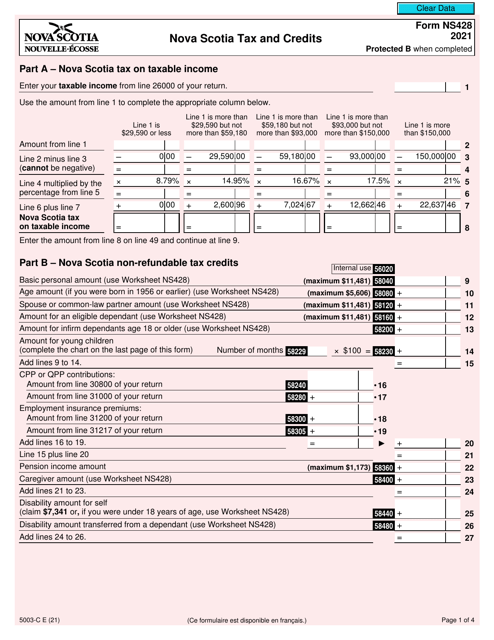

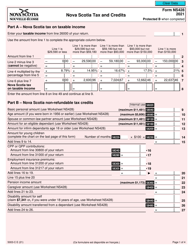

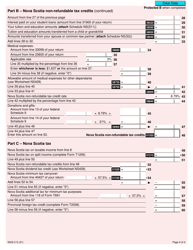

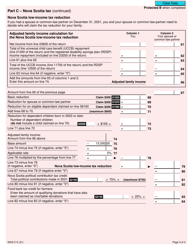

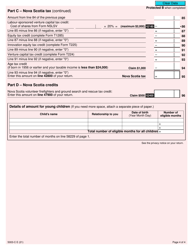

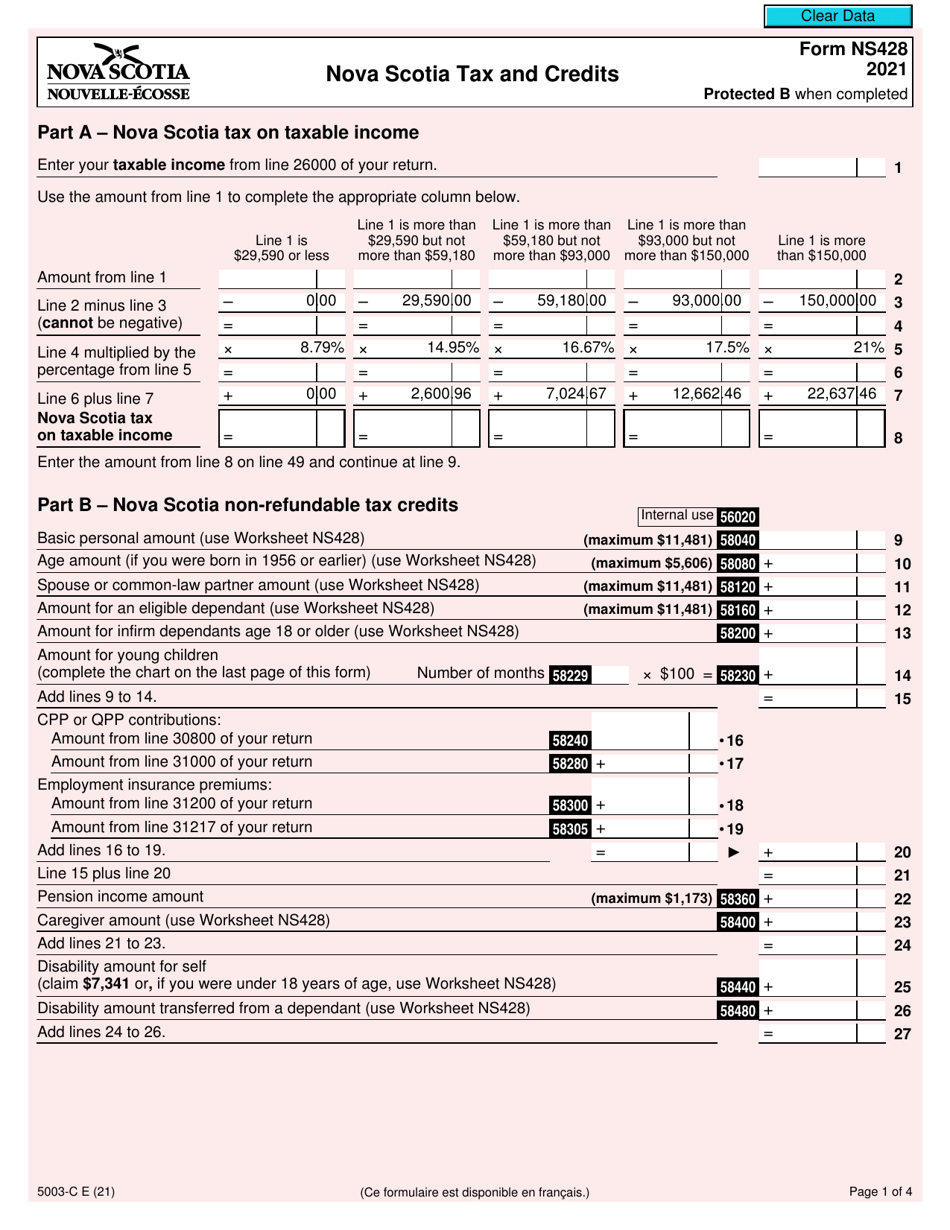

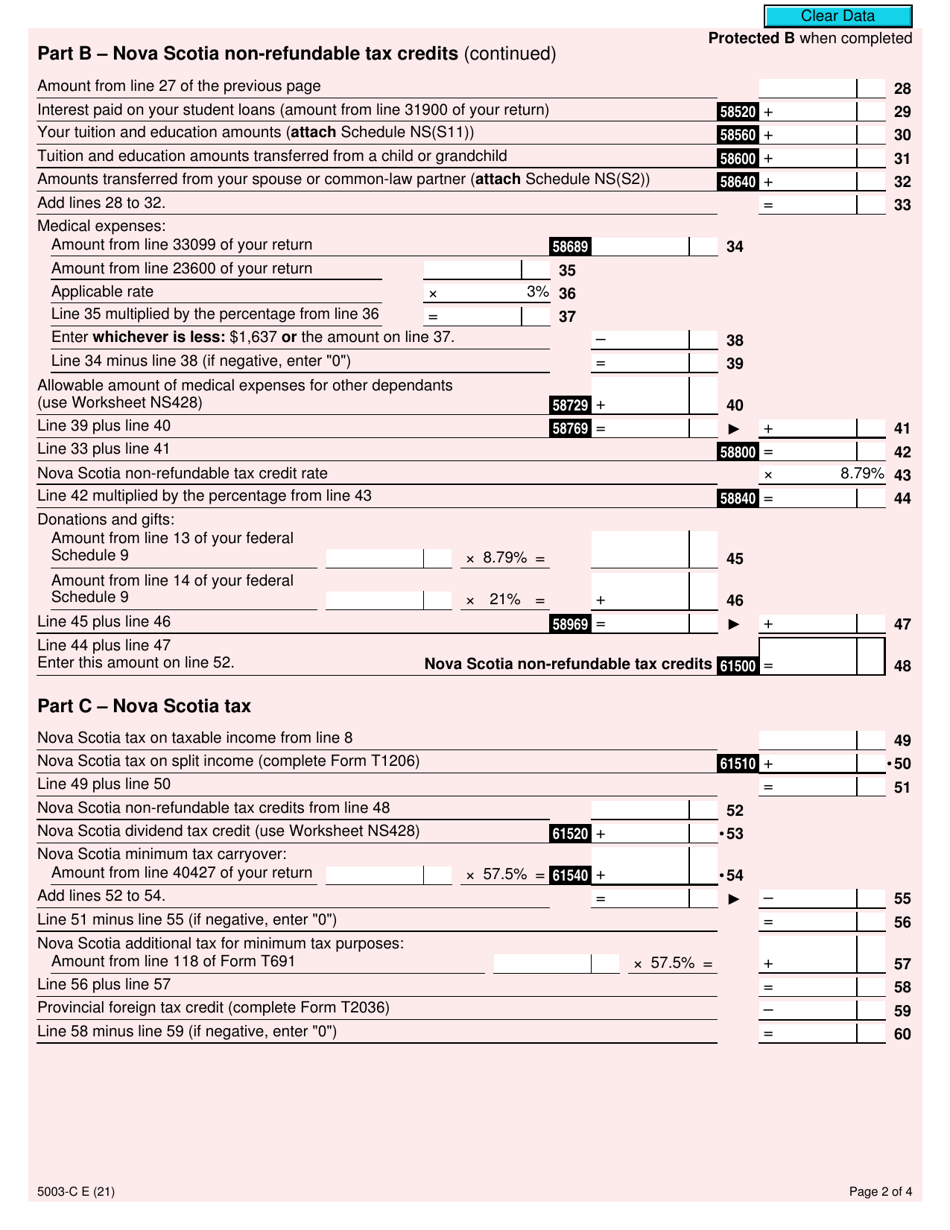

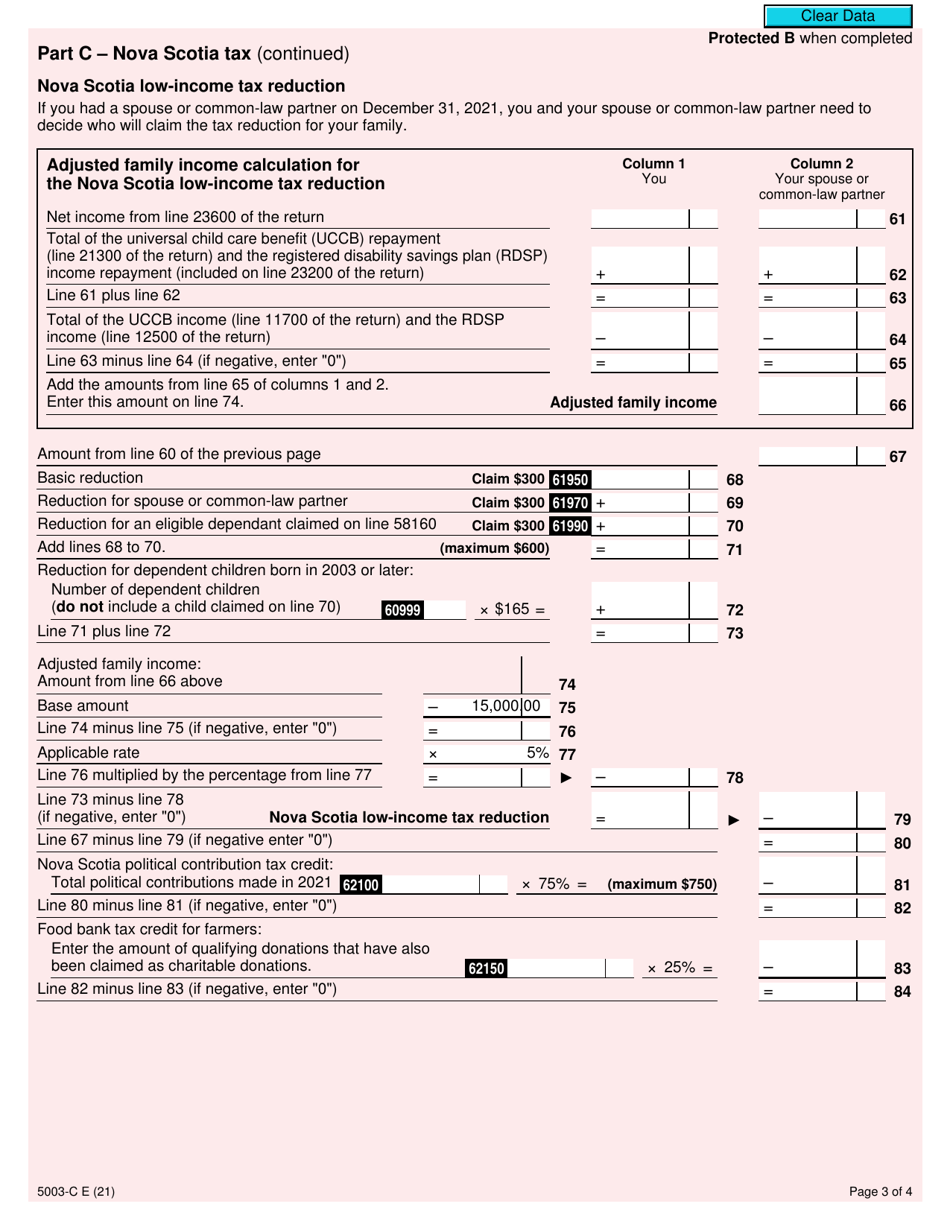

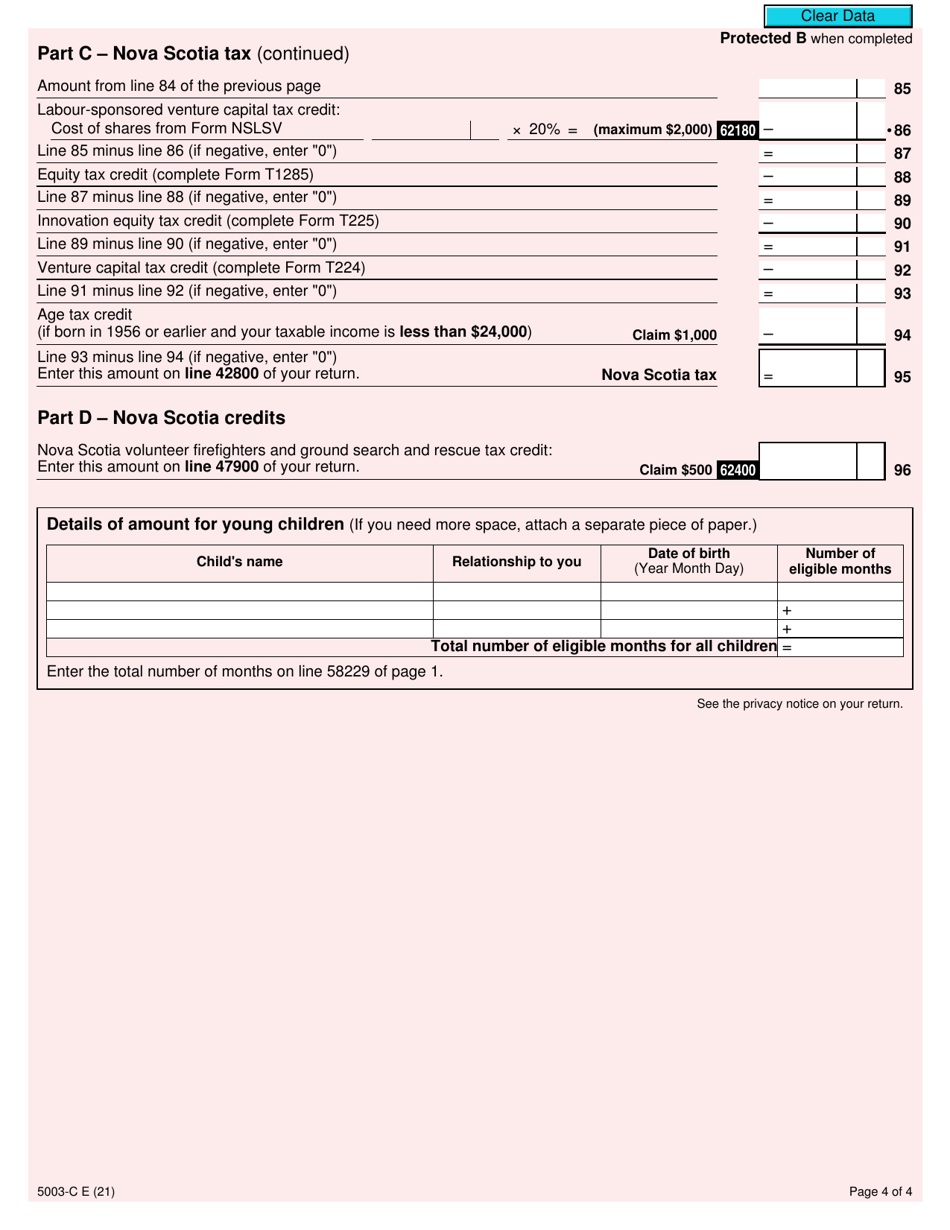

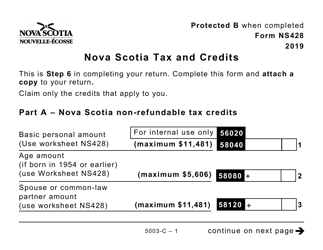

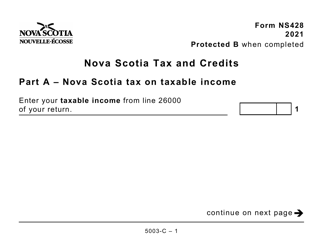

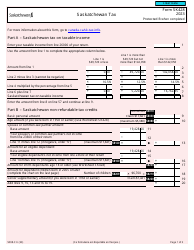

Form 5003-C (NS428) Nova Scotia Tax and Credits - Canada

Form 5003-C (NS428) is used in Nova Scotia, Canada for reporting provincial taxes and claiming tax credits.

The individual taxpayer files the Form 5003-C (NS428) in Nova Scotia, Canada.

Form 5003-C (NS428) Nova Scotia Tax and Credits - Canada - Frequently Asked Questions (FAQ)

Q: What is Form 5003-C (NS428)?

A: Form 5003-C (NS428) is a Nova Scotia tax form used by residents of Nova Scotia, Canada to calculate their provincial taxes and claim credits.

Q: Who needs to fill out Form 5003-C (NS428)?

A: Residents of Nova Scotia who have to file their taxes and claim provincial tax credits need to fill out Form 5003-C (NS428).

Q: What information is required on Form 5003-C (NS428)?

A: Form 5003-C (NS428) requires information related to your income, deductions, and credits specific to Nova Scotia.

Q: When is the deadline to file Form 5003-C (NS428)?

A: The deadline to file Form 5003-C (NS428) is usually the same as the deadline to file your federal tax return, which is April 30th of each year.

Q: What if I need help filling out Form 5003-C (NS428)?

A: If you need assistance with filling out Form 5003-C (NS428), you can seek help from a professional tax preparer or contact the Canada Revenue Agency (CRA) for guidance.

Q: Can I file Form 5003-C (NS428) electronically?

A: Yes, you can file Form 5003-C (NS428) electronically if you use certified tax preparation software or hire a certified tax professional.

Q: What should I do after filing Form 5003-C (NS428)?

A: After filing Form 5003-C (NS428), make sure to keep a copy of the form for your records and submit any required payment to the Canada Revenue Agency (CRA) if you have a balance owing.

Q: Are there penalties for late filing of Form 5003-C (NS428)?

A: Yes, if you file Form 5003-C (NS428) after the deadline, you may be subject to penalties and interest charges on any amount owing.

Q: Can I make changes to Form 5003-C (NS428) after filing?

A: If you need to make changes to Form 5003-C (NS428) after filing, you can request an adjustment by contacting the Canada Revenue Agency (CRA) and explaining the changes that need to be made.