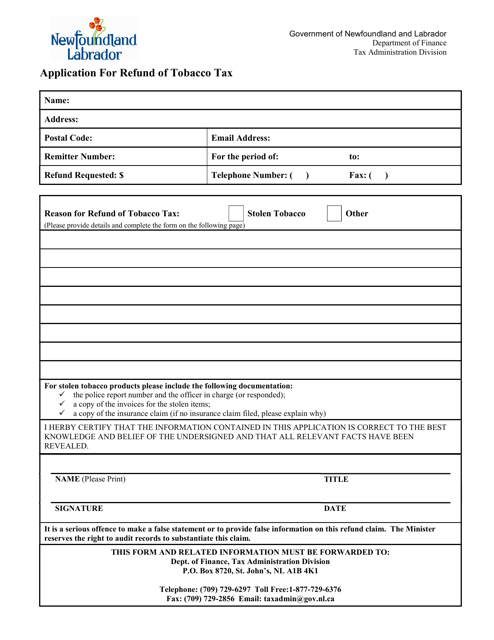

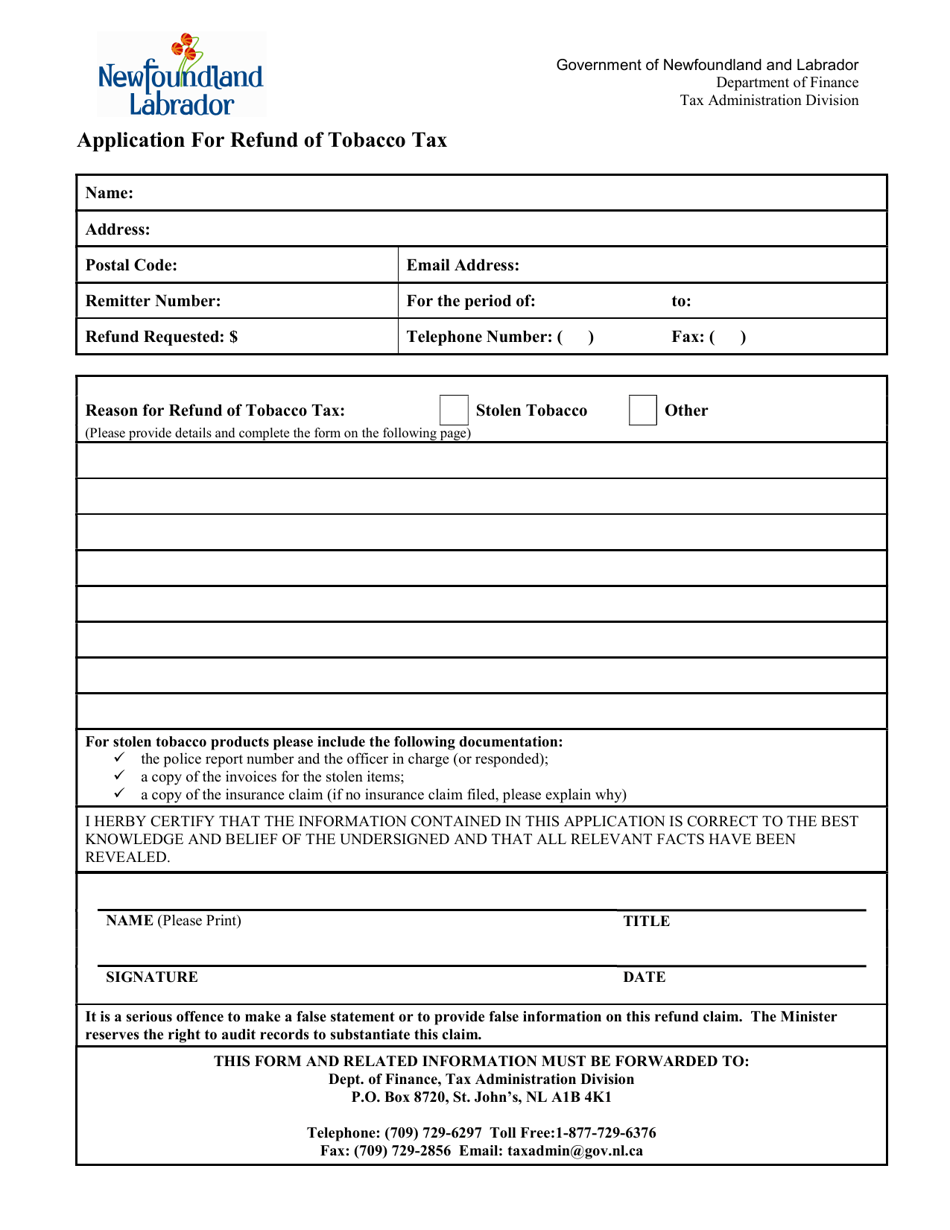

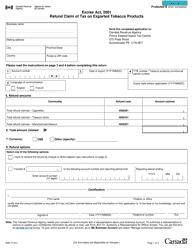

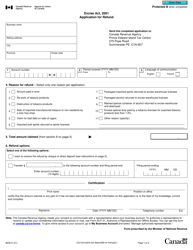

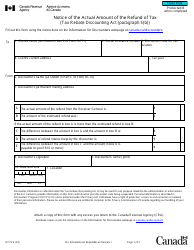

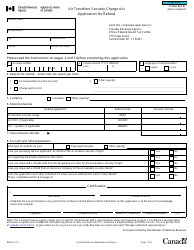

Application for Refund of Tobacco Tax - Newfoundland and Labrador, Canada

The Application for Refund of Tobacco Tax in Newfoundland and Labrador, Canada is used to request a refund of tobacco tax paid on tobacco products.

The application for refund of tobacco tax in Newfoundland and Labrador, Canada, is filed by the person who paid the tax.

Application for Refund of Tobacco Tax - Newfoundland and Labrador, Canada - Frequently Asked Questions (FAQ)

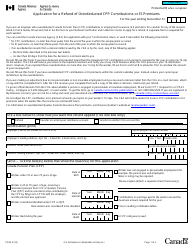

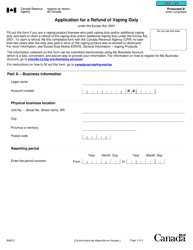

Q: What is the application for refund of tobacco tax? A: The application for refund of tobacco tax is a form that allows individuals in Newfoundland and Labrador, Canada, to request a refund of the tobacco tax they have paid.

Q: Who can apply for a refund of tobacco tax? A: Any individual who has paid tobacco tax in Newfoundland and Labrador, Canada, can apply for a refund.

Q: What is the purpose of the refund? A: The purpose of the refund is to provide reimbursement for individuals who have overpaid or made an error in paying their tobacco tax.

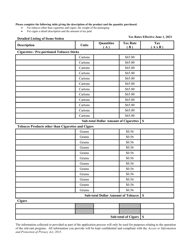

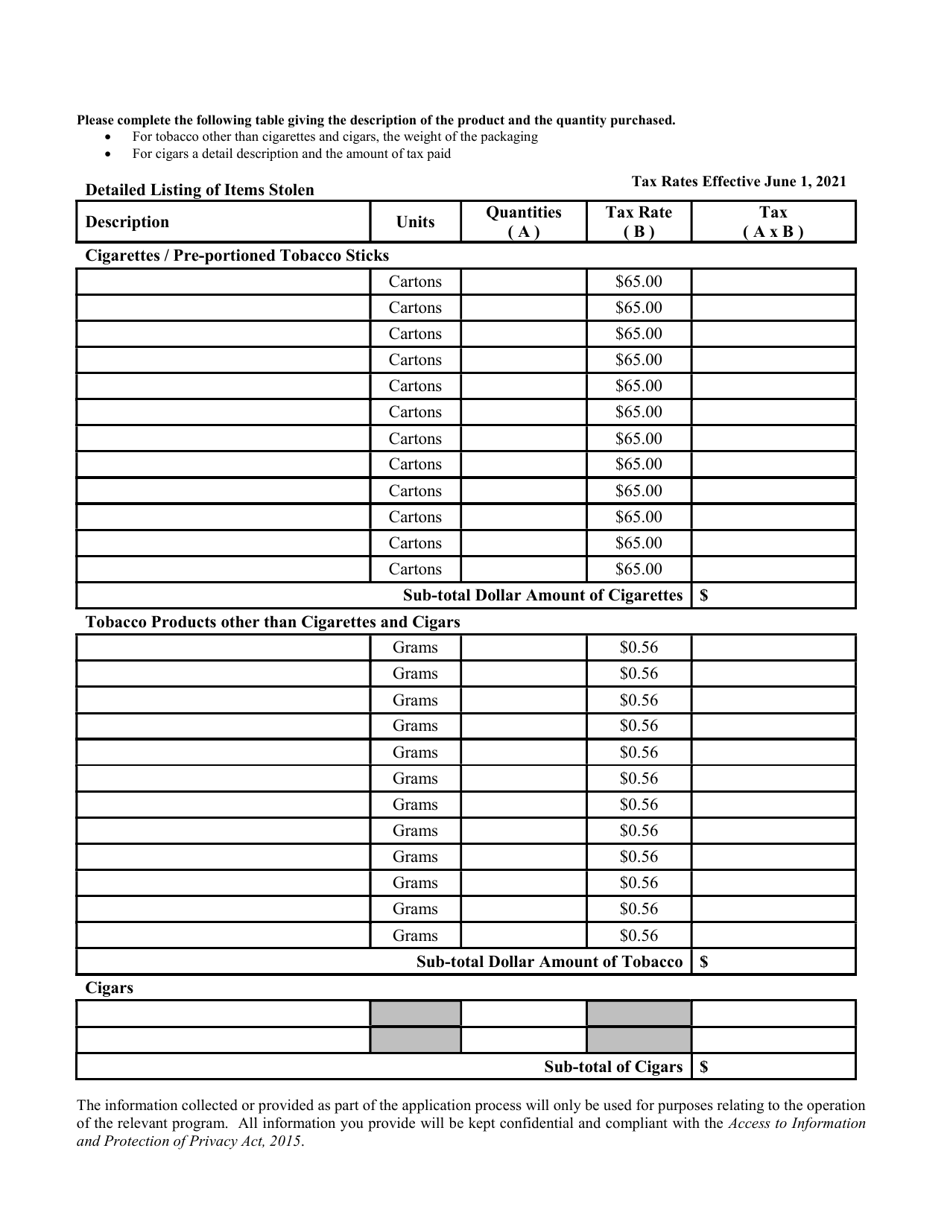

Q: What information do I need to provide on the application form? A: On the application form, you will need to provide your personal information, details about the tobacco products for which you are seeking a refund, and supporting documentation.

Q: Is there a deadline for submitting the application? A: Yes, there is a deadline for submitting the application. The deadline is typically six months from the date of purchase of the tobacco products.

Q: How long does it take to process the refund? A: The processing time for the refund can vary, but you can expect it to take several weeks to a few months.

Q: What happens if my application is approved? A: If your application is approved, you will receive a refund of the tobacco tax amount that you have overpaid or made an error in paying.

Q: What happens if my application is denied? A: If your application is denied, you will receive a notification explaining the reason for the denial and any recourse options available to you.