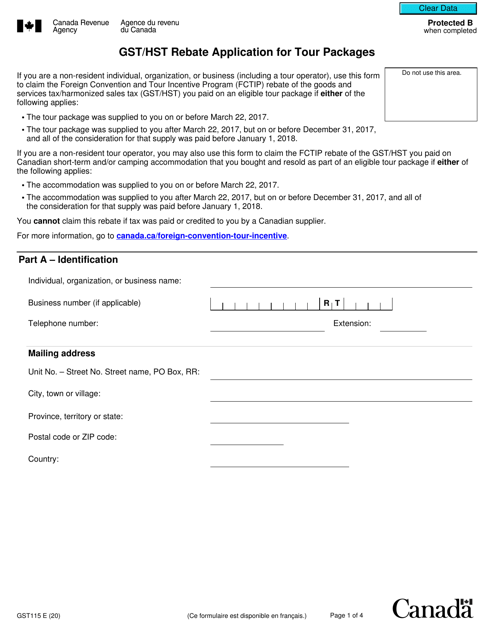

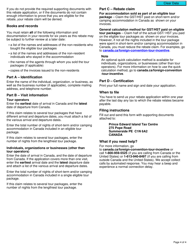

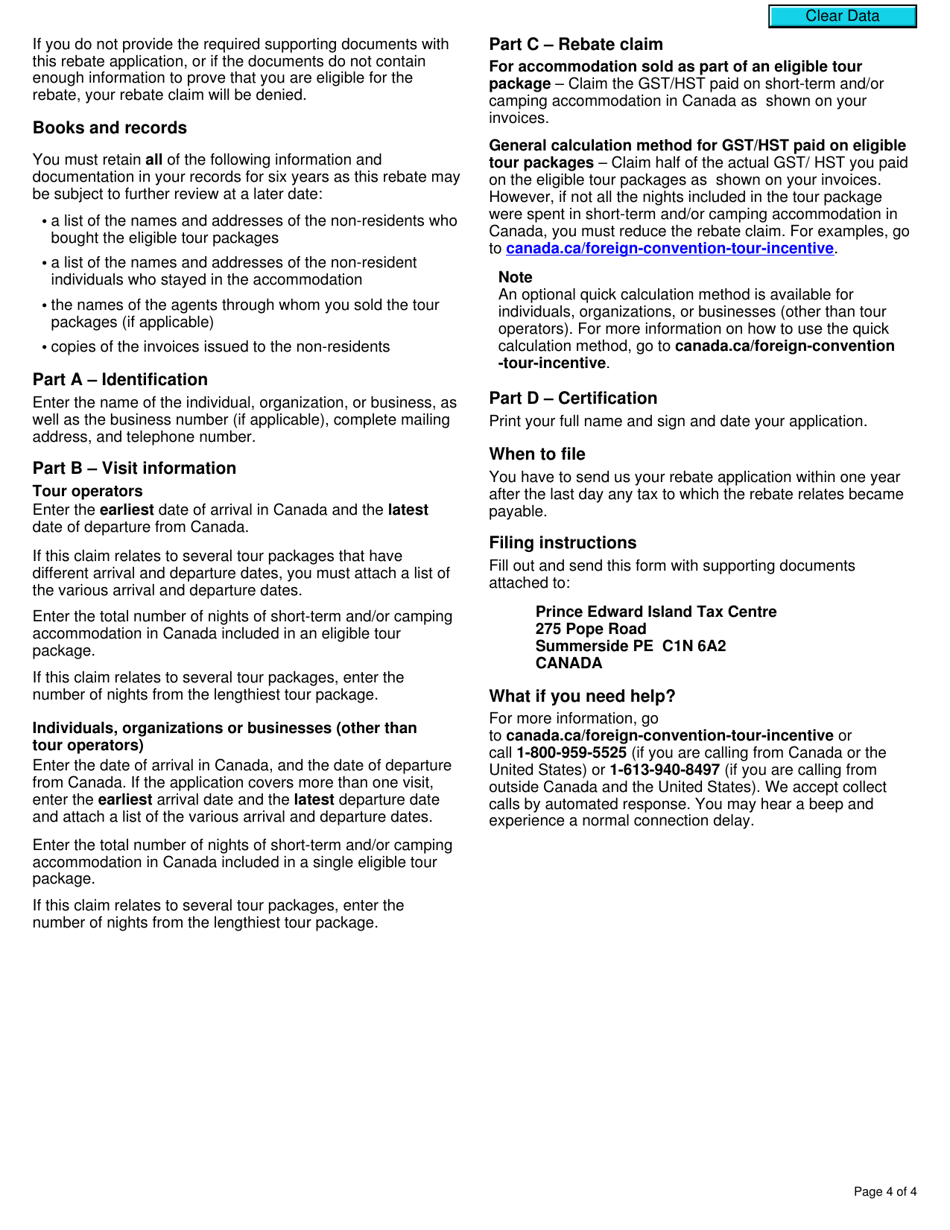

Form GST115 Gst / Hst Rebate Application for Tour Packages - Canada

Form GST115 is used in Canada to apply for a GST/HST rebate related to tour packages. It allows individuals or businesses to claim a rebate on the goods and services tax (GST) or harmonized sales tax (HST) paid on eligible expenses for tour packages.

The form GST115 GST/HST Rebate Application for Tour Packages in Canada is filed by the tour package operator.

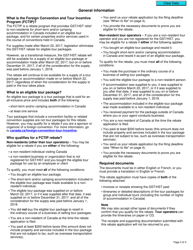

Form GST115 Gst/Hst Rebate Application for Tour Packages - Canada - Frequently Asked Questions (FAQ)

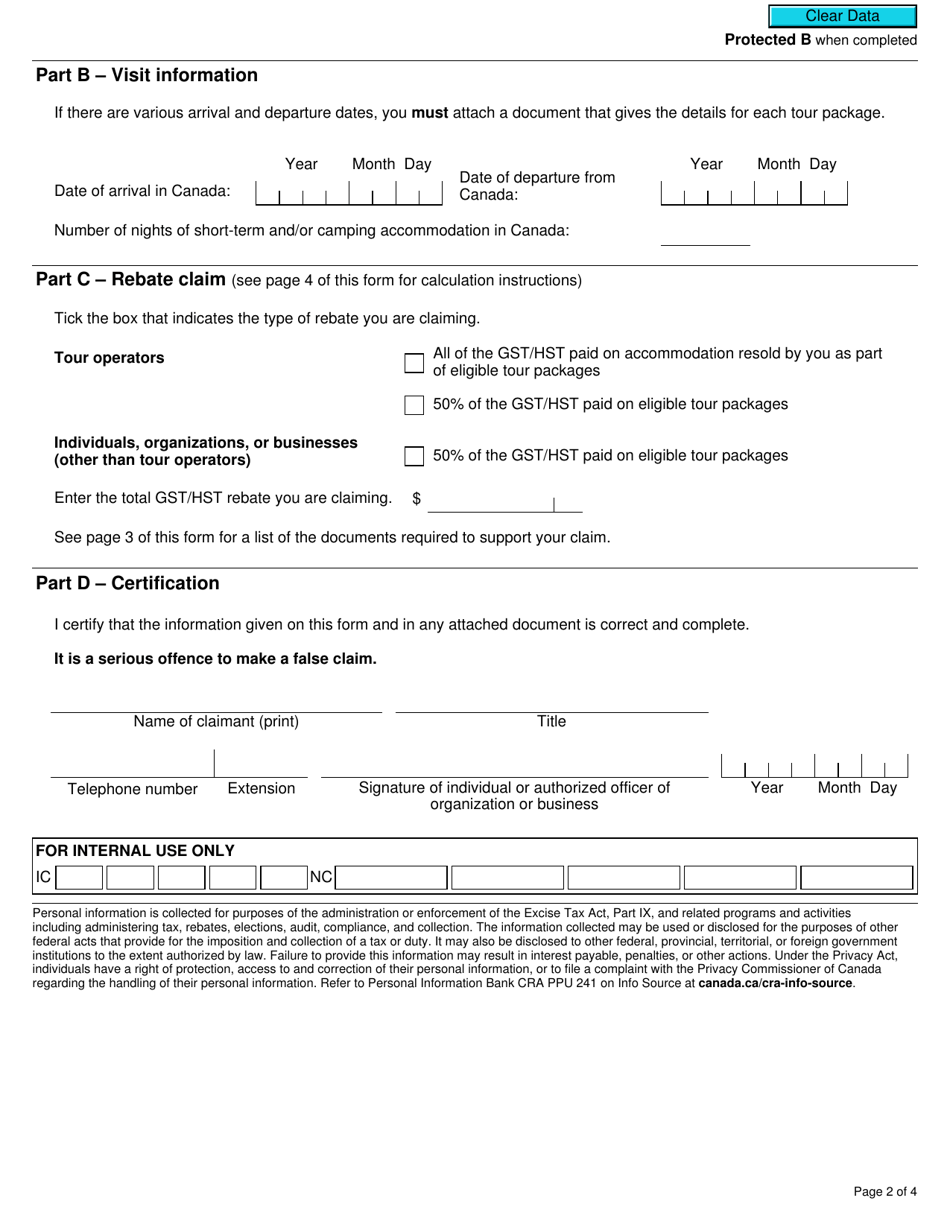

Q: What is Form GST115? A: Form GST115 is the GST/HST Rebate Application for Tour Packages in Canada.

Q: Who can use Form GST115? A: Tour package operators in Canada can use Form GST115 to apply for a rebate of the GST/HST paid on eligible tour packages.

Q: What is the purpose of Form GST115? A: The purpose of Form GST115 is to claim a rebate of the GST/HST paid on eligible tour packages in Canada.

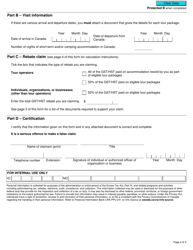

Q: What are tour packages? A: Tour packages refer to pre-arranged travel services offered by tour operators, which may include accommodation, transportation, and other services.

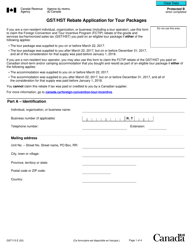

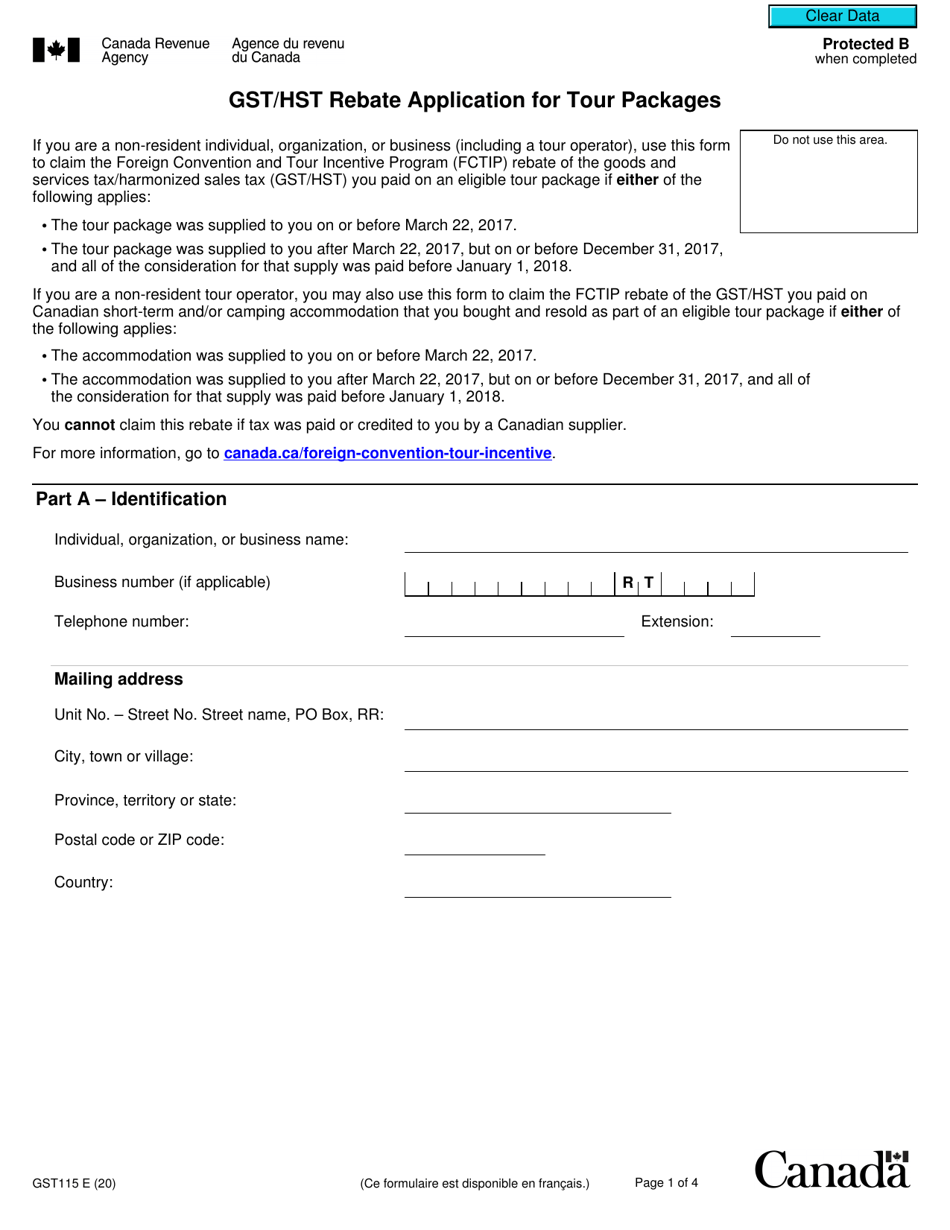

Q: How to complete Form GST115? A: To complete Form GST115, fill in the required information, including your business details, tour package information, and the amount of GST/HST paid.

Q: What is the deadline for submitting Form GST115? A: The deadline for submitting Form GST115 is generally within two years after the end of the reporting period in which the rebate is being claimed.

Q: Is there any fee for submitting Form GST115? A: There is no fee for submitting Form GST115.

Q: Can I claim a rebate for GST/HST paid on all tour packages? A: No, you can only claim a rebate for GST/HST paid on eligible tour packages that meet certain criteria.