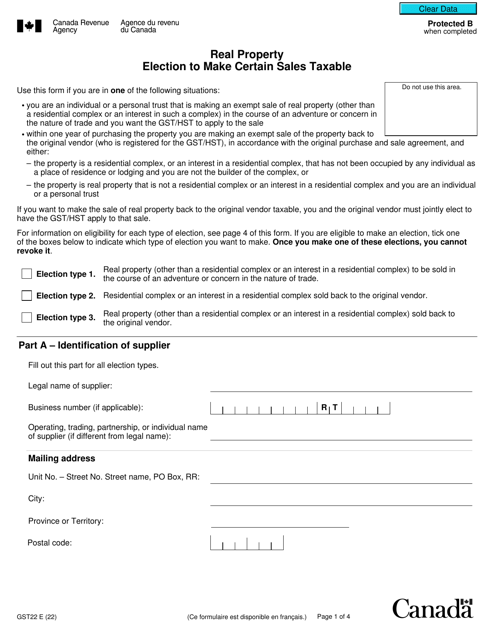

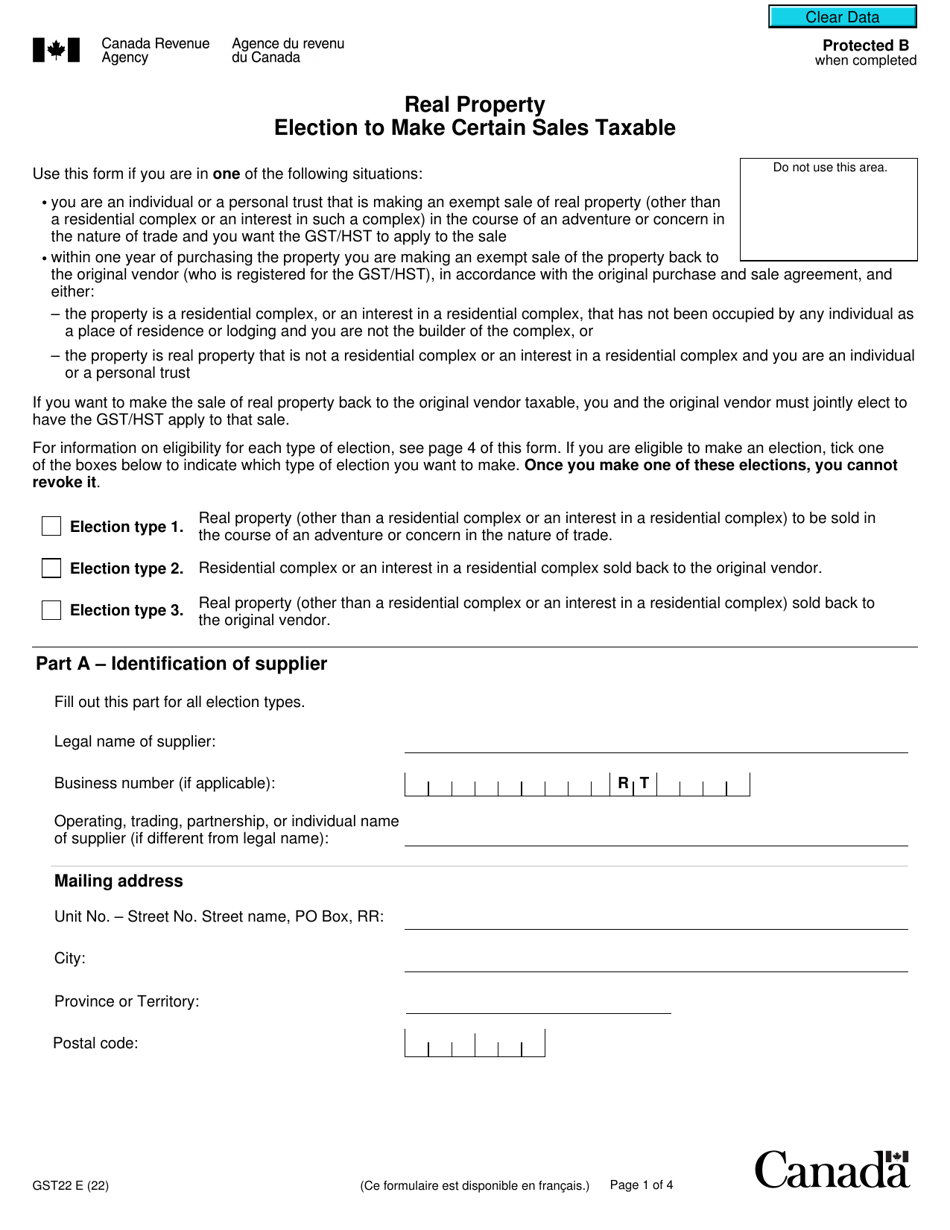

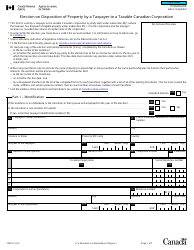

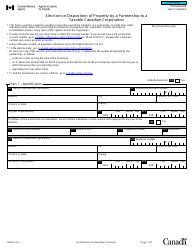

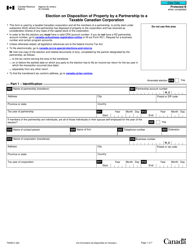

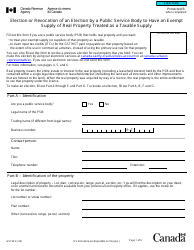

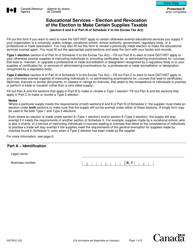

Form GST22 Real Property Election to Make Certain Sales Taxable - Canada

Form GST22 Real Property Election to Make Certain Sales Taxable in Canada is used by suppliers to elect to make certain sales of real property taxable. This form allows suppliers to voluntarily charge and collect the Goods and Services Tax (GST) on the sale of specific types of real property. It is used to notify the Canada Revenue Agency (CRA) of the election and provides details of the real property being sold.

The Form GST22 Real Property Election to Make Certain Sales Taxable in Canada can be filed by the seller or lessor of the real property.

Form GST22 Real Property Election to Make Certain Sales Taxable - Canada - Frequently Asked Questions (FAQ)

Q: What is the GST22 form?

A: The GST22 form is the Real Property Election form in Canada.

Q: What is the purpose of the GST22 form?

A: The purpose of the GST22 form is to make certain sales of real property taxable for Goods and Services Tax (GST) purposes in Canada.

Q: Who should use the GST22 form?

A: Anyone selling real property in Canada and wishing to make the sale taxable for GST purposes should use the GST22 form.

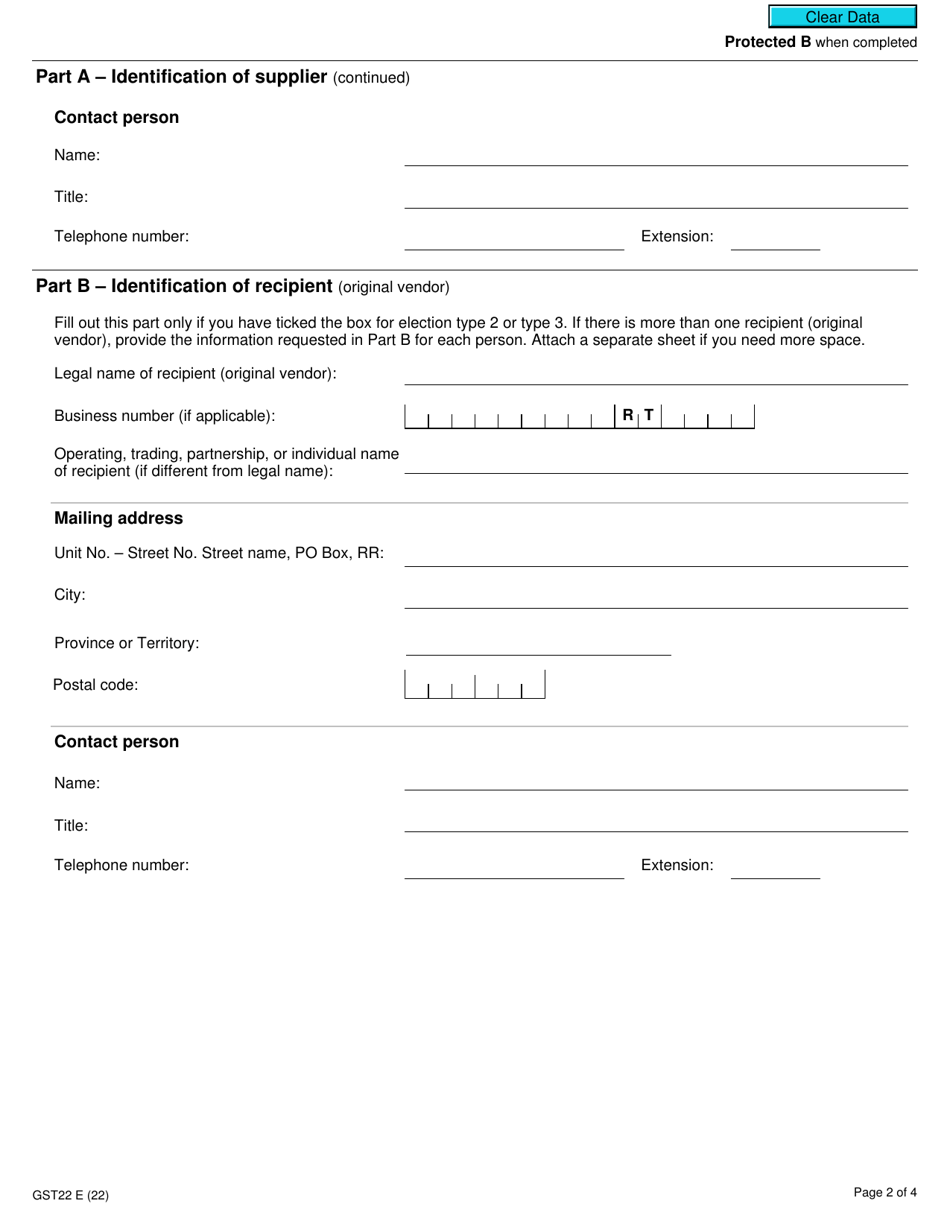

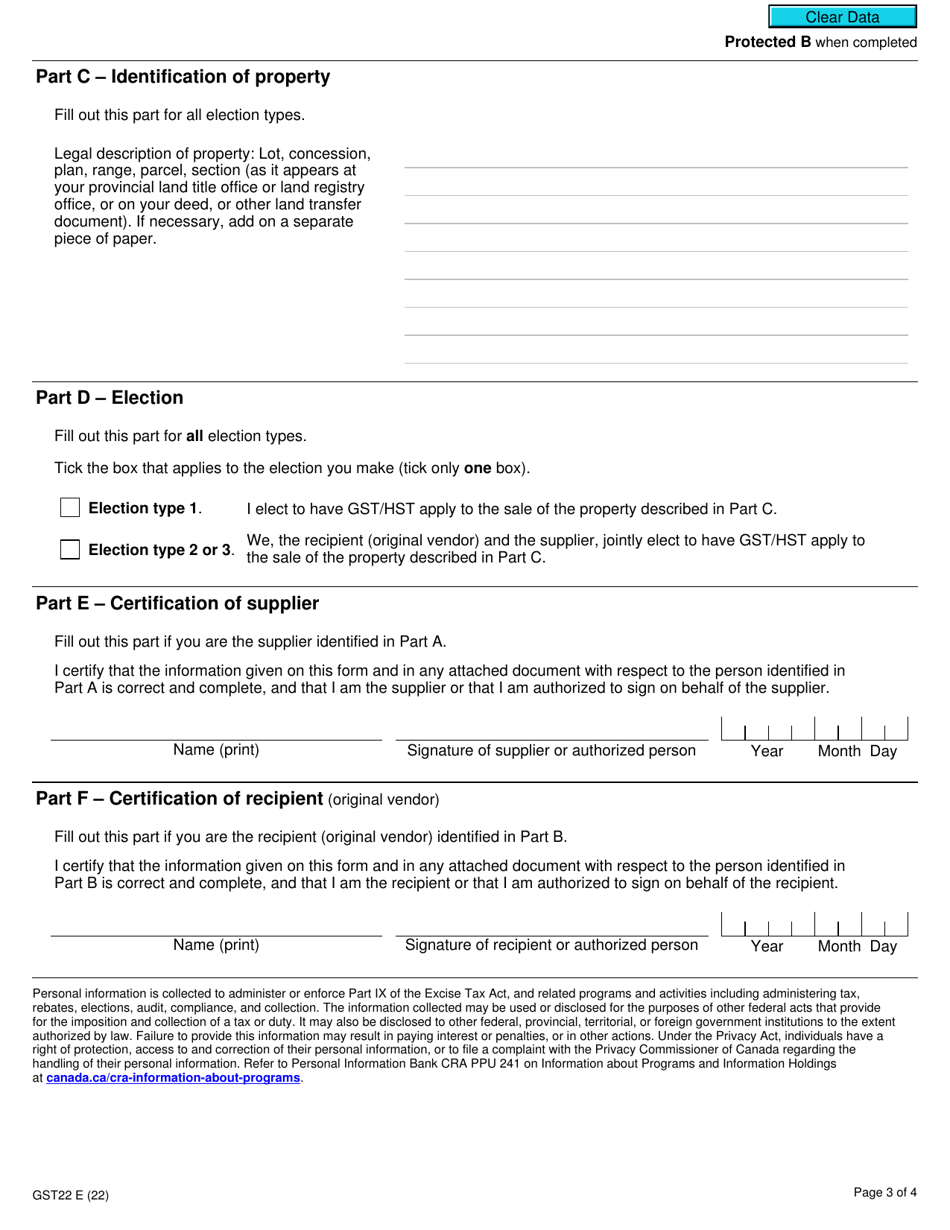

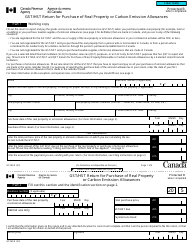

Q: What information is required on the GST22 form?

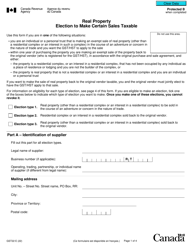

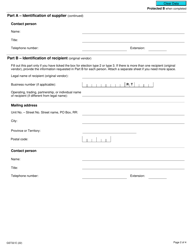

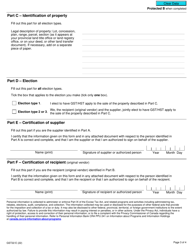

A: The GST22 form requires information about the seller, the property being sold, and details of the election being made.

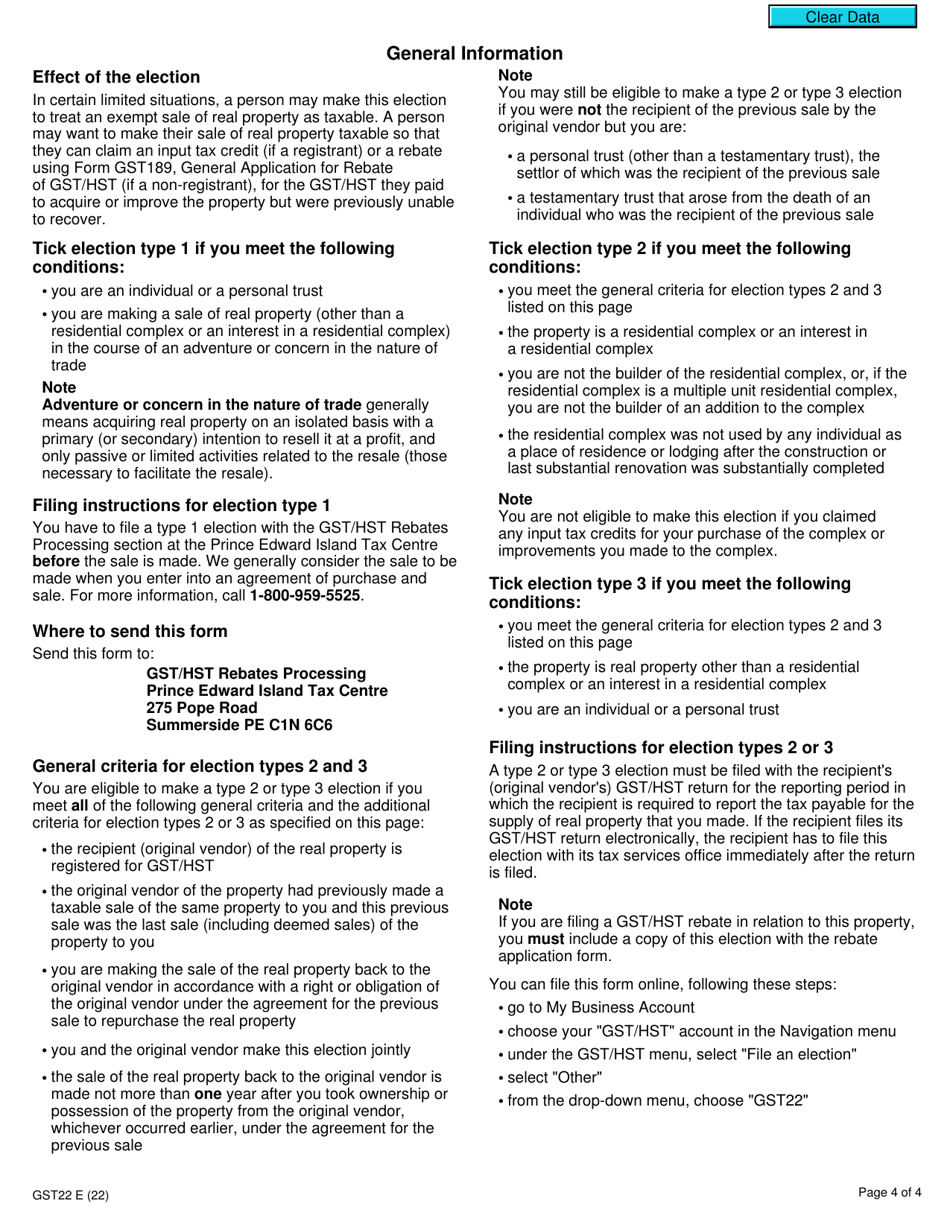

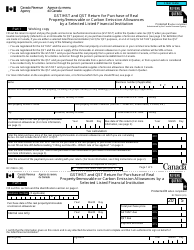

Q: Is there a deadline for filing the GST22 form?

A: Yes, the GST22 form must be filed within 90 days after the date of the first supply of the real property.

Q: What happens after I file the GST22 form?

A: After filing the GST22 form, the sale of the real property will be considered taxable for GST purposes.

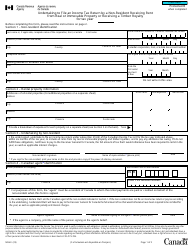

Q: Are there any exceptions or limitations to using the GST22 form?

A: Yes, there are certain exceptions and limitations outlined in the instructions provided with the GST22 form.

Q: Can the GST22 form be revoked or amended?

A: Yes, the GST22 form can be revoked or amended under certain circumstances.