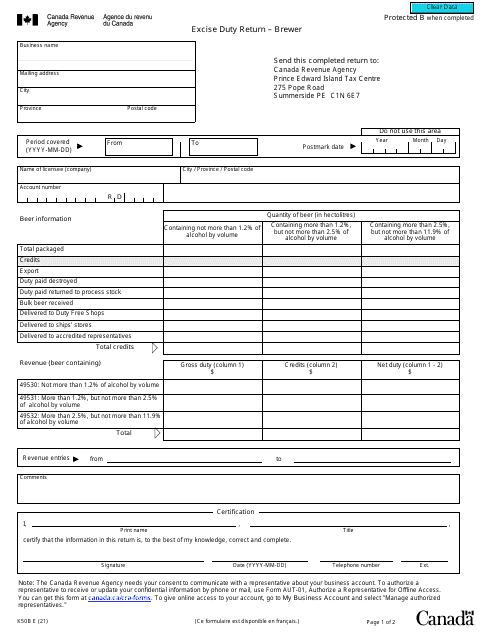

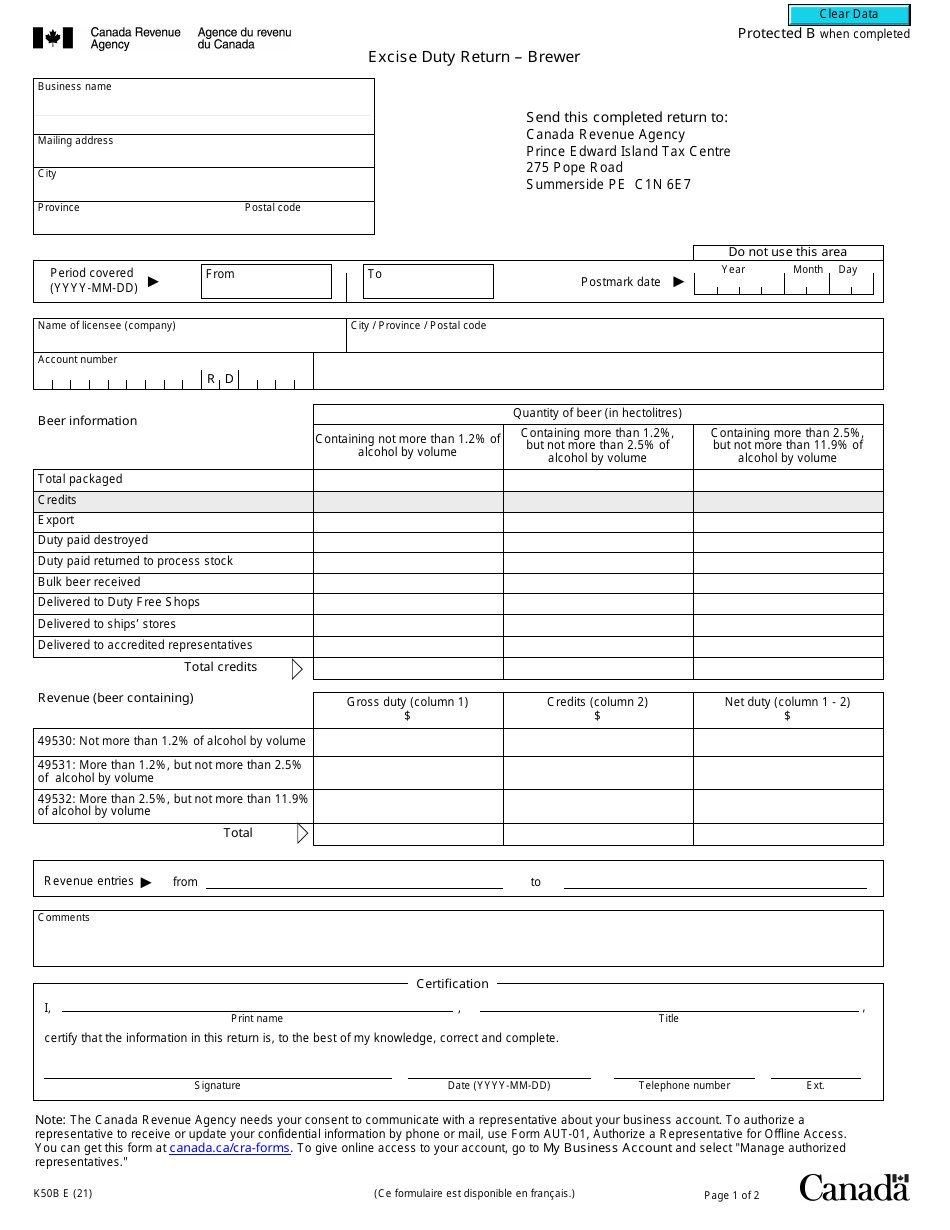

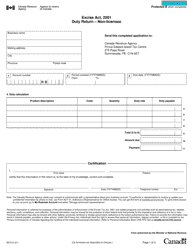

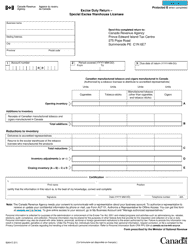

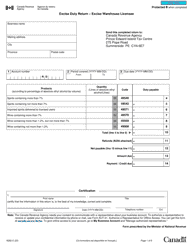

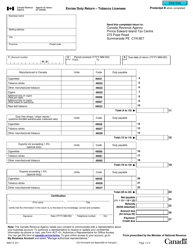

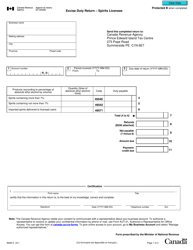

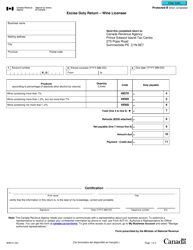

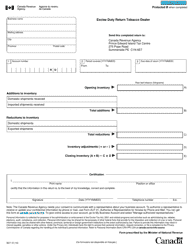

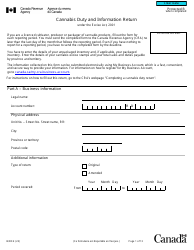

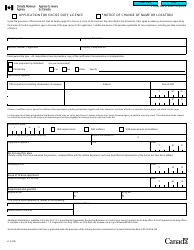

Form K50B Excise Duty Return - Brewer - Canada

Form K50B Excise Duty Return - Brewer is used in Canada for brewers to report and pay excise duty on beer produced or imported for sale.

The Form K50B Excise Duty Return is filed by brewers in Canada.

Form K50B Excise Duty Return - Brewer - Canada - Frequently Asked Questions (FAQ)

Q: What is Form K50B? A: Form K50B is an excise duty return form specific to brewers in Canada.

Q: Who is required to file Form K50B? A: Brewers in Canada are required to file Form K50B.

Q: What is excise duty? A: Excise duty is a tax imposed on certain goods, including alcoholic beverages, produced or manufactured in Canada.

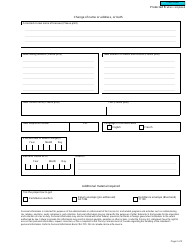

Q: What information needs to be reported on Form K50B? A: Form K50B requires brewers to report details such as the quantity of beer produced, the amount of duty payable, and any allowances or credits.

Q: When is the deadline to file Form K50B? A: Form K50B is due on or before the 20th day of the month following the end of the reporting period.

Q: Are there any penalties for not filing Form K50B? A: Yes, there can be penalties for late or non-filing of Form K50B.

Q: Can I file Form K50B electronically? A: Yes, you can file Form K50B electronically through the CRA's My Business Account portal.

Q: Do I need to keep records when filing Form K50B? A: Yes, brewers are required to keep records of their production and sales for a specified period of time.