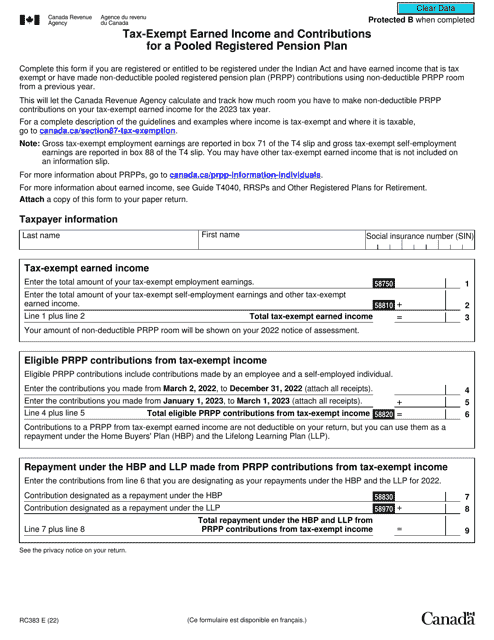

Form RC383 Tax-Exempt Earned Income and Contributions for a Pooled Registered Pension Plan - Canada

Form RC383 Tax-Exempt Earned Income and Contributions for a Pooled Registered Pension Plan is used in Canada to report tax-exempt earned income and contributions for individuals who participate in a Pooled Registered Pension Plan. It helps individuals claim any tax benefits or exemptions associated with their contributions to the plan.

The employer or plan administrator files the Form RC383 Tax-Exempt Earned Income and Contributions for a Pooled Registered Pension Plan in Canada.

Form RC383 Tax-Exempt Earned Income and Contributions for a Pooled Registered Pension Plan - Canada - Frequently Asked Questions (FAQ)

Q: What is form RC383? A: Form RC383 is a tax form used in Canada to report tax-exempt earned income and contributions for a Pooled Registered Pension Plan (PRPP).

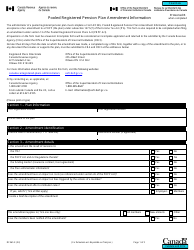

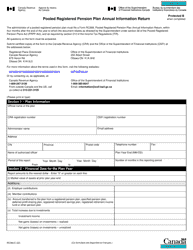

Q: What is a Pooled Registered Pension Plan (PRPP)? A: A PRPP is a type of pension plan available in Canada that is administered by a financial institution and designed to provide retirement income for individuals.

Q: Who needs to file form RC383? A: Individuals who have earned income and made contributions to a PRPP in the tax year need to file form RC383.

Q: What information is required on form RC383? A: Form RC383 requires individuals to provide details about their earned income, contributions made to a PRPP, and any amounts transferred from other registered plans.