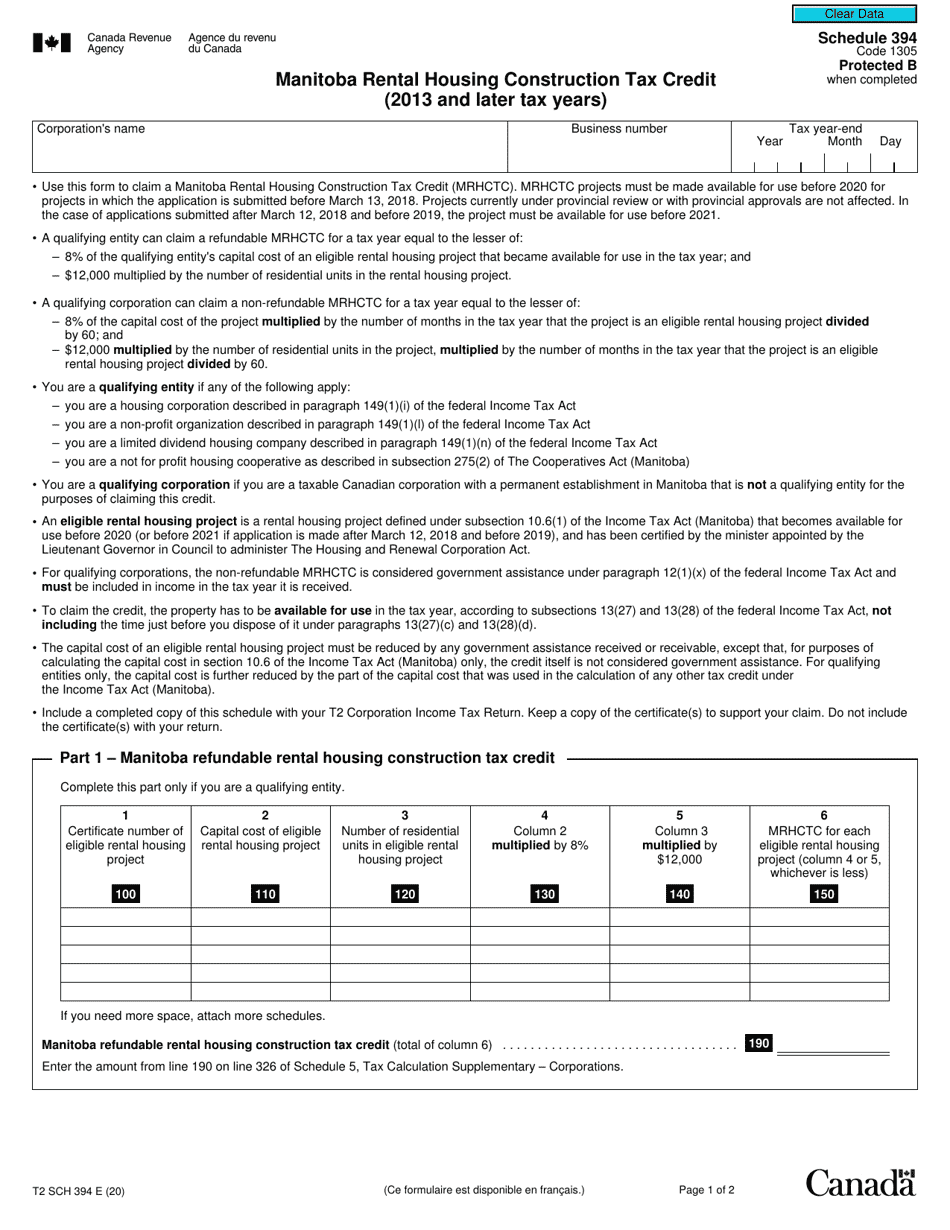

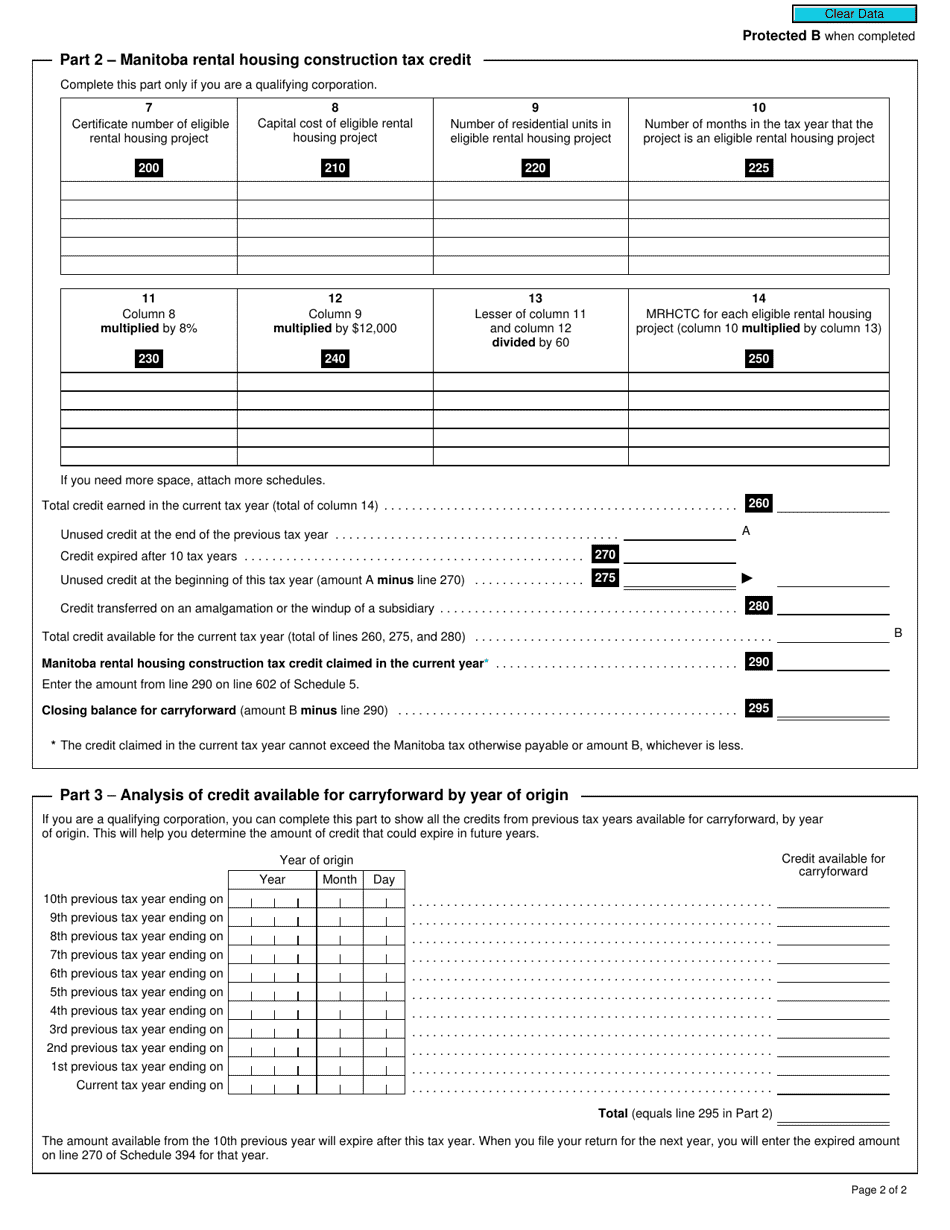

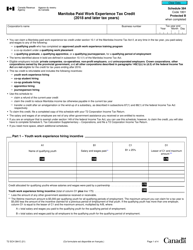

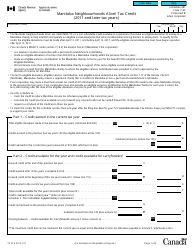

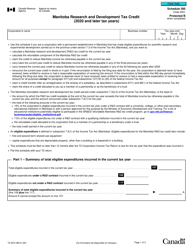

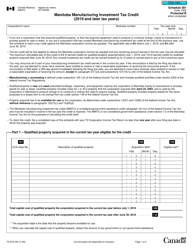

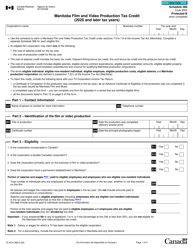

Form T2 Schedule 394 Manitoba Rental Housing Construction Tax Credit (2013 and Later Tax Years) - Canada

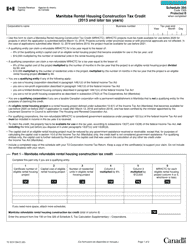

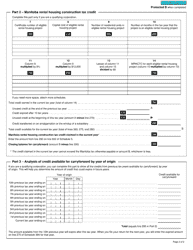

Form T2 Schedule 394, the Manitoba Rental Housing Construction Tax Credit, is a Canadian tax form used by corporations that have built eligible rental housing in Manitoba. This form is specifically for the tax years 2013 and later. It allows corporations to claim a tax credit for the costs incurred in constructing or renovating rental housing units, as long as these units meet the eligibility criteria set by the Manitoba government. The purpose of this tax credit is to encourage the development of affordable rental housing in the province.

The Form T2 Schedule 394 - Manitoba Rental Housing Construction Tax Credit is filed by corporations or other entities that have built or are in the process of constructing rental housing properties in Manitoba, Canada. This tax credit is available for tax years 2013 and later.

Form T2 Schedule 394 Manitoba Rental Housing Construction Tax Credit (2013 and Later Tax Years) - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T2 Schedule 394? A: Form T2 Schedule 394 is a tax form used in Canada for claiming the Manitoba Rental Housing Construction Tax Credit.

Q: What is the purpose of the Manitoba Rental Housing Construction Tax Credit? A: The purpose of the Manitoba Rental Housing Construction Tax Credit is to encourage the construction of new rental housing in Manitoba.

Q: Who is eligible for the Manitoba Rental Housing Construction Tax Credit? A: To be eligible for the Manitoba Rental Housing Construction Tax Credit, you must be an eligible corporation or partnership that has constructed or substantially renovated rental housing in Manitoba.

Q: What expenses can be claimed under the Manitoba Rental Housing Construction Tax Credit? A: Eligible expenses that can be claimed under the Manitoba Rental Housing Construction Tax Credit include costs related to the construction or substantial renovation of rental housing in Manitoba, such as materials and labor costs.

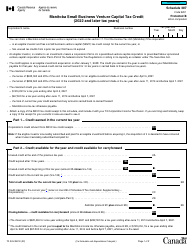

Q: How much is the Manitoba Rental Housing Construction Tax Credit? A: The Manitoba Rental Housing Construction Tax Credit is equal to 8% of the eligible expenses incurred for the construction or substantial renovation of rental housing in Manitoba.

Q: What is the deadline for claiming the Manitoba Rental Housing Construction Tax Credit? A: The deadline for claiming the Manitoba Rental Housing Construction Tax Credit is 18 months from the end of the taxation year in which the expenses were incurred.

Q: Do I need to include any supporting documents with Form T2 Schedule 394? A: Yes, you need to include supporting documents such as invoices, receipts, and contracts that show the eligible expenses incurred for the construction or substantial renovation of rental housing in Manitoba.

Q: Can I claim the Manitoba Rental Housing Construction Tax Credit for expenses incurred in previous tax years? A: No, the Manitoba Rental Housing Construction Tax Credit can only be claimed for expenses incurred in the current tax year and later tax years.

Q: Can I carry forward any unused Manitoba Rental Housing Construction Tax Credit? A: No, any unused Manitoba Rental Housing Construction Tax Credit cannot be carried forward to future tax years.