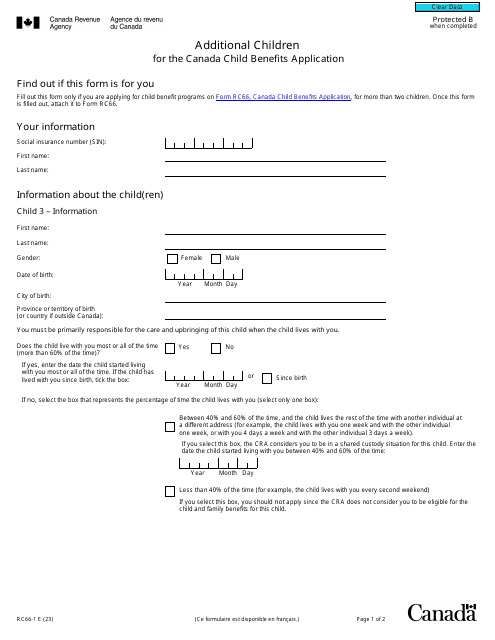

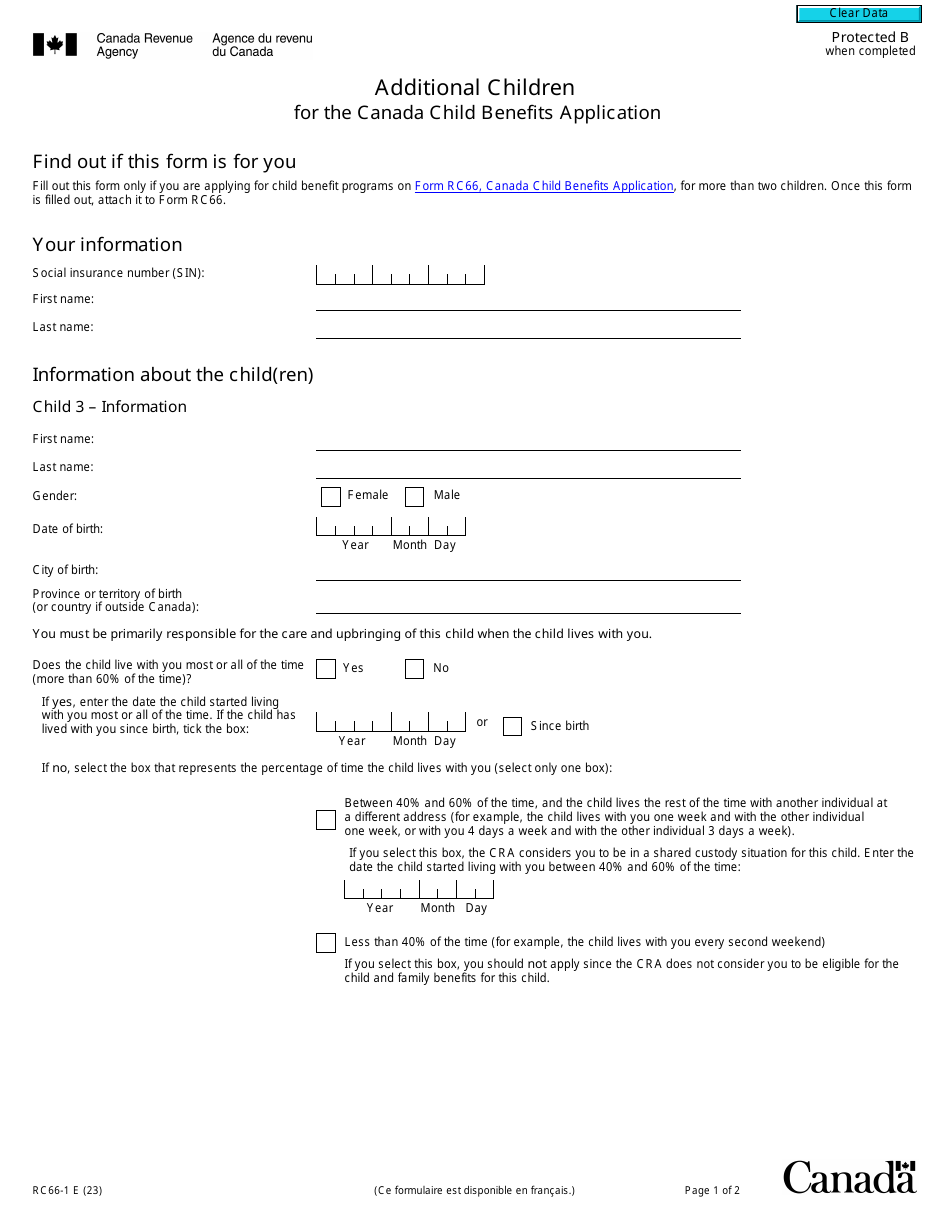

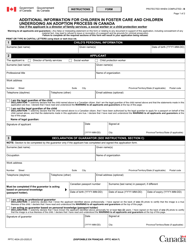

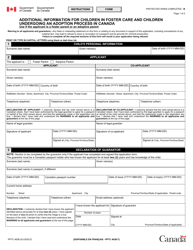

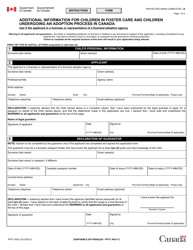

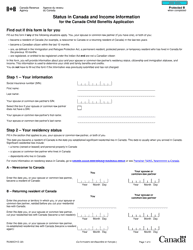

Form RC66-1 Additional Children for the Canada Child Benefits Application - Canada

Form RC66-1 Additional Children for the Canada Child Benefits Application is used by residents of Canada to add additional children to their Canada Child Benefits application. This form gathers information about the additional children, such as their names, birth dates, and Social Insurance Numbers, to ensure they are eligible for the benefits.

The primary caregiver or parent who is applying for the Canada Child Benefits would file the Form RC66-1 Additional Children application.

Form RC66-1 Additional Children for the Canada Child Benefits Application - Canada - Frequently Asked Questions (FAQ)

Q: What is Form RC66-1? A: Form RC66-1 is the Additional Children form for the Canada Child Benefits Application.

Q: What is the Canada Child Benefits Application? A: The Canada Child Benefits Application is a form used to apply for financial assistance for raising children in Canada.

Q: Who should use Form RC66-1? A: Form RC66-1 should be used by individuals who have additional children and want to include them in their Canada Child Benefits Application.

Q: What information is required on Form RC66-1? A: Form RC66-1 requires information such as the child's name, birthdate, and Social Insurance Number.

Q: Is there a deadline for submitting Form RC66-1? A: There is no specific deadline for submitting Form RC66-1, but it is recommended to apply as soon as possible to ensure timely benefits.

Q: Will submitting Form RC66-1 automatically result in receiving Canada Child Benefits? A: Submitting Form RC66-1 is the first step in applying for Canada Child Benefits, but eligibility will be determined by the Canada Revenue Agency.

Q: What other documents may be required in addition to Form RC66-1? A: Additional documents such as proof of income, birth certificates, and immigration documents may be required when applying for Canada Child Benefits.