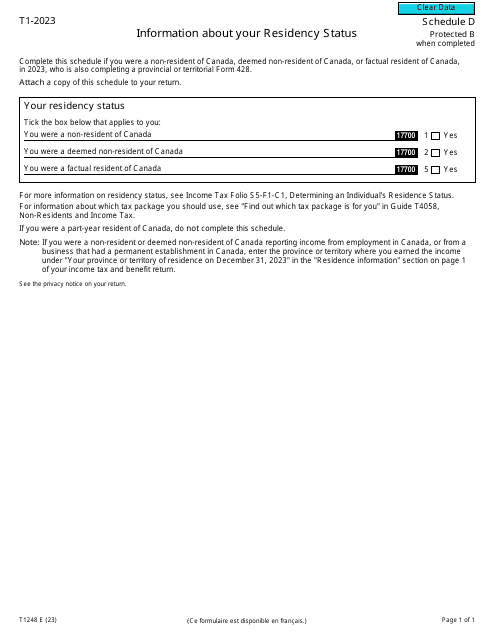

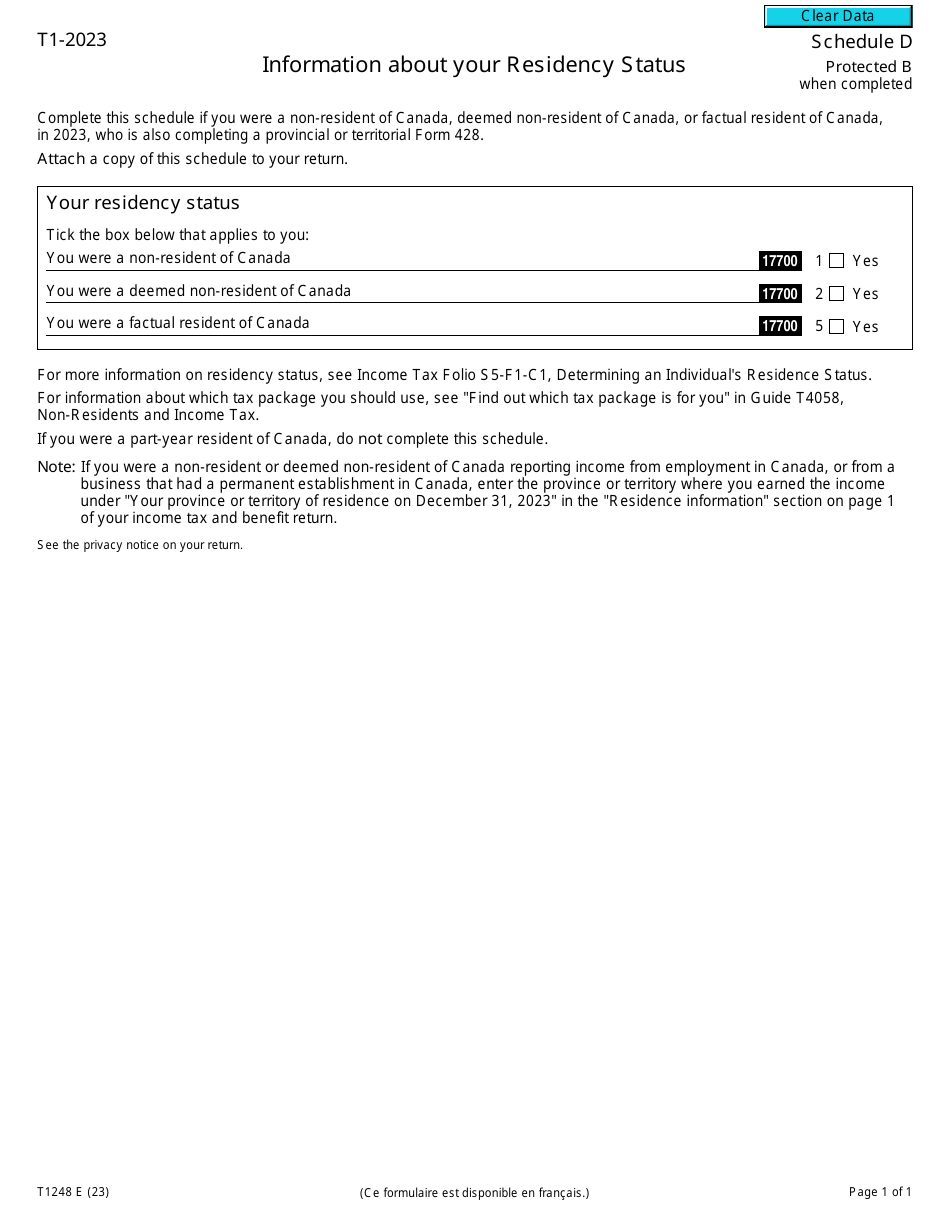

Form T1248 Schedule D Information About Your Residency Status - Canada

Form T1248 Schedule D is used to report your residency status as a taxpayer in Canada. It is a part of the Individual Income Tax Return and is used to determine your eligibility for certain tax benefits and obligations based on your residency status.

The taxpayer is responsible for filing Form T1248 Schedule D - Information About Your Residency Status in Canada.

Form T1248 Schedule D Information About Your Residency Status - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T1248? A: Form T1248 is a schedule used in Canada to provide information about your residency status.

Q: What is Schedule D? A: Schedule D is a specific section of Form T1248 that pertains to your residency status.

Q: Why is residency status important? A: Residency status is important for tax purposes and determines your tax obligations in Canada.

Q: What information is required on Schedule D? A: Schedule D requires information about your immigration status, the dates you arrived in Canada, and any periods of non-residency.

Q: Who needs to complete Form T1248? A: If you are a non-resident of Canada and you have Canadian-source income, you may need to complete Form T1248.

Q: Is Form T1248 the only form for determining residency status? A: No, there are other forms and factors that may be considered in determining residency status, such as Form NR73 or the significant residential ties test.

Q: When is the deadline for filing Form T1248? A: The deadline for filing Form T1248 depends on your individual tax situation. It is usually due at the same time as your annual income tax return.

Q: What happens if I provide incorrect information on Form T1248? A: Providing incorrect information on Form T1248 can result in penalties or interest charges, as well as a reassessment of your tax liability.

Q: Can I get help completing Form T1248? A: Yes, you can seek assistance from a tax professional or contact the Canada Revenue Agency (CRA) for guidance on completing Form T1248.