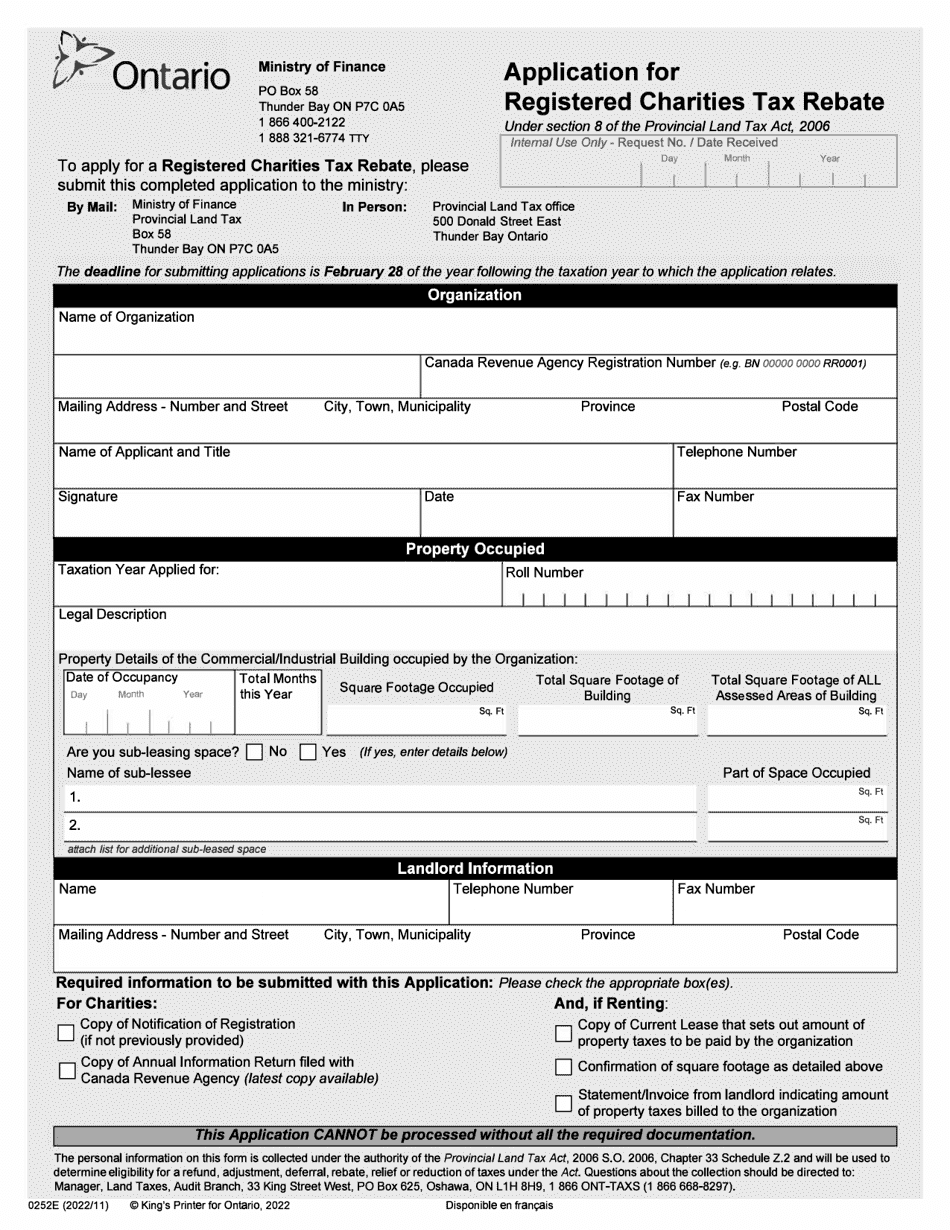

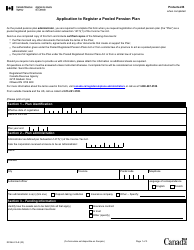

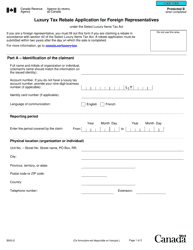

Form 0252E Application for Registered Charities Tax Rebate - Ontario, Canada

Form 0252E Application for Registered Charities Tax Rebate in Ontario, Canada is used by registered charities to apply for a rebate of a portion of the retail sales tax paid on eligible purchases.

The Form 0252E Application for Registered Charities Tax Rebate in Ontario, Canada is typically filed by registered charities themselves.

Form 0252E Application for Registered Charities Tax Rebate - Ontario, Canada - Frequently Asked Questions (FAQ)

Q: What is Form 0252E? A: Form 0252E is the application form for the Registered Charities Tax Rebate in Ontario, Canada.

Q: Who is eligible to use Form 0252E? A: Registered charities in Ontario, Canada are eligible to use Form 0252E.

Q: What is the Registered Charities Tax Rebate? A: The Registered Charities Tax Rebate is a tax refund program for eligible charities in Ontario, Canada.

Q: What information is required on Form 0252E? A: Form 0252E requires information about the charity's registration number, address, financial information, and details of any business activities.

Q: When is the deadline to submit Form 0252E? A: The deadline to submit Form 0252E is typically six months after the charity's fiscal period end date.

Q: Is there a fee to submit Form 0252E? A: No, there is no fee to submit Form 0252E.

Q: How long does it take to process Form 0252E? A: Processing times for Form 0252E may vary, but it typically takes several weeks to several months to receive a response.

Q: Can I claim the Registered Charities Tax Rebate if my charity operates in multiple provinces? A: No, the Registered Charities Tax Rebate is specific to Ontario, Canada. Other provinces may have their own tax refund programs for charities.