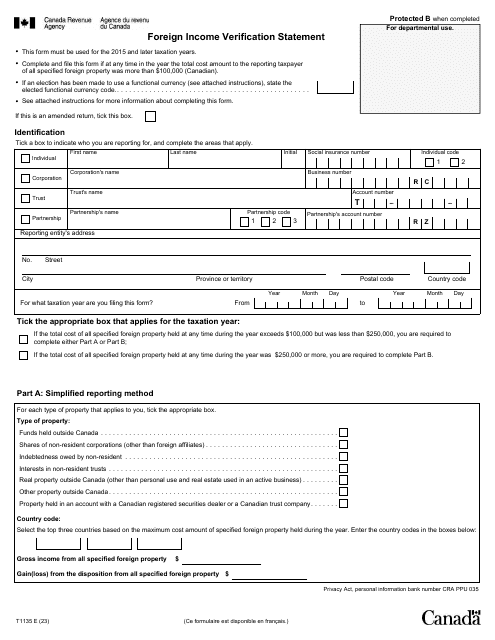

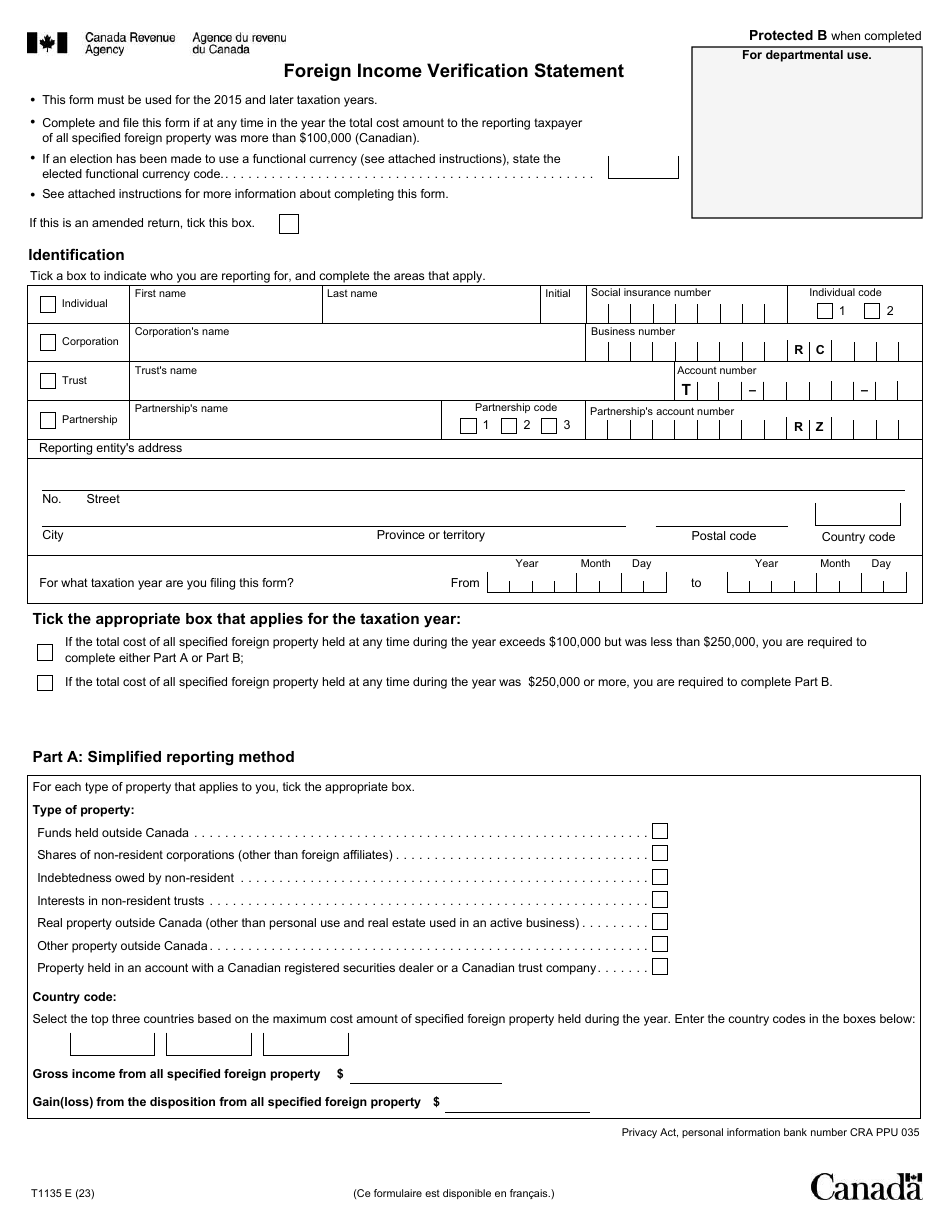

Form T1135 Foreign Income Verification Statement - Canada

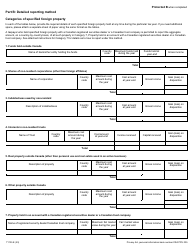

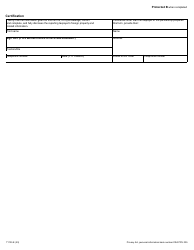

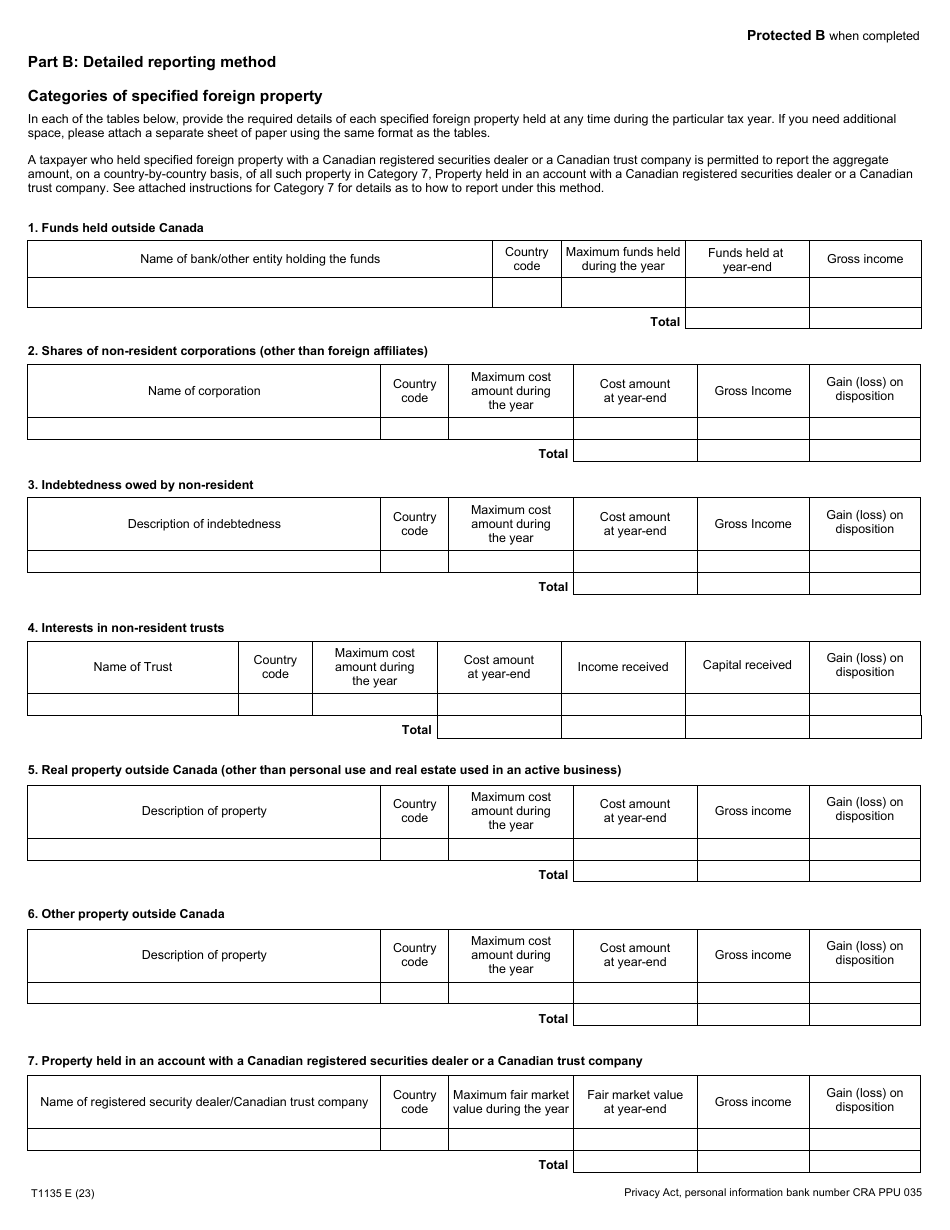

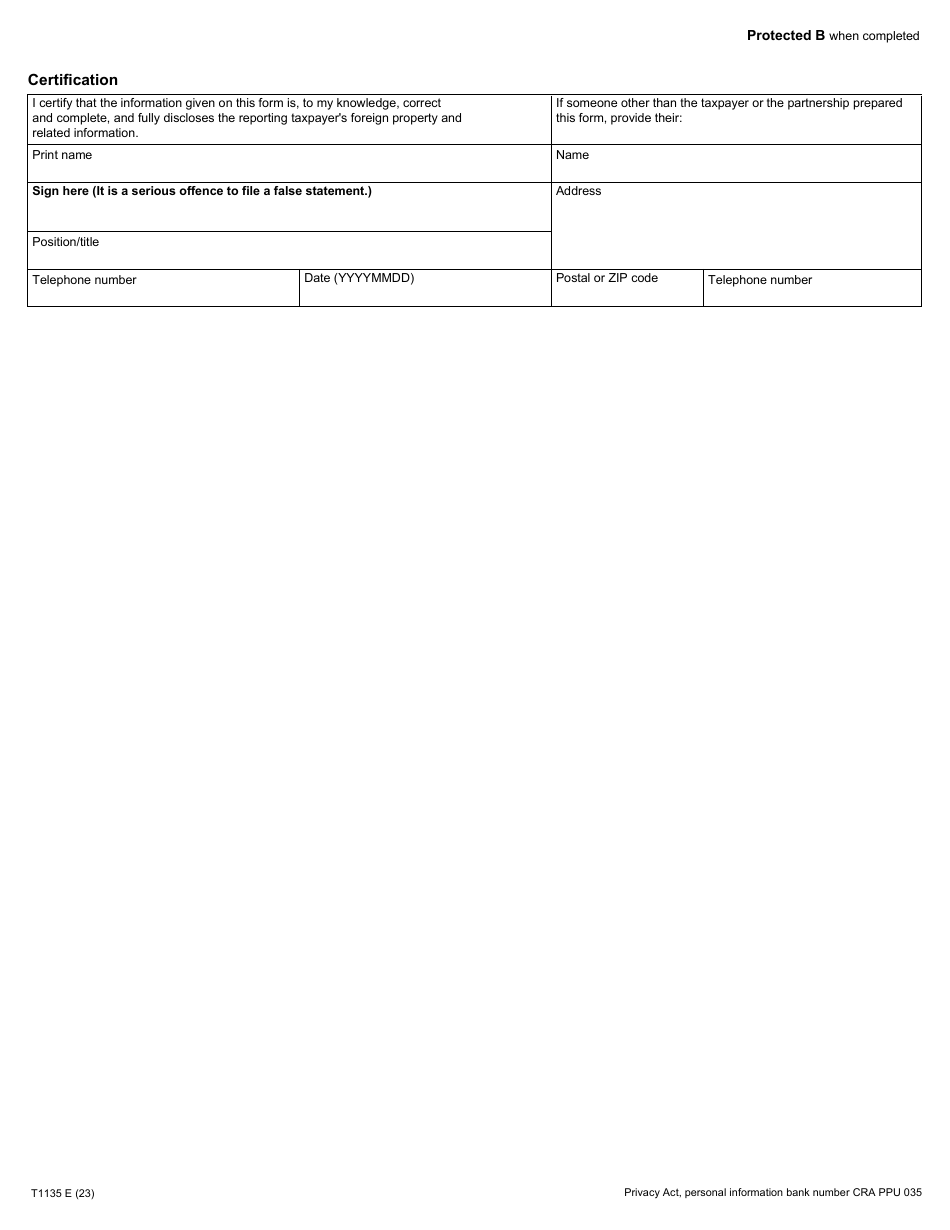

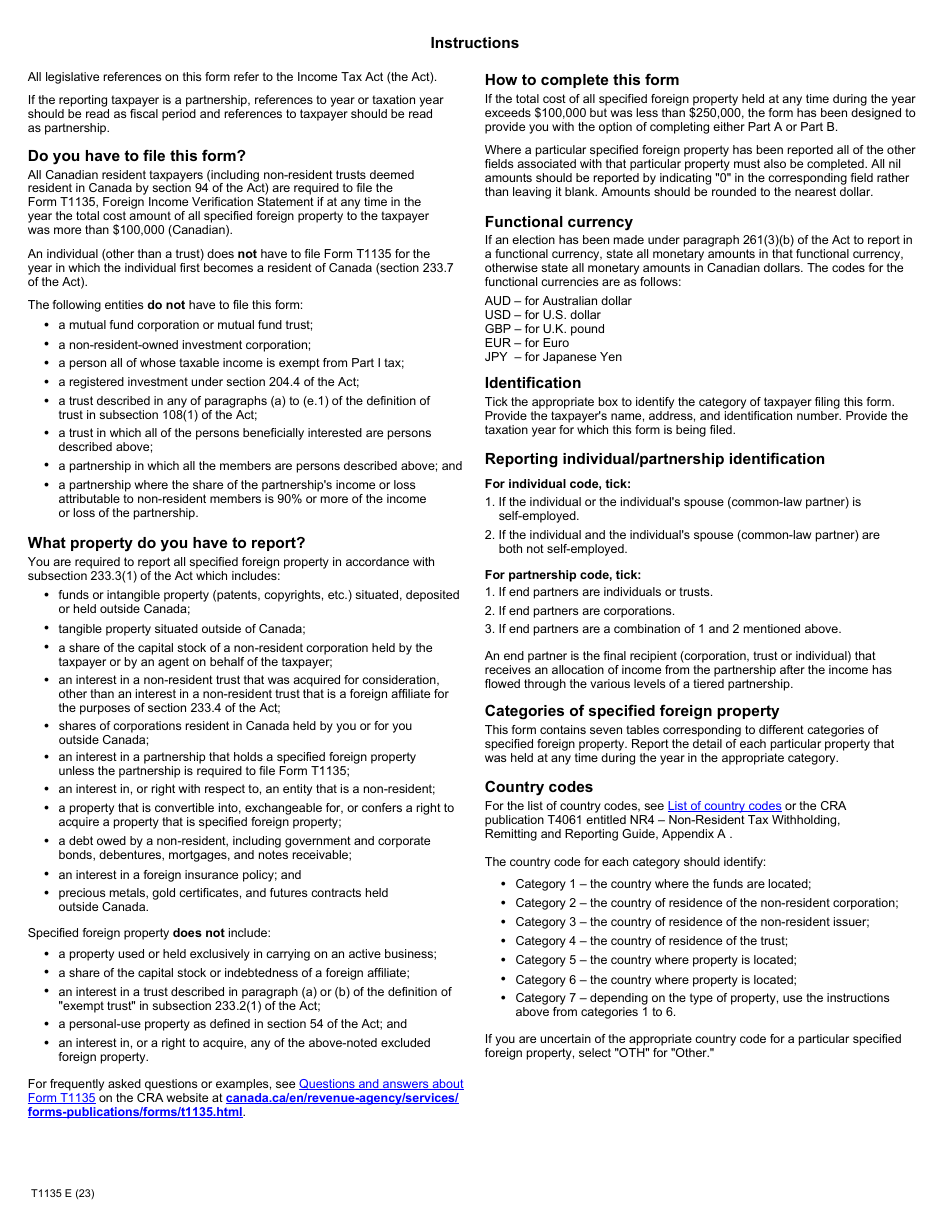

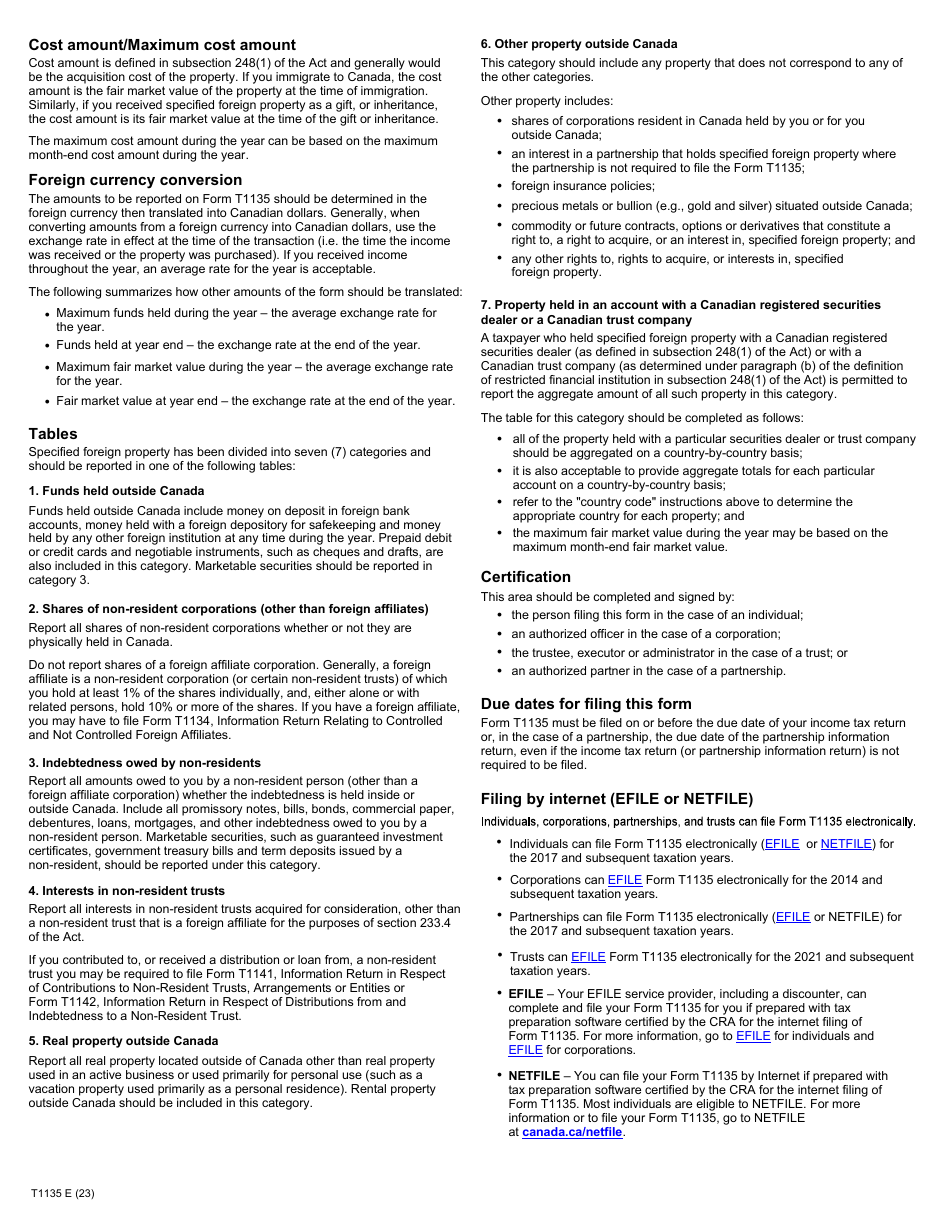

Form T1135, also known as the Foreign Income Verification Statement, is used by Canadian residents to report specified foreign property that they own. This includes assets such as foreign bank accounts, foreign securities, and real estate outside of Canada. It helps the Canadian government track and verify foreign income and assets for tax purposes.

Individuals or corporations who are Canadian residents and have specified foreign property with a total cost of more than $100,000 CAD at any point during the year are required to file the Form T1135 Foreign Income Verification Statement in Canada.

Form T1135 Foreign Income Verification Statement - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T1135? A: Form T1135 is a Foreign Income Verification Statement.

Q: What is the purpose of Form T1135? A: The purpose of Form T1135 is to report specified foreign property.

Q: Who needs to file Form T1135? A: Canadian residents who own specified foreign property with a total cost of over $100,000 CAD at any time during the year need to file Form T1135.

Q: What is specified foreign property? A: Specified foreign property includes funds held in foreign bank accounts, shares of foreign corporations, real estate outside of Canada, and certain debts owed by non-residents.

Q: When is the deadline to file Form T1135? A: The deadline to file Form T1135 is the same as the individual's income tax return deadline, which is usually April 30th of the following year.

Q: What happens if Form T1135 is filed late? A: Late filing of Form T1135 may result in penalties and interest charges.

Q: Are there any exemptions to filing Form T1135? A: Yes, there are certain exemptions and exclusions to filing Form T1135. It is recommended to consult with a tax professional for specific circumstances.