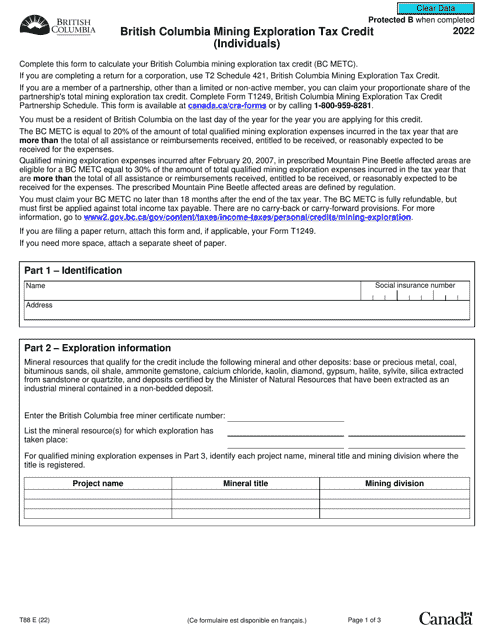

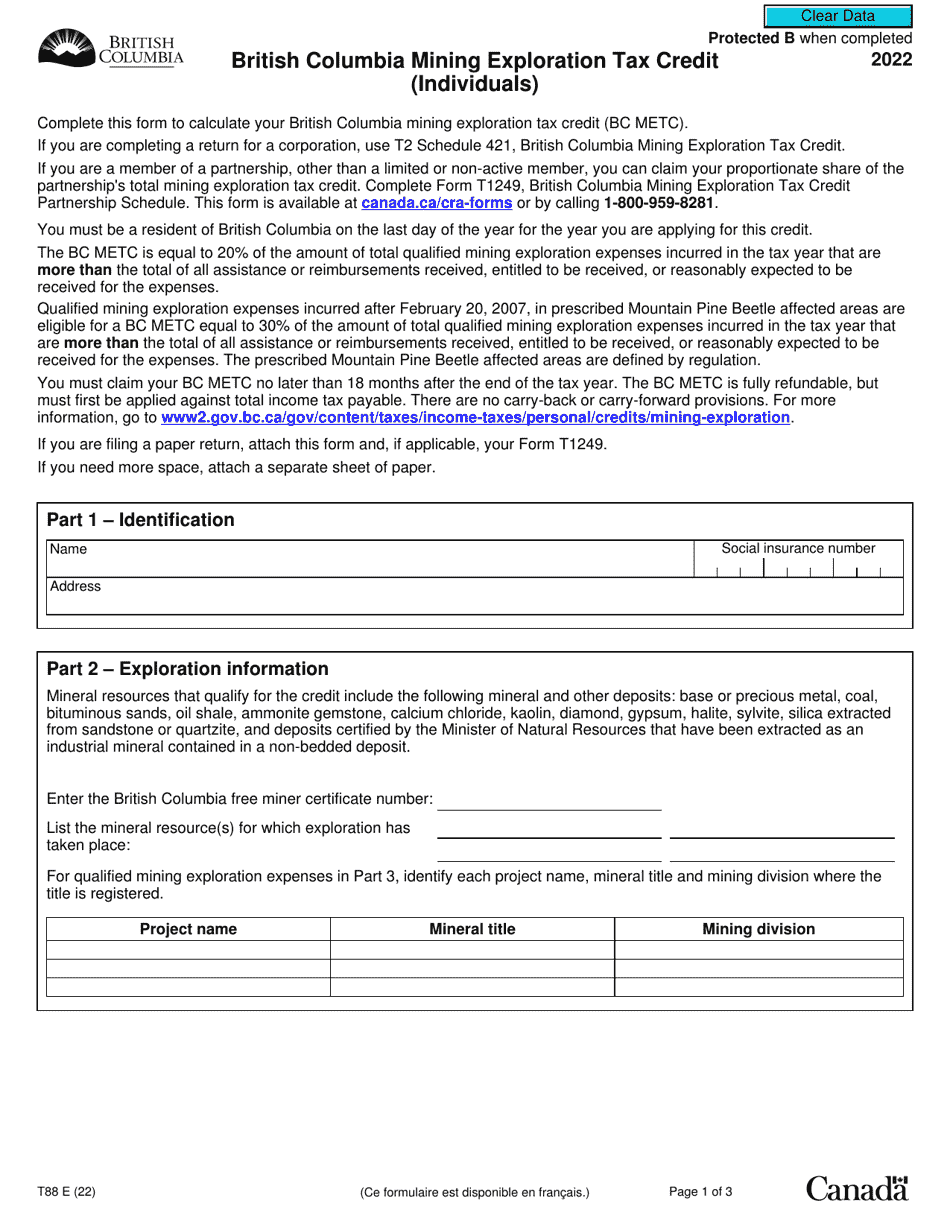

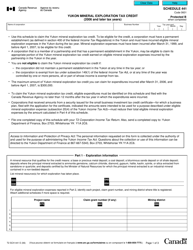

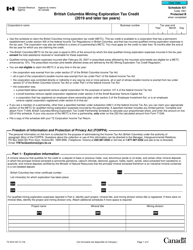

Form T88 British Columbia Mining Exploration Tax Credit (Individuals) - Canada

Form T88 is used in British Columbia, Canada, to claim the Mining Exploration Tax Credit for individuals. This credit is meant to encourage investment in mineral exploration activities in the province.

Form T88 British Columbia Mining Exploration Tax Credit (Individuals) - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T88?

A: Form T88 is the British Columbia Mining Exploration Tax Credit form for individuals.

Q: What is the purpose of Form T88?

A: The purpose of Form T88 is to claim the British Columbia Mining Exploration Tax Credit.

Q: Who is eligible to claim the British Columbia Mining Exploration Tax Credit?

A: Individuals who invested in qualifying mining exploration activities in British Columbia may be eligible to claim the tax credit.

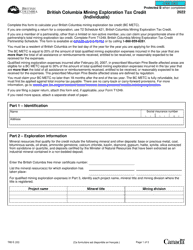

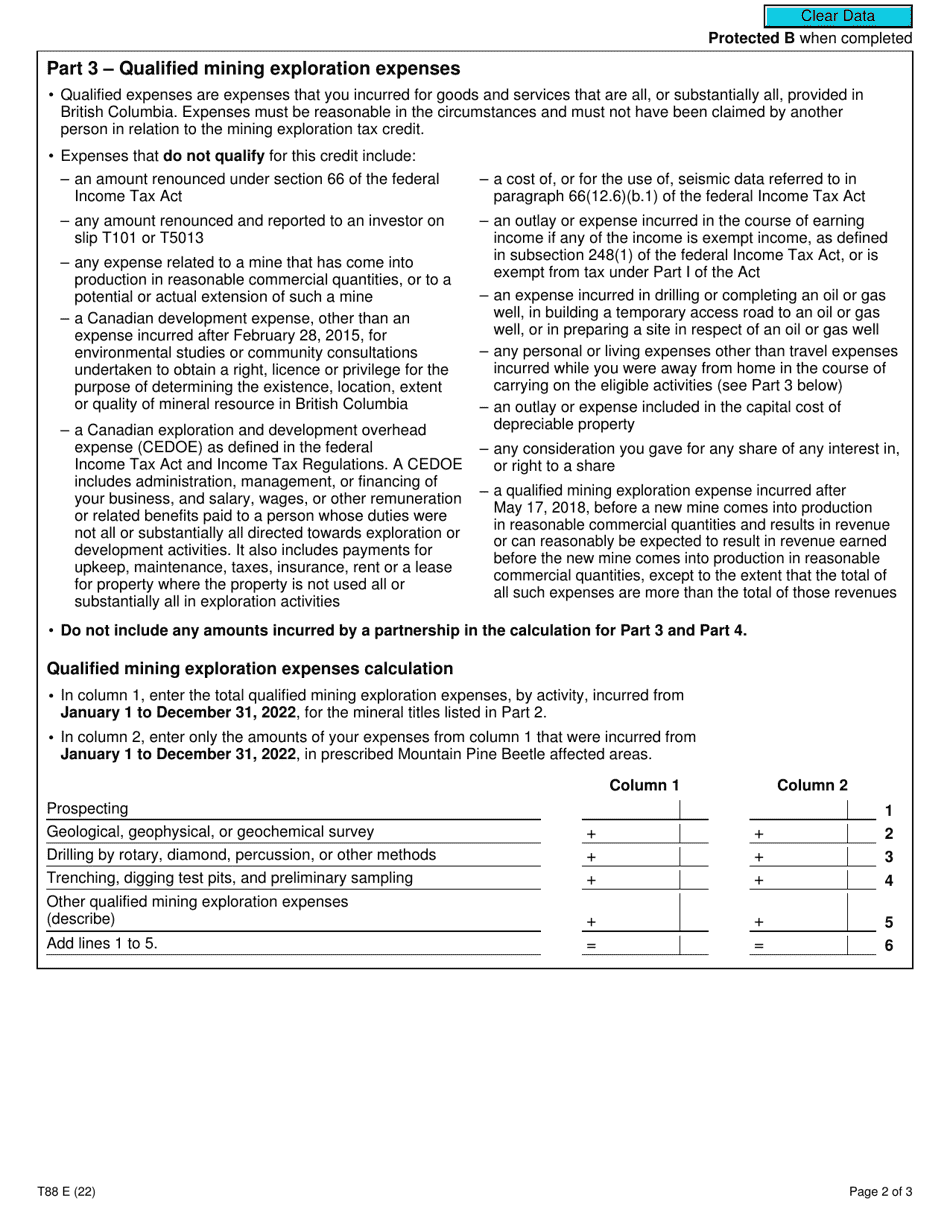

Q: What are qualifying mining exploration activities?

A: Qualifying mining exploration activities include surveying, drilling, trenching, and other activities directly related to prospecting and exploring for minerals.

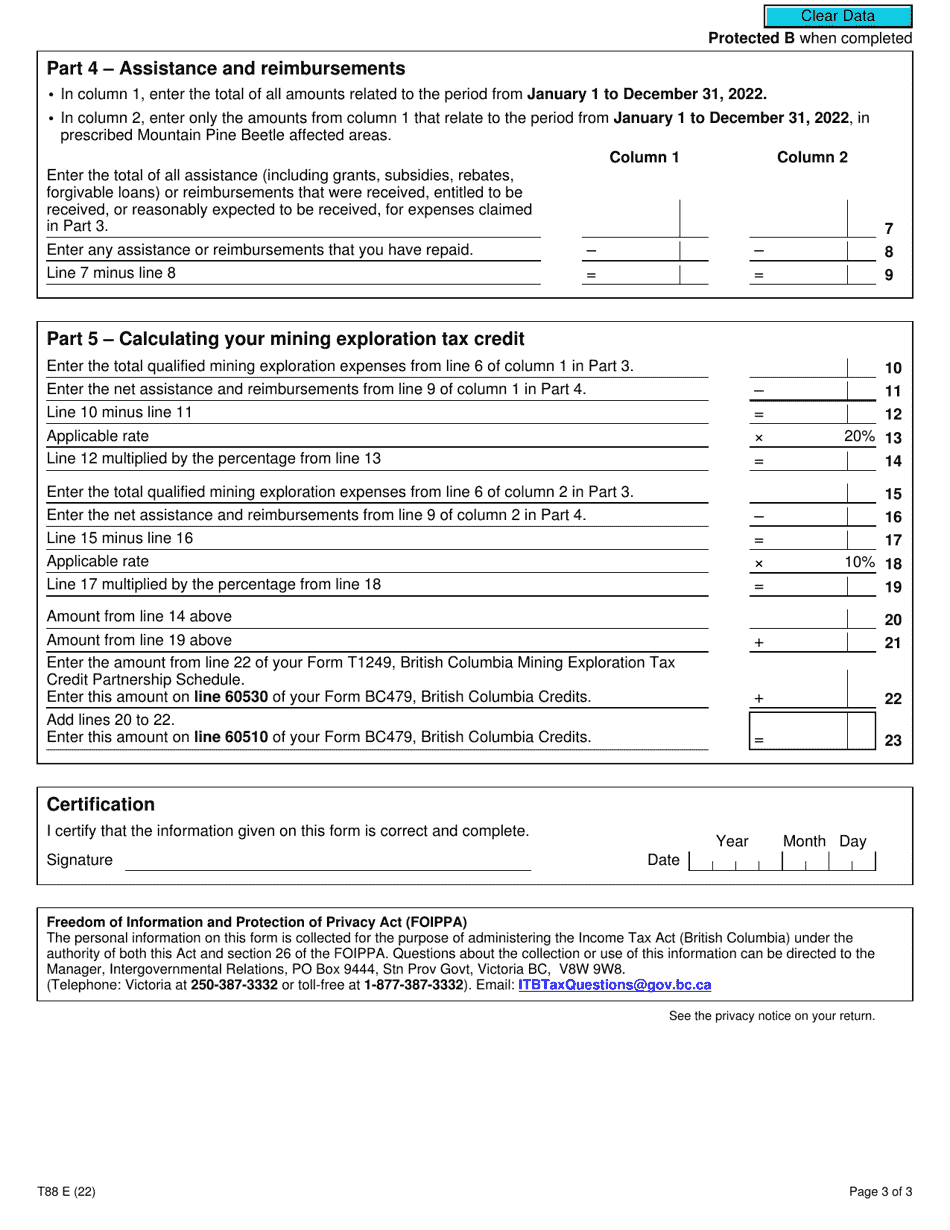

Q: How much is the British Columbia Mining Exploration Tax Credit?

A: The tax credit is equal to 20% of eligible mining expenditures.

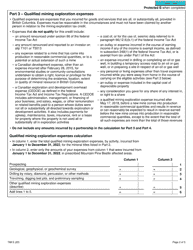

Q: When should Form T88 be filed?

A: Form T88 should be filed with your annual tax return.

Q: Is the British Columbia Mining Exploration Tax Credit refundable?

A: No, the tax credit is non-refundable. It can only be used to reduce your taxable income.

Q: Can I carry forward any unused tax credits?

A: Yes, any unused tax credits can be carried forward for up to 10 years.