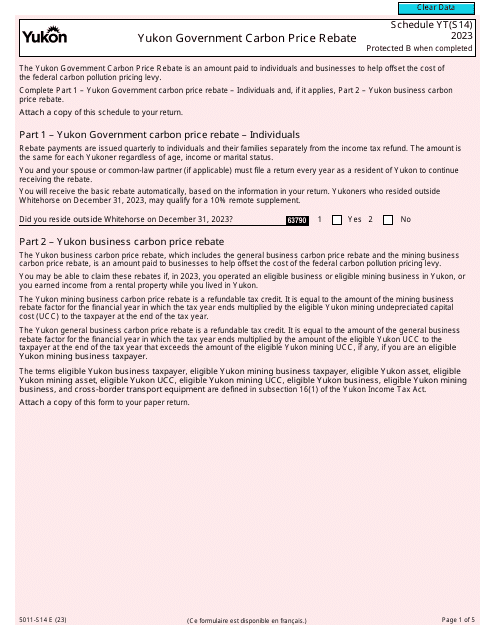

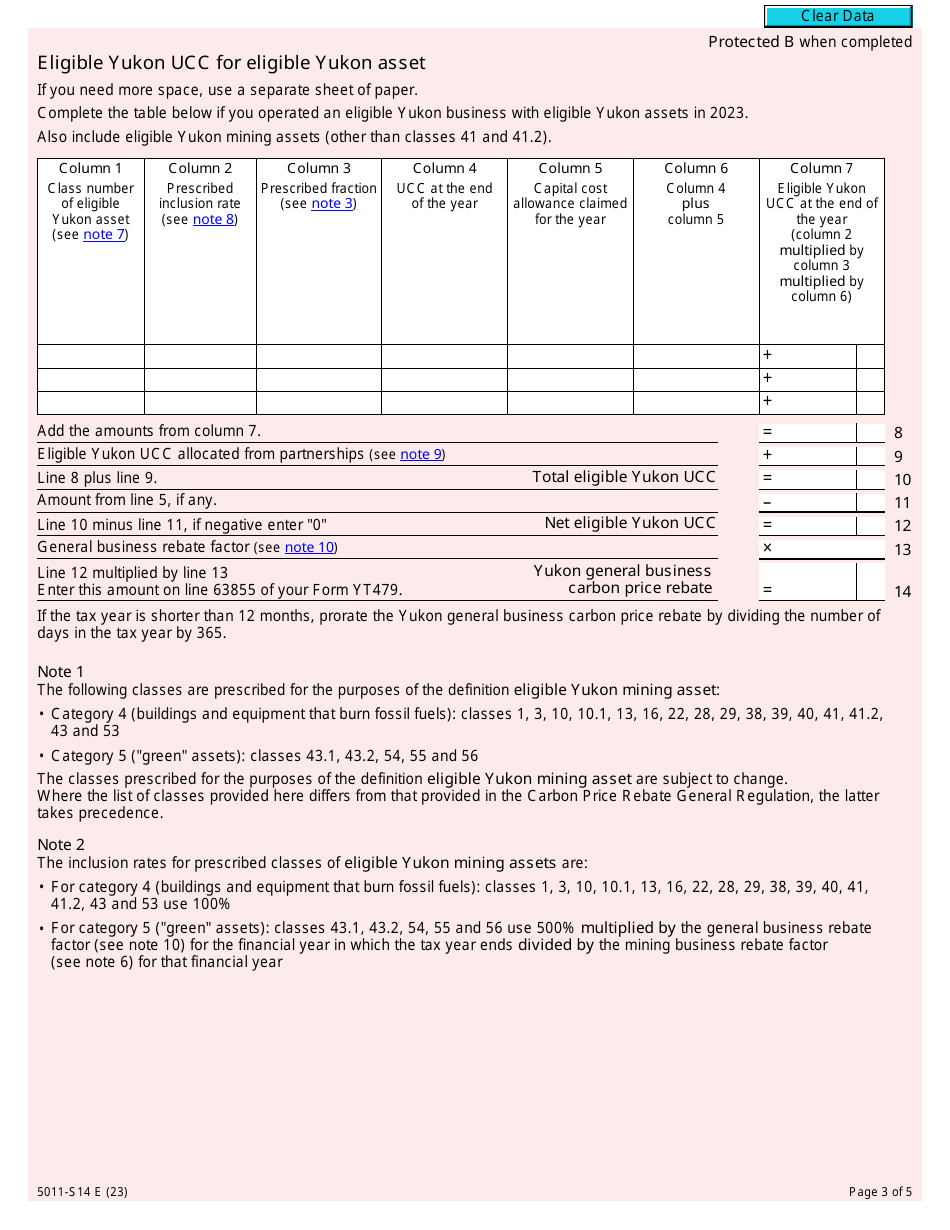

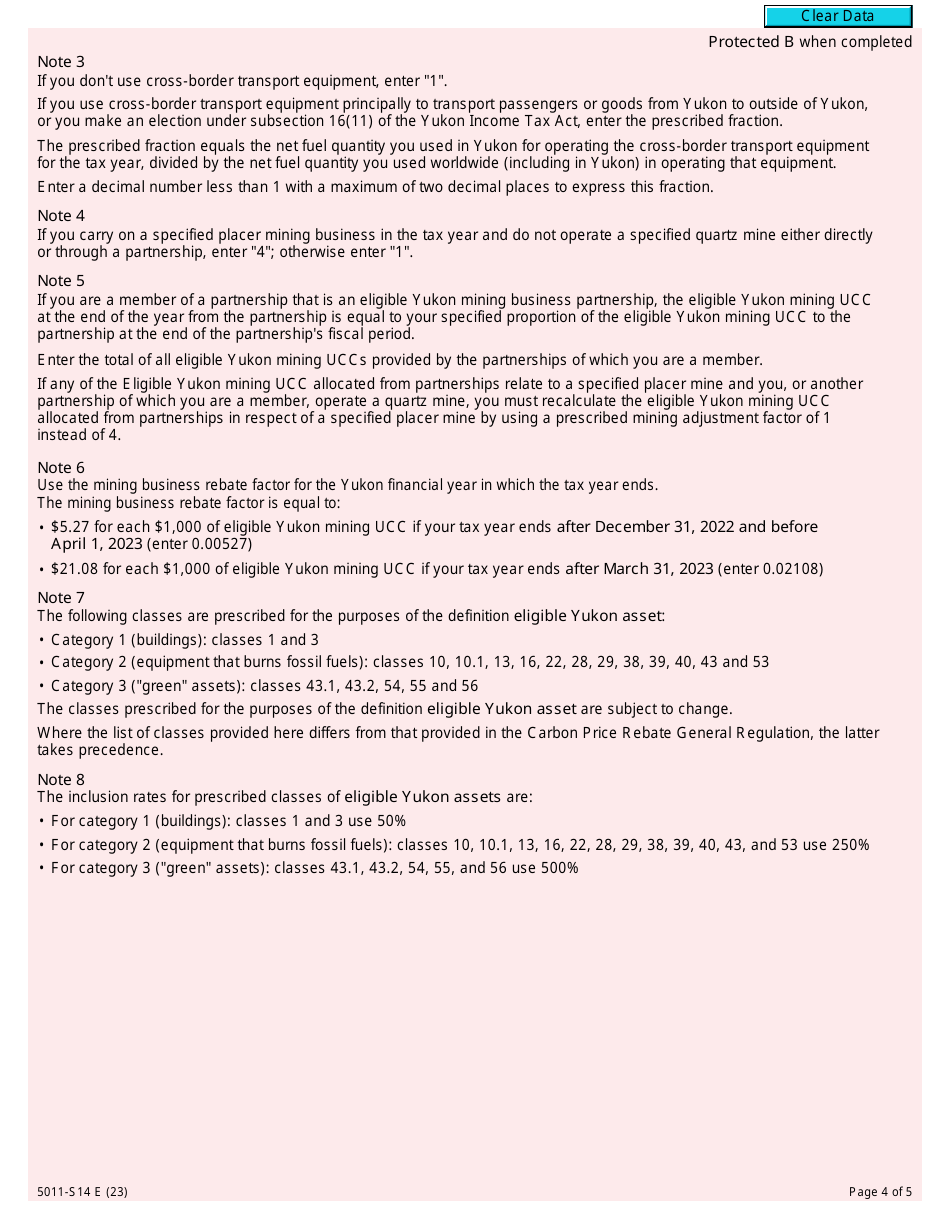

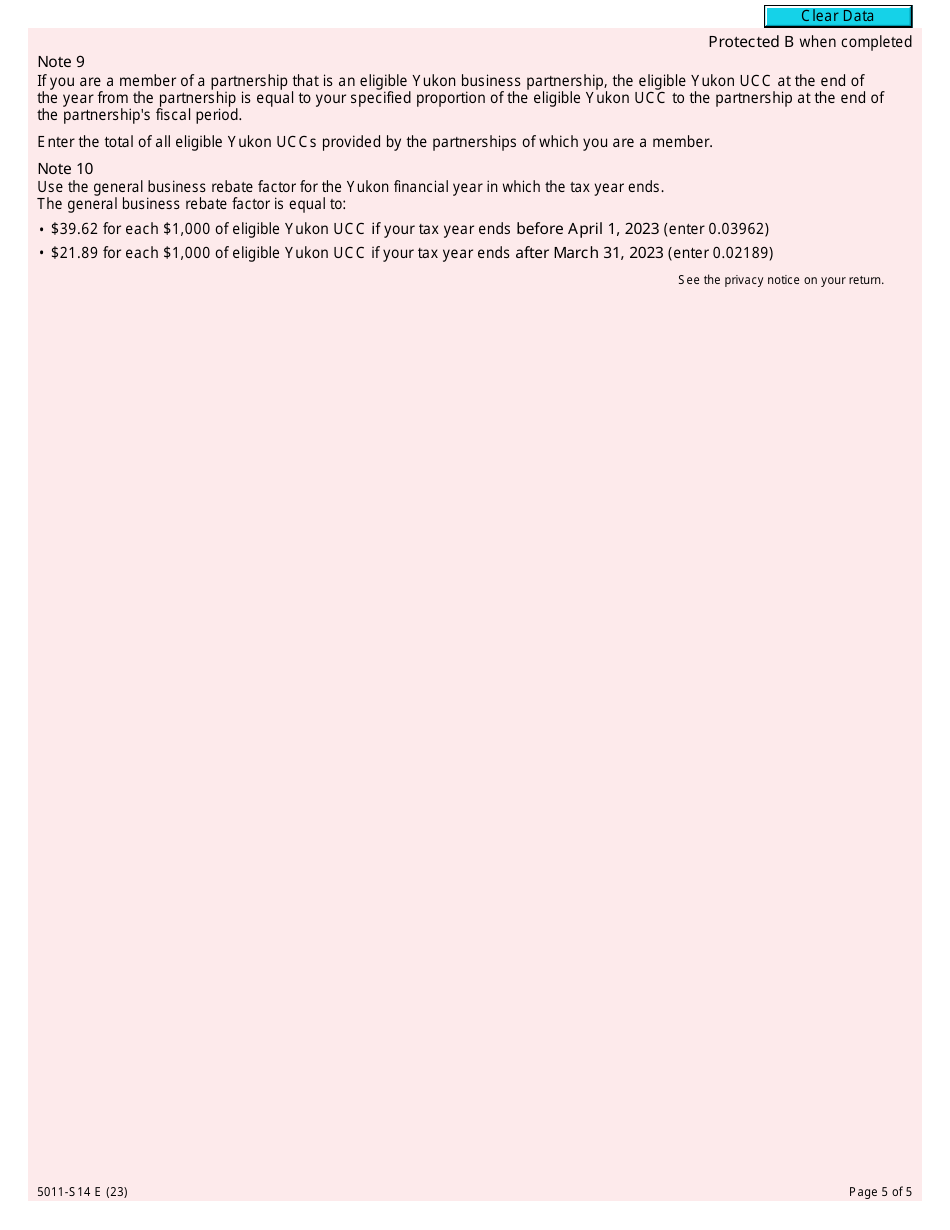

Form 5011-S14 Schedule YT(S14) Yukon Government Carbon Price Rebate - Canada

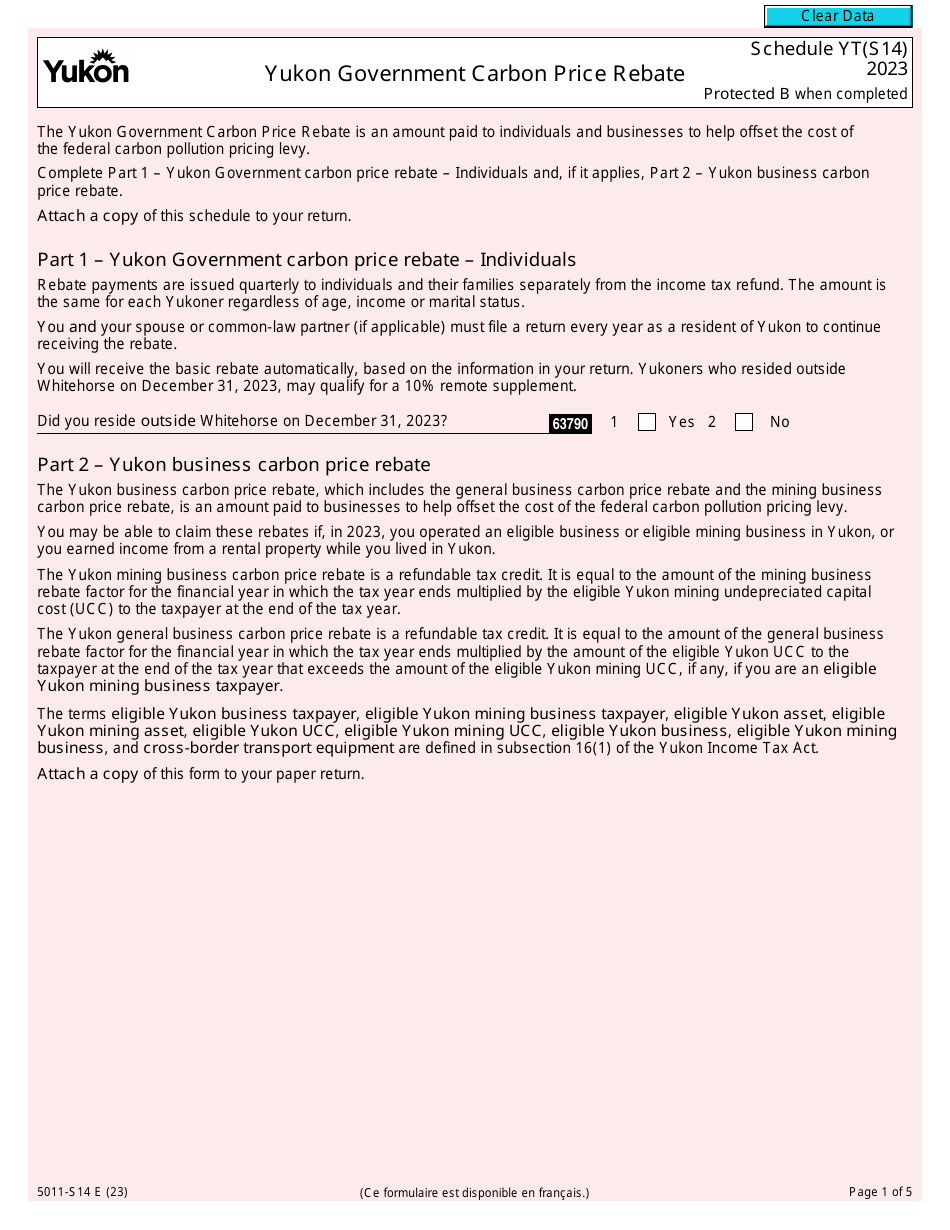

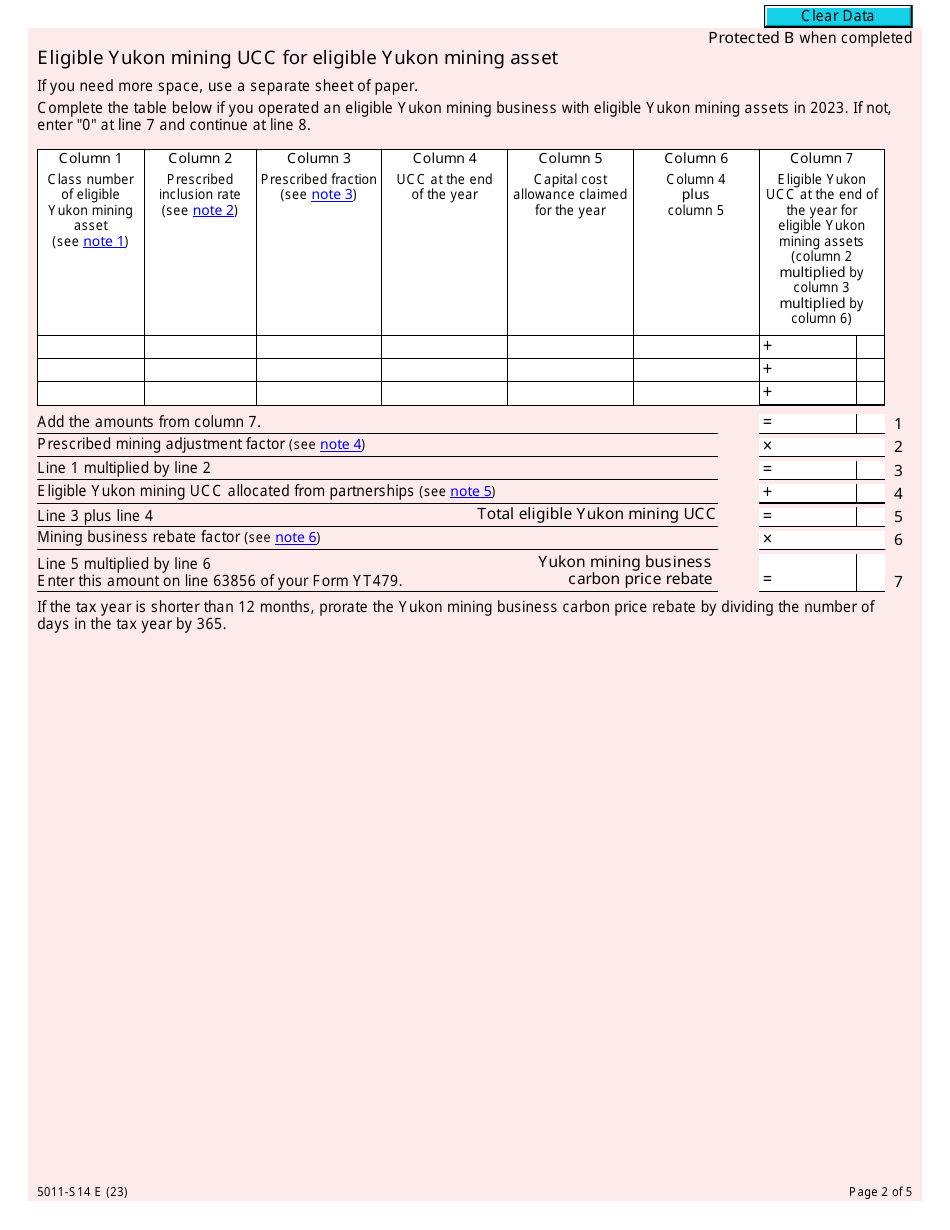

Form 5011-S14 Schedule YT(S14) Yukon Government Carbon Price Rebate is for claiming the carbon price rebate provided by the Yukon Government in Canada. It is a form to apply for financial compensation related to the carbon pricing system implemented in the Yukon territory.

The Form 5011-S14 Schedule YT(S14) Yukon Government Carbon Price Rebate is filed by individuals who are eligible for the carbon price rebate in Yukon, Canada.

Form 5011-S14 Schedule YT(S14) Yukon Government Carbon Price Rebate - Canada - Frequently Asked Questions (FAQ)

Q: What is Form 5011-S14?

A: Form 5011-S14 is a government document specifically for the Yukon territory in Canada.

Q: What is Schedule YT(S14) for?

A: Schedule YT(S14) is for claiming the Yukon government carbon price rebate.

Q: What is the Yukon government carbon price rebate?

A: The Yukon government carbon price rebate is a financial incentive provided by the government to offset the cost of the carbon price.

Q: Who is eligible for the rebate?

A: Residents of Yukon who meet certain criteria are eligible for the rebate.

Q: How can I claim the rebate?

A: To claim the rebate, you need to fill out Form 5011-S14 Schedule YT(S14) and submit it to the appropriate government office.

Q: What is the purpose of the carbon price?

A: The carbon price is intended to reduce greenhouse gas emissions by incentivizing individuals and businesses to reduce their carbon footprint.

Q: Is the rebate taxable?

A: The rebate is not taxable income.

Q: Is the carbon price rebate available in other provinces?

A: No, the carbon price rebate is specific to the Yukon territory in Canada.