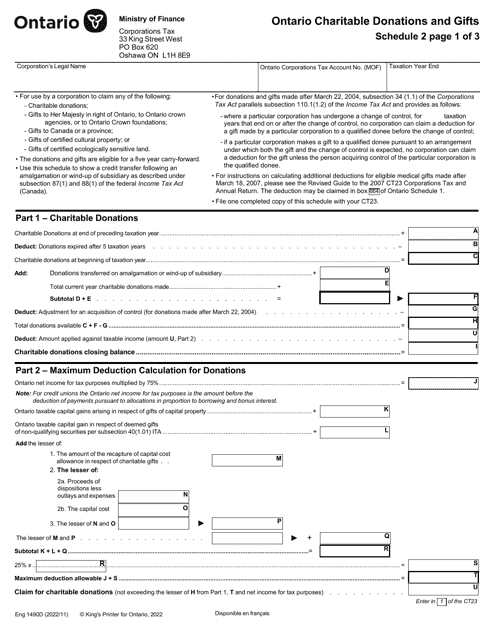

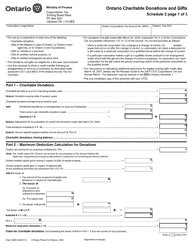

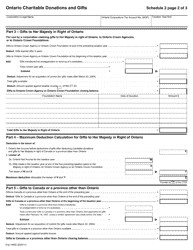

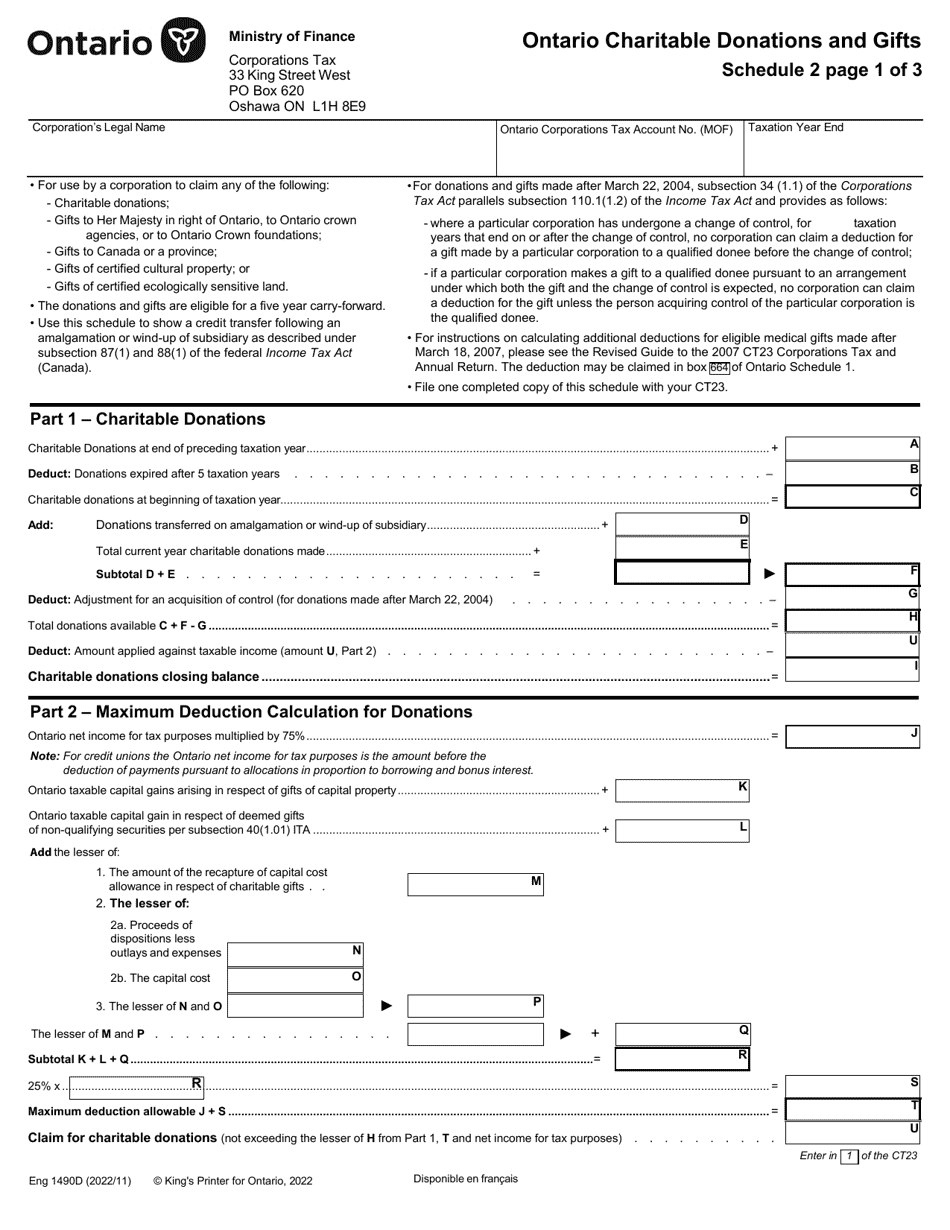

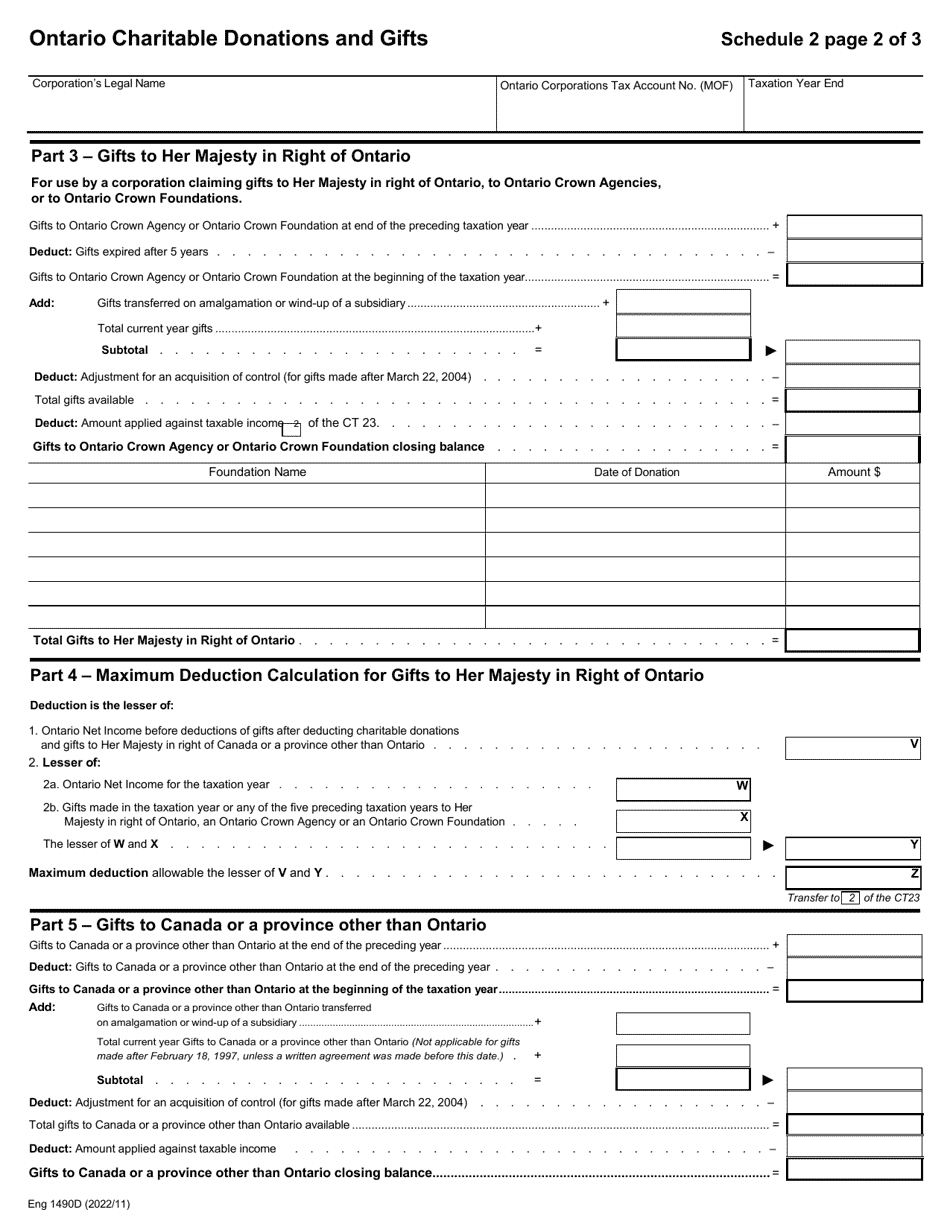

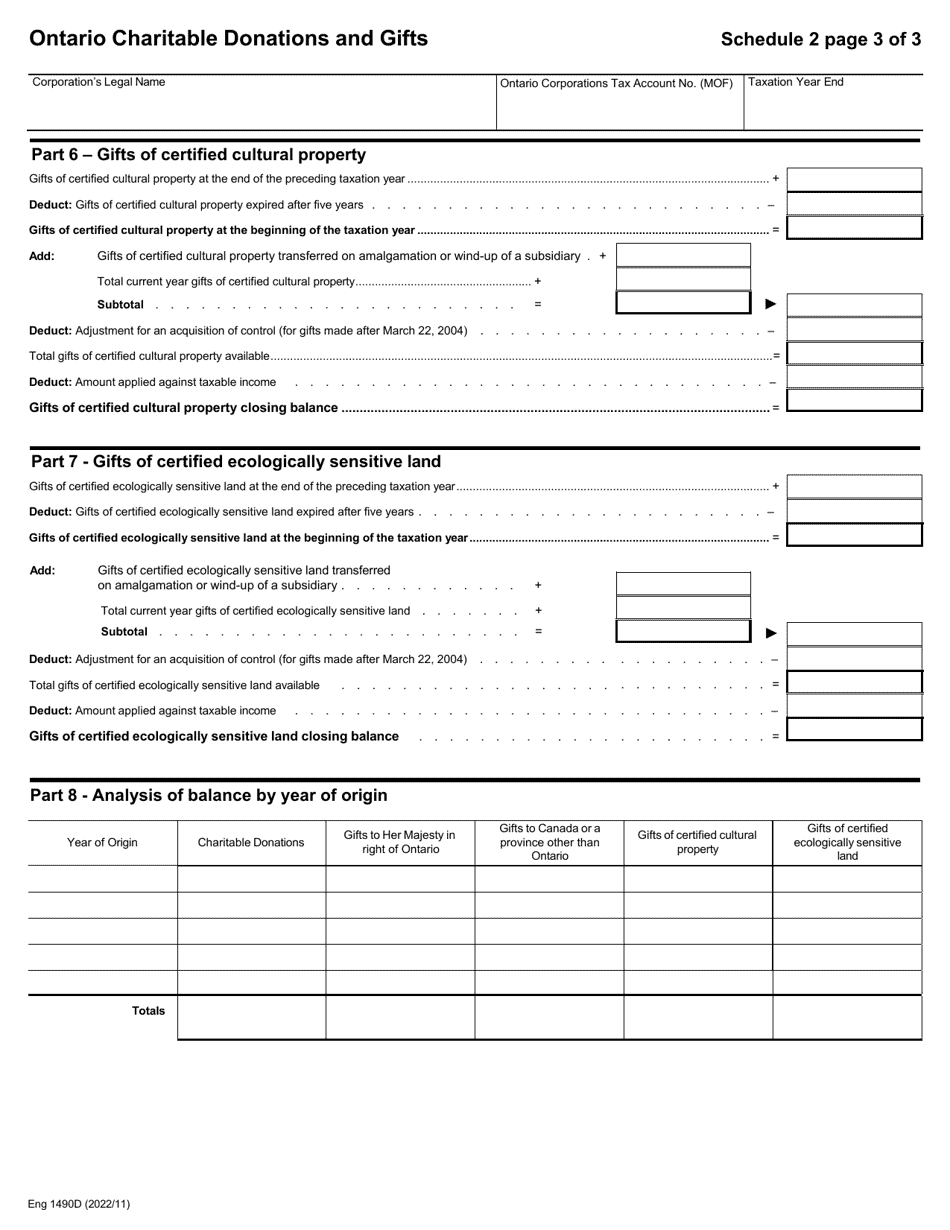

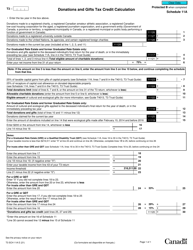

Form 1490D Schedule 2 Ontario Charitable Donations and Gifts - Ontario, Canada

Form 1490D Schedule 2 in Ontario, Canada is used to report charitable donations and gifts made by individuals for income tax purposes. It allows taxpayers to claim tax credits for eligible donations made to registered charities and other qualified donees in Ontario.

The Form 1490D Schedule 2 Ontario Charitable Donations and Gifts is filed by individuals or corporations in Ontario, Canada who have made charitable donations or gifts and wish to claim a tax credit.

Form 1490D Schedule 2 Ontario Charitable Donations and Gifts - Ontario, Canada - Frequently Asked Questions (FAQ)

Q: What is Form 1490D Schedule 2? A: Form 1490D Schedule 2 is a tax form used in Ontario, Canada to report charitable donations and gifts.

Q: What is the purpose of Form 1490D Schedule 2? A: The purpose of Form 1490D Schedule 2 is to claim tax credits for charitable donations and gifts made in Ontario.

Q: Who needs to fill out Form 1490D Schedule 2? A: Individuals and corporations who have made eligible charitable donations and gifts in Ontario need to fill out Form 1490D Schedule 2.

Q: What information is required to fill out Form 1490D Schedule 2? A: To fill out Form 1490D Schedule 2, you will need details about the charities or qualified donees you donated to, the date and amount of your donations, and any receipts or donation certificates you received.

Q: Are there any restrictions on the donations eligible for tax credits? A: Yes, there are certain restrictions on the donations eligible for tax credits. In Ontario, only donations made to registered charities or qualified donees are eligible for tax credits.

Q: Can I claim donations made outside of Ontario on Form 1490D Schedule 2? A: No, Form 1490D Schedule 2 is specifically for claiming tax credits for donations made in Ontario. Donations made outside of Ontario may be eligible for tax credits on other forms or in other provinces.

Q: What happens if I don't have all the required donation receipts? A: If you don't have all the required donation receipts, you may not be able to claim tax credits for those donations. It's important to keep proper records of your donations to ensure accurate reporting on Form 1490D Schedule 2.

Q: Can I carry forward unused donation credits from a previous year? A: Yes, unused donation credits can be carried forward for up to five years and claimed on future tax returns. This can help maximize the tax benefits of your charitable donations.