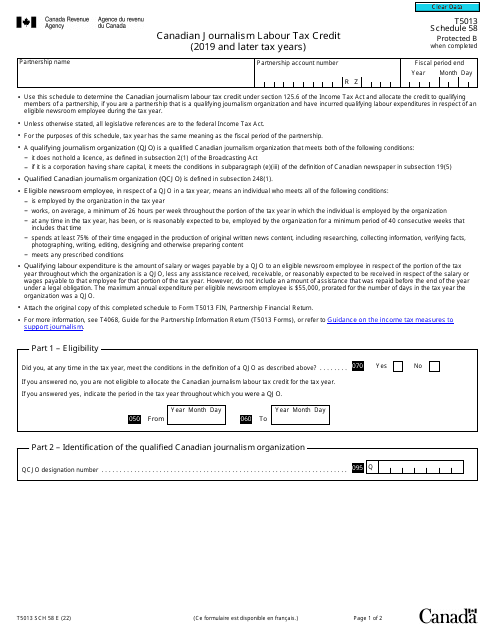

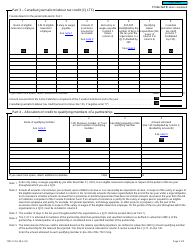

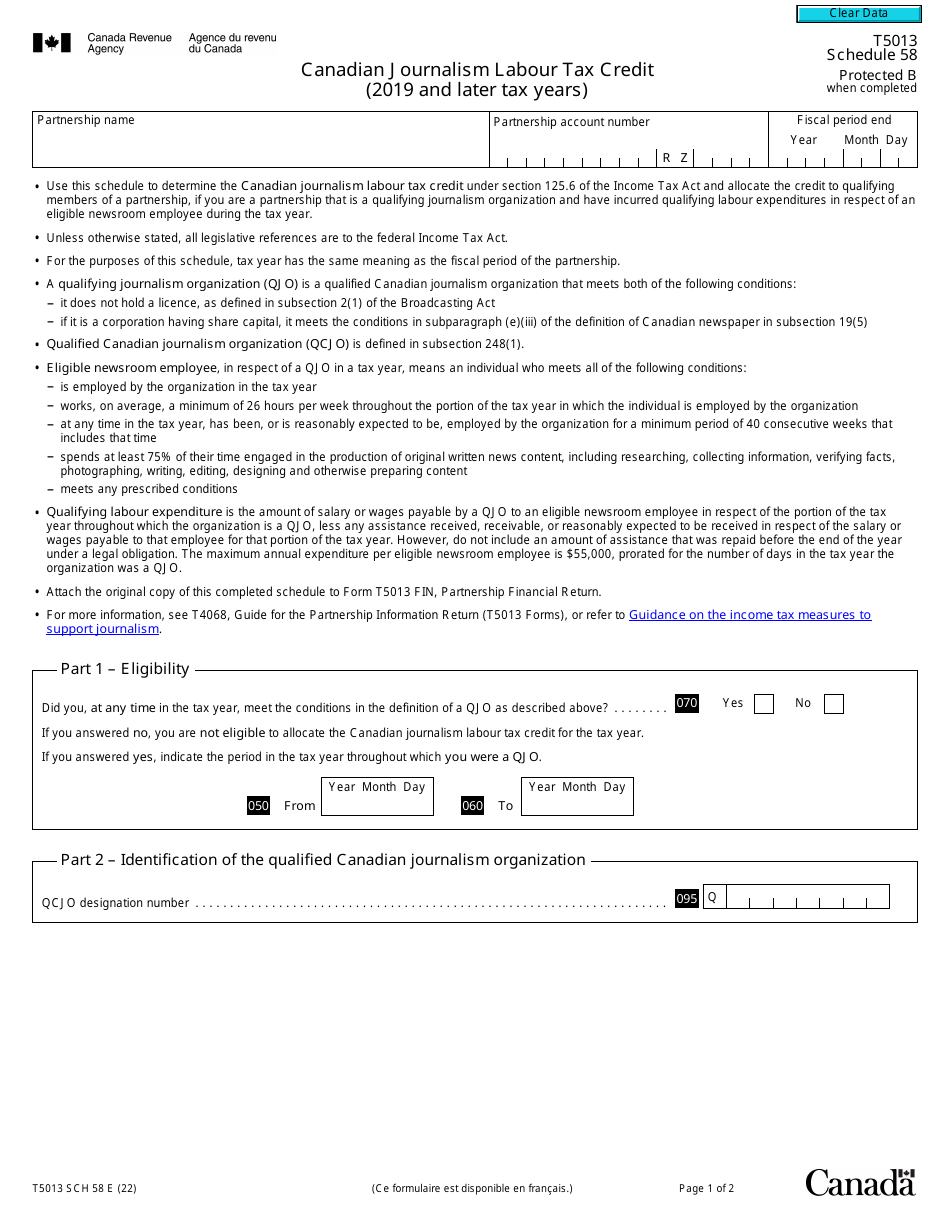

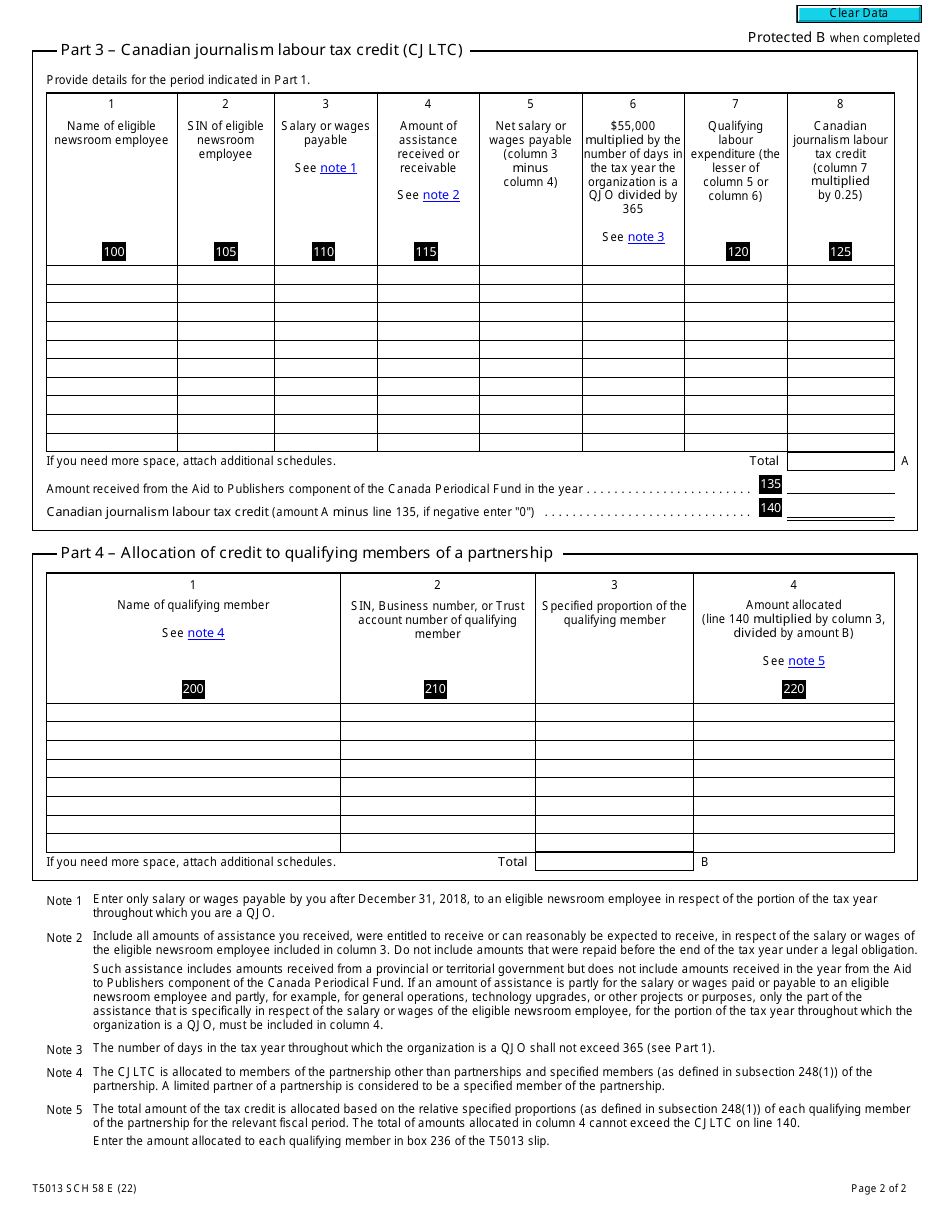

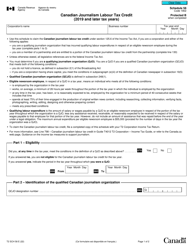

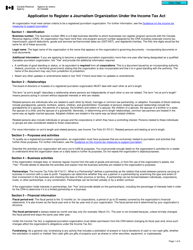

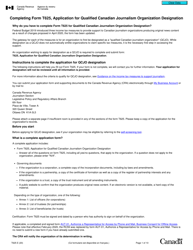

Form T5013 Schedule 58 Canadian Journalism Labour Tax Credit (2019 and Later Tax Years) - Canada

Form T5013 Schedule 58 is used for claiming the Canadian Journalism Labour Tax Credit for tax years 2019 and later. This credit is available to eligible Canadian journalism organizations to help support news coverage.

The Form T5013 Schedule 58 Canadian Journalism Labour Tax Credit is filed by eligible corporations engaged in the production of news content in Canada.

Form T5013 Schedule 58 Canadian Journalism Labour Tax Credit (2019 and Later Tax Years) - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T5013 Schedule 58? A: Form T5013 Schedule 58 is a tax form used in Canada to claim the Canadian Journalism Labour Tax Credit.

Q: What is the Canadian Journalism Labour Tax Credit? A: The Canadian Journalism Labour Tax Credit is a tax credit available to eligible Canadian journalists.

Q: Who is eligible for the Canadian Journalism Labour Tax Credit? A: Canadian journalists who meet certain criteria are eligible for the tax credit.

Q: What is the purpose of the tax credit? A: The tax credit is designed to support journalism in Canada by providing tax relief to eligible journalists.

Q: What tax years does Form T5013 Schedule 58 apply to? A: Form T5013 Schedule 58 applies to the 2019 tax year and later.