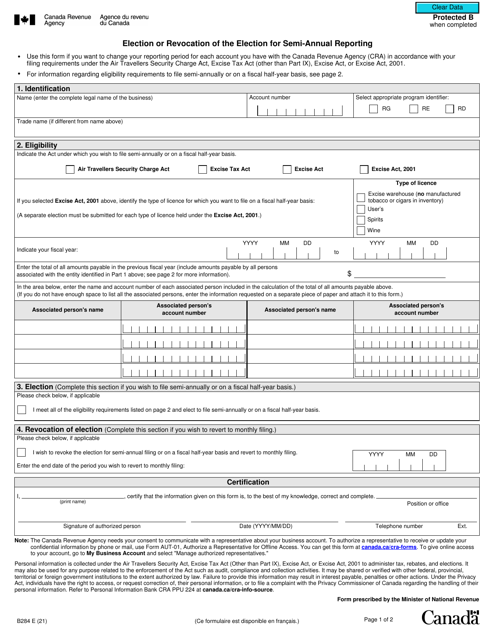

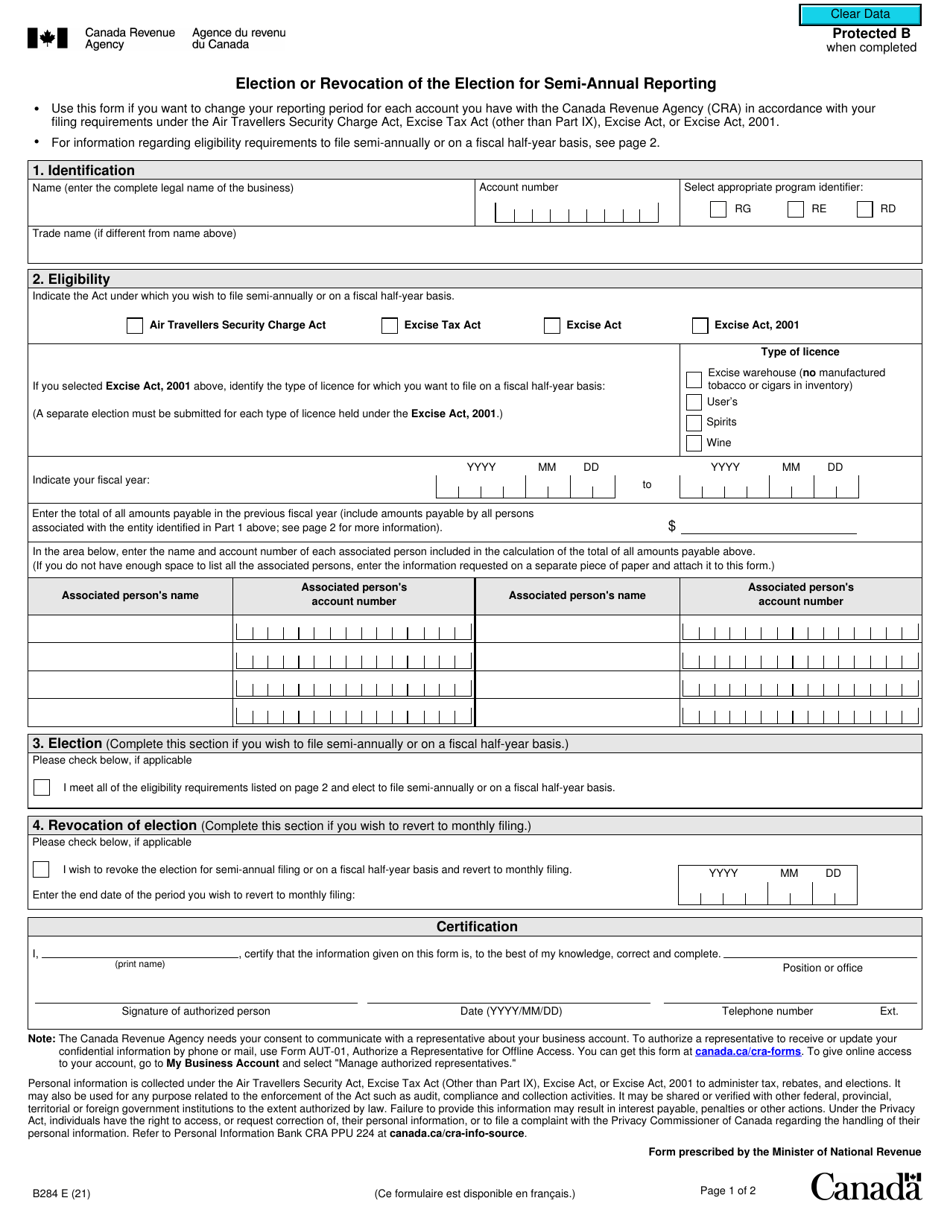

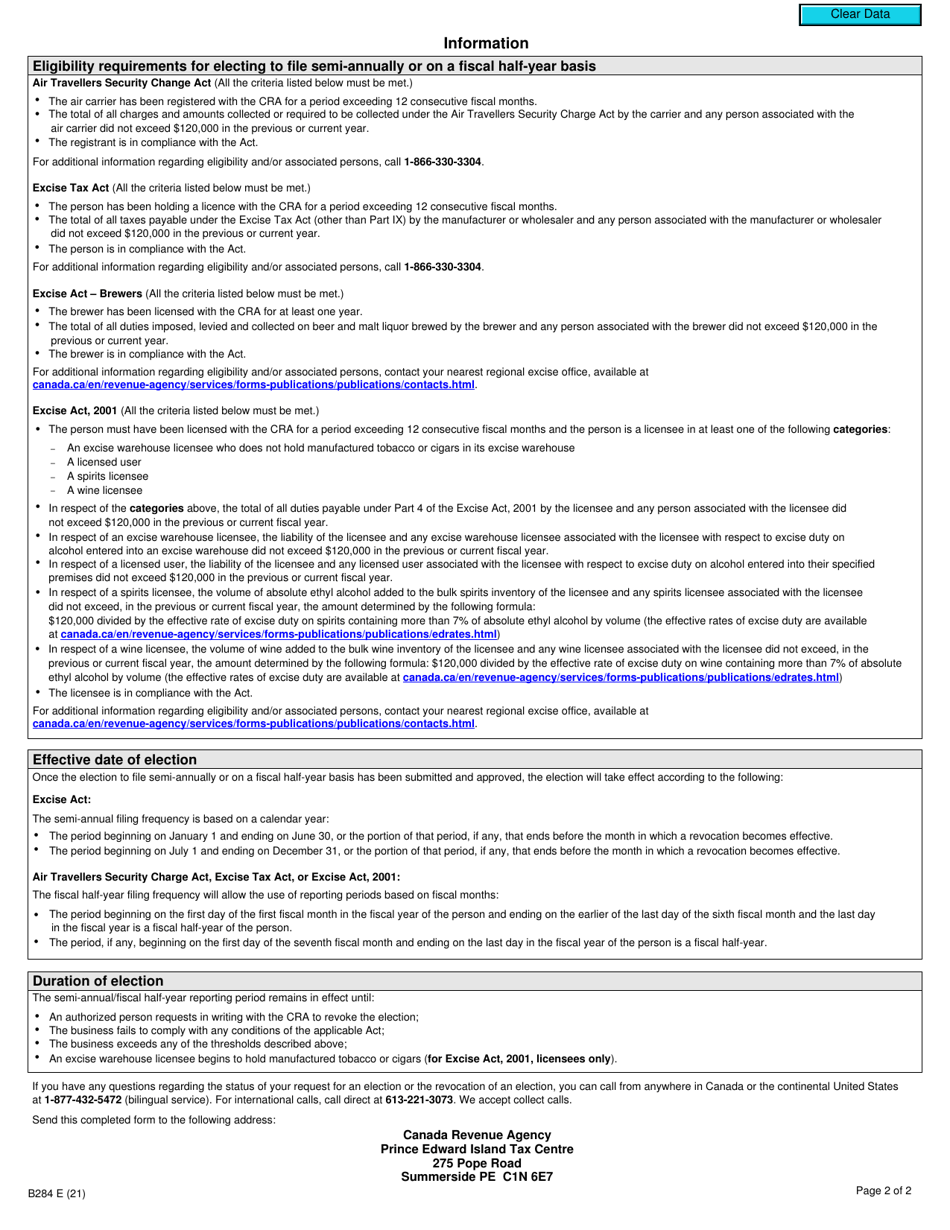

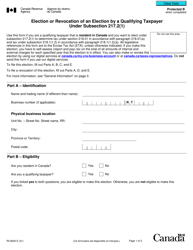

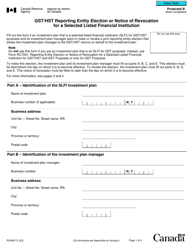

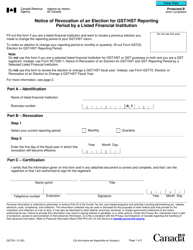

Form B284 Election or Revocation of the Election for Semi-annual Reporting - Canada

Form B284 Election or Revocation of the Election for Semi-annual Reporting - Canada is used for the purpose of either electing or revoking the election for semi-annual reporting for certain businesses in Canada.

Form B284 Election or Revocation of the Election for Semi-annual Reporting - Canada - Frequently Asked Questions (FAQ)

Q: What is Form B284?

A: Form B284 is an Election or Revocation of the Election for Semi-annual Reporting form in Canada.

Q: What is the purpose of Form B284?

A: The purpose of Form B284 is to elect or revoke the election for semi-annual reporting in Canada.

Q: Who is required to file Form B284?

A: Taxpayers in Canada who wish to elect or revoke the election for semi-annual reporting are required to file Form B284.

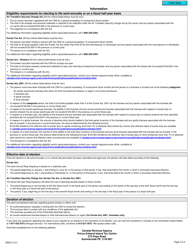

Q: Is there a deadline for filing Form B284?

A: Yes, there is a deadline for filing Form B284. It should be filed by the due date of the first reporting period to which the election or revocation applies.

Q: Are there any penalties for not filing Form B284?

A: Yes, there may be penalties for not filing Form B284 or for filing it late. It is important to file the form on time to avoid any penalties.

Q: What information do I need to complete Form B284?

A: To complete Form B284, you will need your business information, such as your business number, reporting period details, and the election or revocation information.

Q: Can I make changes to my election after filing Form B284?

A: No, once you have filed Form B284, you cannot make changes to your election or revocation. It is important to review the form carefully before filing it.