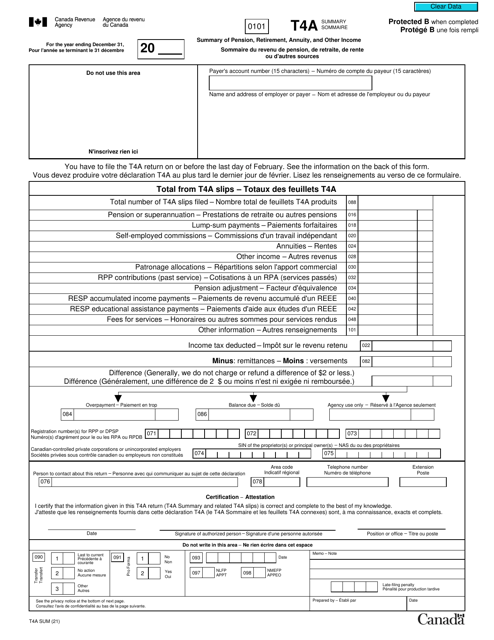

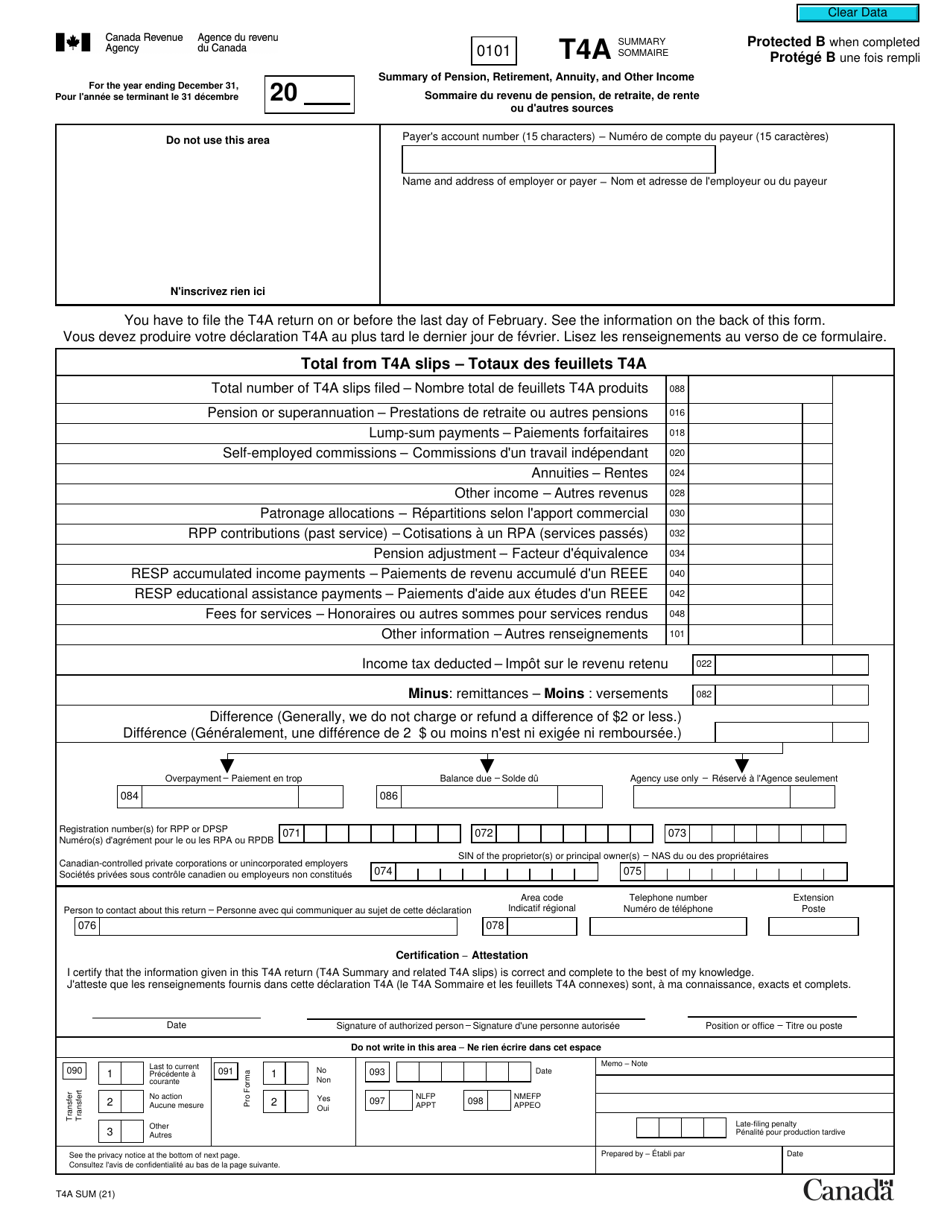

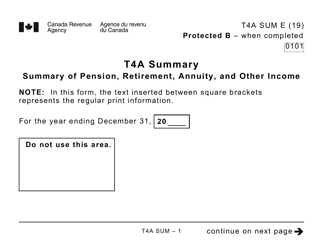

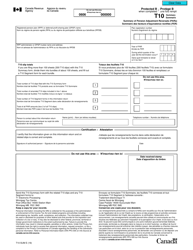

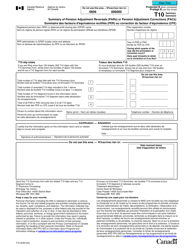

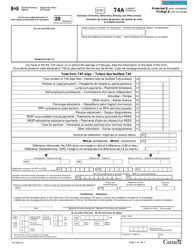

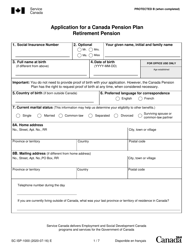

Form T4ASUM Summary of Pension, Retirement, Annuity, and Other Income - Canada (English / French)

Form T4ASUM is used in Canada to report the summary of pension, retirement, annuity, and other income. It provides a breakdown of income received from various sources, which is important for tax reporting purposes. The form is available in both English and French and helps individuals accurately report their income to the Canada Revenue Agency (CRA).

The individual or organization that pays the pension, retirement, annuity, or other income files the Form T4ASUM Summary in Canada.

Form T4ASUM Summary of Pension, Retirement, Annuity, and Other Income - Canada (English/French) - Frequently Asked Questions (FAQ)

Q: What is Form T4ASUM?

A: Form T4ASUM is a summary of income received from pensions, retirement plans, annuities, and other sources in Canada.

Q: Who needs to file Form T4ASUM?

A: Individuals who received income from pensions, retirement plans, annuities, or other sources in Canada may need to file Form T4ASUM.

Q: What information is required to complete Form T4ASUM?

A: You will need to provide your personal information, such as your name, address, and social insurance number, as well as details about your pension, retirement plan, annuity, or other sources of income.

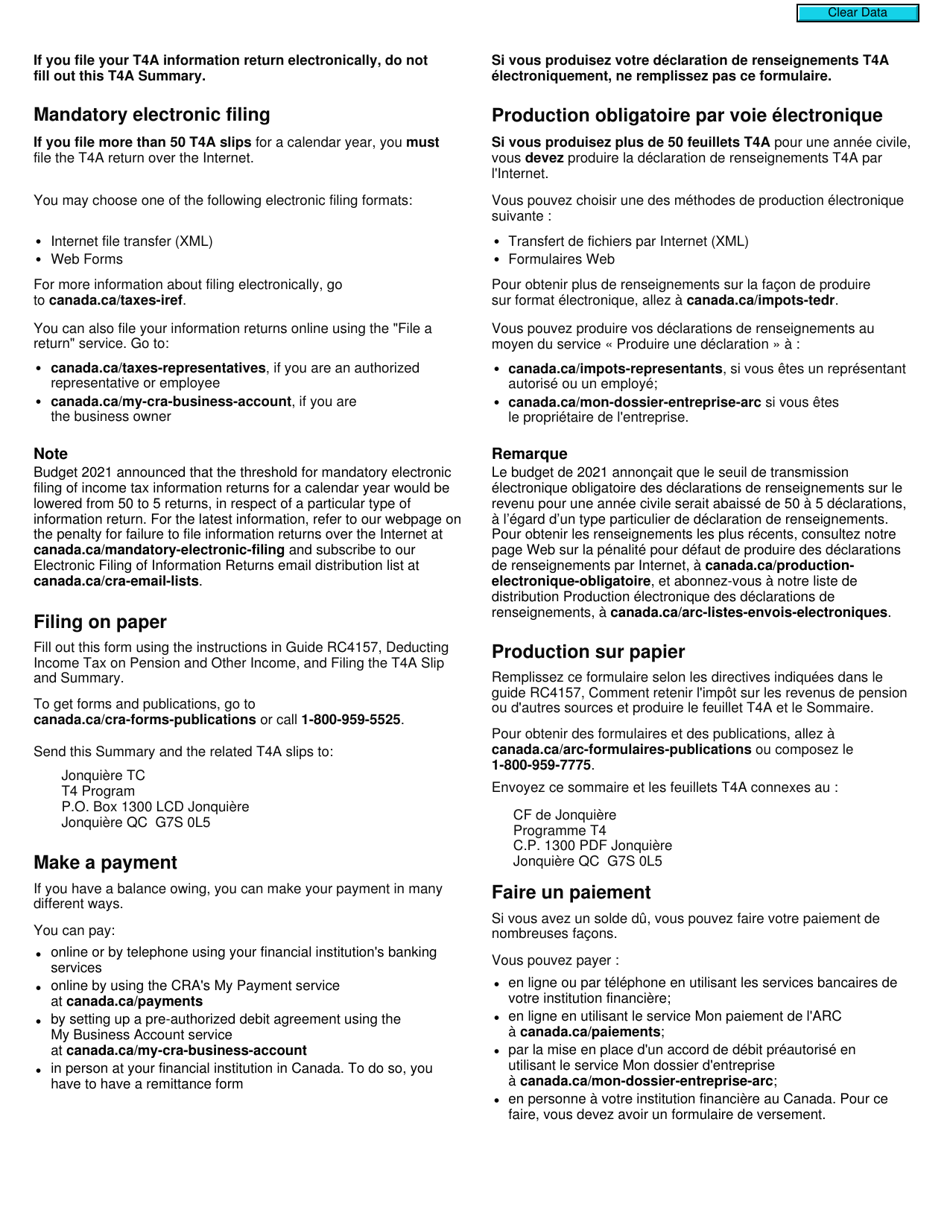

Q: When is the deadline for filing Form T4ASUM?

A: The deadline for filing Form T4ASUM is usually February 28th of the following year, or the next business day if it falls on a weekend or public holiday.

Q: Do I need to include copies of my income statements with Form T4ASUM?

A: No, you do not need to include copies of your income statements with Form T4ASUM. However, you should keep them for your records.

Q: What is the penalty for not filing Form T4ASUM on time?

A: If you do not file Form T4ASUM on time, you may be subject to penalties and interest charges.

Q: Can I amend my Form T4ASUM after filing?

A: Yes, if you need to make changes or corrections to your Form T4ASUM after filing, you can submit an amended return to the CRA.