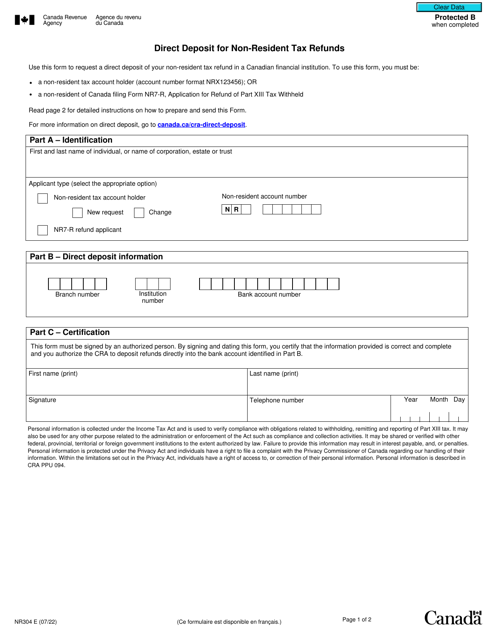

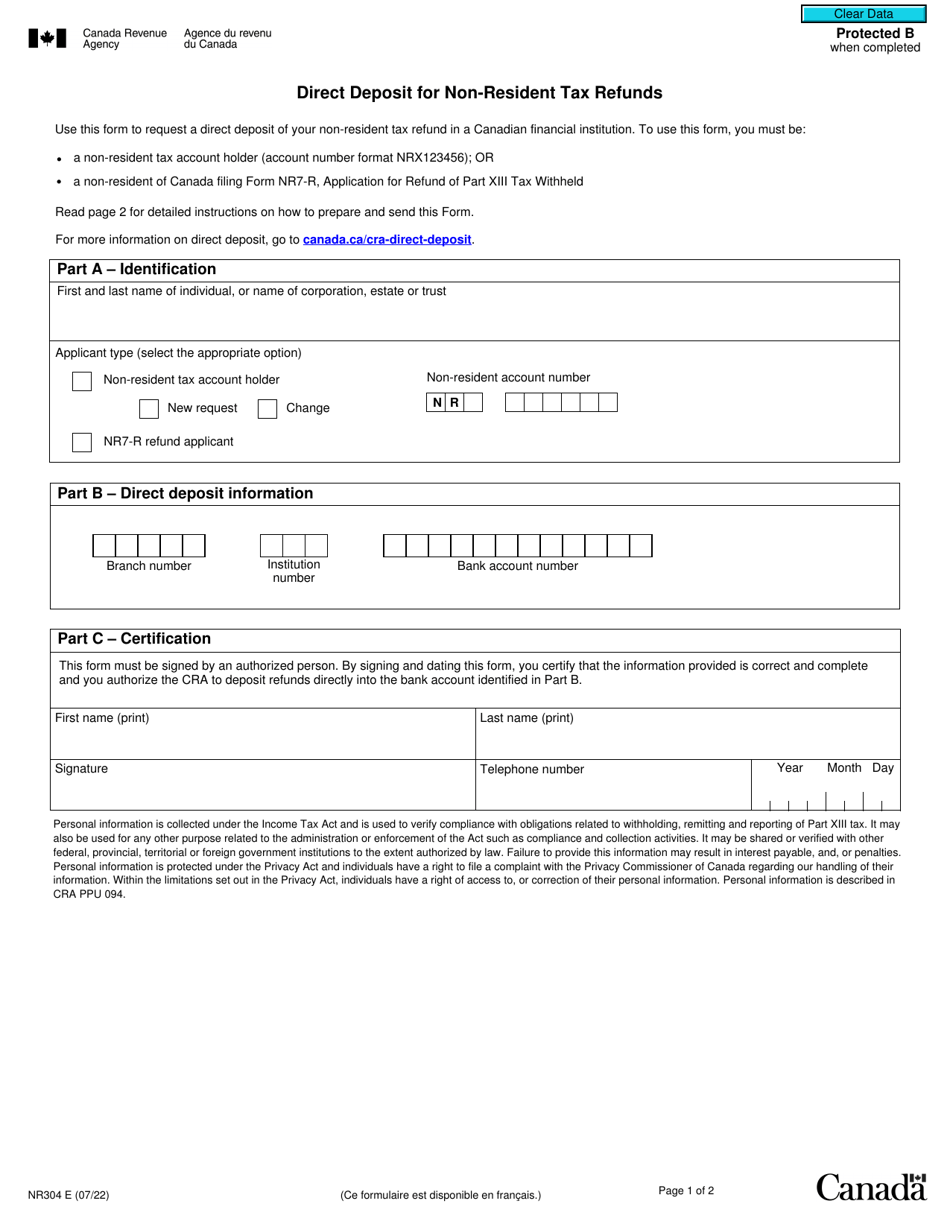

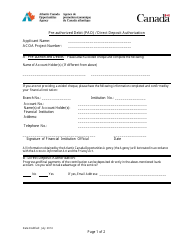

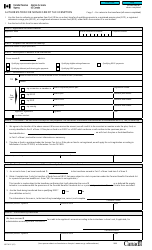

Form NR304 Direct Deposit for Non-resident Tax Refunds - Canada

Form NR304 Direct Deposit for Non-resident Tax Refunds in Canada is used to provide the necessary banking information for receiving tax refunds for non-residents.

The Non-Resident Taxpayer files the Form NR304 for direct deposit of tax refunds in Canada.

Form NR304 Direct Deposit for Non-resident Tax Refunds - Canada - Frequently Asked Questions (FAQ)

Q: What is form NR304? A: Form NR304 is the Direct Deposit Request for non-resident tax refunds in Canada.

Q: Who can use form NR304? A: Form NR304 can be used by non-residents who are eligible for a tax refund in Canada.

Q: What is the purpose of form NR304? A: The purpose of form NR304 is to request direct deposit of tax refunds for non-residents.

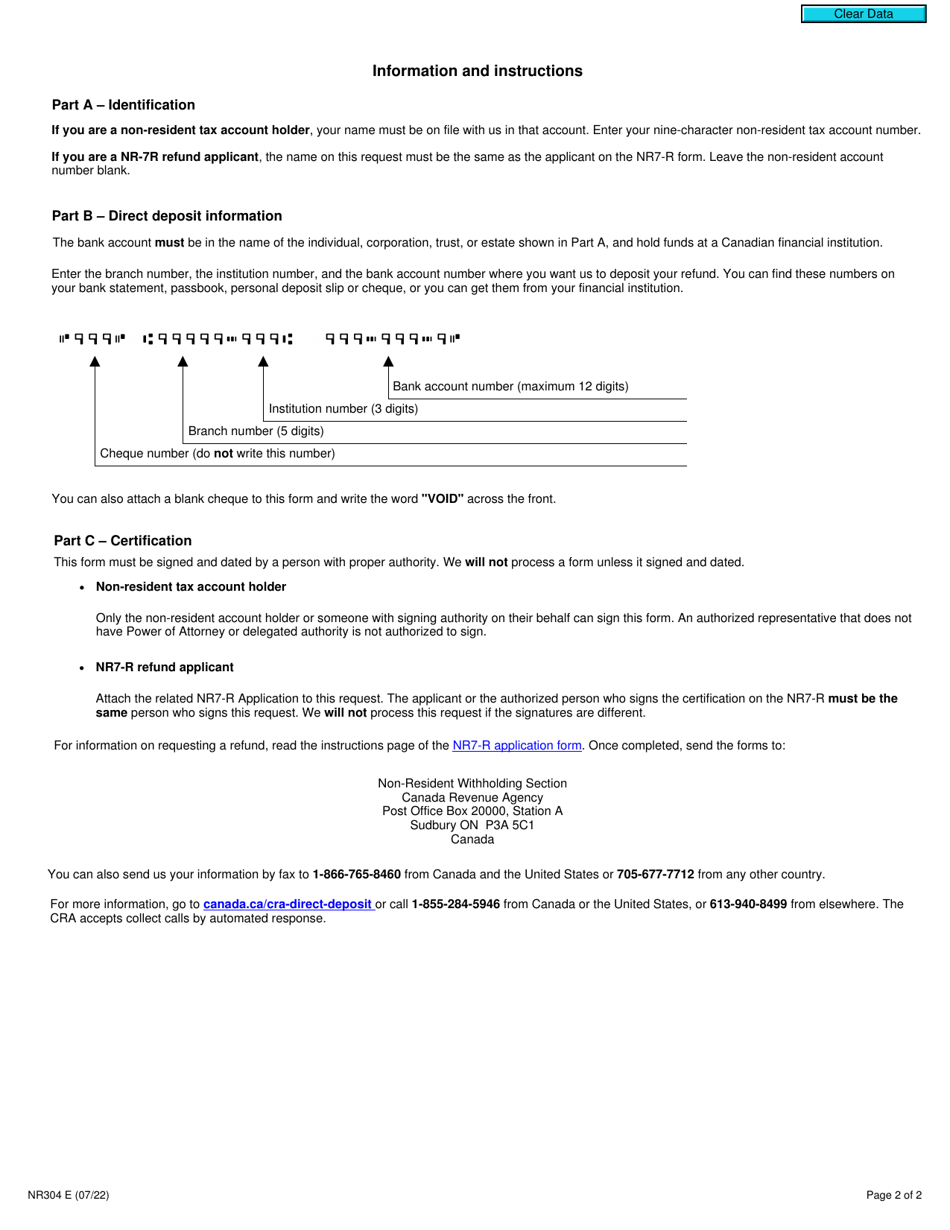

Q: What information is required on form NR304? A: Form NR304 requires you to provide pertinent personal and banking information, including your name, address, social insurance number, and bank account details.

Q: Can I receive my tax refund by direct deposit as a non-resident? A: Yes, as a non-resident, you can choose to receive your tax refund by direct deposit using form NR304.

Q: Are there any fees associated with direct deposit for non-resident tax refunds? A: No, there are no fees associated with direct deposit for non-resident tax refunds.

Q: How long does it take to receive a tax refund through direct deposit? A: The processing time for a tax refund through direct deposit can vary, but it is generally faster than receiving a refund by mail.

Q: What should I do if there is an issue with my direct deposit for a non-resident tax refund? A: If you encounter any issues with your direct deposit for a non-resident tax refund, you should contact the CRA for assistance.