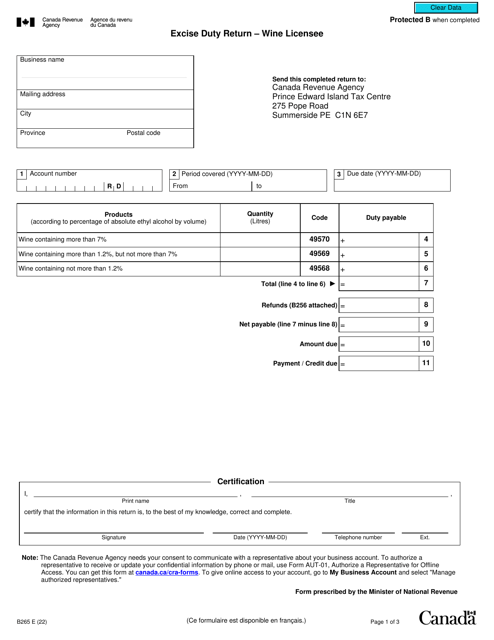

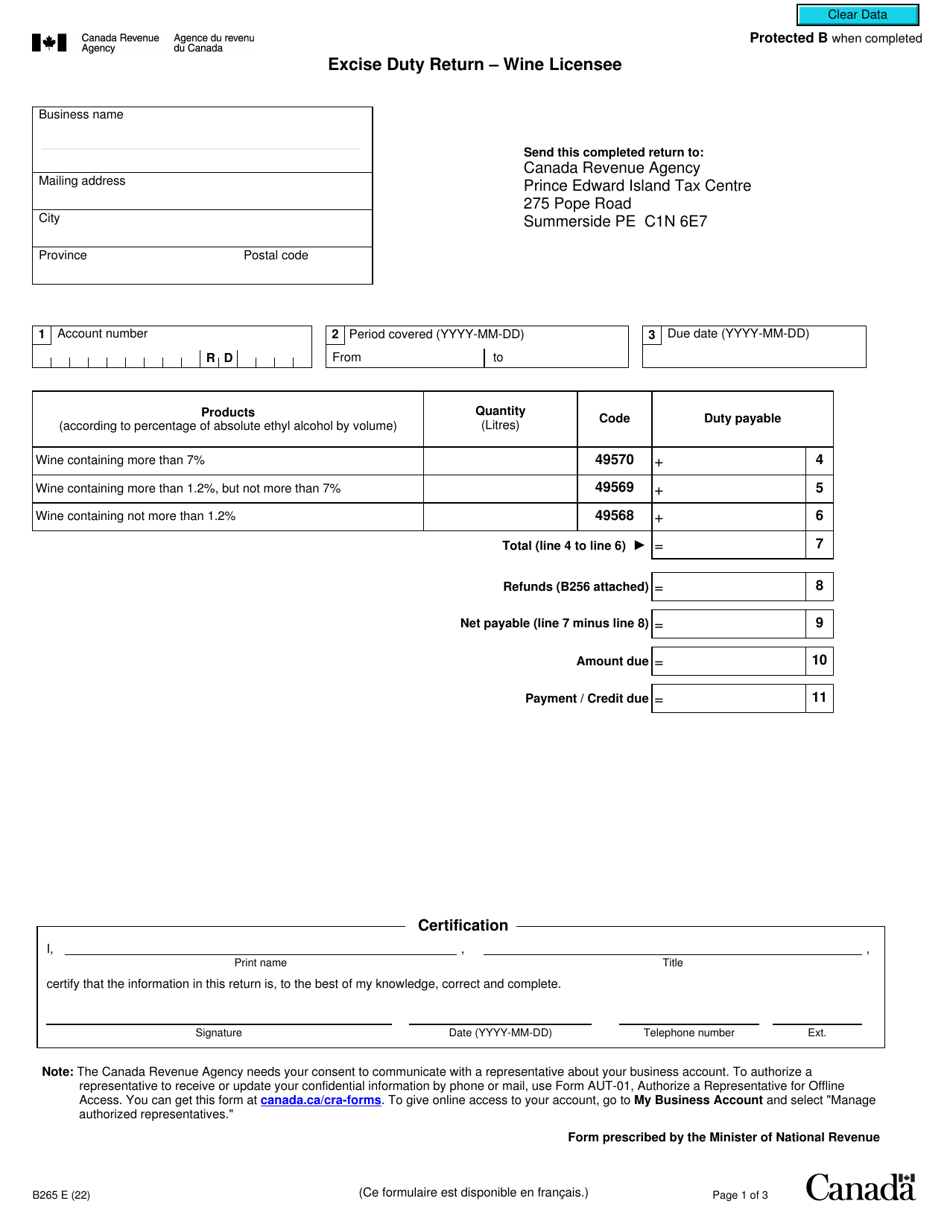

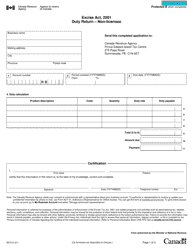

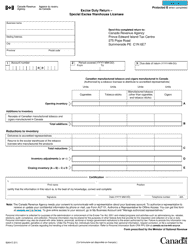

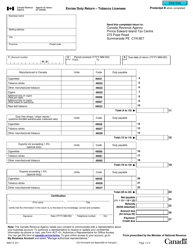

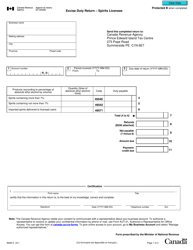

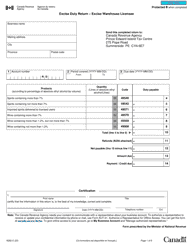

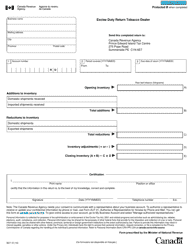

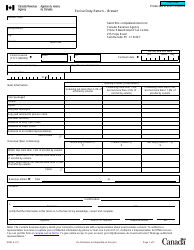

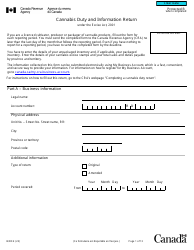

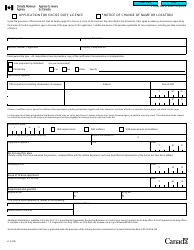

Form B265 Excise Duty Return - Wine Licensee - Canada

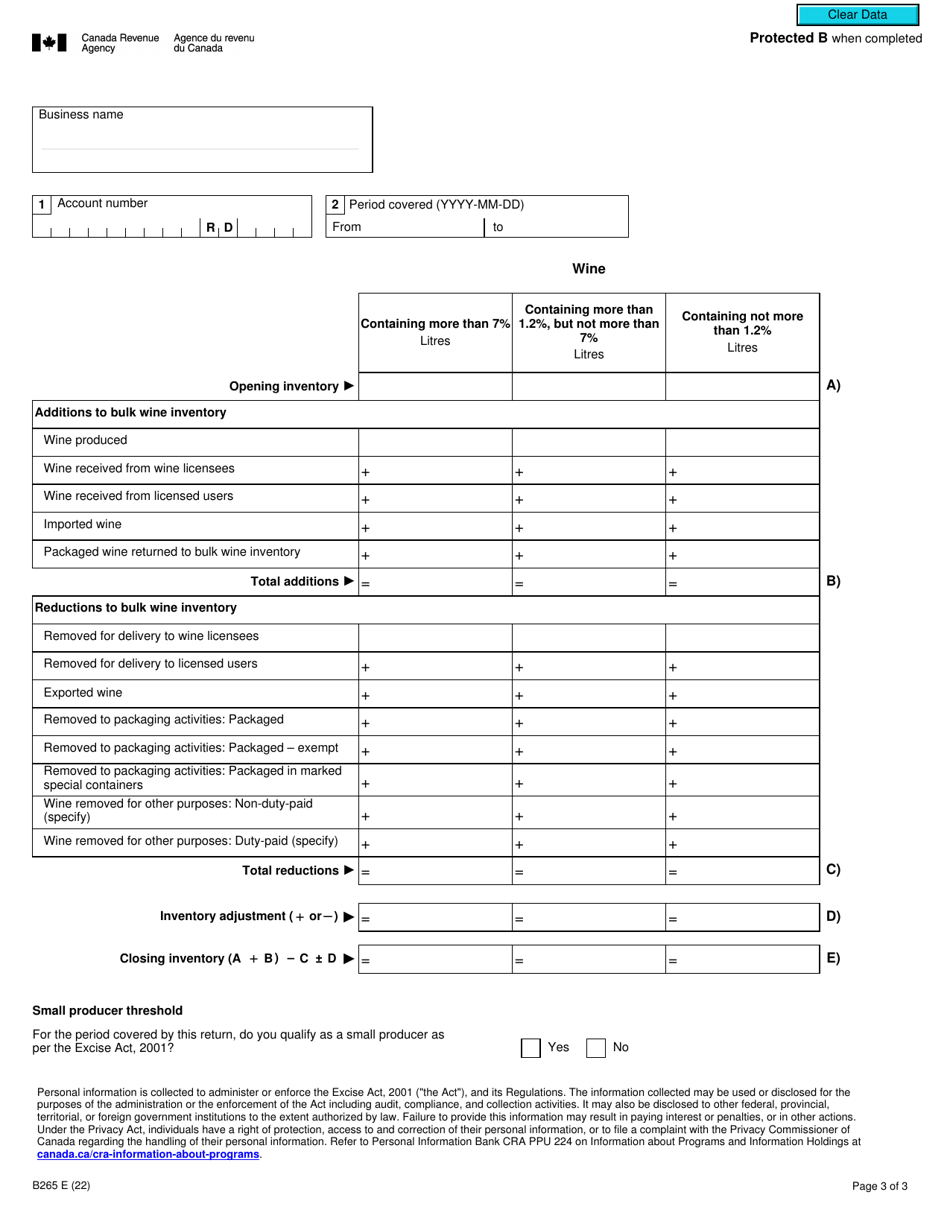

Form B265 Excise Duty Return - Wine Licensee is used by wine licensees in Canada to report and pay excise duty on wine sales. It helps the Canadian government keep track of excise taxes and ensures compliance with the law.

The Form B265 Excise Duty Return - Wine Licensee in Canada is filed by the wine licensee themselves.

Form B265 Excise Duty Return - Wine Licensee - Canada - Frequently Asked Questions (FAQ)

Q: What is Form B265? A: Form B265 is the Excise Duty Return specifically for Wine Licensees in Canada.

Q: Who needs to file Form B265? A: Wine Licensees in Canada need to file Form B265 to report and pay excise duty on wine products.

Q: What is the purpose of Form B265? A: Form B265 is used to report and remit excise duty on wine products for Wine Licensees in Canada.

Q: How often do Wine Licensees need to file Form B265? A: Wine Licensees need to file Form B265 on a monthly basis.