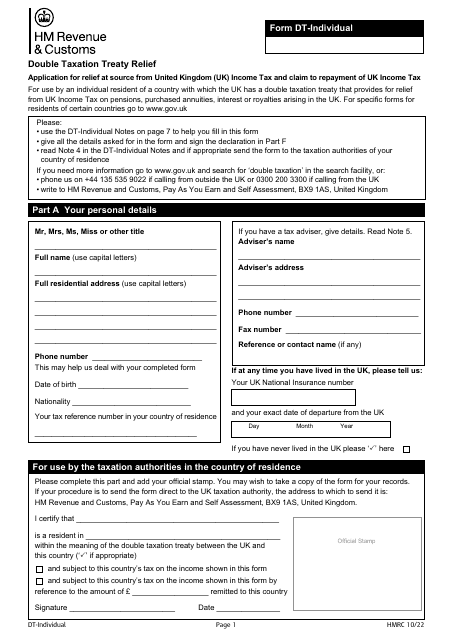

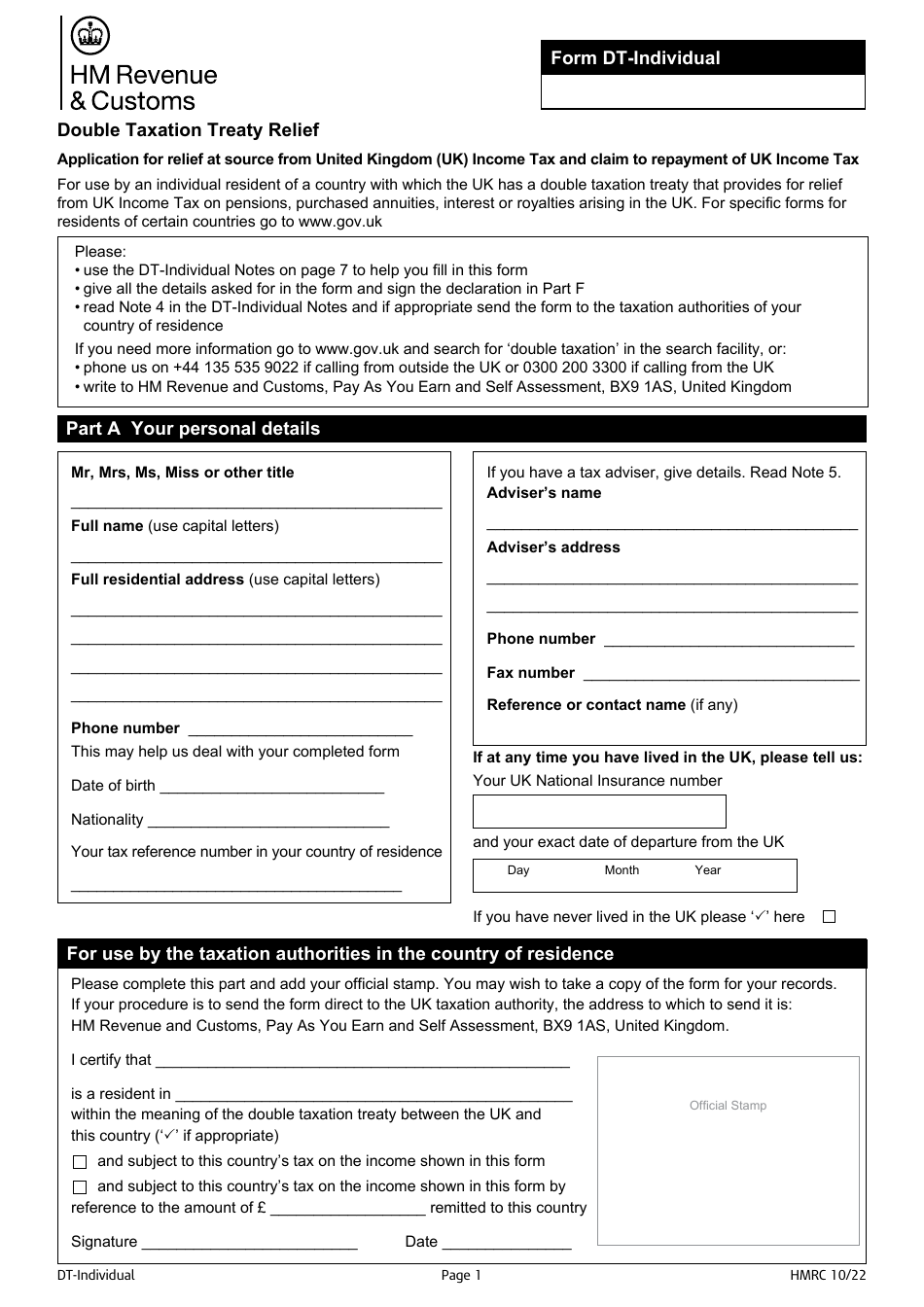

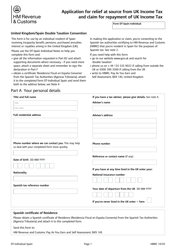

Form DT-INDIVIDUAL Double Taxation Treaty Relief - United Kingdom

Form DT-INDIVIDUAL Double Taxation Treaty Relief - United Kingdom is used to claim relief from double taxation under the tax treaty between the United Kingdom and another country for individuals.

The Form DT-INDIVIDUAL Double Taxation Treaty Relief for the United Kingdom is typically filed by individuals who are residents of the United States and have income that is subject to taxation in both the United States and the United Kingdom.

Form DT-INDIVIDUAL Double Taxation Treaty Relief - United Kingdom - Frequently Asked Questions (FAQ)

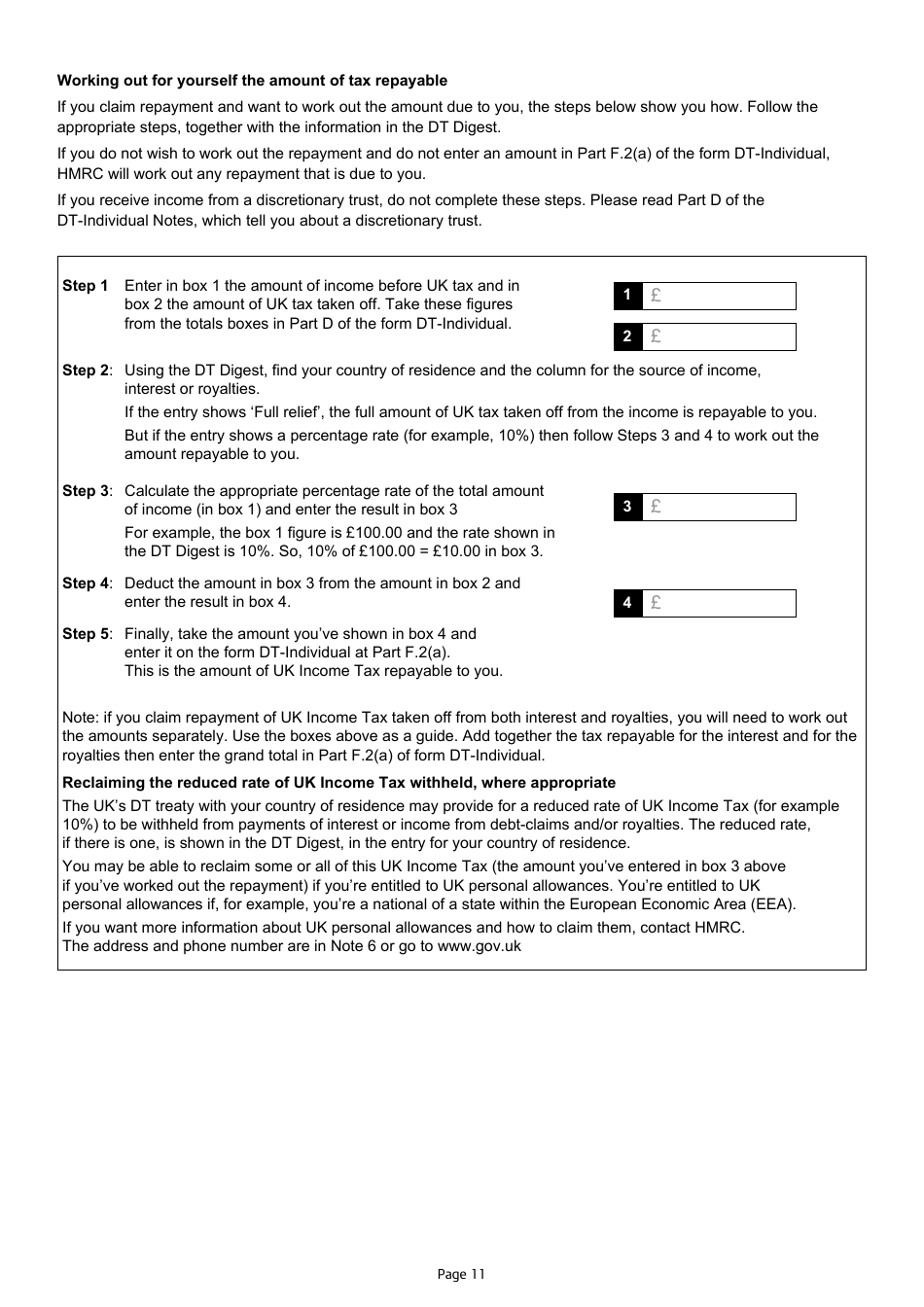

Q: What is Form DT-INDIVIDUAL? A: Form DT-INDIVIDUAL is a form used for claiming double taxation treaty relief between the United Kingdom and another country.

Q: What is double taxation treaty relief? A: Double taxation treaty relief is a provision in international tax agreements to prevent individuals from being taxed on the same income in two different countries.

Q: Who can use Form DT-INDIVIDUAL? A: Form DT-INDIVIDUAL can be used by individuals who are residents of the United Kingdom and are eligible for double taxation treaty relief.

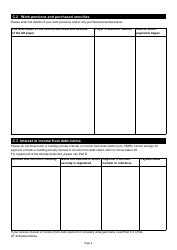

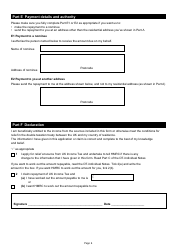

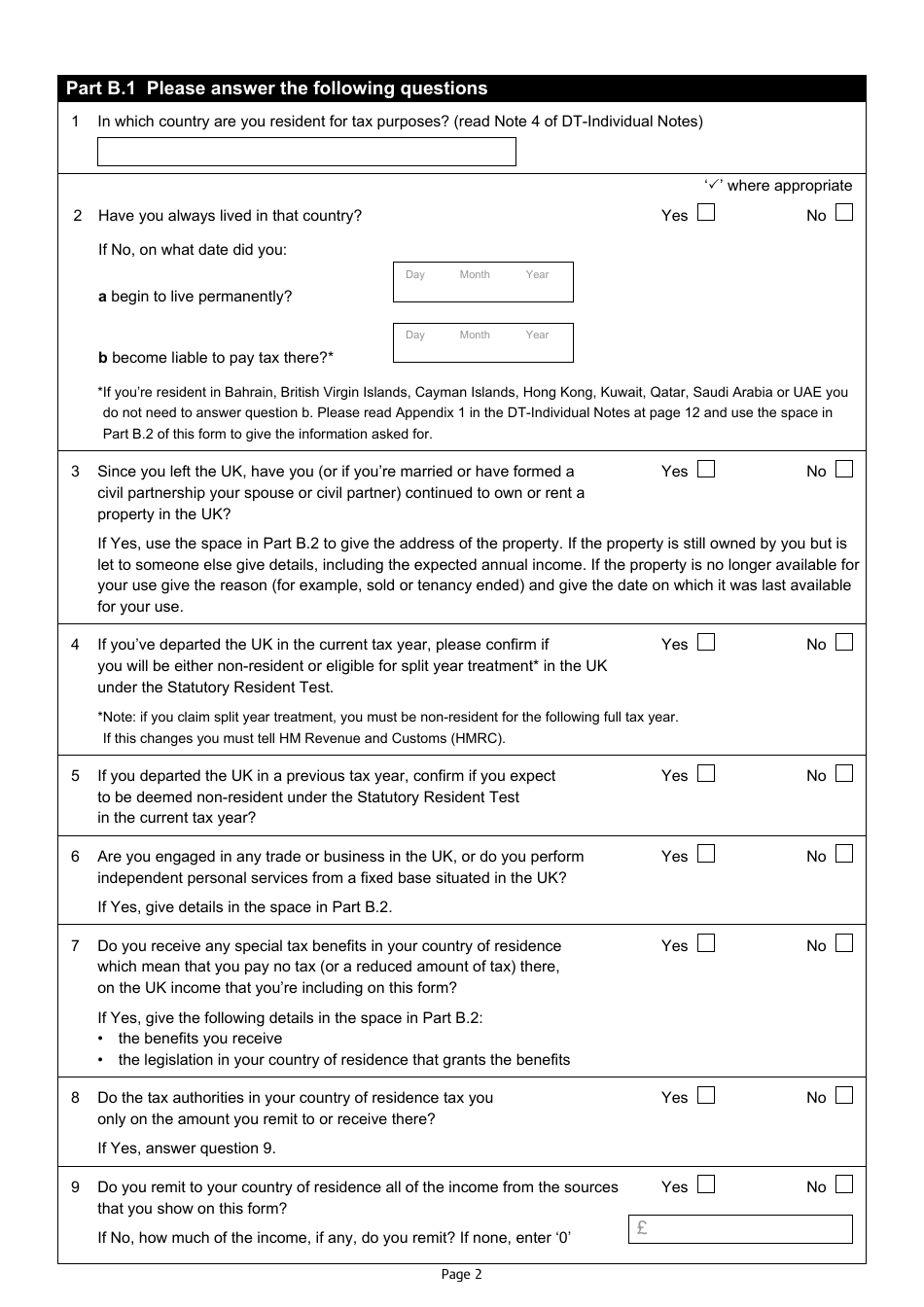

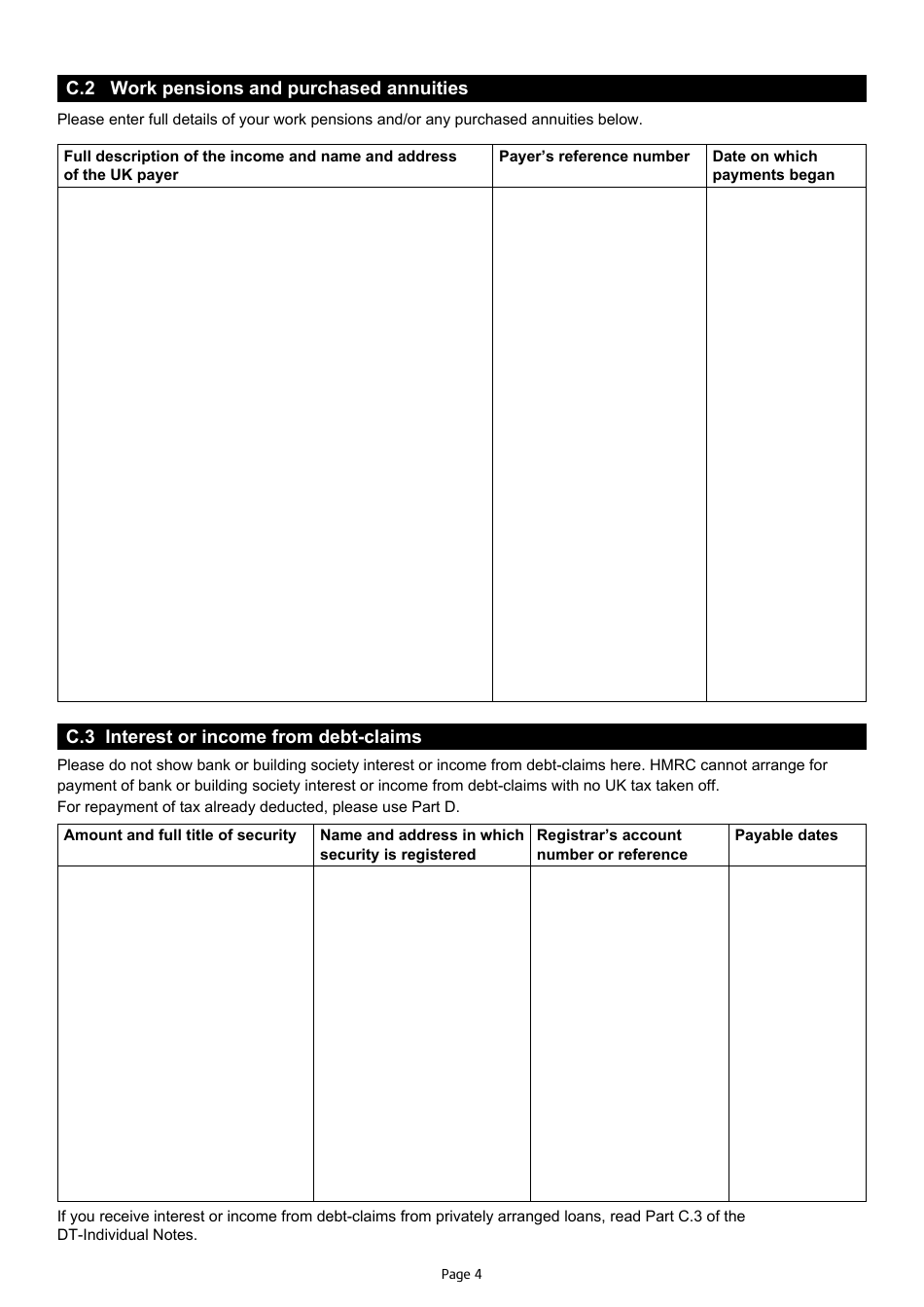

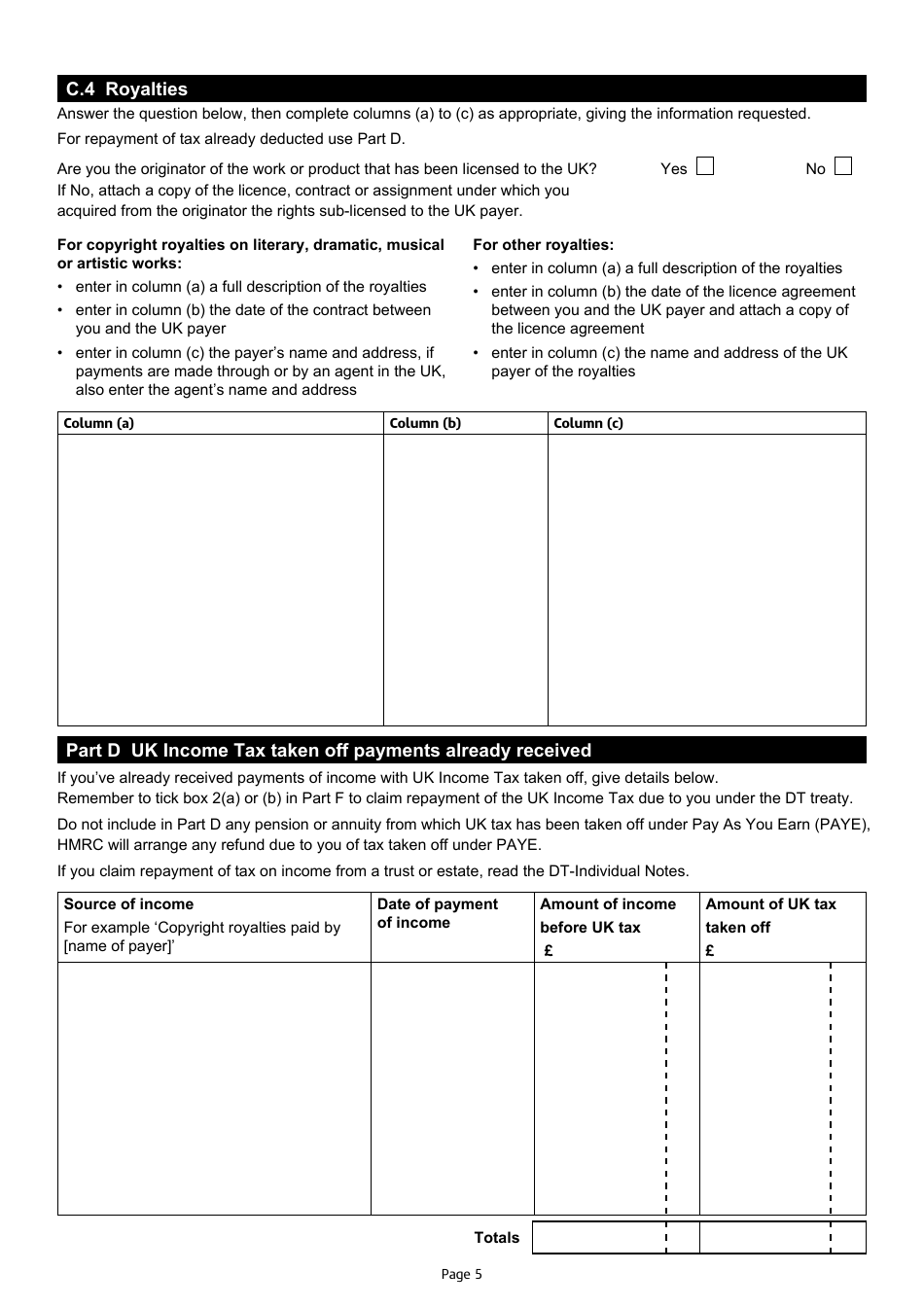

Q: What information is required on Form DT-INDIVIDUAL? A: Form DT-INDIVIDUAL requires information such as the taxpayer's personal details, details of the foreign tax paid, and the applicable tax treaty provisions.