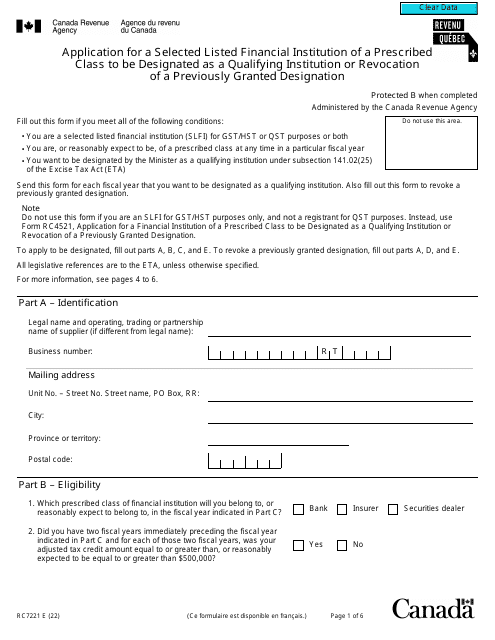

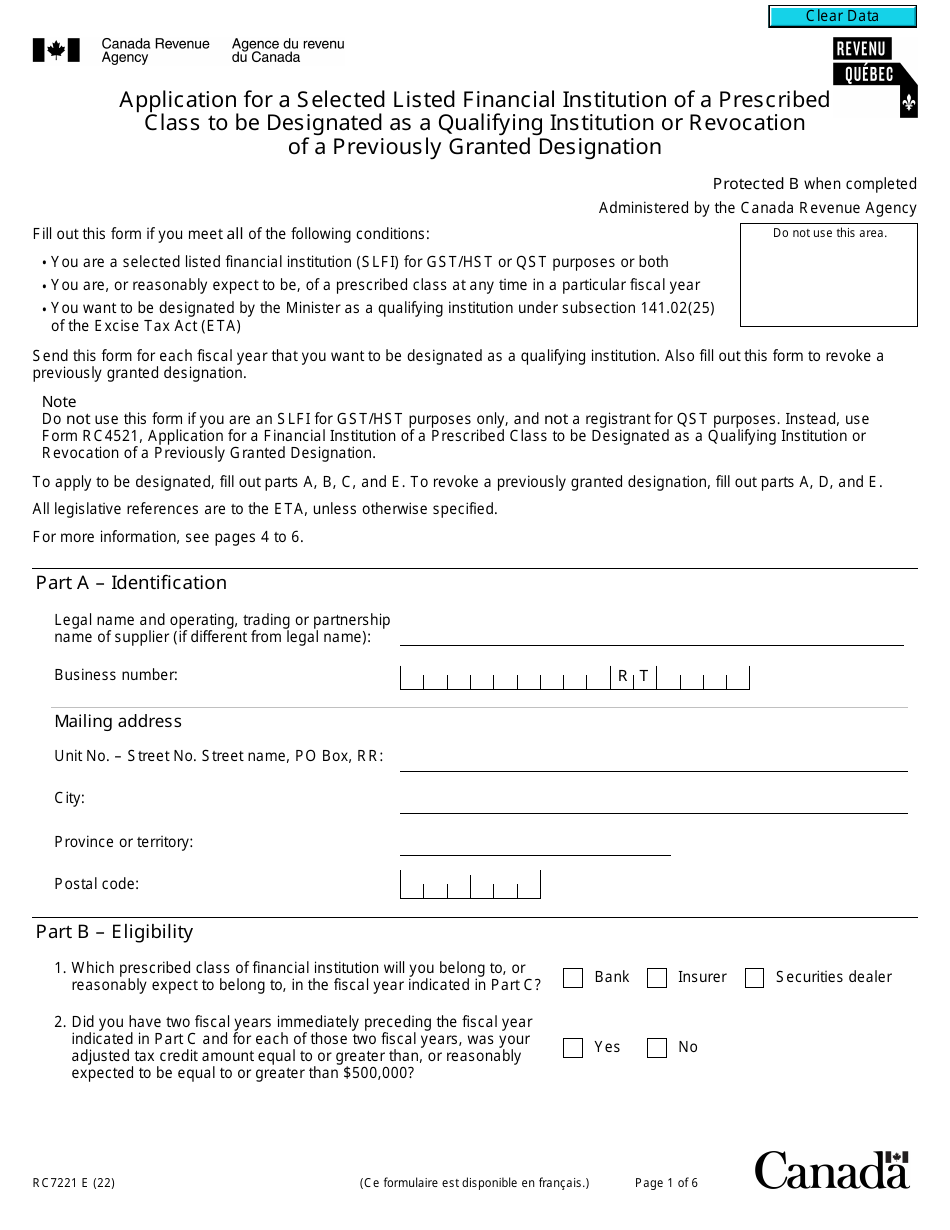

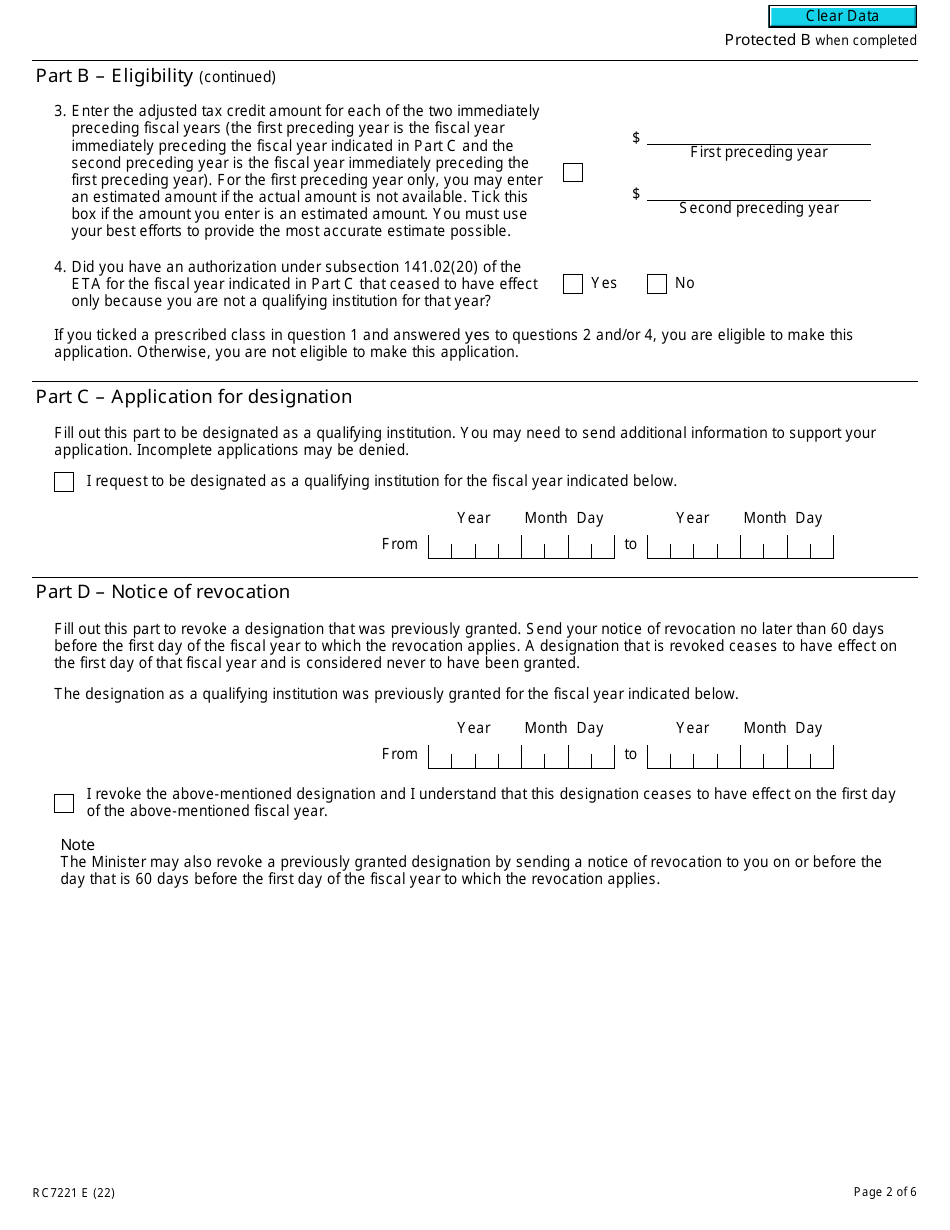

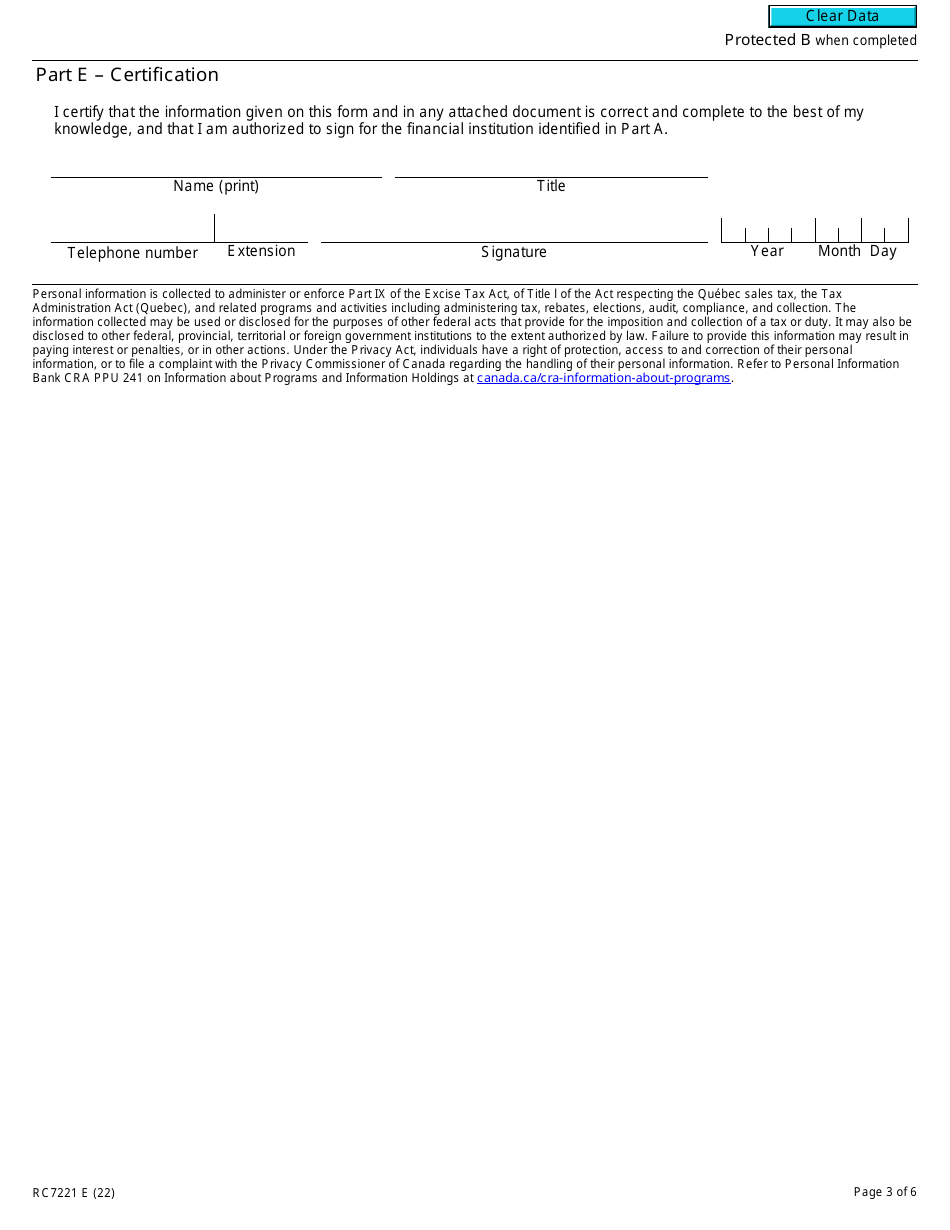

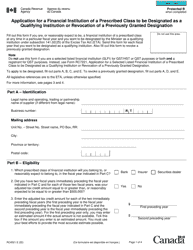

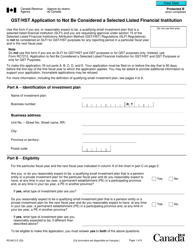

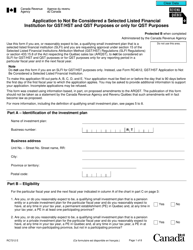

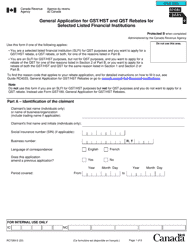

Form RC7221 Application for a Selected Listed Financial Institution of a Prescribed Class to Be Designated as a Qualifying Institution or Revocation of a Previously Granted Designation - Canada

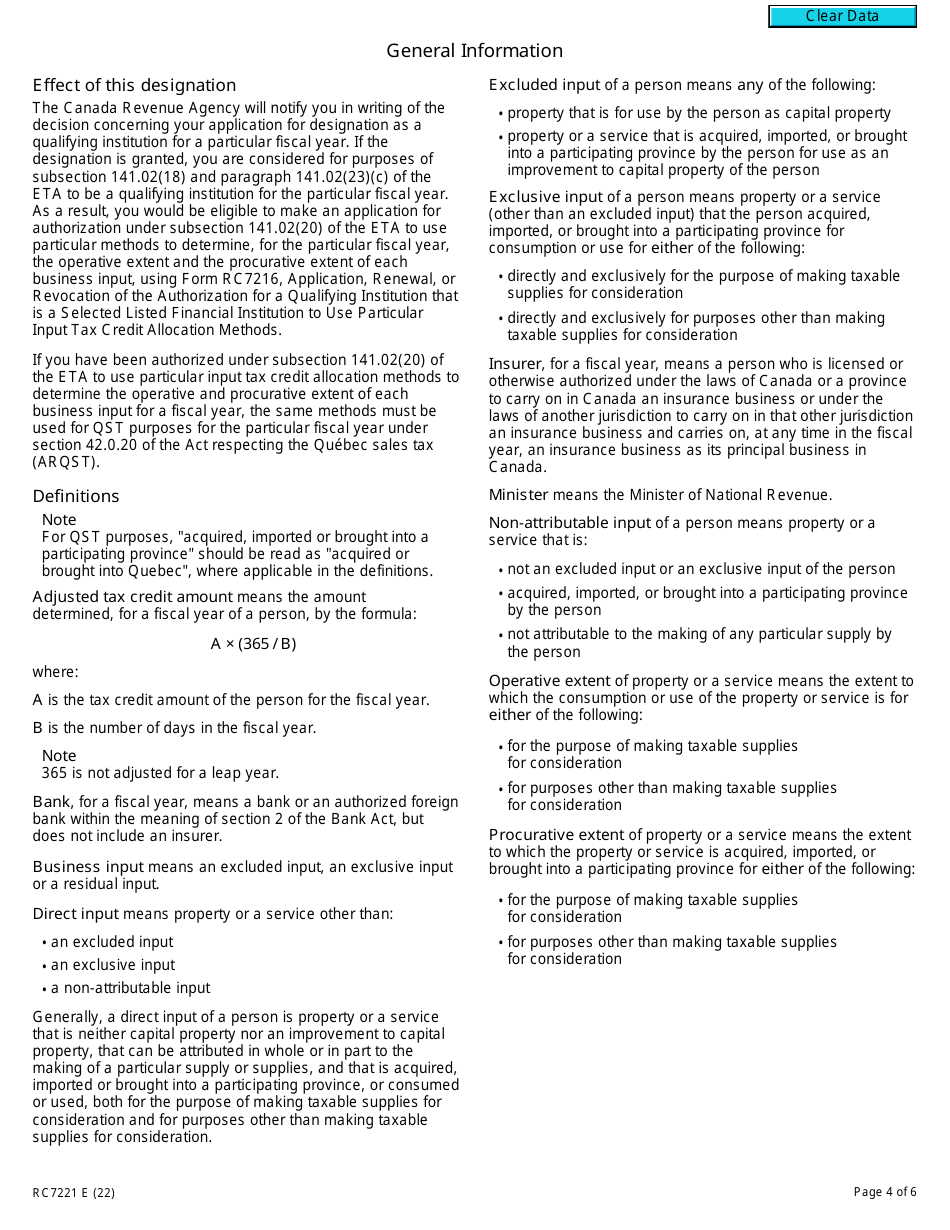

Form RC7221 is used in Canada by a financial institution to apply for designation as a qualifying institution or to revoke a previously granted designation. This designation allows the institution to receive certain tax benefits under the Income Tax Act.

The Form RC7221 Application is filed by a selected listed financial institution of a prescribed class in Canada.

Form RC7221 Application for a Selected Listed Financial Institution of a Prescribed Class to Be Designated as a Qualifying Institution or Revocation of a Previously Granted Designation - Canada - Frequently Asked Questions (FAQ)

Q: What is Form RC7221? A: Form RC7221 is the application for a selected listed financial institution to be designated as a qualifying institution or to revoke a previously granted designation in Canada.

Q: Who can use Form RC7221? A: Form RC7221 can be used by selected listed financial institutions of a prescribed class in Canada.

Q: What is the purpose of Form RC7221? A: The purpose of Form RC7221 is to apply for a designation as a qualifying institution or to revoke a previously granted designation for selected listed financial institutions.

Q: Is Form RC7221 mandatory? A: Yes, selected listed financial institutions must use Form RC7221 to apply for a designation or to revoke a previously granted designation.