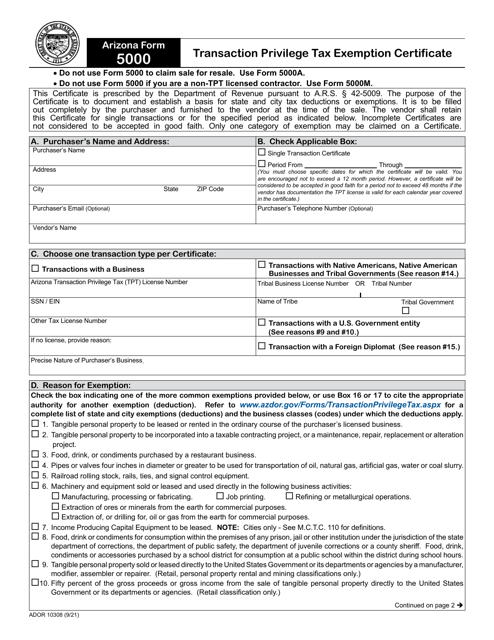

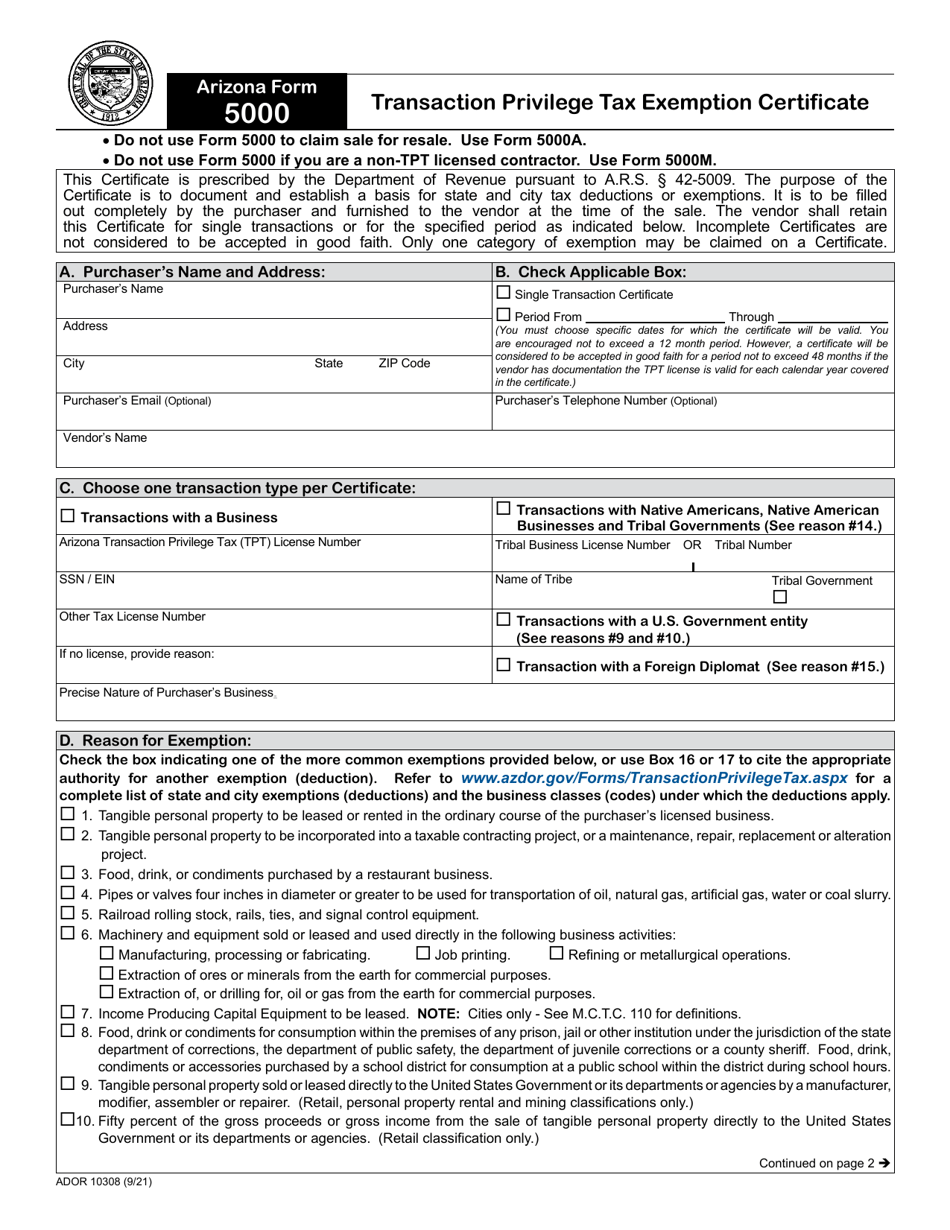

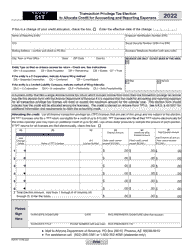

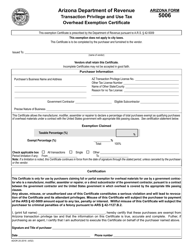

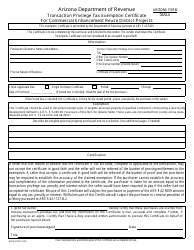

Arizona Form 5000 (ADOR10308) Transaction Privilege Tax Exemption Certificate - Arizona

What Is Arizona Form 5000?

Arizona Form 5000, Transaction Privilege Tax Exemption Certificate , is a document that establishes a basis for state exceptions. Transaction privilege tax (TPT) is a sales tax levied by the state of Arizona on vendors for the ability to conduct business in the state. Different business activities must be licensed because they are subject to the transaction privilege tax.

In Arizona, certain items can be exempt from the sales tax. Some examples of such exceptions to the tax include but are not limited to: tangible personal property to be leased or rented, food purchased by a restaurant business, rails and signal control equipment, machinery, or equipment used in manufacturing. In case of purchasing such items, a vendor can claim Arizona Transaction Privilege Tax Exemption. The purchaser should fill out Form 5000 and provide it to the vendor at the time of the sale.

This form was released by the Arizona Department of Revenue and the latest version was issued on September 1, 2021 . An Arizona 5000 Form fillable version is available for download below.

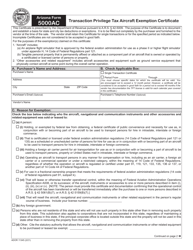

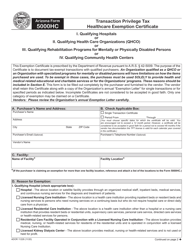

What Is the Difference Between Arizona Form 5000 and 5000A?

While Form 5000 covers an extensive list of state exemptions and is used for a sale only, Form 5000A, Arizona Resale Certificate, specially developed for making purchases of tangible personal property for resale. As well as Form 5000, it should be filled out by the purchaser and delivered to the vendor, and can be used for single purchases or specified periods. To purchase tangible personal property for resale, it is necessary to have a Transaction Privilege Tax (TPT).

If the purchaser is a non-TPT licensed contractor, in this case, Form 5000M, Non-TPT Licensed Contractor Certificate (MRRA Project). should be used.

Arizona Form 5000 Instructions

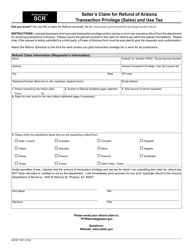

Arizona 5000 Form instructions are the following:

- The purchaser's name and address should be indicated.

- The kind of certificate should be checked. It can be a Single Transaction Certificate that is used for a one-time purchase. In the case of a regular series of purchases, a period for which the certificate will be valid should be indicated. It is better not to exceed 12 months. A period within 48 months can be accepted as well if there is documentation confirming the TPT license is valid during this time.

- Choose one transaction type for the certificate. It can be transactions with a business, Native Americans, a US government entity, or a foreign diplomat.

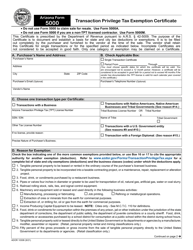

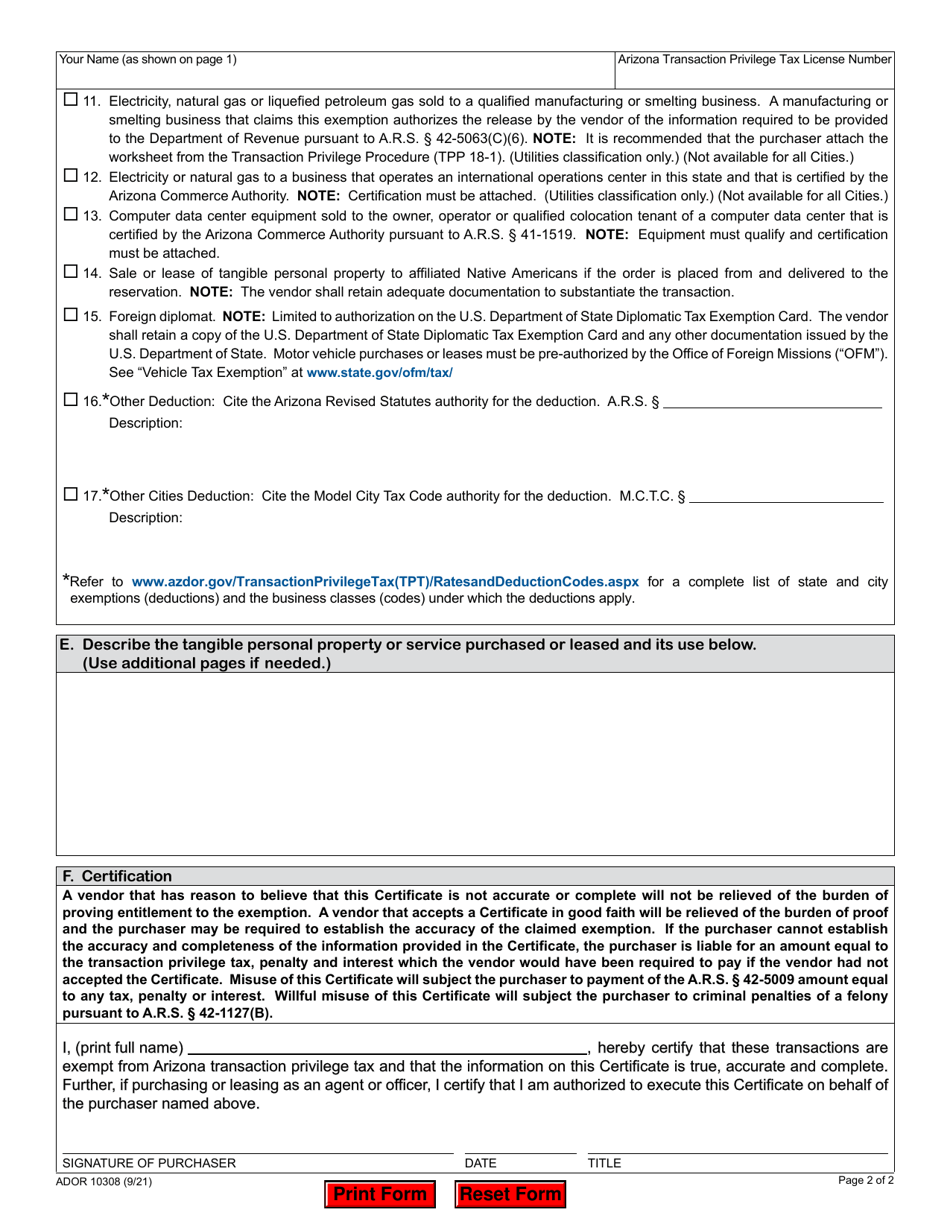

- The reason for exemption should be chosen from the list of the most common exemptions. Check the applicable box from 1 to 13. Indicate other deduction if it is not included in the list provided. In this case choose the boxes 14 and 15, using a space for the description of the exemption. The purchaser can claim only one category of exemption on the certificate.

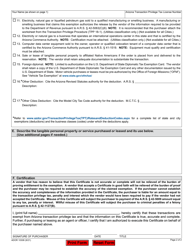

- The purchaser should describe the tangible personal property or service purchased and how it is used.

- Certification. In this part the purchaser should print their full name, sign a form and indicate the date, thereby certify that the information on the certificate is true and complete.