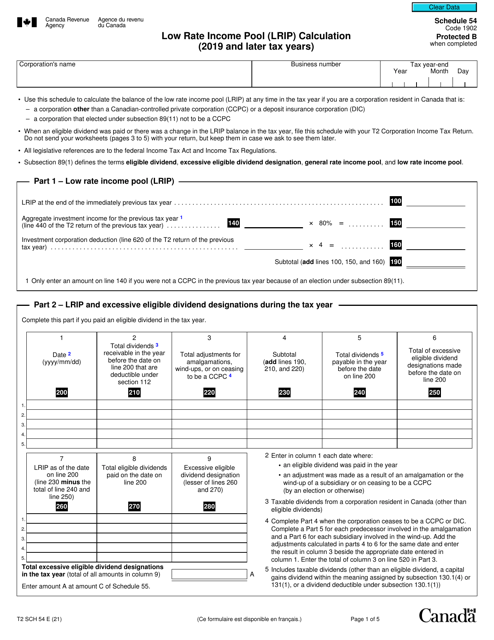

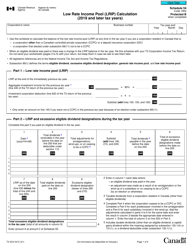

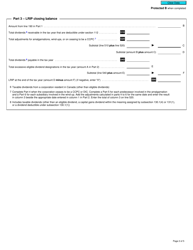

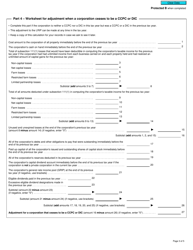

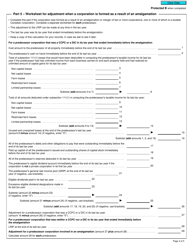

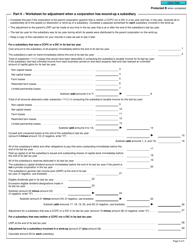

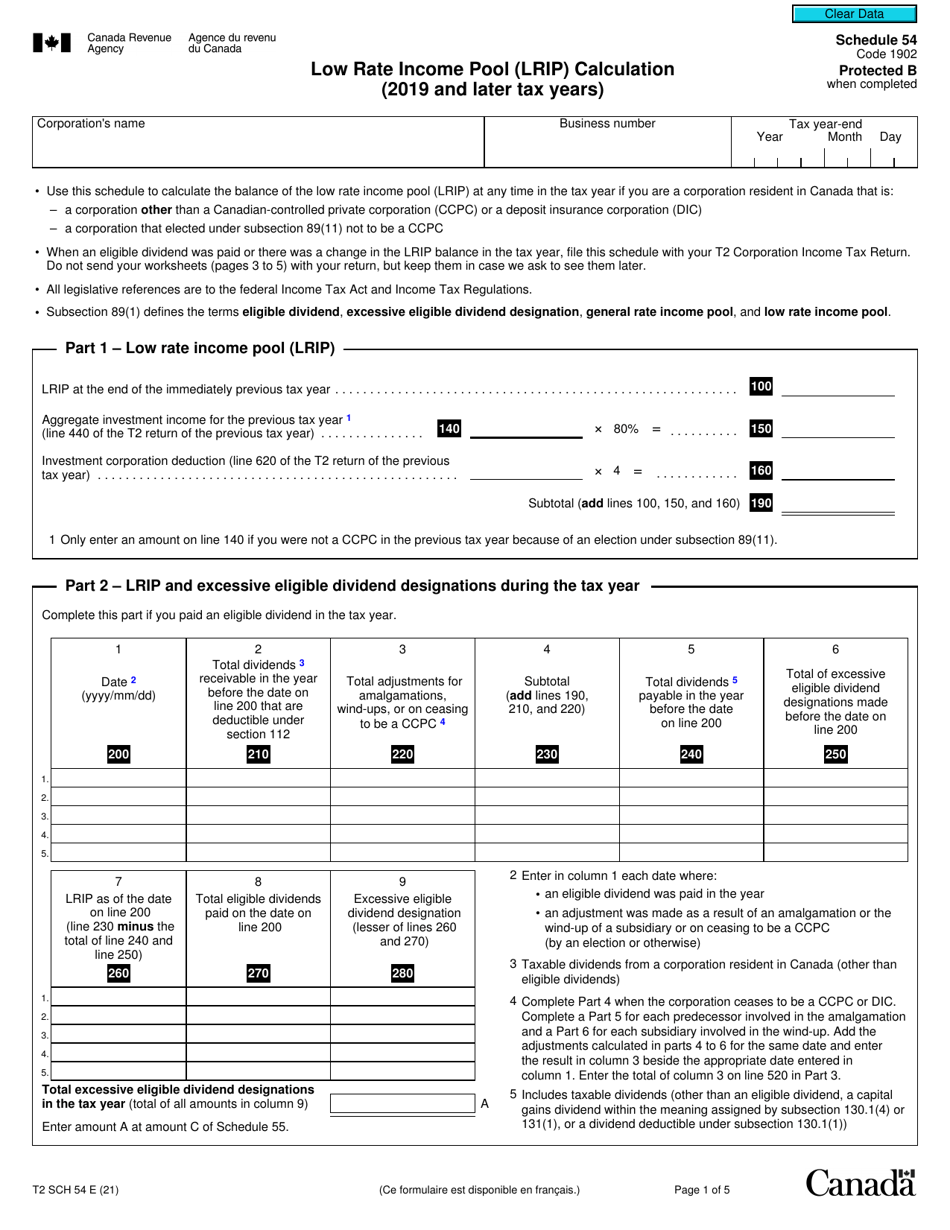

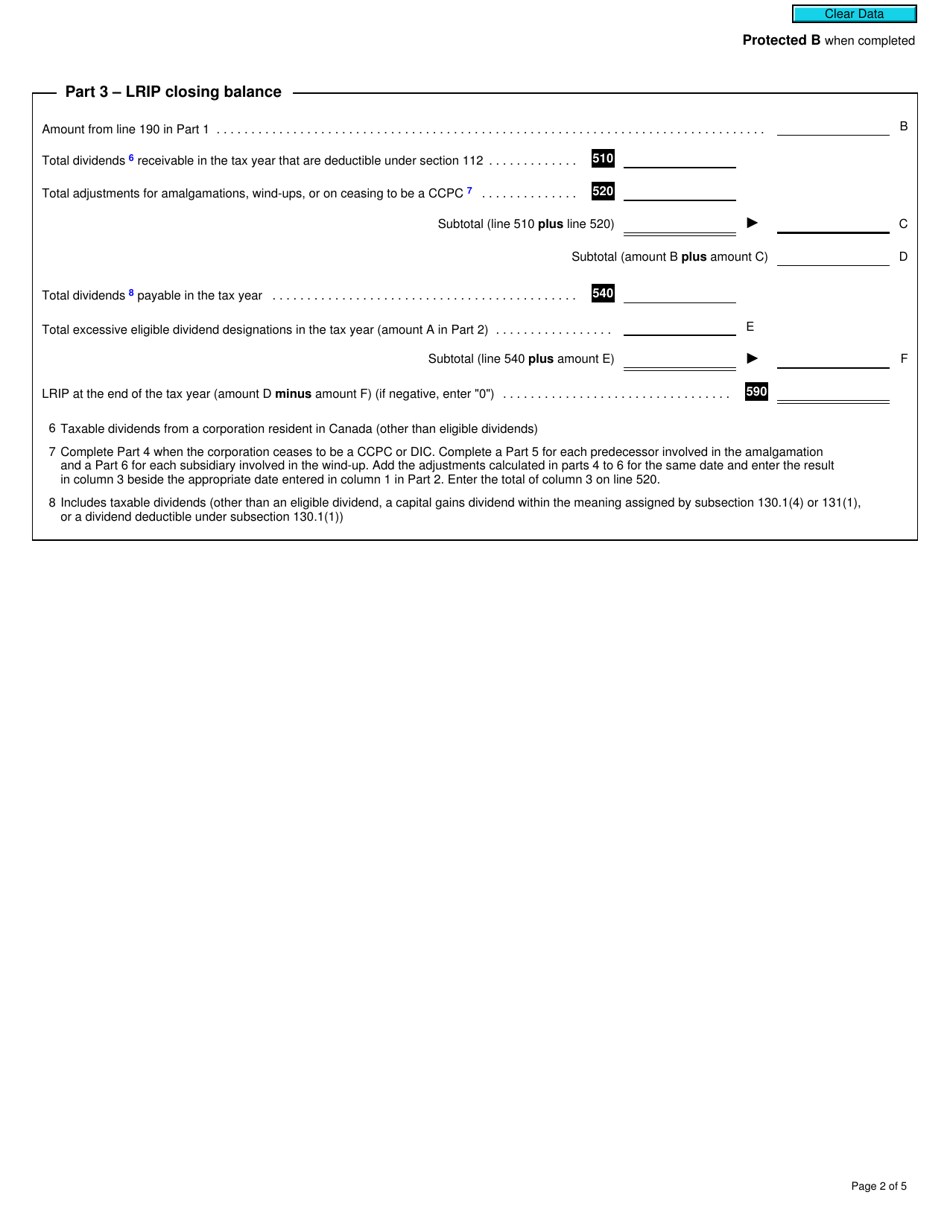

Form T2 Schedule 54 Low Rate Income Pool (Lrip) Calculation (2019 and Later Tax Years) - Canada

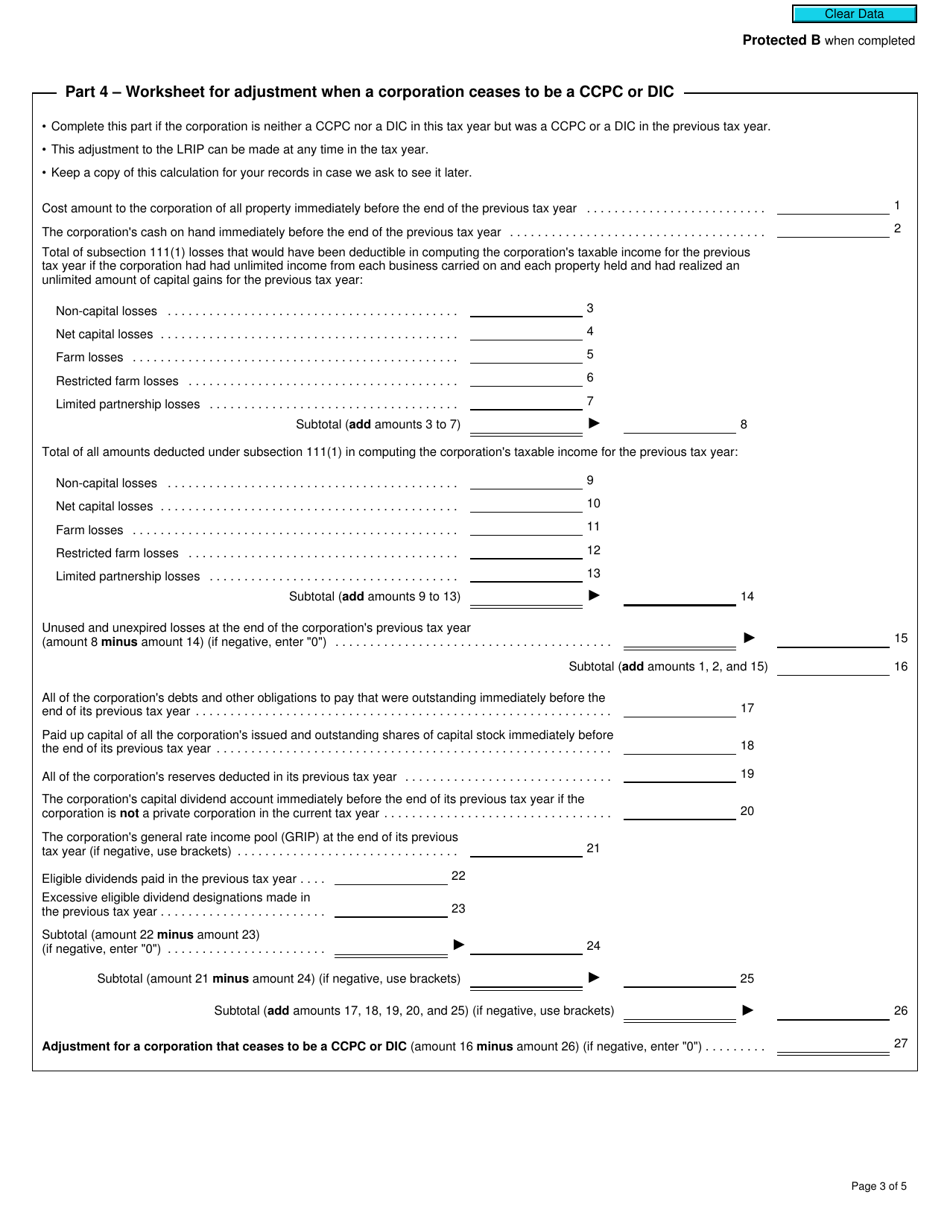

Form T2 Schedule 54 Low Rate Income Pool (LRIP) Calculation is used by Canadian corporations to calculate the amount of income eligible for the LRIP deduction. The LRIP deduction helps businesses defer taxes on certain income earned from active business and rental properties.

The corporation files the Form T2 Schedule 54 Low Rate Income Pool (LRIP) Calculation in Canada.

Form T2 Schedule 54 Low Rate Income Pool (Lrip) Calculation (2019 and Later Tax Years) - Canada - Frequently Asked Questions (FAQ)

Q: What is T2 Schedule 54?

A: T2 Schedule 54 is a form used in Canada for the calculation of the Low Rate Income Pool (LRIP).

Q: What is the Low Rate Income Pool (LRIP)?

A: The Low Rate Income Pool (LRIP) is a tax provision in Canada that allows businesses to defer taxes on a portion of their income.

Q: What is the purpose of T2 Schedule 54?

A: The purpose of T2 Schedule 54 is to calculate the amount that can be added to a company's LRIP, which will result in a lower tax liability.

Q: When should T2 Schedule 54 be filed?

A: T2 Schedule 54 should be filed along with the company's income tax return for the tax year in question.

Q: What tax years does T2 Schedule 54 apply to?

A: T2 Schedule 54 applies to tax years starting in 2019 and later in Canada.