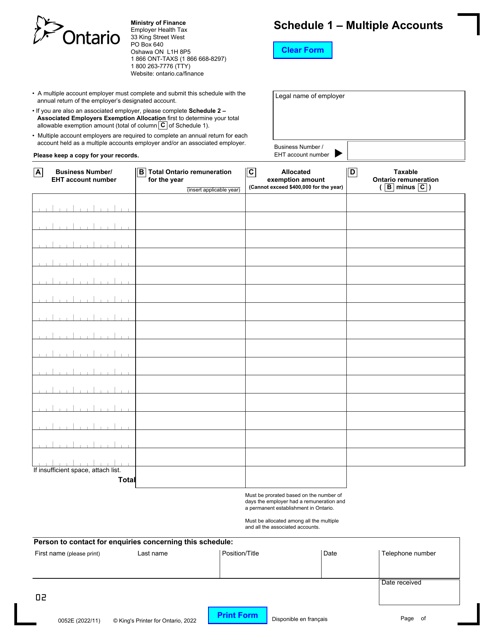

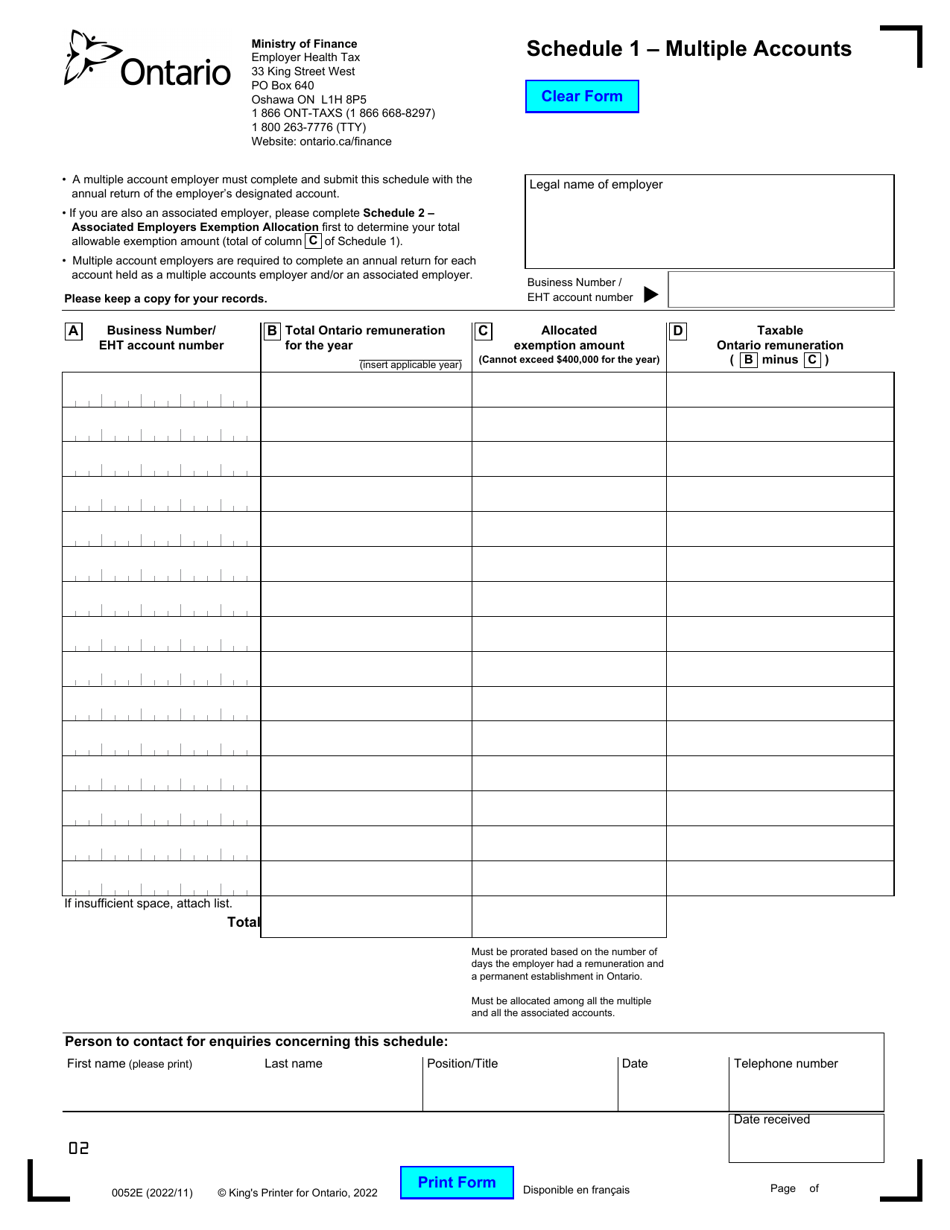

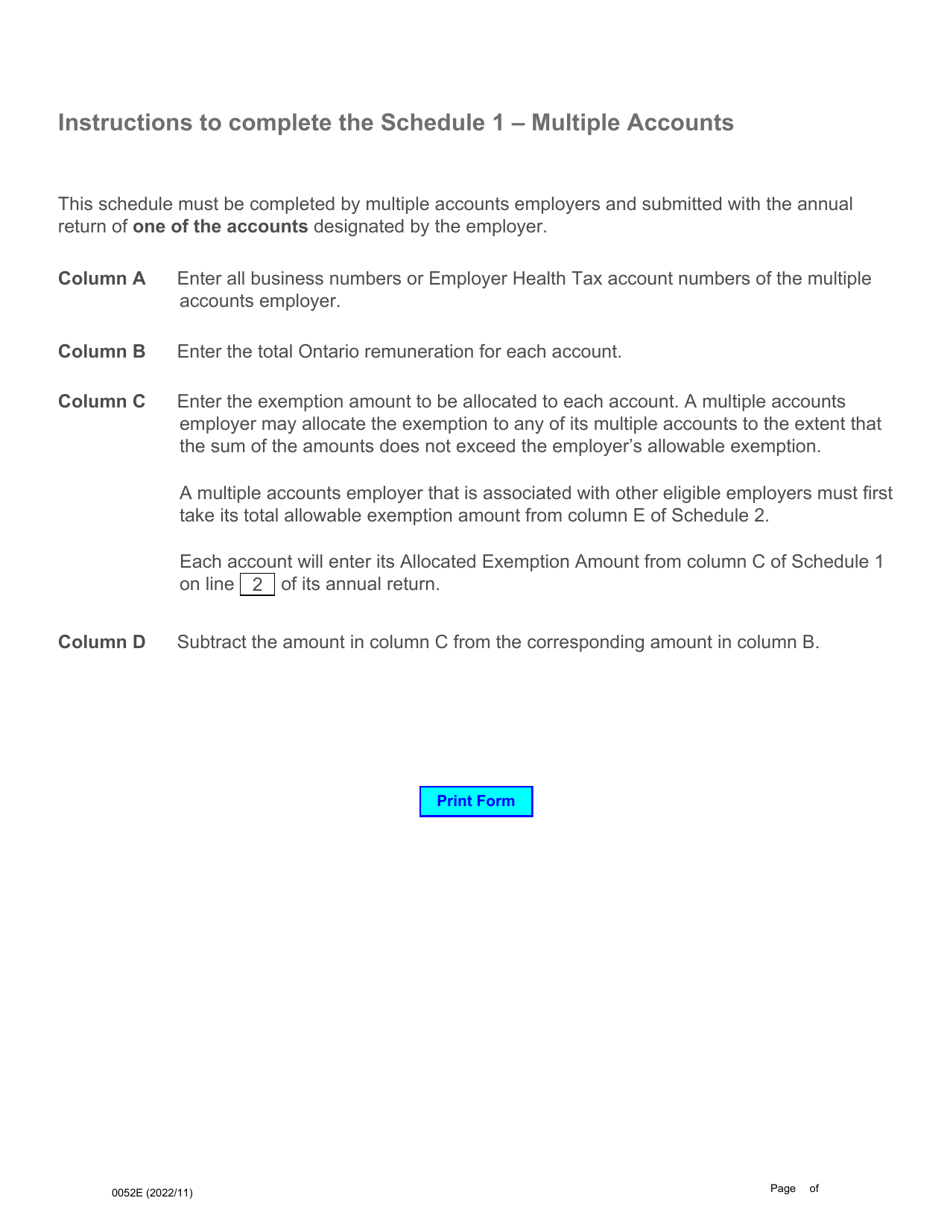

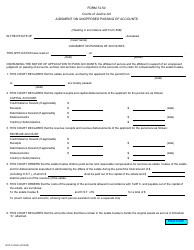

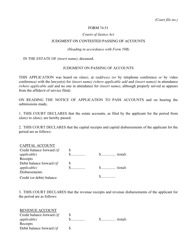

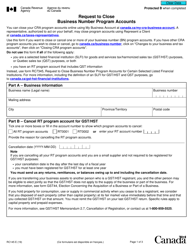

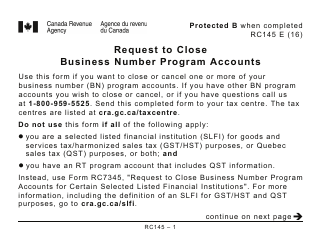

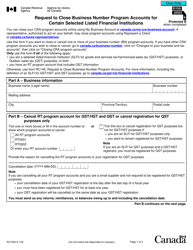

Form 0052E Schedule 1 Multiple Accounts - Ontario, Canada

Form 0052E Schedule 1 Multiple Accounts is used in Ontario, Canada to report multiple accounts for a specific purpose. However, I am not aware of the specific purpose for which this form is used.

The Form 0052E Schedule 1 Multiple Accounts in Ontario, Canada is filed by individuals or businesses who have multiple accounts with the government.

Form 0052E Schedule 1 Multiple Accounts - Ontario, Canada - Frequently Asked Questions (FAQ)

Q: What is Form 0052E Schedule 1 Multiple Accounts? A: Form 0052E Schedule 1 Multiple Accounts is a tax form used in Ontario, Canada to account for multiple accounts.

Q: Who needs to fill out Form 0052E Schedule 1 Multiple Accounts? A: Individuals or businesses in Ontario, Canada who have multiple accounts that need to be accounted for.

Q: What is the purpose of Form 0052E Schedule 1 Multiple Accounts? A: The purpose of Form 0052E Schedule 1 Multiple Accounts is to accurately report and track multiple accounts for tax purposes in Ontario.

Q: Is Form 0052E Schedule 1 Multiple Accounts mandatory? A: If you have multiple accounts that need to be accounted for in Ontario, filling out Form 0052E Schedule 1 Multiple Accounts is mandatory to accurately report your taxes.

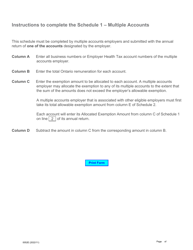

Q: What information do I need to fill out Form 0052E Schedule 1 Multiple Accounts? A: You will need information about each of your multiple accounts, such as account numbers, balances, and any transactions made during the applicable tax year.

Q: What happens if I don't fill out Form 0052E Schedule 1 Multiple Accounts? A: If you are required to fill out Form 0052E Schedule 1 Multiple Accounts and fail to do so, you may face penalties or consequences from the CRA for inaccurate tax reporting.