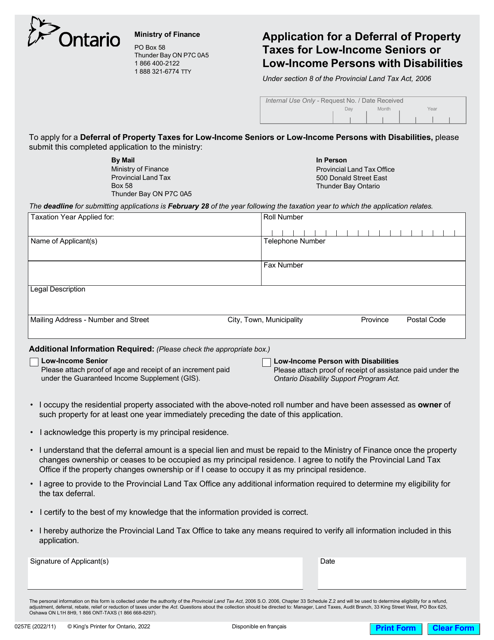

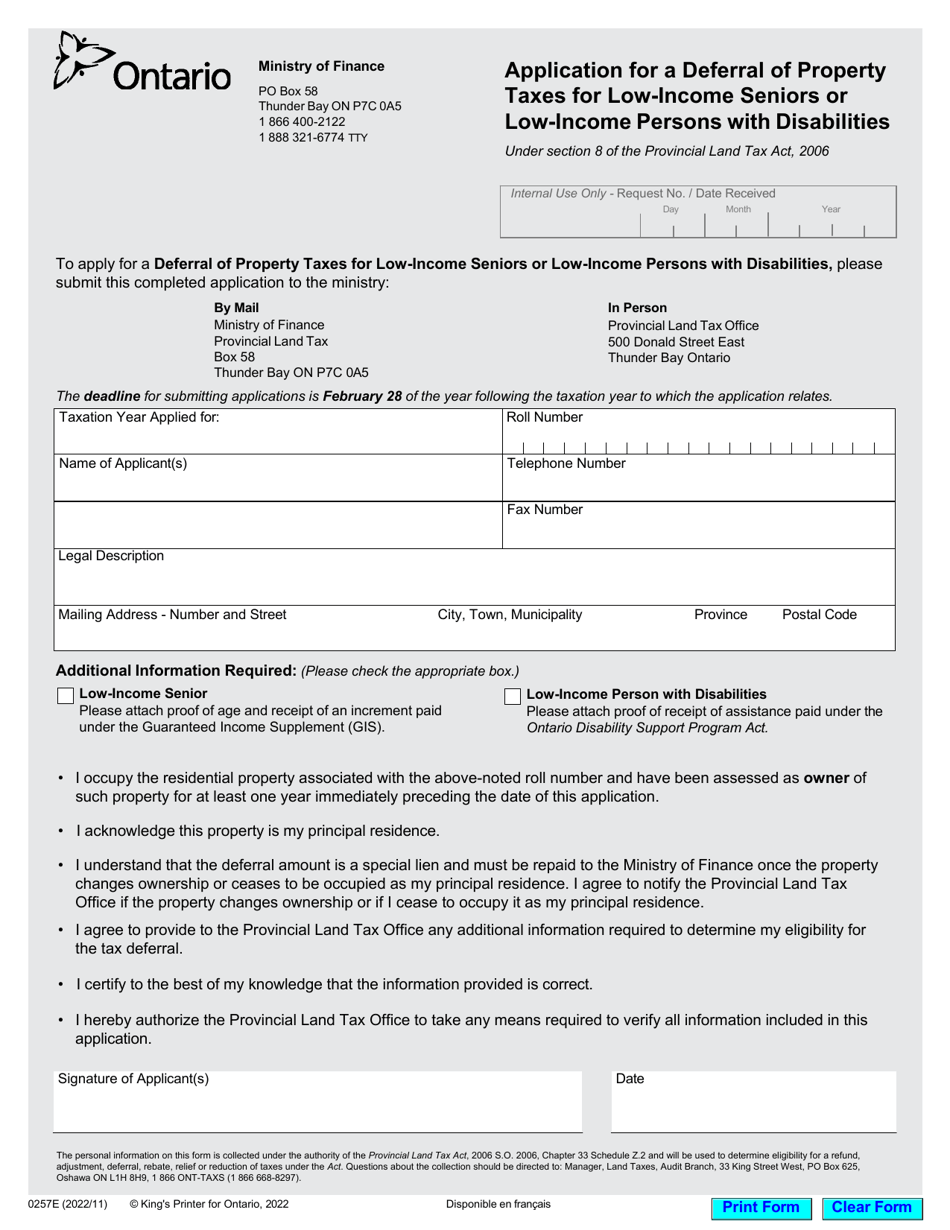

Form 0257E Application for a Deferral of Property Taxes for Low-Income Seniors or Low-Income Persons With Disabilities - Ontario, Canada

Form 0257E is an application form used in Ontario, Canada, for low-income seniors or low-income persons with disabilities to apply for a deferral of property taxes. This form allows eligible individuals to request a temporary waiver or reduction of their property tax payments based on their financial circumstances.

The Form 0257E Application for a Deferral of Property Taxes for Low-Income Seniors or Low-Income Persons With Disabilities in Ontario, Canada is typically filed by the eligible low-income seniors or low-income persons with disabilities themselves.

Form 0257E Application for a Deferral of Property Taxes for Low-Income Seniors or Low-Income Persons With Disabilities - Ontario, Canada - Frequently Asked Questions (FAQ)

Q: What is Form 0257E? A: Form 0257E is an application for a deferral of property taxes for low-income seniors or low-income persons with disabilities in Ontario, Canada.

Q: Who can apply for a deferral of property taxes? A: Low-income seniors or low-income persons with disabilities in Ontario, Canada can apply for a deferral of property taxes.

Q: What is the purpose of this application? A: The purpose of this application is to request a deferral of property taxes for eligible individuals who meet the low-income criteria.

Q: What does low-income mean? A: Low-income means that an individual's income falls below a certain threshold set by the government.

Q: What documentation do I need to include with the application? A: You will need to include proof of income and any other required documents as specified on the application form.

Q: Is there a deadline for submitting the application? A: The application should be submitted before the deadline specified on the application form, usually before the property tax due date.

Q: Will my property taxes be deferred indefinitely? A: No, the deferral is temporary and the deferred property taxes will need to be paid back with interest in the future.