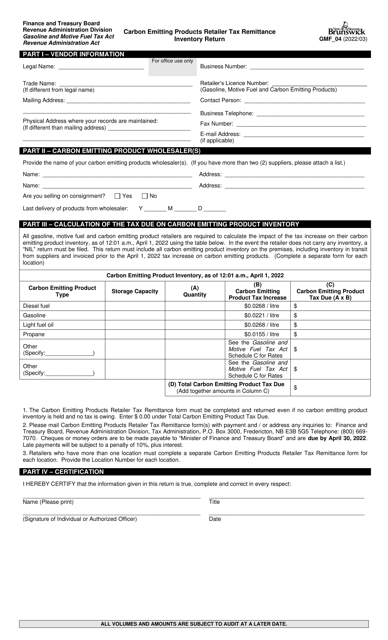

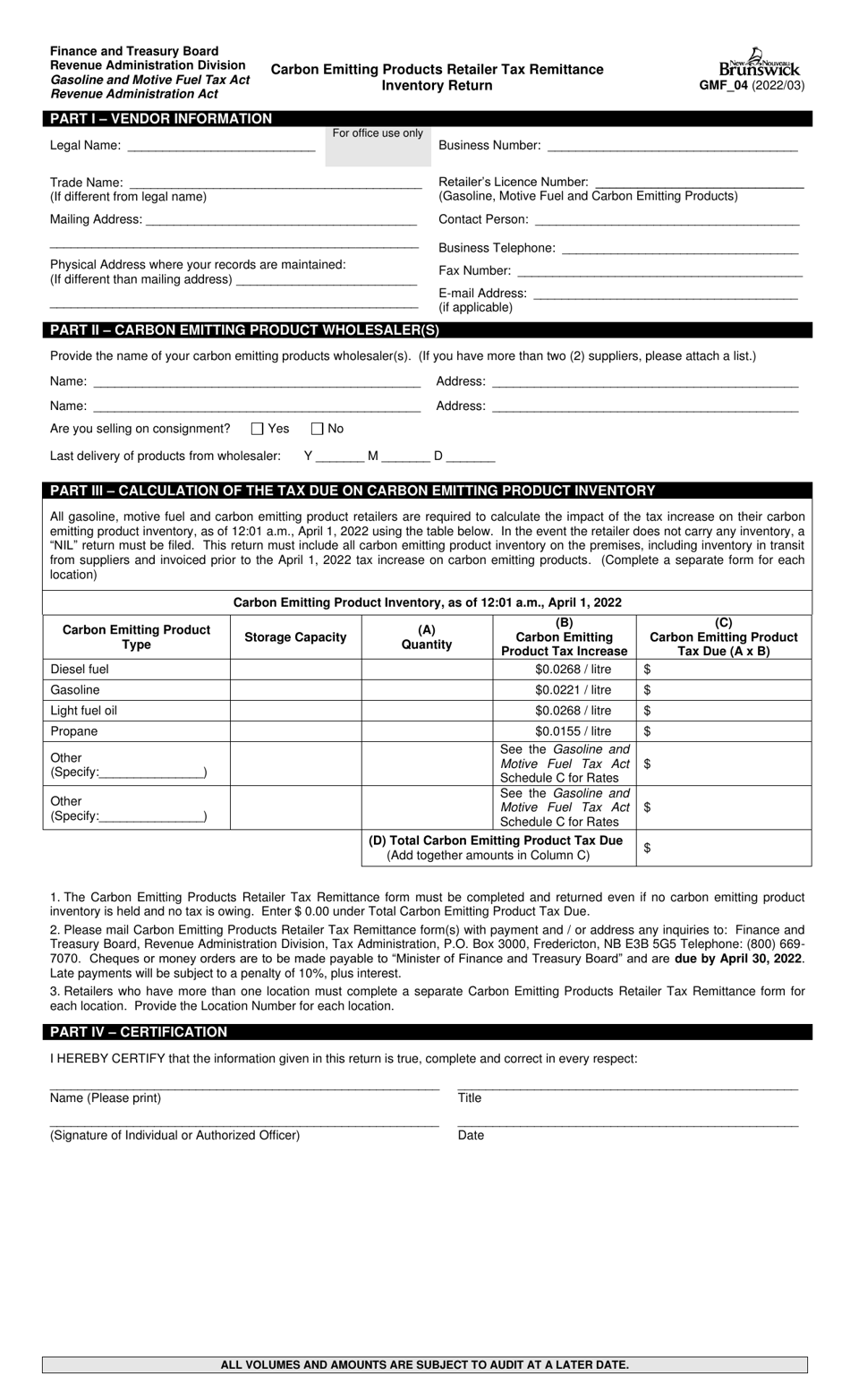

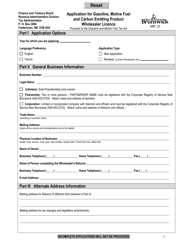

Form GMF_04 Carbon Emitting Products Retailer Tax Remittance Inventory Return - New Brunswick, Canada

Form GMF_04 Carbon Emitting Products Retailer Tax Remittance Inventory Return is a tax remittance form used by retailers in New Brunswick, Canada to report the amount of carbon taxes collected on the sale of carbon-emitting products. This form is used to calculate and remit the tax owed to the government.

The Form GMF_04 Carbon Emitting Products Retailer Tax Remittance Inventory Return in New Brunswick, Canada is filed by retailers of carbon emitting products.

Form GMF_04 Carbon Emitting Products Retailer Tax Remittance Inventory Return - New Brunswick, Canada - Frequently Asked Questions (FAQ)

Q: What is the GMF_04 Carbon Emitting Products Retailer Tax Remittance Inventory Return?

A: The GMF_04 form is used for retailers in New Brunswick, Canada to report and remit taxes on carbon emitting products.

Q: Who needs to file the GMF_04 Carbon Emitting Products Retailer Tax Remittance Inventory Return?

A: Retailers in New Brunswick, Canada selling carbon emitting products are required to file this return.

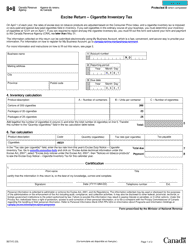

Q: What are carbon emitting products?

A: Carbon emitting products are goods or substances that release carbon dioxide or other greenhouse gases when used or burned, such as fossil fuels, natural gas, and coal.

Q: What is the purpose of the Carbon Emitting Products Retailer Tax?

A: The tax is imposed on retailers to encourage the reduction of greenhouse gas emissions and promote cleaner energy alternatives.

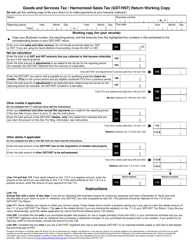

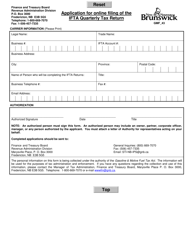

Q: How often do retailers need to file the GMF_04 return?

A: Retailers are required to file the GMF_04 return on a regular basis, typically monthly or quarterly, depending on their sales volume.

Q: What information is required to complete the GMF_04 form?

A: The form requires retailers to provide details about their sales of carbon emitting products, including quantities sold and the amount of tax to be remitted.

Q: Can retailers claim any exemptions or deductions on the GMF_04 form?

A: Yes, retailers may be eligible for certain exemptions or deductions, such as sales to exempt organizations or specific types of customers. These should be clearly indicated on the form.

Q: What are the consequences of not filing the GMF_04 return?

A: Failure to file the GMF_04 return or remit the required taxes may result in penalties and interest charges imposed by the tax authority.