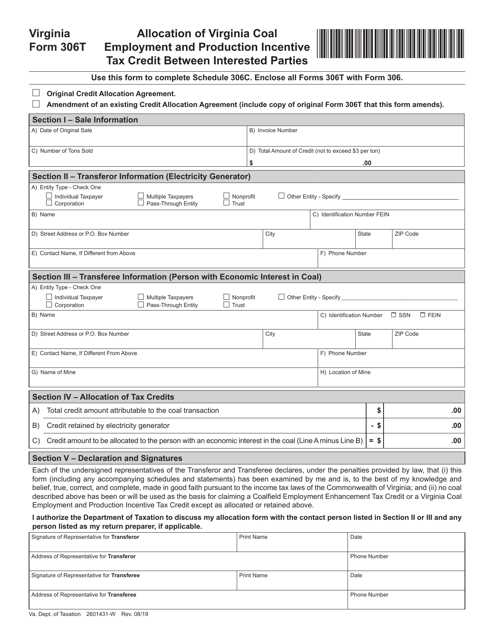

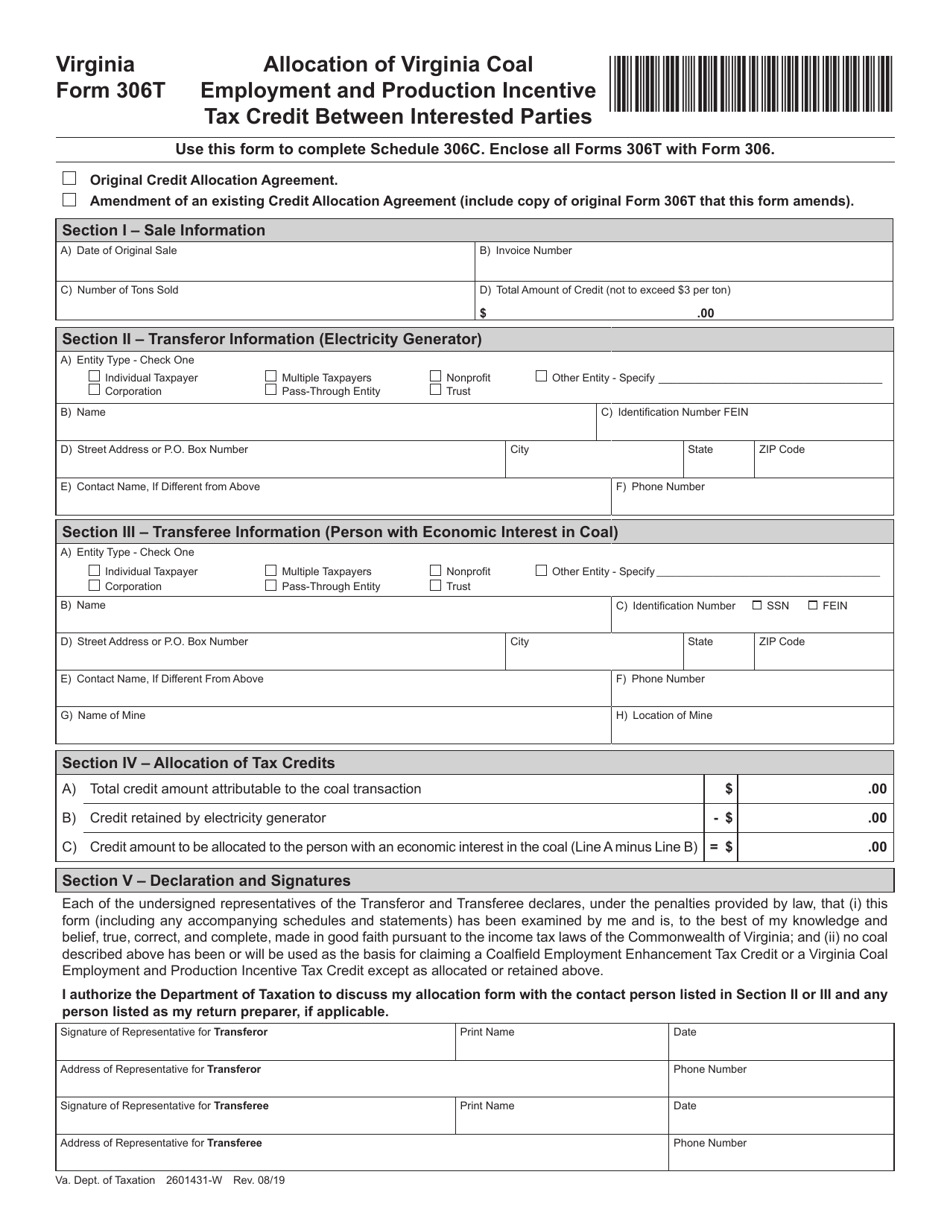

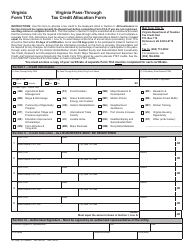

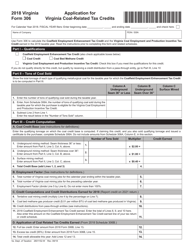

Form 306T Allocation of Virginia Coal Employment and Production Incentive Tax Credit Between Interested Parties - Virginia

Fill PDF Online

Fill out online for free

without registration or credit card

What Is Form 306T?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 306T by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.