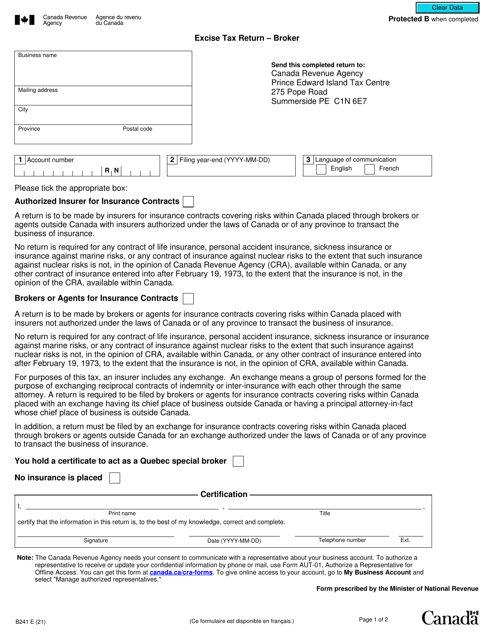

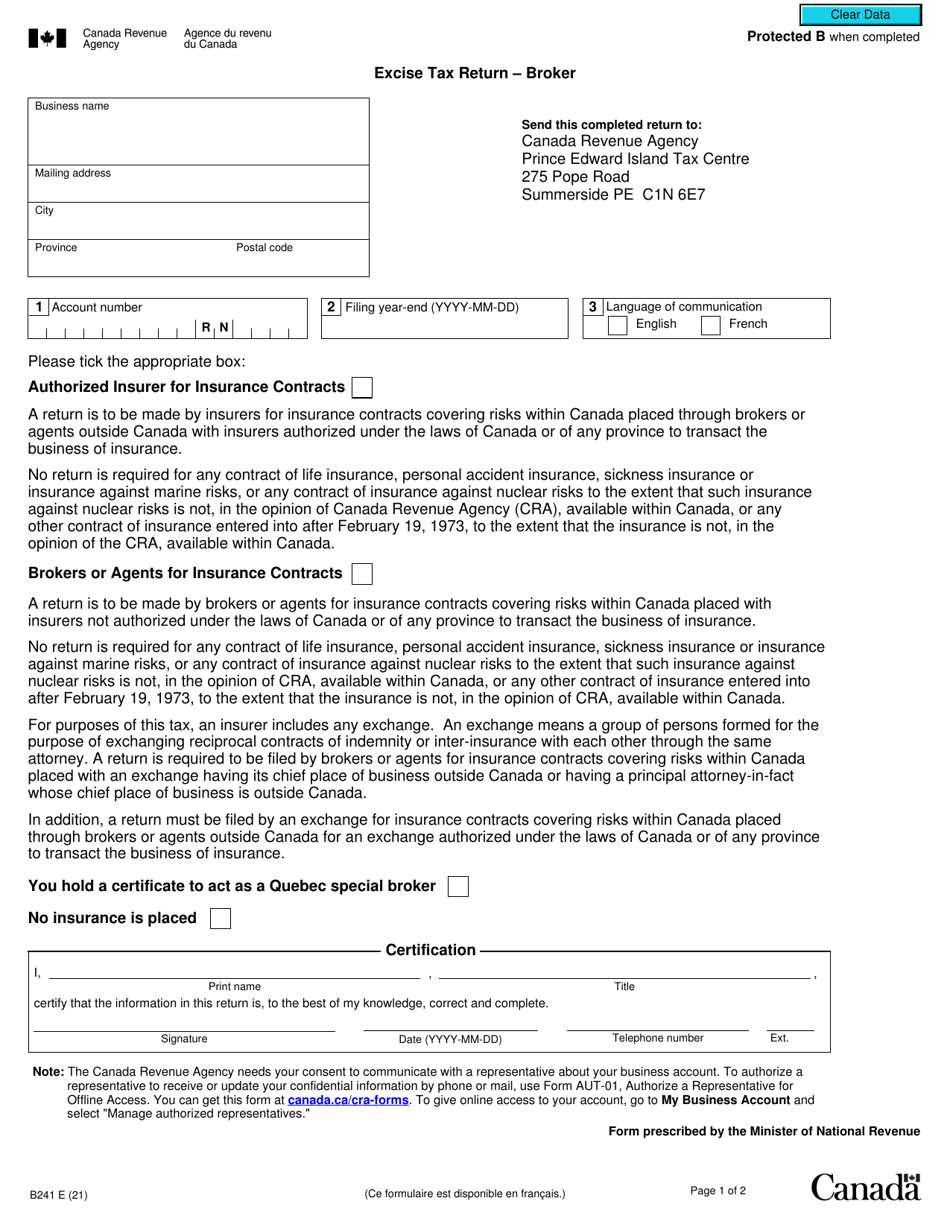

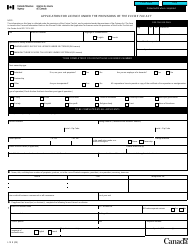

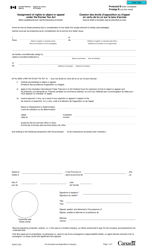

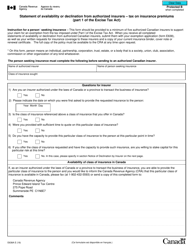

Form B241 Excise Tax Return - Broker - Canada

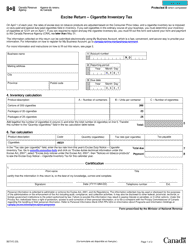

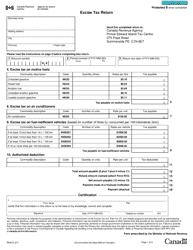

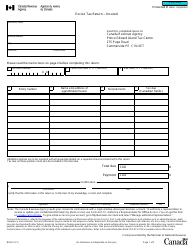

Form B241 Excise Tax Return - Broker in Canada is used to report and remit excise tax on certain goods that are received or removed from a Registered Broker's warehouse. This form is used by brokers to fulfill their tax obligations with the Canada Revenue Agency (CRA).

Form B241 Excise Tax Return - Broker - Canada - Frequently Asked Questions (FAQ)

Q: What is Form B241 Excise Tax Return? A: Form B241 Excise Tax Return is a document used in Canada for reporting and paying excise taxes.

Q: Who needs to file Form B241 Excise Tax Return? A: Brokers in Canada who are liable to pay excise tax must file Form B241.

Q: What is the purpose of Form B241 Excise Tax Return? A: The purpose of Form B241 is to report and remit excise taxes collected by brokers in Canada.

Q: When is Form B241 Excise Tax Return due? A: The due date for filing Form B241 Excise Tax Return depends on the reporting period, but it is generally due either monthly, quarterly, or annually.

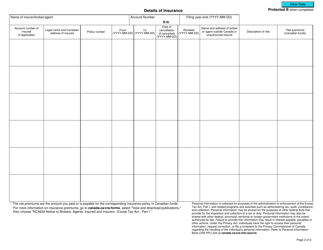

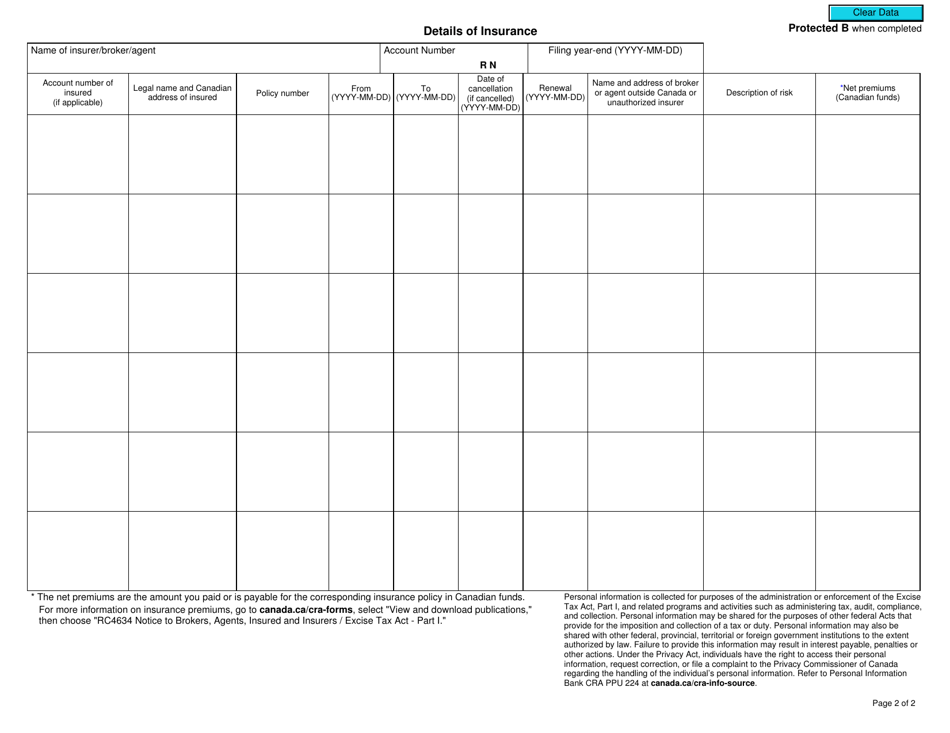

Q: What information is required to complete Form B241 Excise Tax Return? A: The form requires information about the broker, the type of excise tax collected, the taxable sales, and any adjustments or exemptions that apply.

Q: Are there any penalties for late or incorrect filing of Form B241 Excise Tax Return? A: Yes, there may be penalties for late or incorrect filing of Form B241 Excise Tax Return. It is important to ensure timely and accurate submission to avoid penalties.