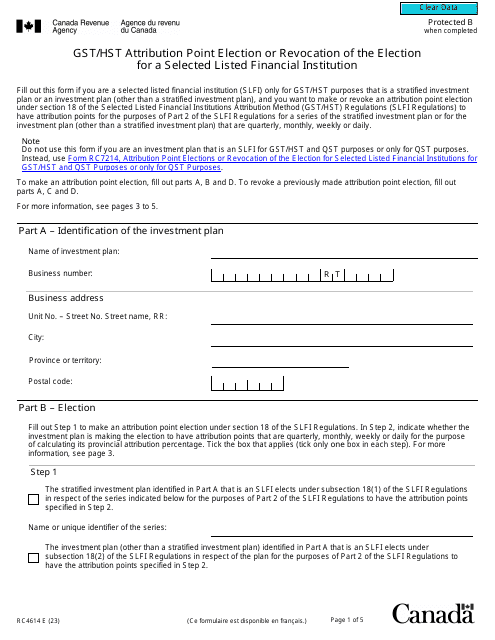

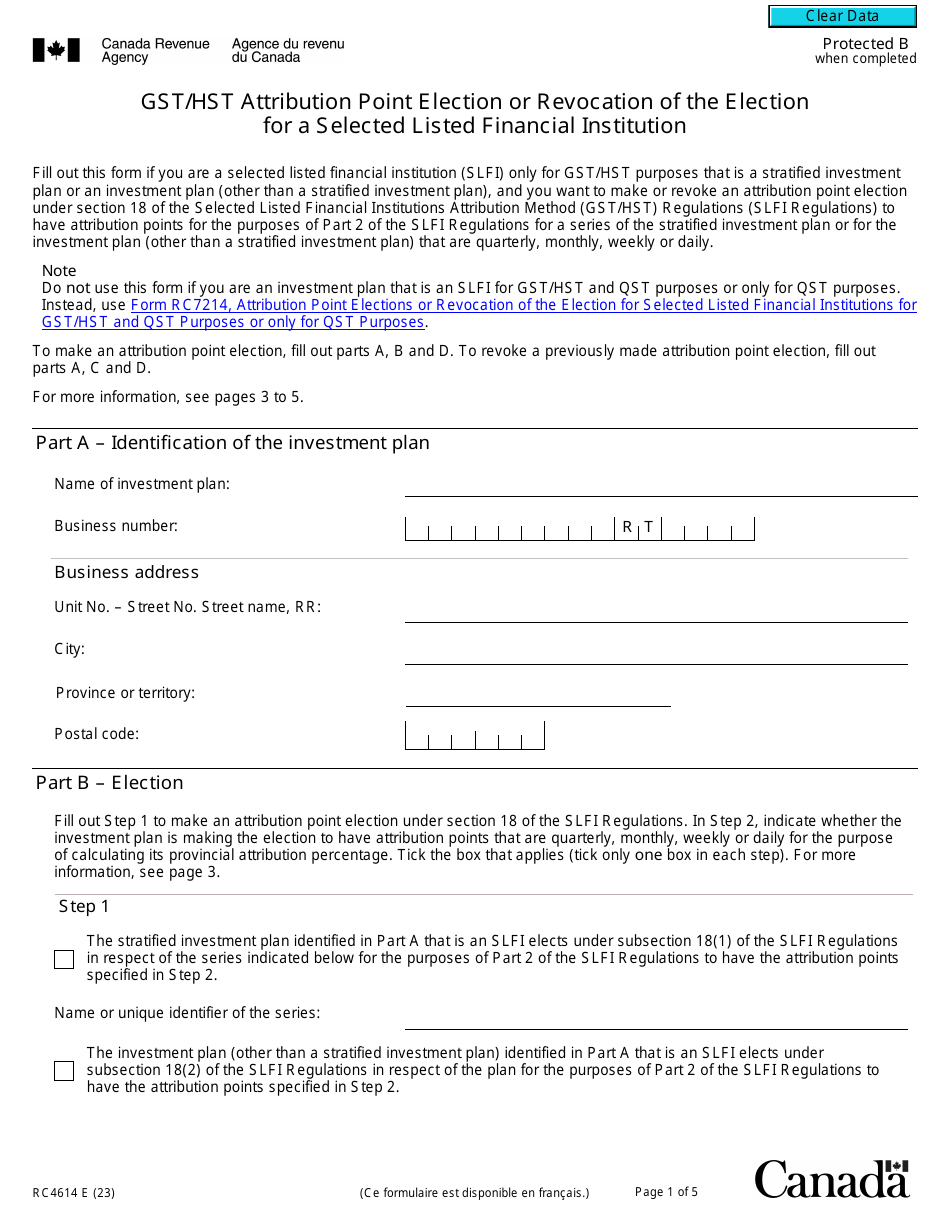

Form RC4614 Gst / Hst Attribution Point Election or Revocation of the Election for a Selected Listed Financial Institution - Canada

Form RC4614 is used by selected listed financial institutions in Canada to make an election or revoke a previously made election for the attribution of GST/HST (Goods and Services Tax/Harmonized Sales Tax) on certain supplies. The form allows these institutions to determine the entity that will be responsible for remitting the GST/HST on certain supplies made to members of a closely related group.

The selected listed financial institution files the Form RC4614 GST/HST Attribution Point Election or Revocation of the Election in Canada.

Form RC4614 Gst/Hst Attribution Point Election or Revocation of the Election for a Selected Listed Financial Institution - Canada - Frequently Asked Questions (FAQ)

Q: What is Form RC4614? A: Form RC4614 is the GST/HST Attribution Point Election or Revocation of the Election for a Selected Listed Financial Institution in Canada.

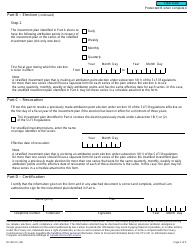

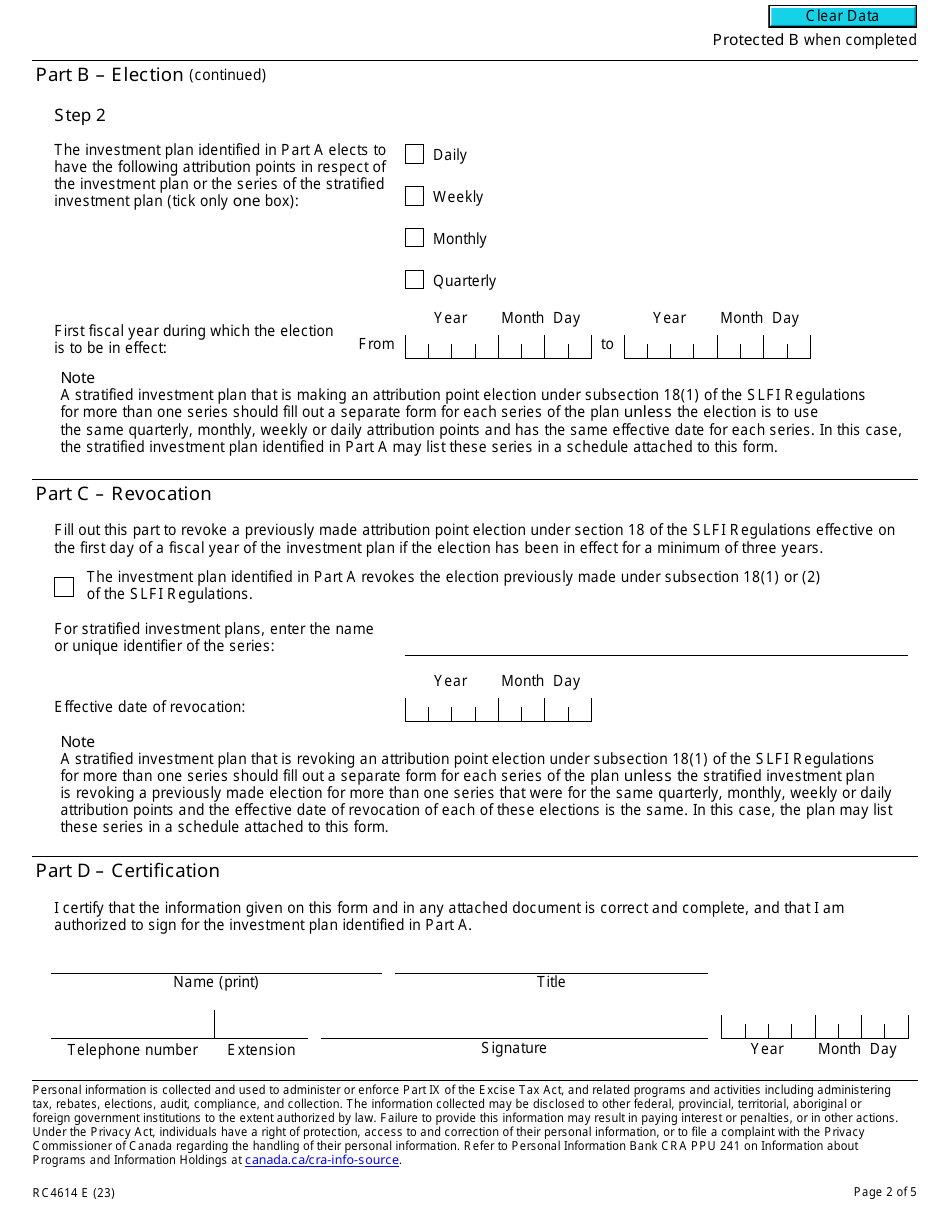

Q: What is the purpose of Form RC4614? A: The purpose of Form RC4614 is to allow a Selected Listed Financial Institution to elect or revoke the election to have a particular date as the attribution point for GST/HST purposes.

Q: What is a Selected Listed Financial Institution? A: A Selected Listed Financial Institution refers to a financial institution that has been designated by the Minister of National Revenue under subsection 225.2(2) of the Excise Tax Act.

Q: Is Form RC4614 mandatory for all financial institutions? A: No, Form RC4614 is only applicable to Selected Listed Financial Institutions that have elected or wish to revoke the election to have a particular date as the attribution point for GST/HST purposes.