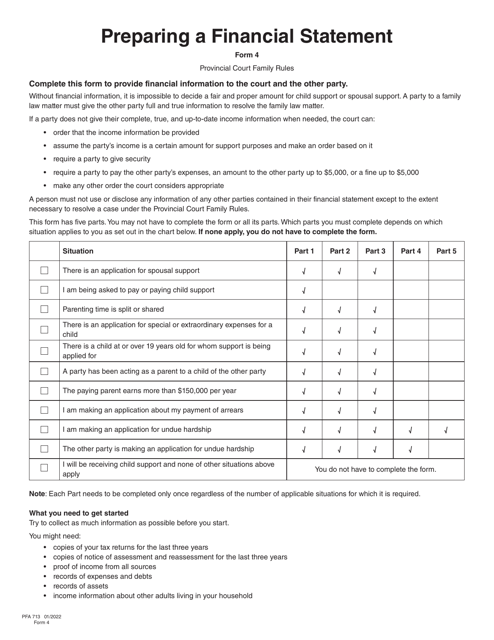

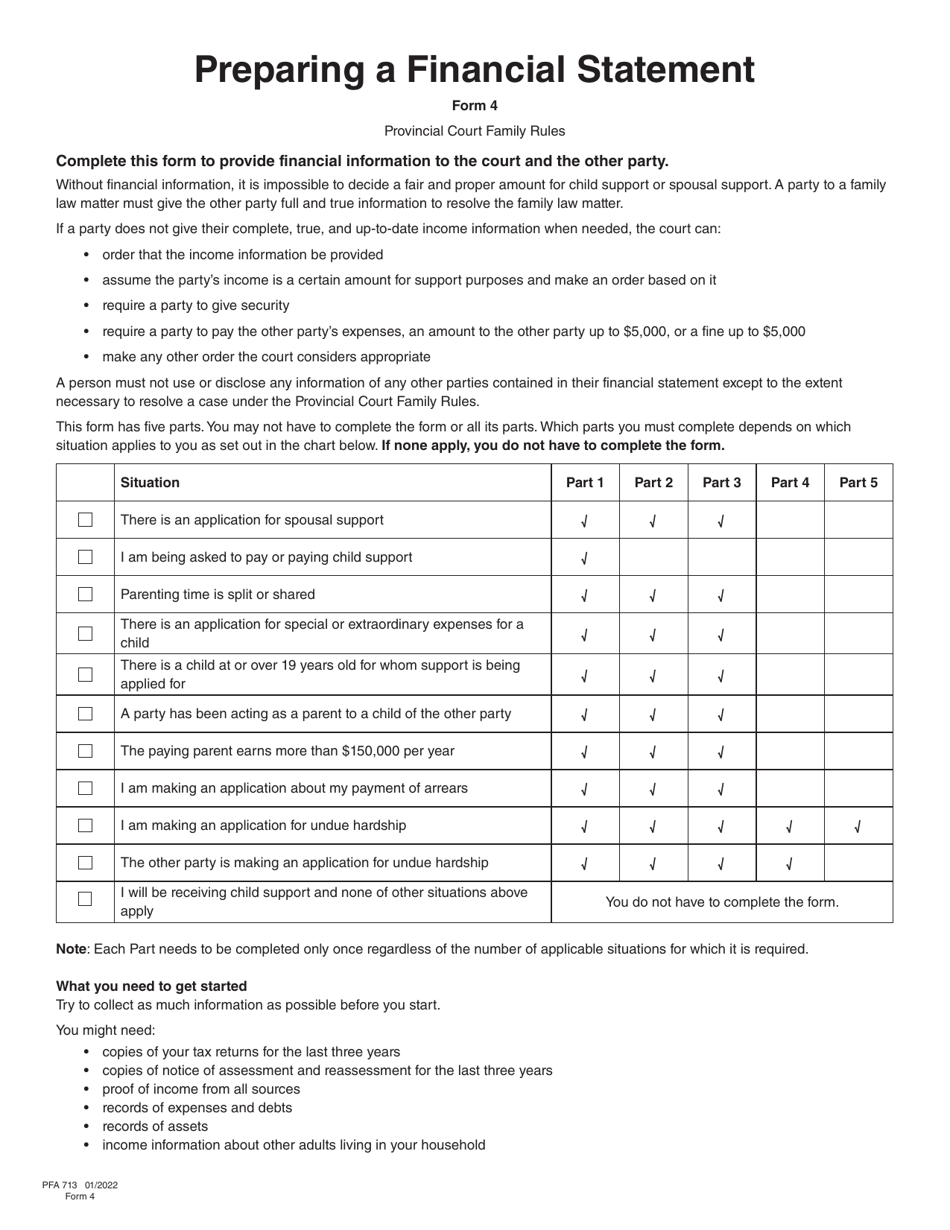

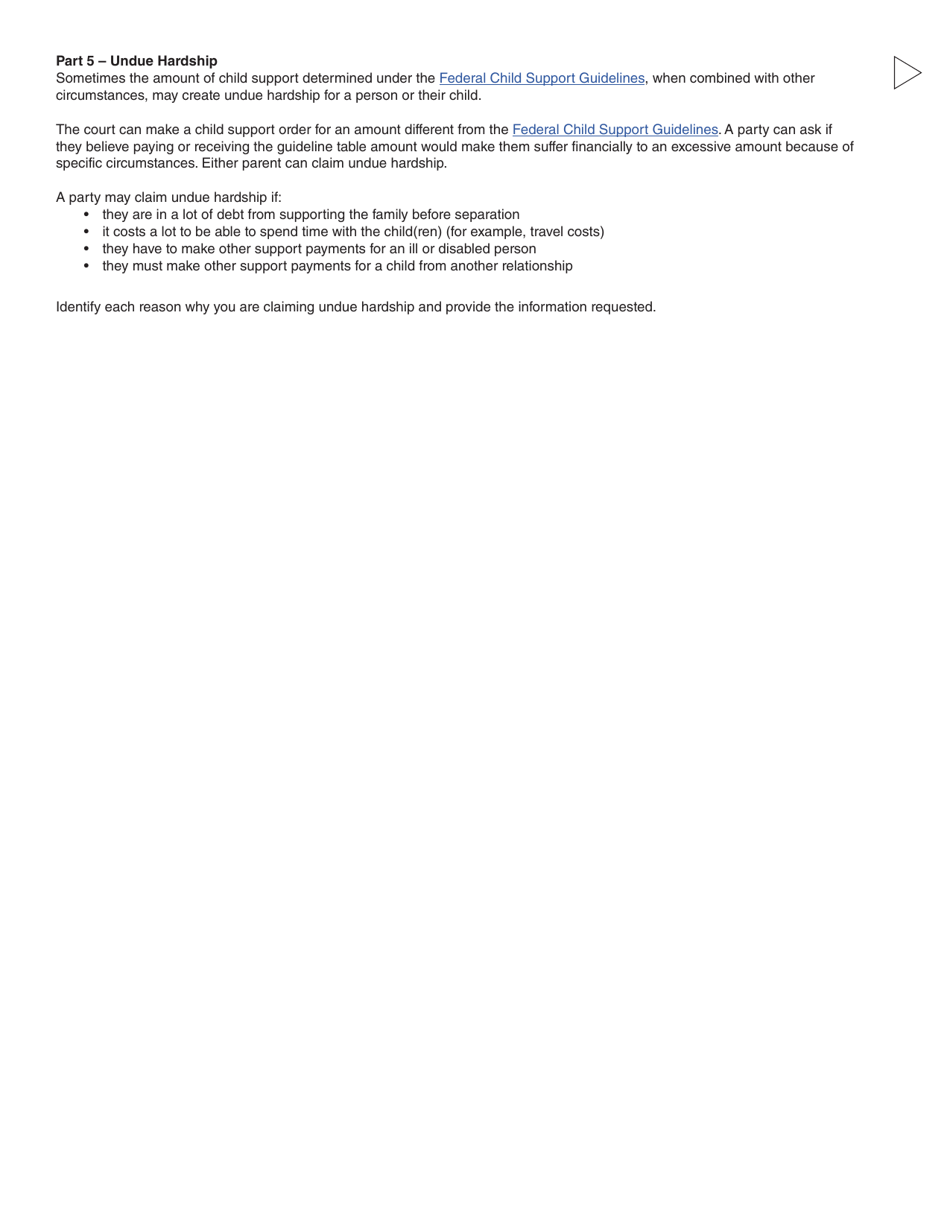

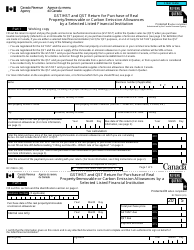

Form 4 (PFA713) Financial Statement - British Columbia, Canada

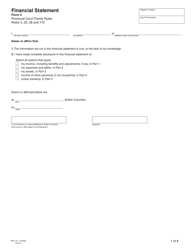

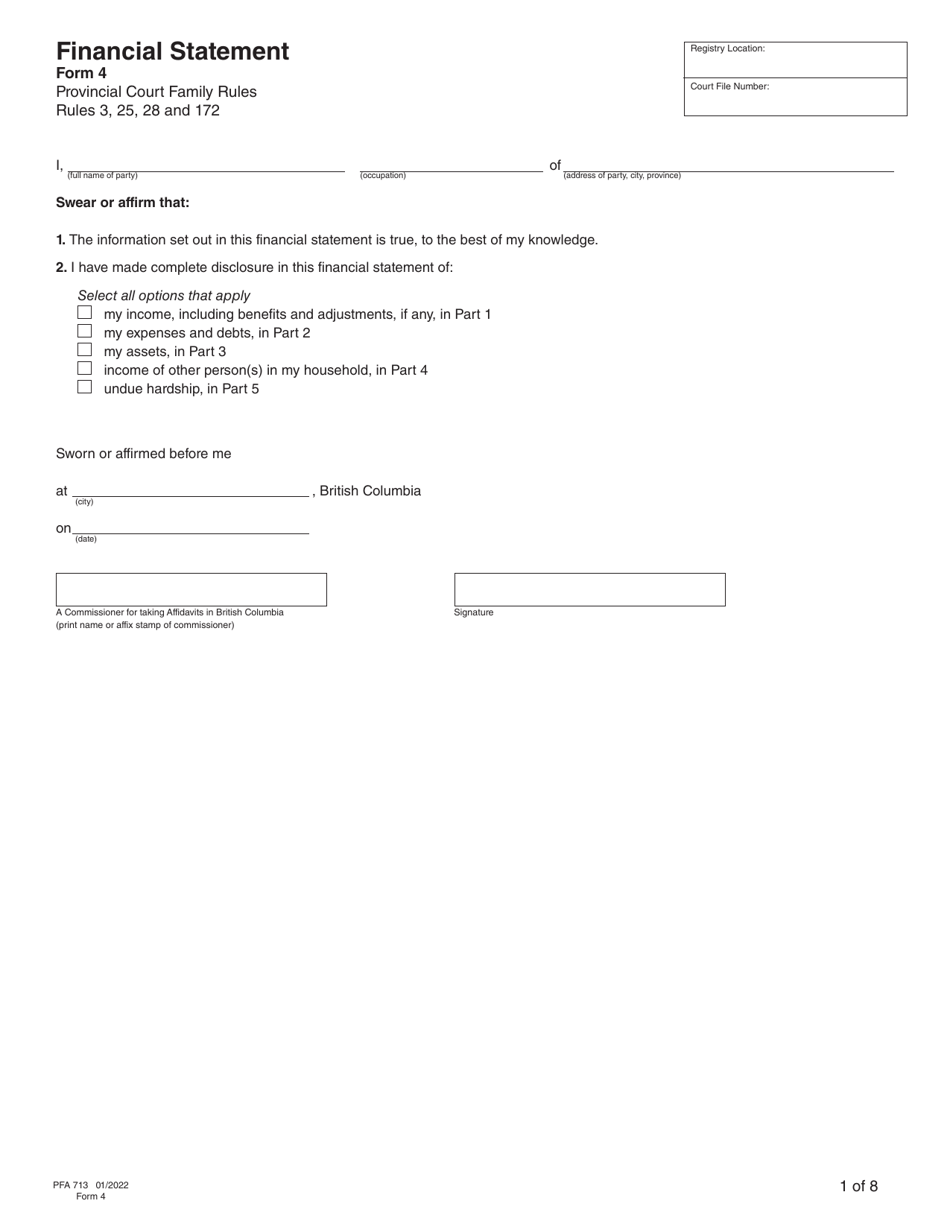

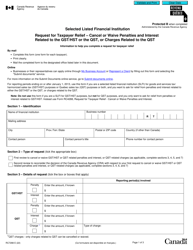

Form 4 (PFA713) Financial Statement in British Columbia, Canada is used for disclosing financial information during a legal proceeding, such as a divorce or separation. It helps to assess the individual's financial situation and determine support payments, property division, and other related matters.

The Form 4 (PFA713) Financial Statement in British Columbia, Canada is typically filed by individuals who are involved in a legal proceeding, such as a divorce or separation. This form is used to disclose financial information to the court.

Form 4 (PFA713) Financial Statement - British Columbia, Canada - Frequently Asked Questions (FAQ)

Q: What is a Form 4 (PFA713) Financial Statement?

A: Form 4 (PFA713) Financial Statement is a document used in British Columbia, Canada to disclose financial information.

Q: Who needs to file a Form 4 (PFA713) Financial Statement?

A: Individuals who are involved in family law proceedings in British Columbia, Canada may be required to file a Form 4 (PFA713) Financial Statement.

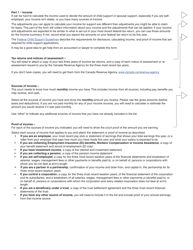

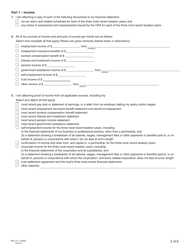

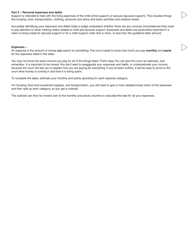

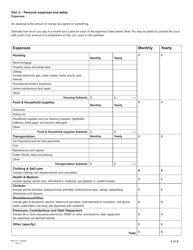

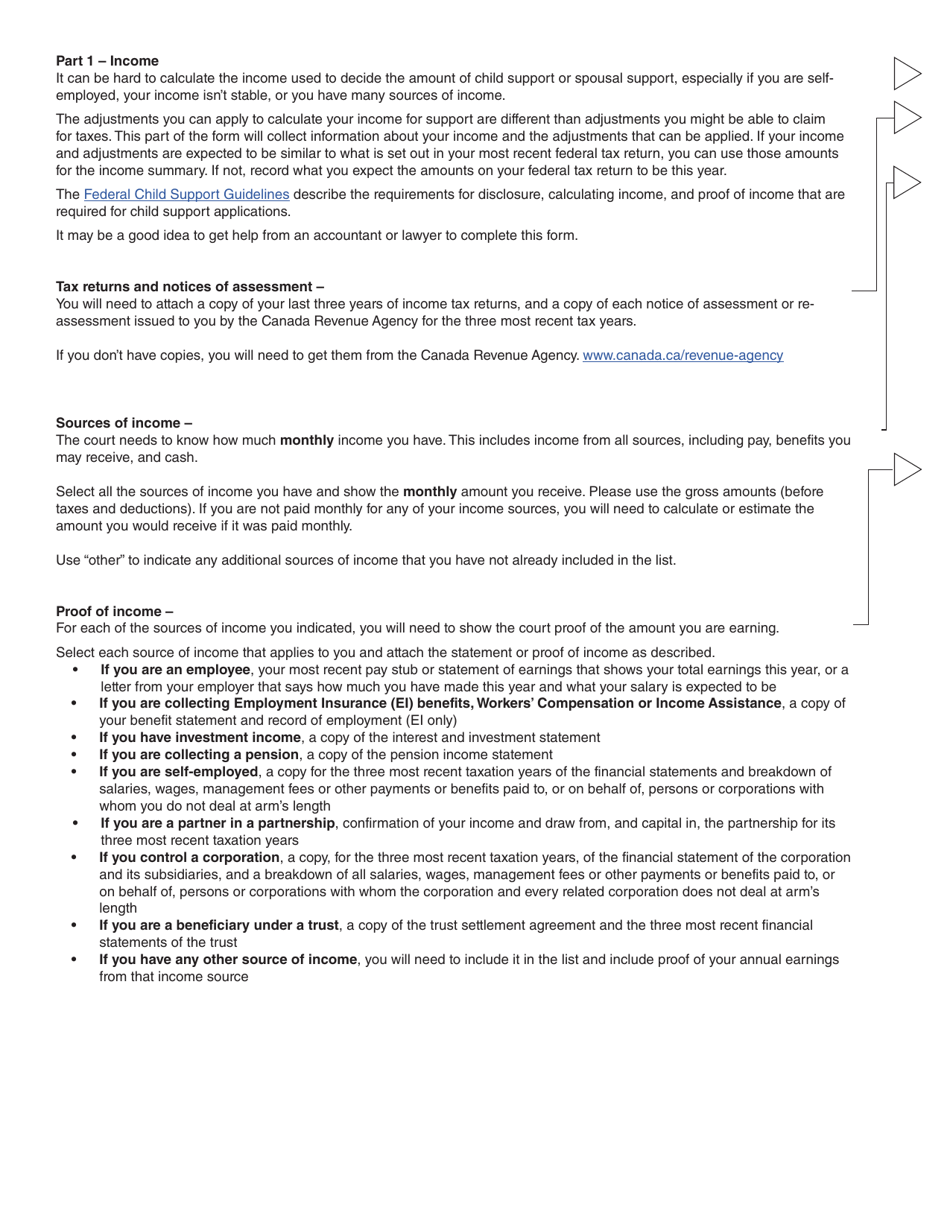

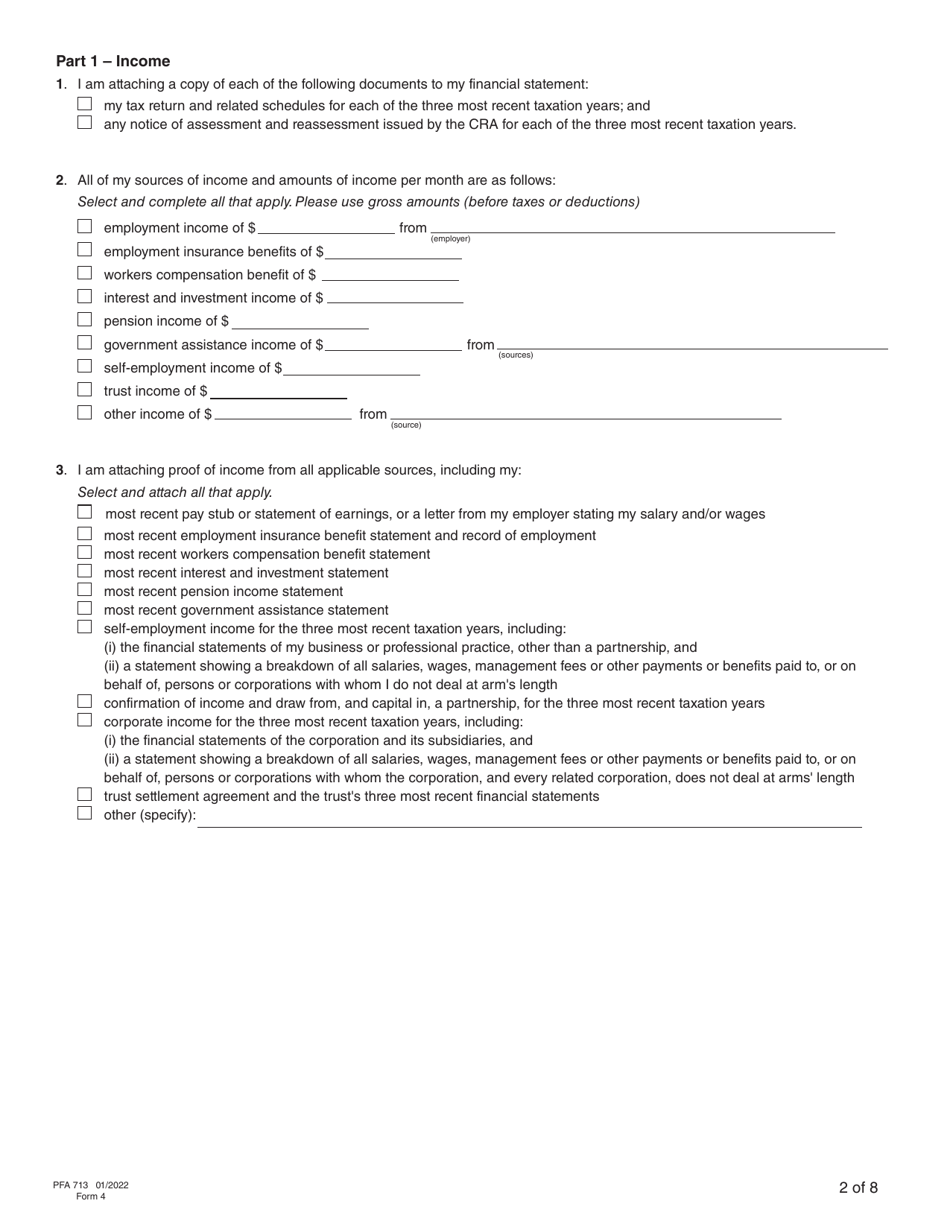

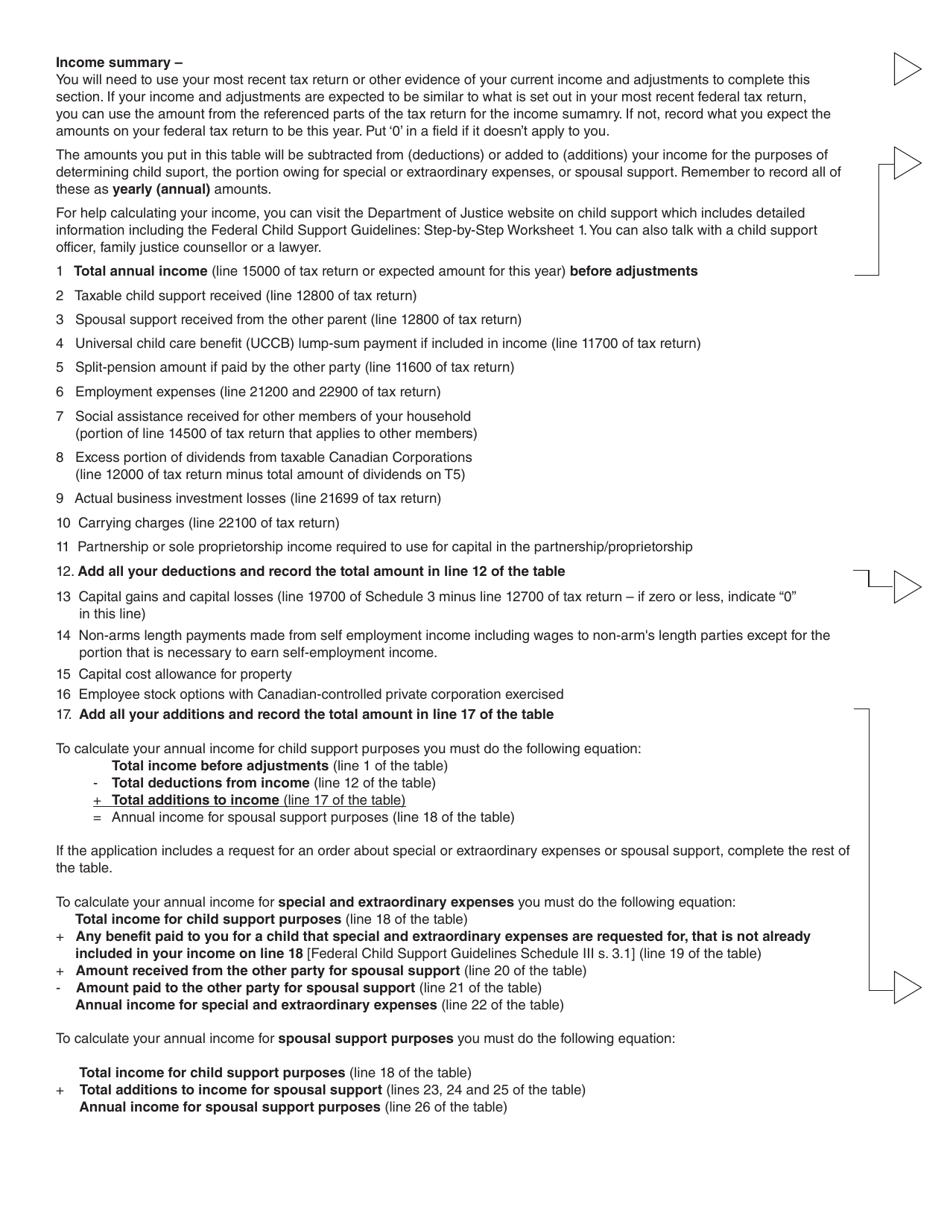

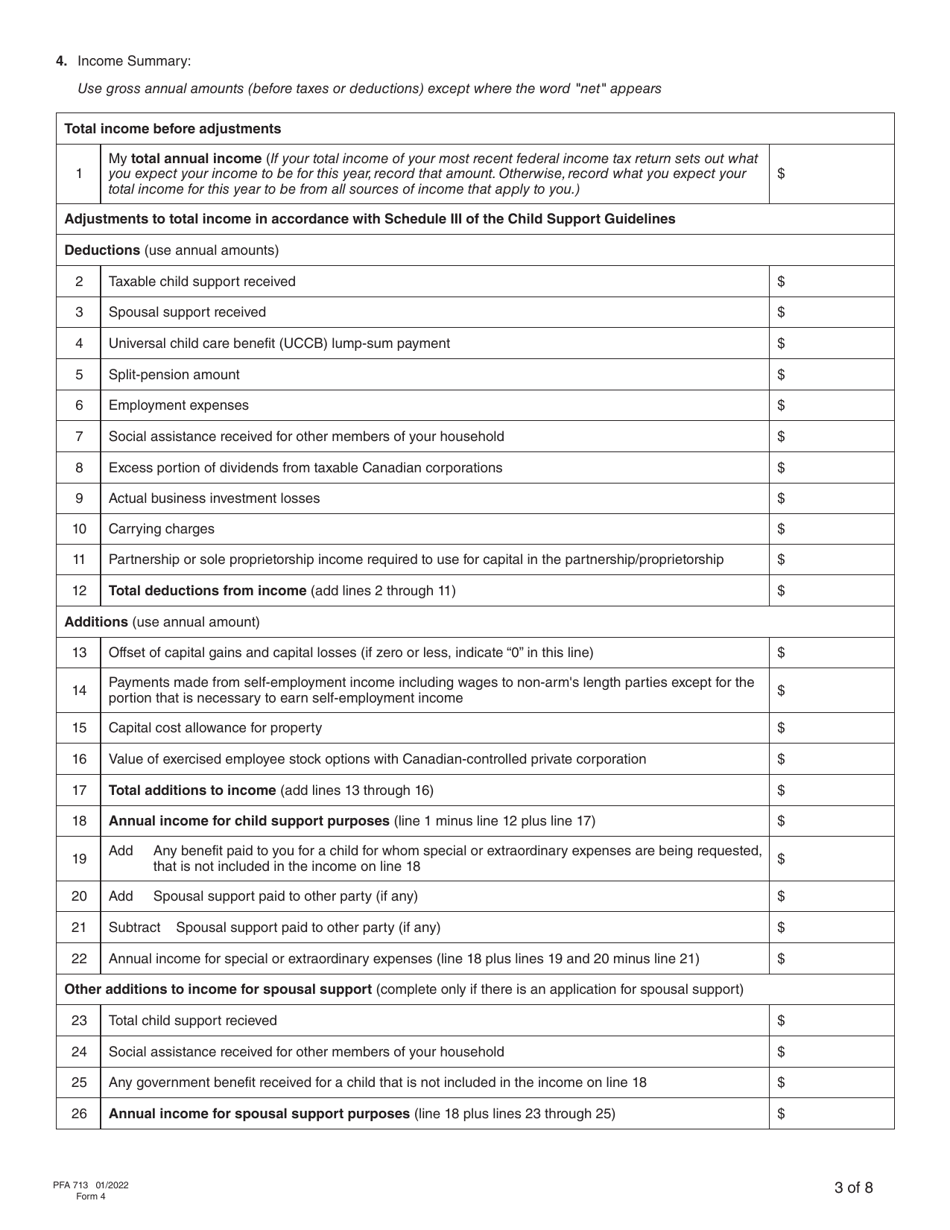

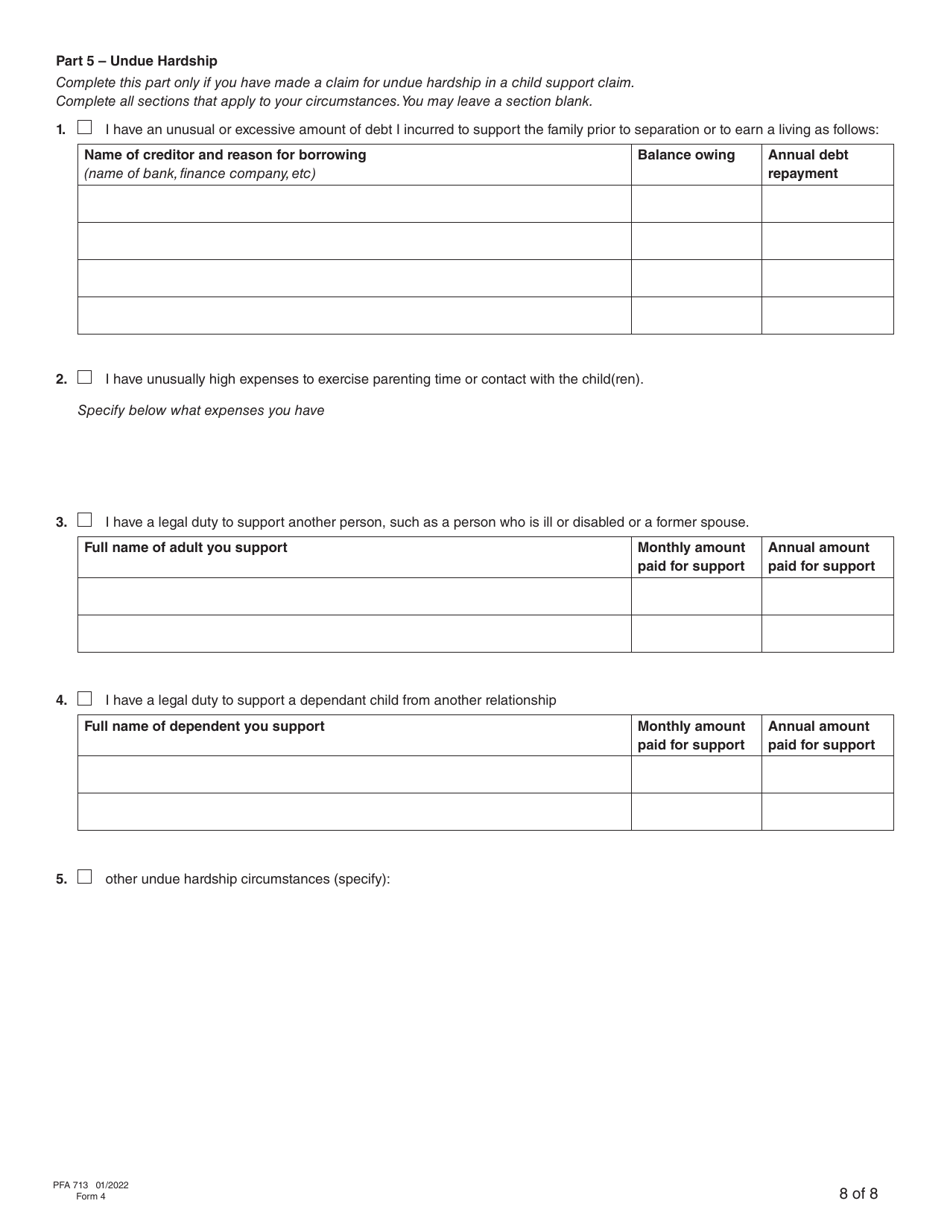

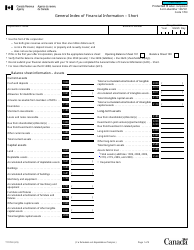

Q: What information is required in a Form 4 (PFA713) Financial Statement?

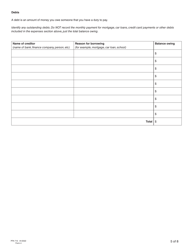

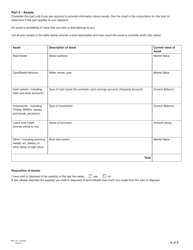

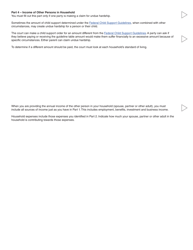

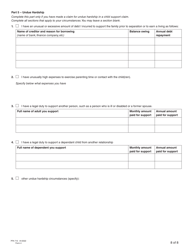

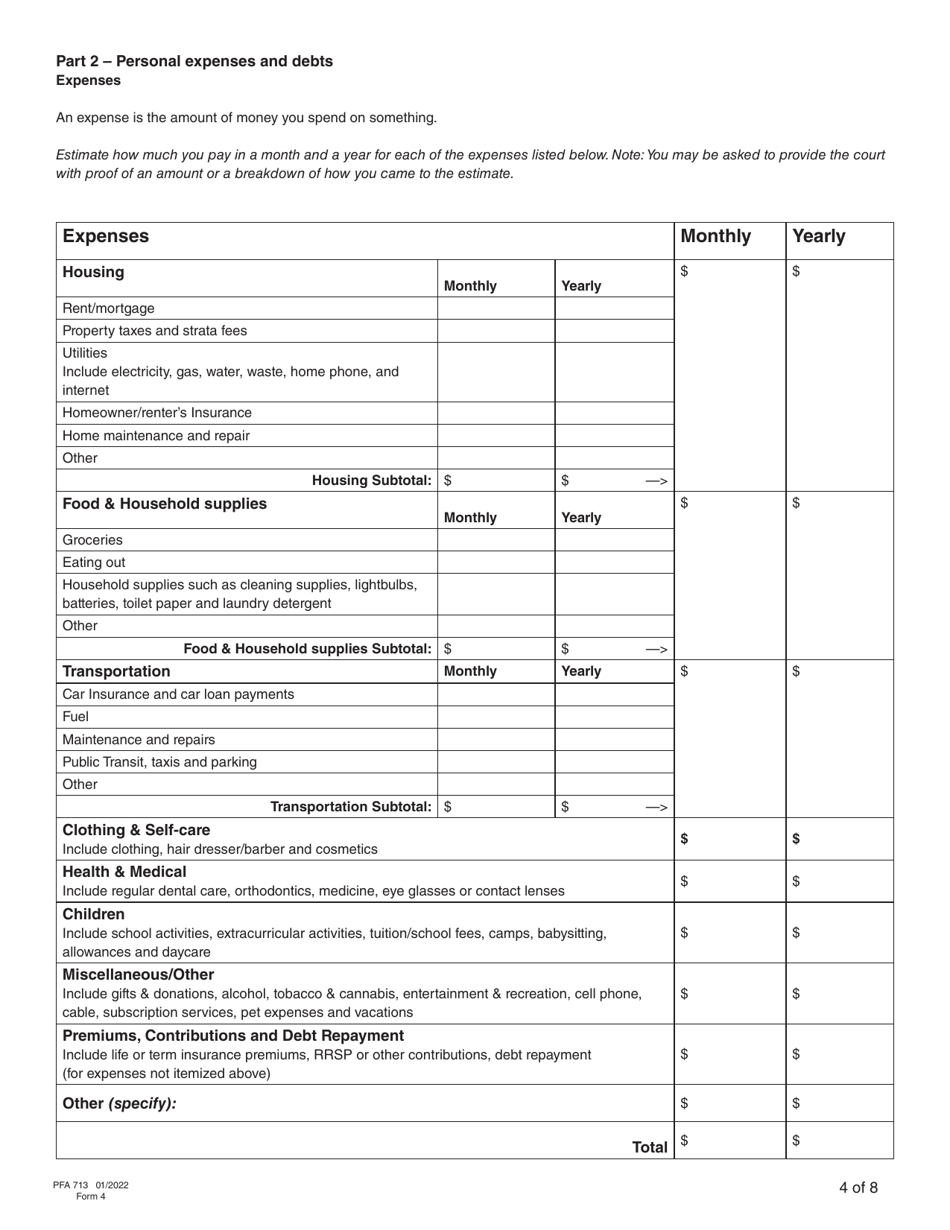

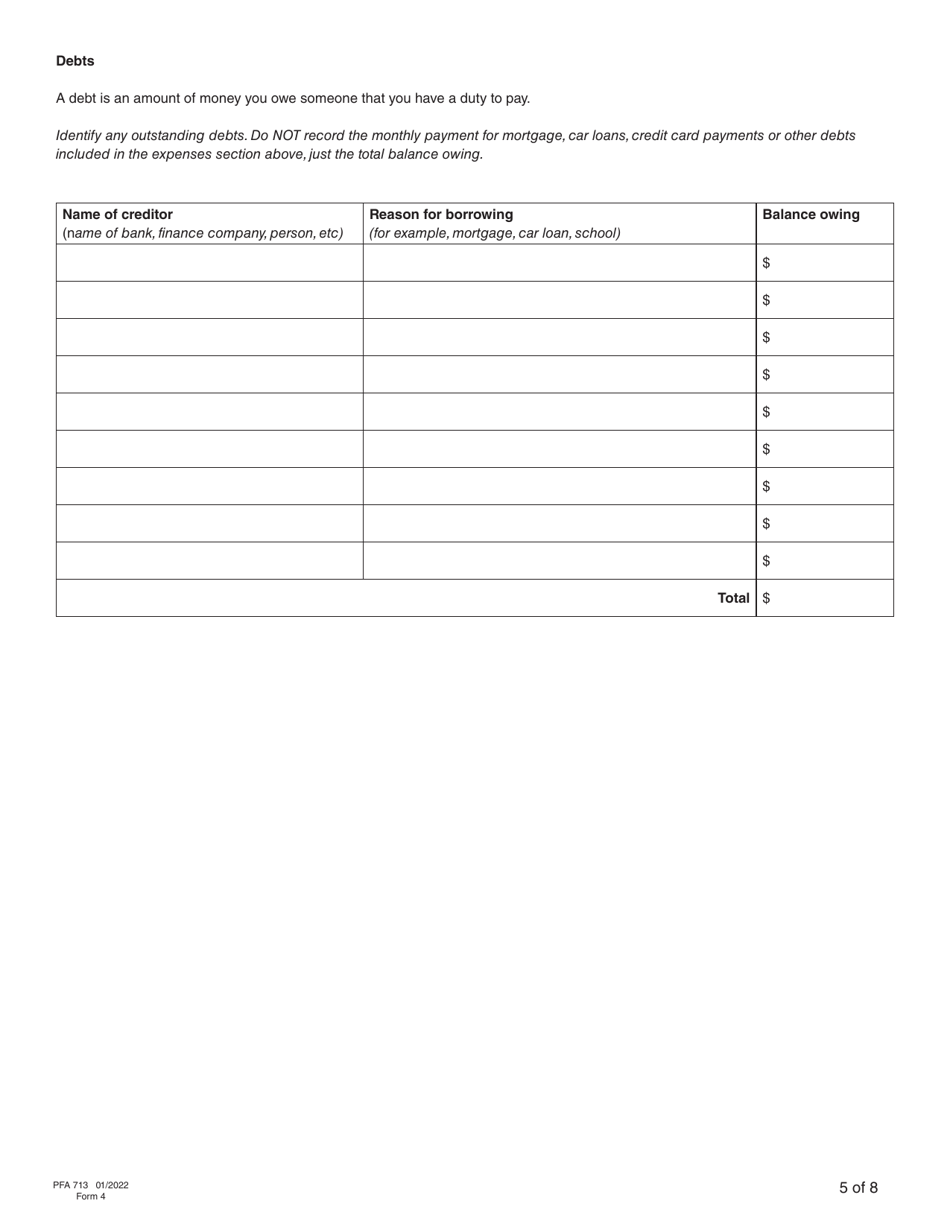

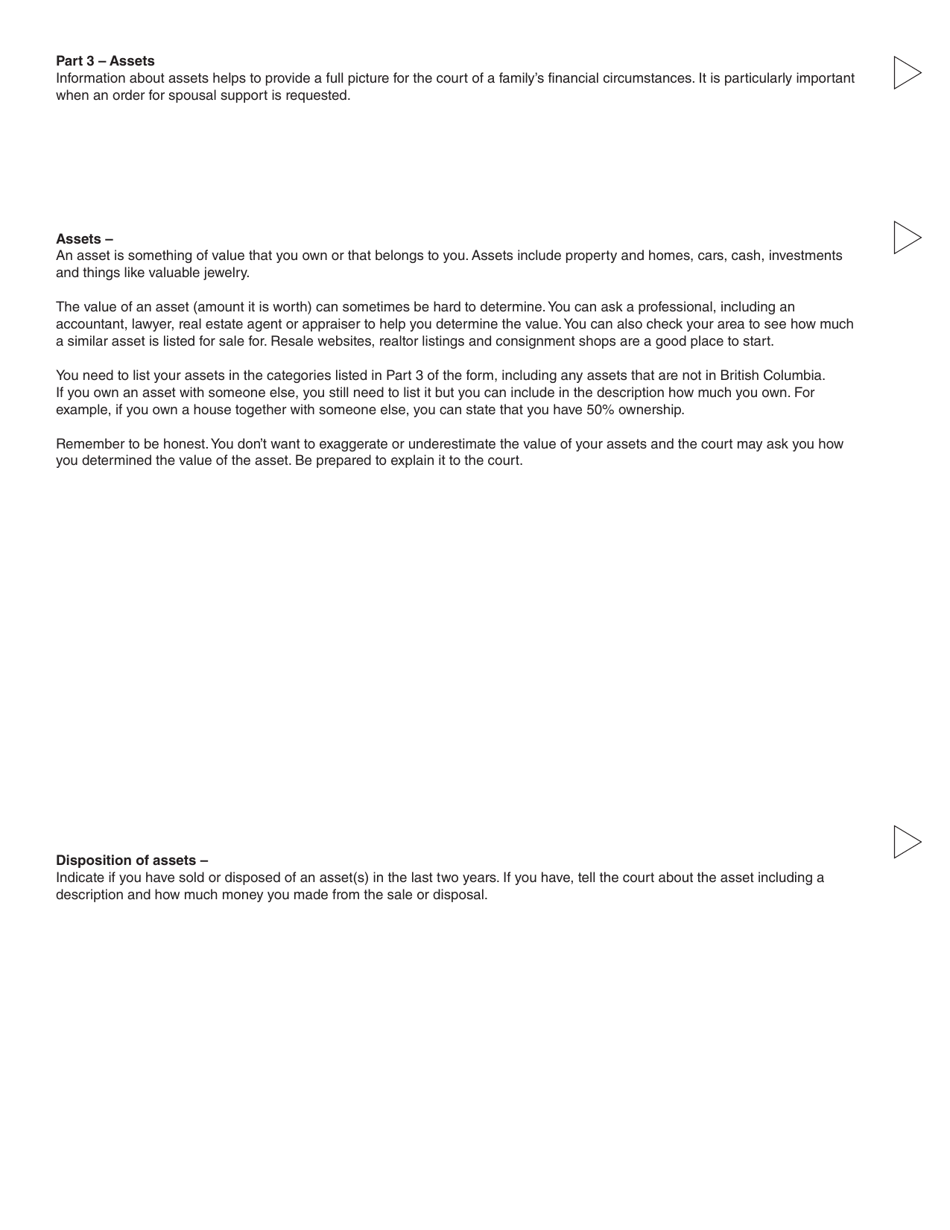

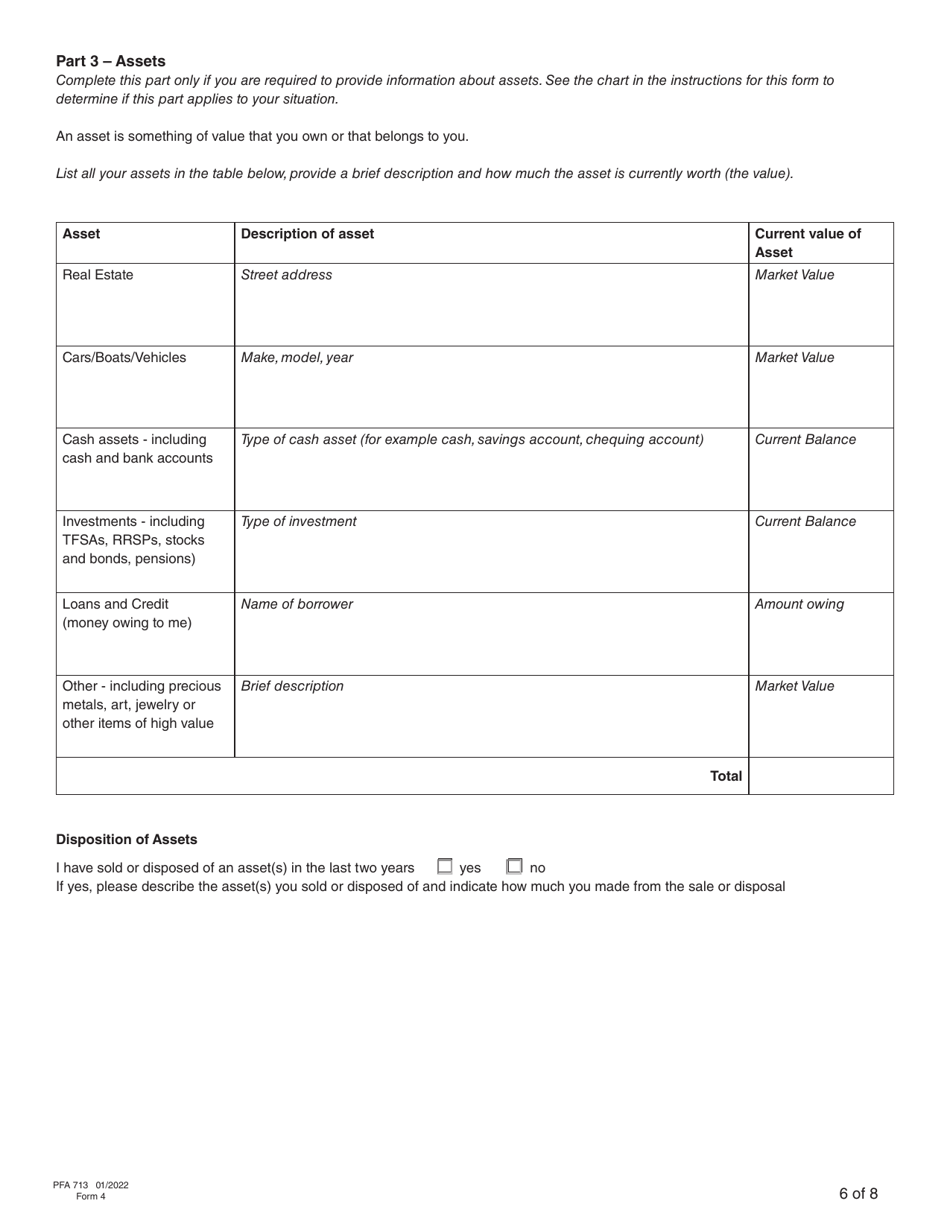

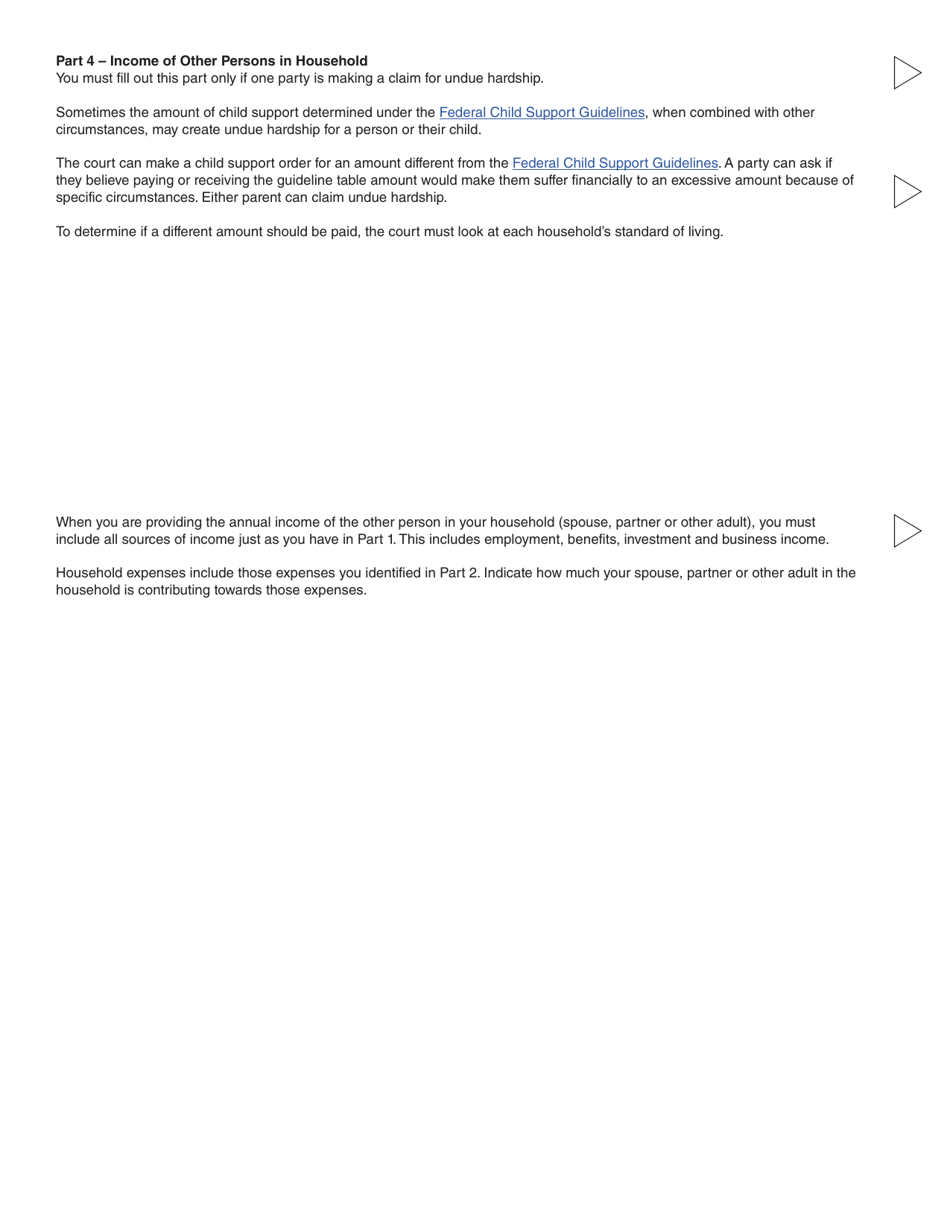

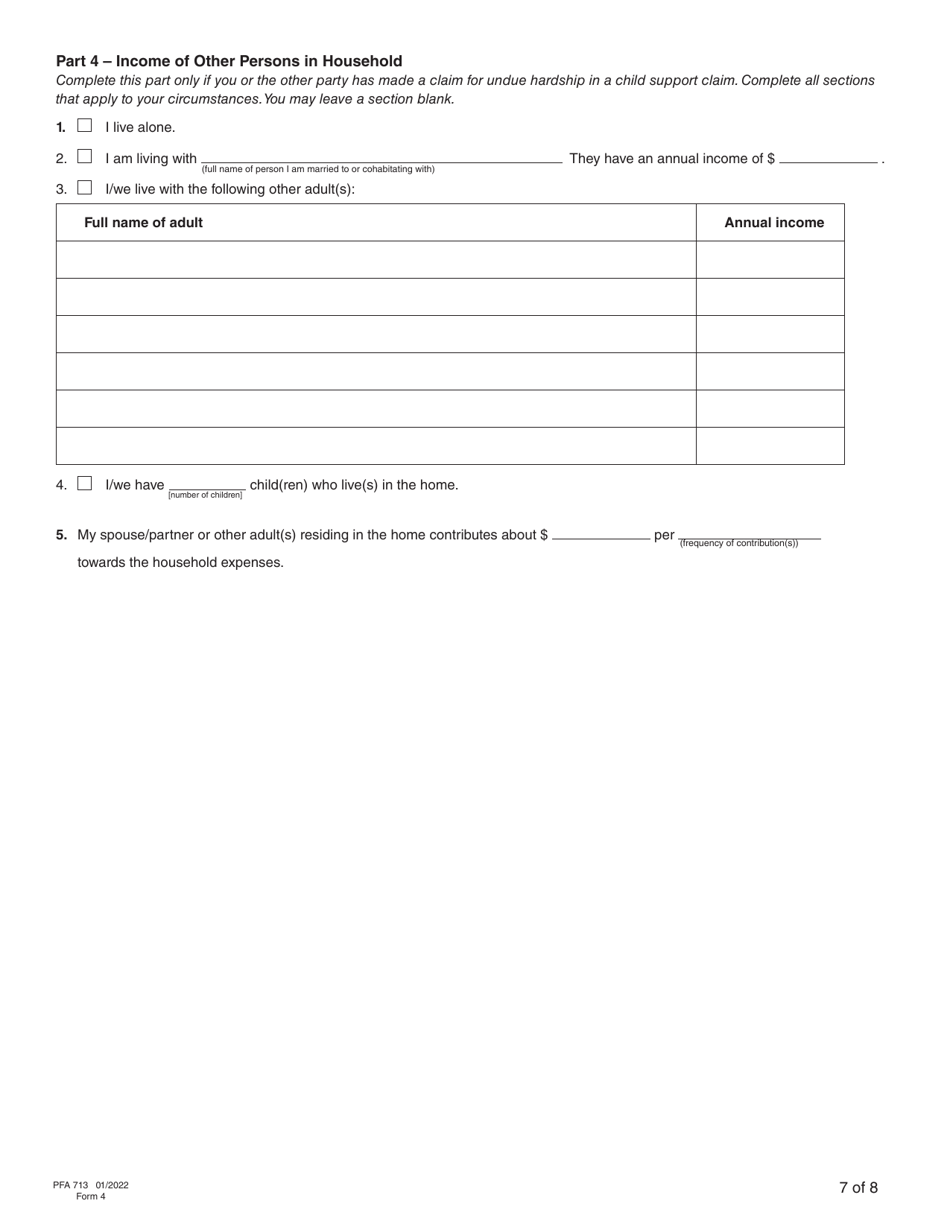

A: A Form 4 (PFA713) Financial Statement requires information about income, assets, liabilities, and expenses of the individual.

Q: When do I need to file a Form 4 (PFA713) Financial Statement?

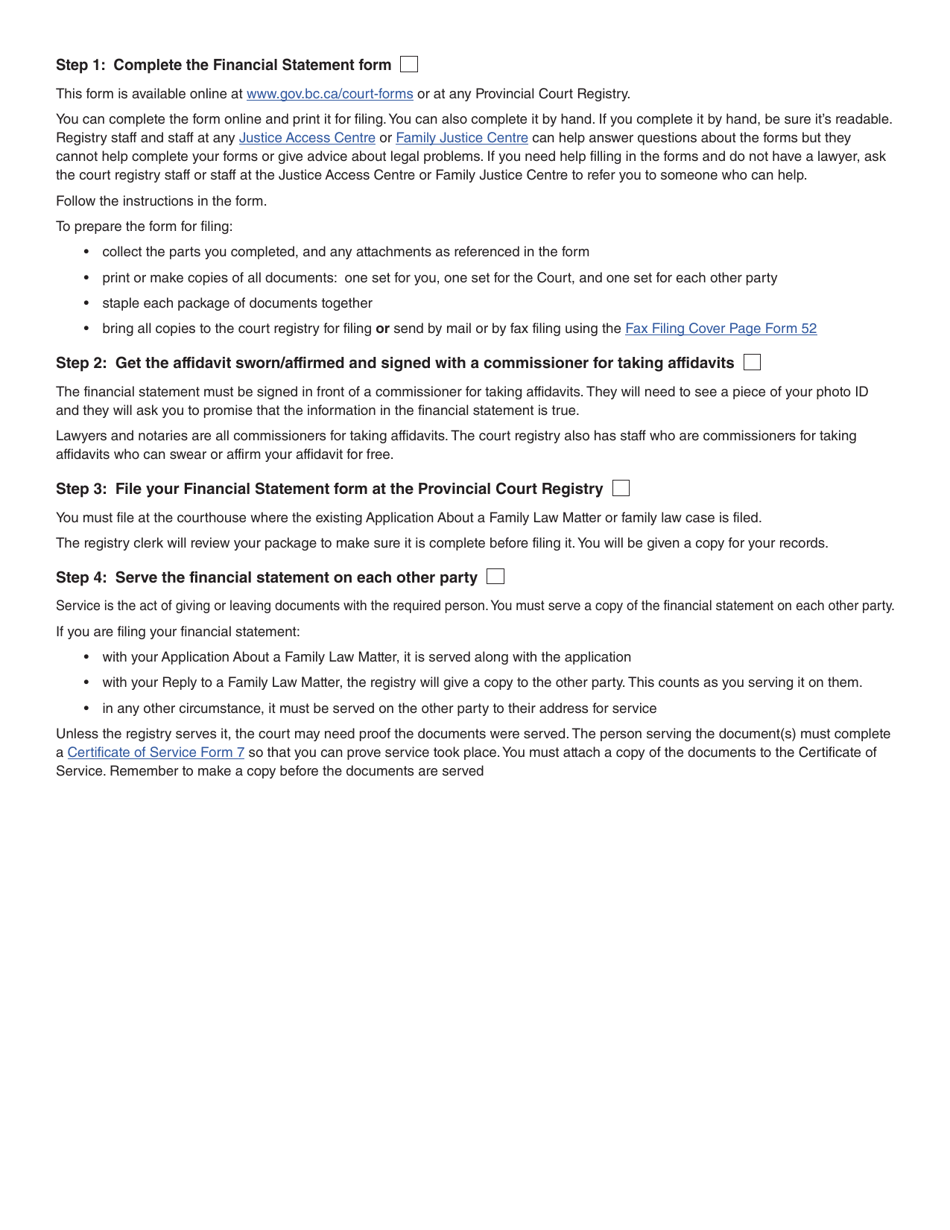

A: The timing of filing a Form 4 (PFA713) Financial Statement depends on the court order or rules of the specific family law proceedings.

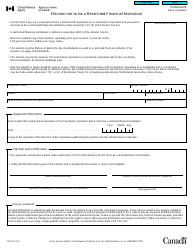

Q: Is a Form 4 (PFA713) Financial Statement confidential?

A: No, a Form 4 (PFA713) Financial Statement is not confidential. It is a court document that may be accessible to the other party, the court, and their legal representatives.

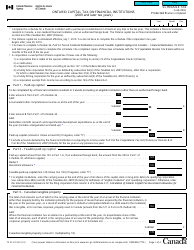

Q: Why is a Form 4 (PFA713) Financial Statement important?

A: A Form 4 (PFA713) Financial Statement is important in family law proceedings as it provides a snapshot of an individual's financial situation, which can be used to determine matters such as child support and spousal support.