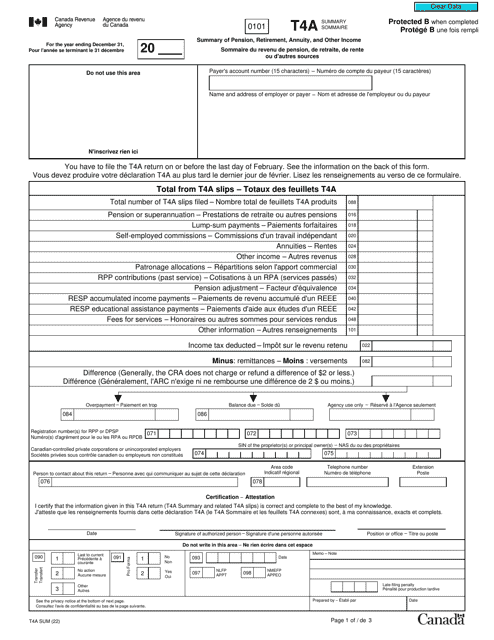

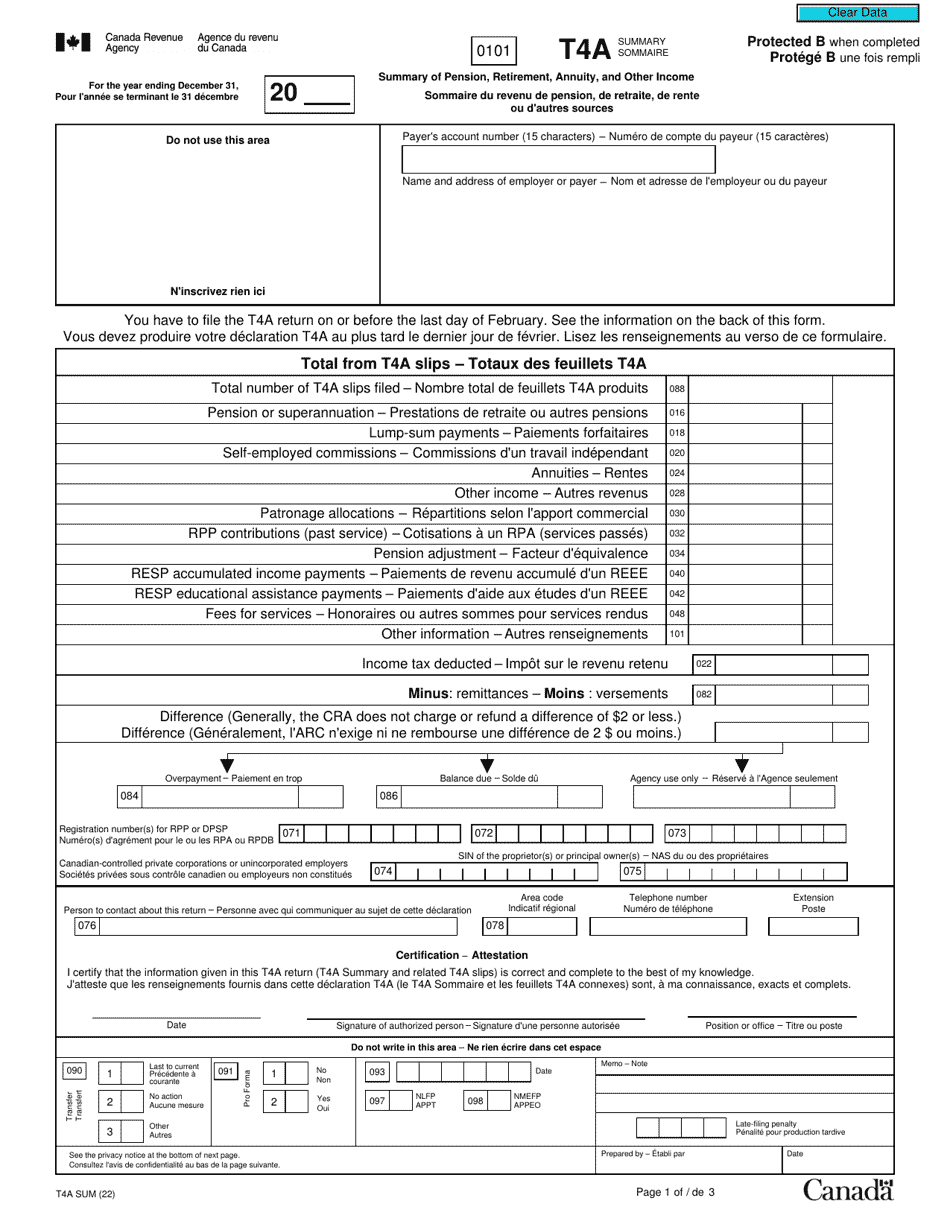

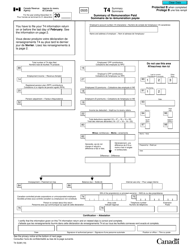

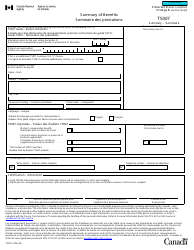

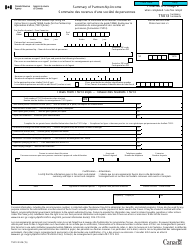

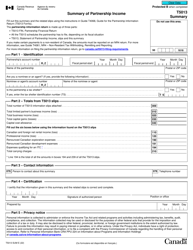

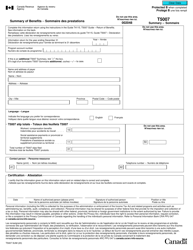

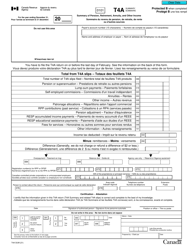

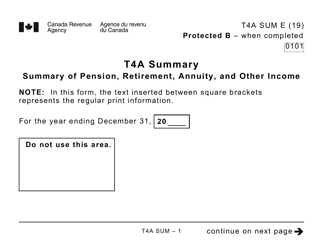

Form T4A SUM Summary of Pension, Retirement, Annuity, and Other Income - Canada (English / French)

Form T4A SUM is used in Canada to report the summary of pension, retirement, annuity, and other types of income received. It provides a record of the income earned and any tax deductions made during the year.

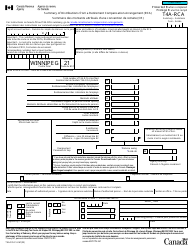

The Form T4A SUM Summary of Pension, Retirement, Annuity, and Other Income in Canada is filed by the payer, not the recipient.

Form T4A SUM Summary of Pension, Retirement, Annuity, and Other Income - Canada (English/French) - Frequently Asked Questions (FAQ)

Q: What is Form T4A SUM? A: Form T4A SUM is a summary of pension, retirement, annuity, and other income in Canada.

Q: Who needs to fill out Form T4A SUM? A: Individuals who receive pension, retirement, annuity, or other income in Canada may need to fill out Form T4A SUM.

Q: What should be reported on Form T4A SUM? A: Form T4A SUM should include details of any pension, retirement, annuity, or other income received during the tax year.

Q: When is the deadline to submit Form T4A SUM? A: The deadline to submit Form T4A SUM is usually the end of February following the tax year.

Q: Is Form T4A SUM only available in English and French? A: Yes, Form T4A SUM is available in both English and French versions.