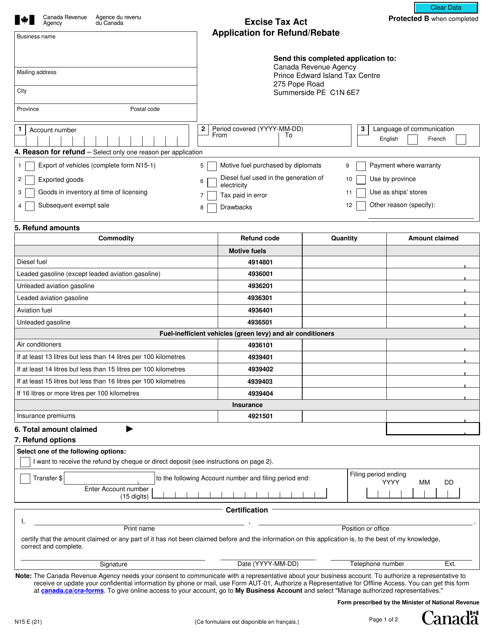

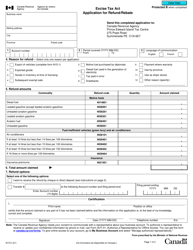

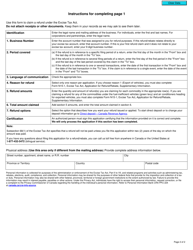

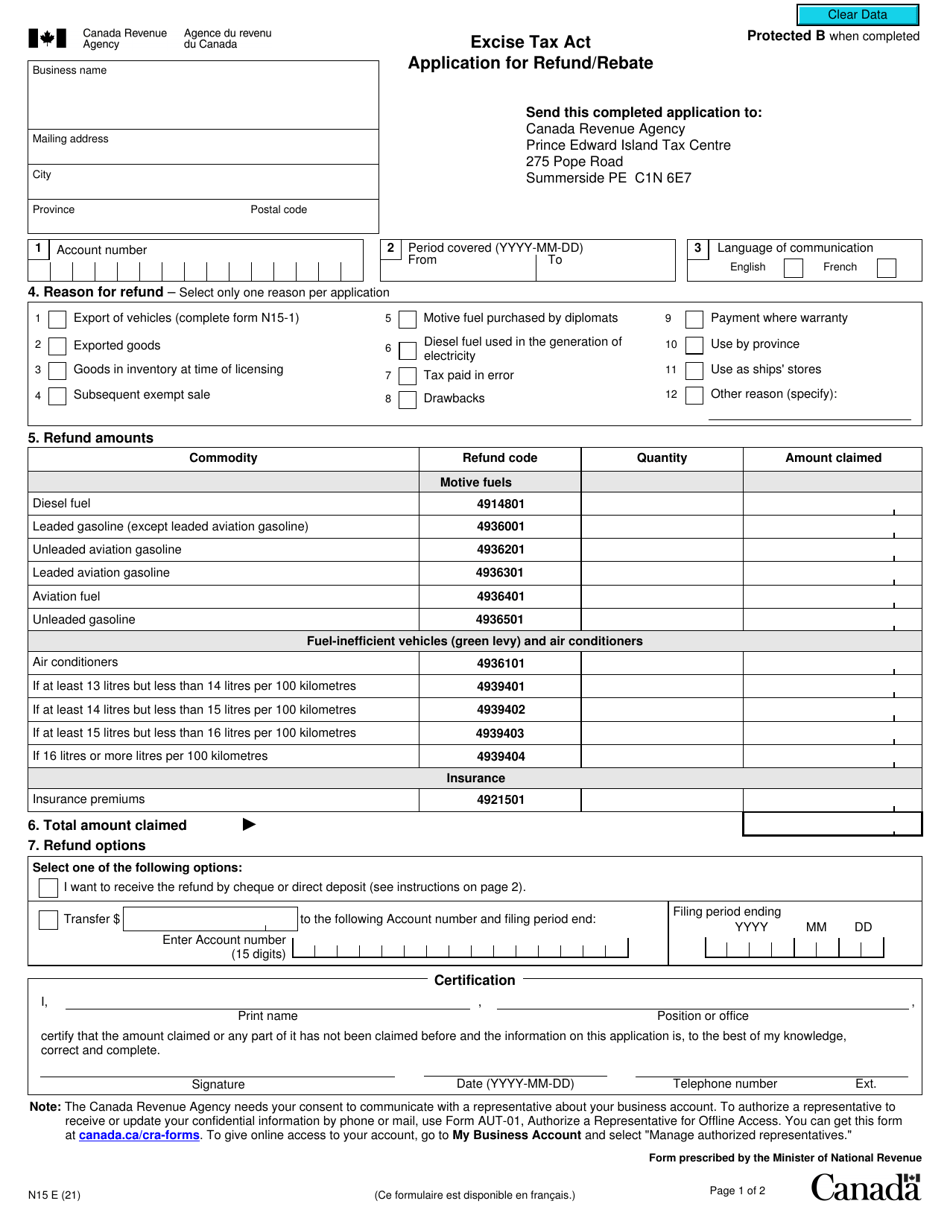

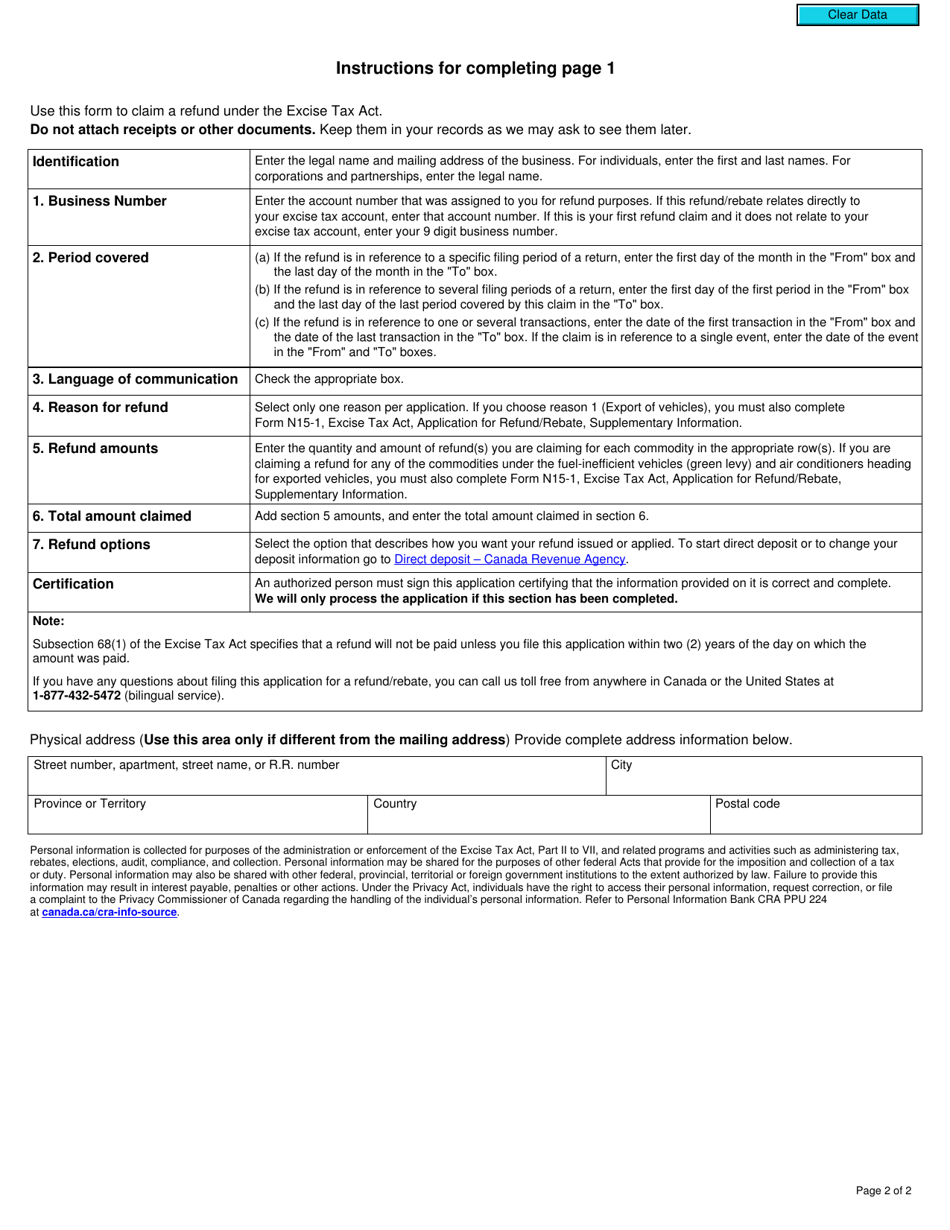

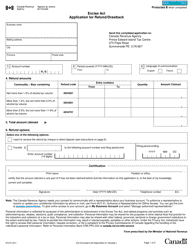

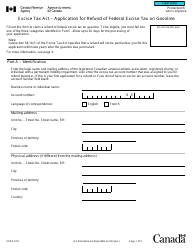

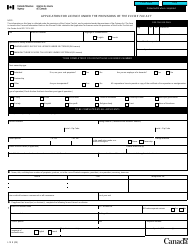

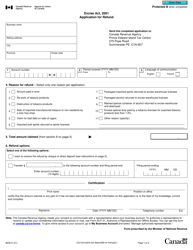

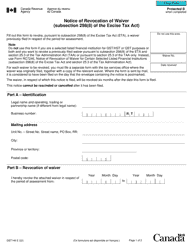

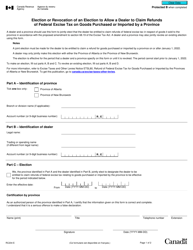

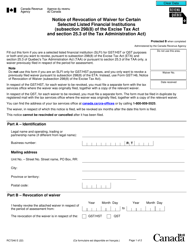

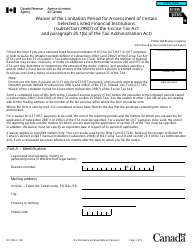

Form N15 Excise Tax Act - Application for Refund / Rebate - Canada

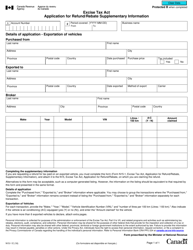

Form N15 Excise Tax Act - Application for Refund/Rebate in Canada is used to claim a refund or rebate for certain excise taxes paid. Excise taxes are taxes imposed on specific goods such as alcohol, tobacco, or gasoline. This form allows individuals or businesses to apply for a refund or rebate if they have overpaid or are eligible for a specific exemption under the Excise Tax Act.

The Form N15 Excise Tax Act - Application for Refund/Rebate in Canada is filed by individuals or businesses who are seeking a refund or rebate under the Excise Tax Act.

Form N15 Excise Tax Act - Application for Refund/Rebate - Canada - Frequently Asked Questions (FAQ)

Q: What is Form N15? A: Form N15 is an application form for refund/rebate under the Excise Tax Act in Canada.

Q: What is the Excise Tax Act? A: The Excise Tax Act is a Canadian law that governs the imposition and collection of excise taxes.

Q: What can I use Form N15 for? A: You can use Form N15 to apply for a refund or rebate of excise tax paid in Canada.

Q: Who can use Form N15? A: Any individual or business that has paid excise tax in Canada can use Form N15.

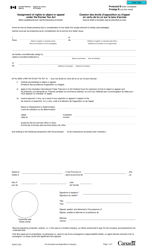

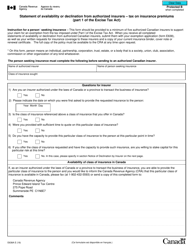

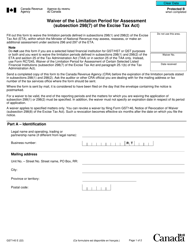

Q: Is there a deadline to submit Form N15? A: Yes, there is a deadline to submit Form N15. The deadline is generally within two years from the end of the reporting period in which the excise tax was paid.

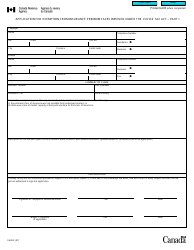

Q: What documents do I need to submit with Form N15? A: You may need to submit supporting documents, such as invoices, receipts, or other relevant records, depending on the nature of the refund or rebate being claimed.

Q: How long does it take to process Form N15? A: The processing time for Form N15 can vary depending on the complexity of the refund or rebate claim. It is recommended to contact the CRA for more information on the processing times.

Q: Are there any fees associated with filing Form N15? A: No, there are no fees associated with filing Form N15.

Q: What should I do if my Form N15 is rejected? A: If your Form N15 is rejected, you should review the rejection letter or notice from the CRA and follow the instructions provided. You may need to provide additional information or make corrections to your application.