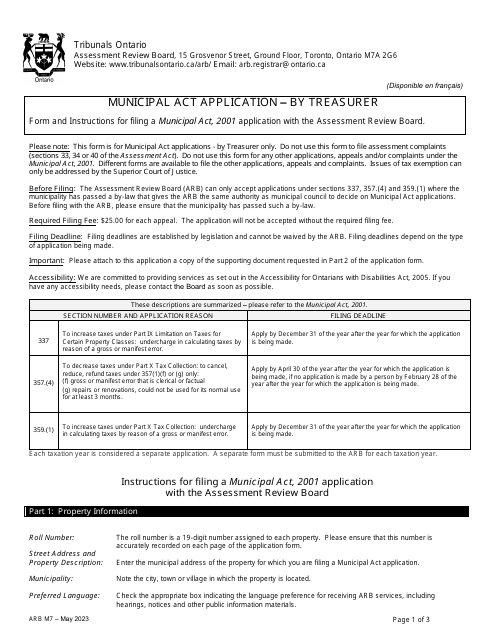

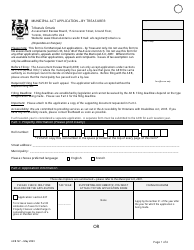

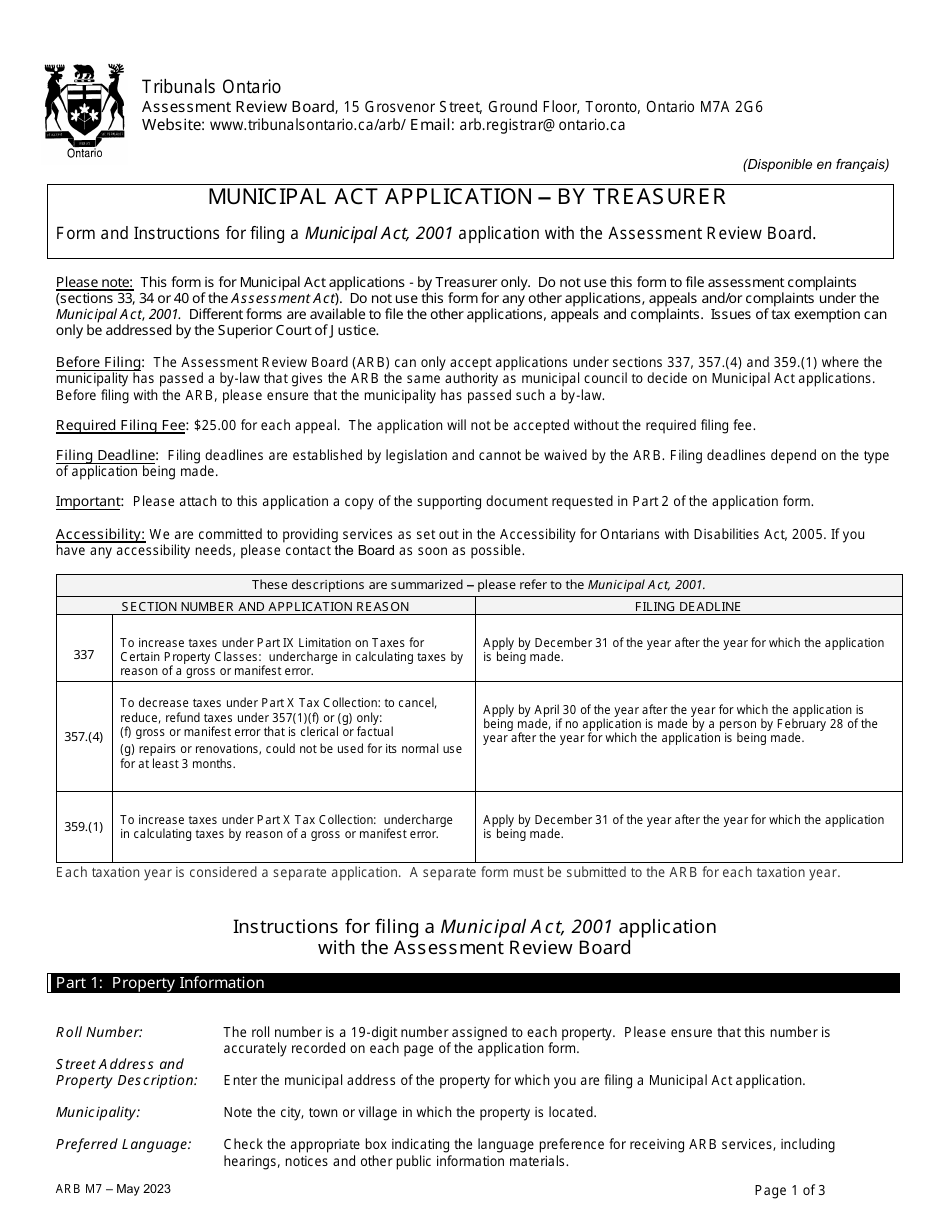

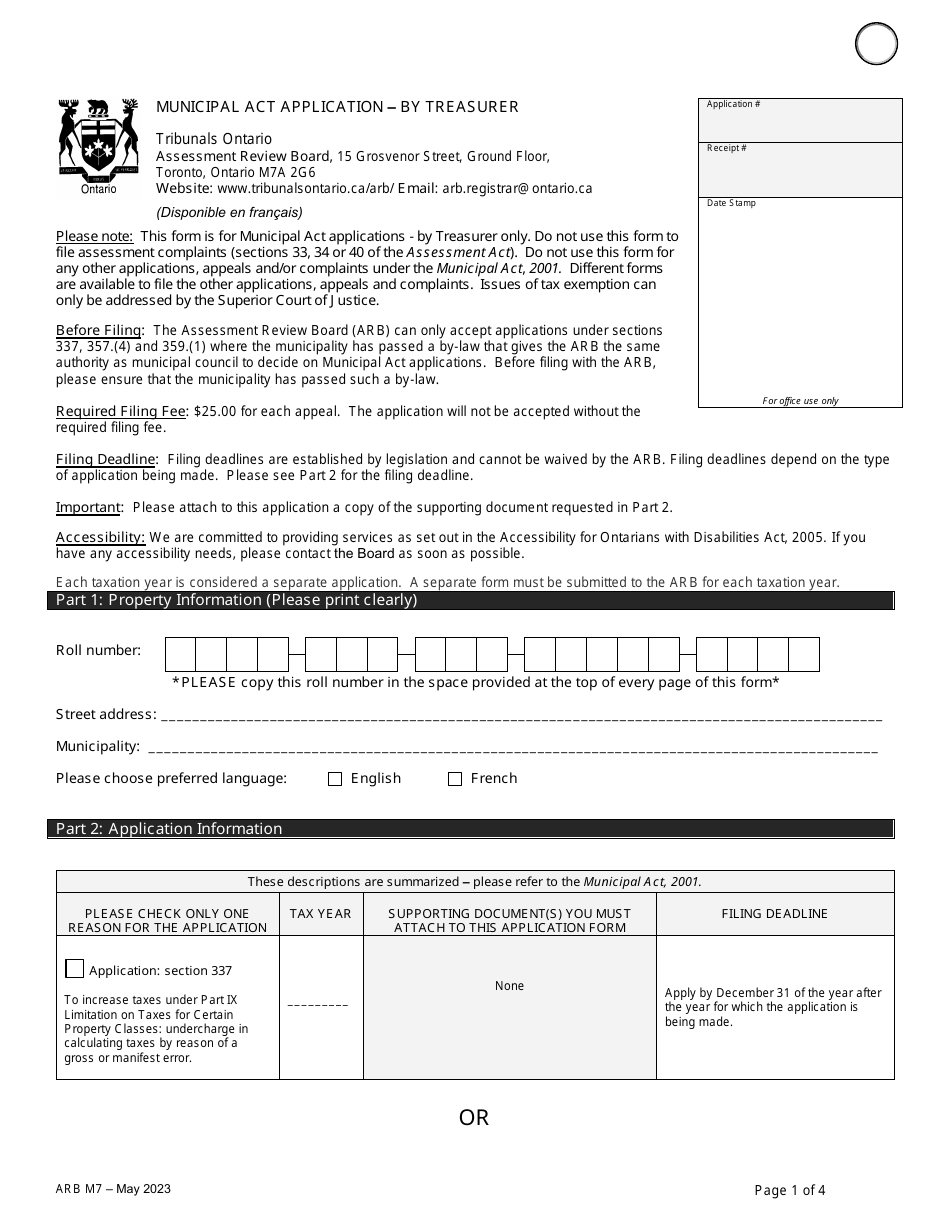

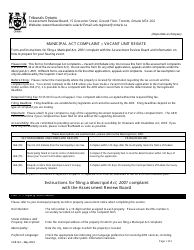

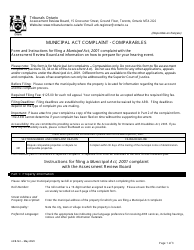

Form ARB-M7 Municipal Act Application - by Treasurer - Ontario, Canada

The Form ARB-M7 Municipal Act Application is typically filed by the Treasurer in Ontario, Canada.

Form ARB-M7 Municipal Act Application - by Treasurer - Ontario, Canada - Frequently Asked Questions (FAQ)

Q: What is the ARB-M7 Municipal Act Application?

A: The ARB-M7 Municipal Act Application is a form used by the Treasurer in the province of Ontario, Canada.

Q: Who uses the ARB-M7 Municipal Act Application?

A: The form is used by the Treasurer in Ontario, Canada.

Q: What is the purpose of the ARB-M7 Municipal Act Application?

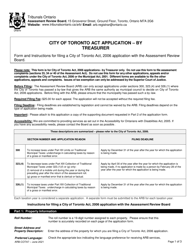

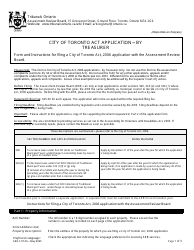

A: The purpose of the form is to provide information related to municipal tax appeals.

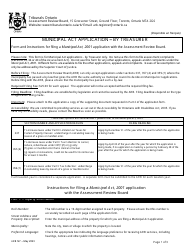

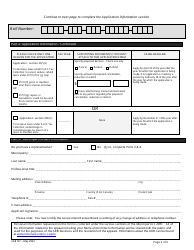

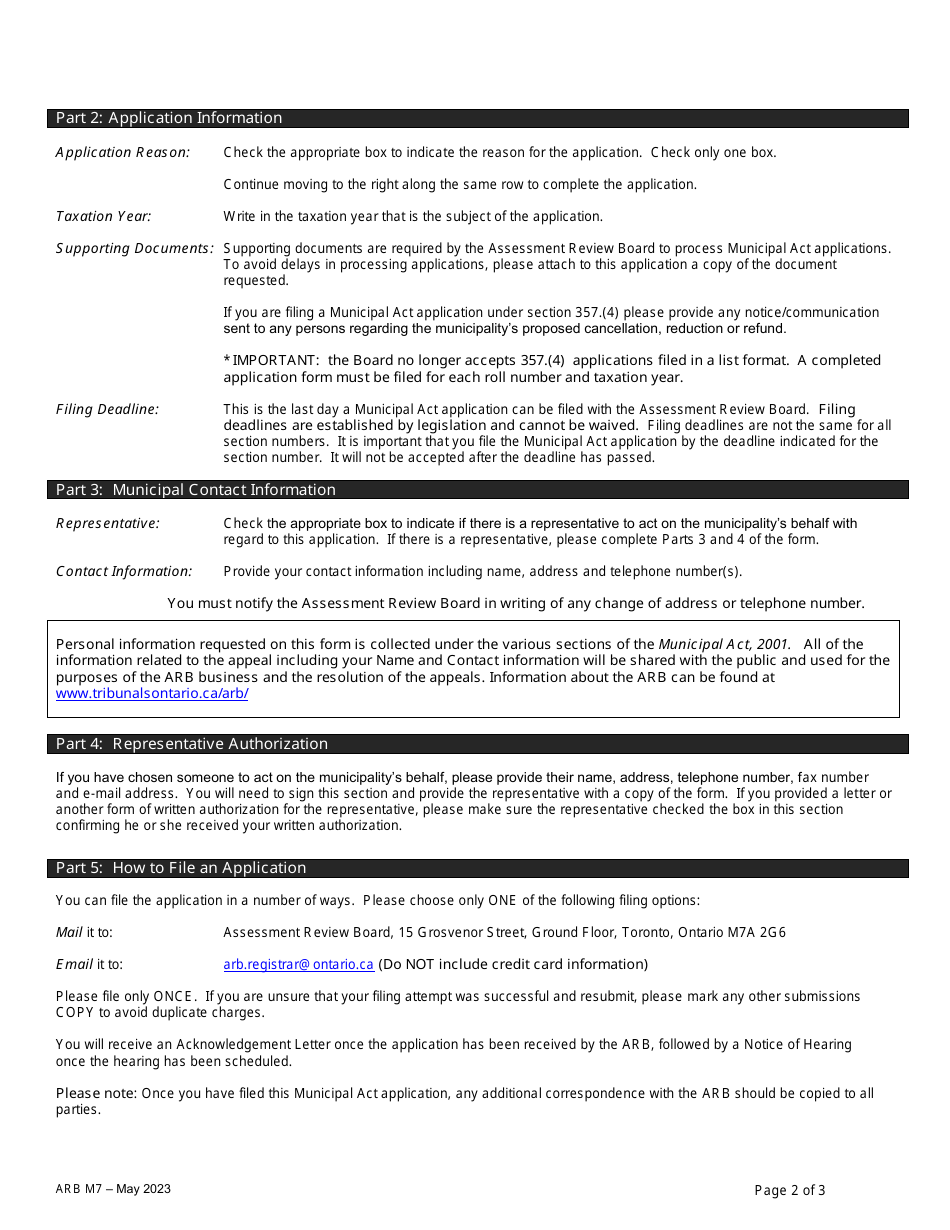

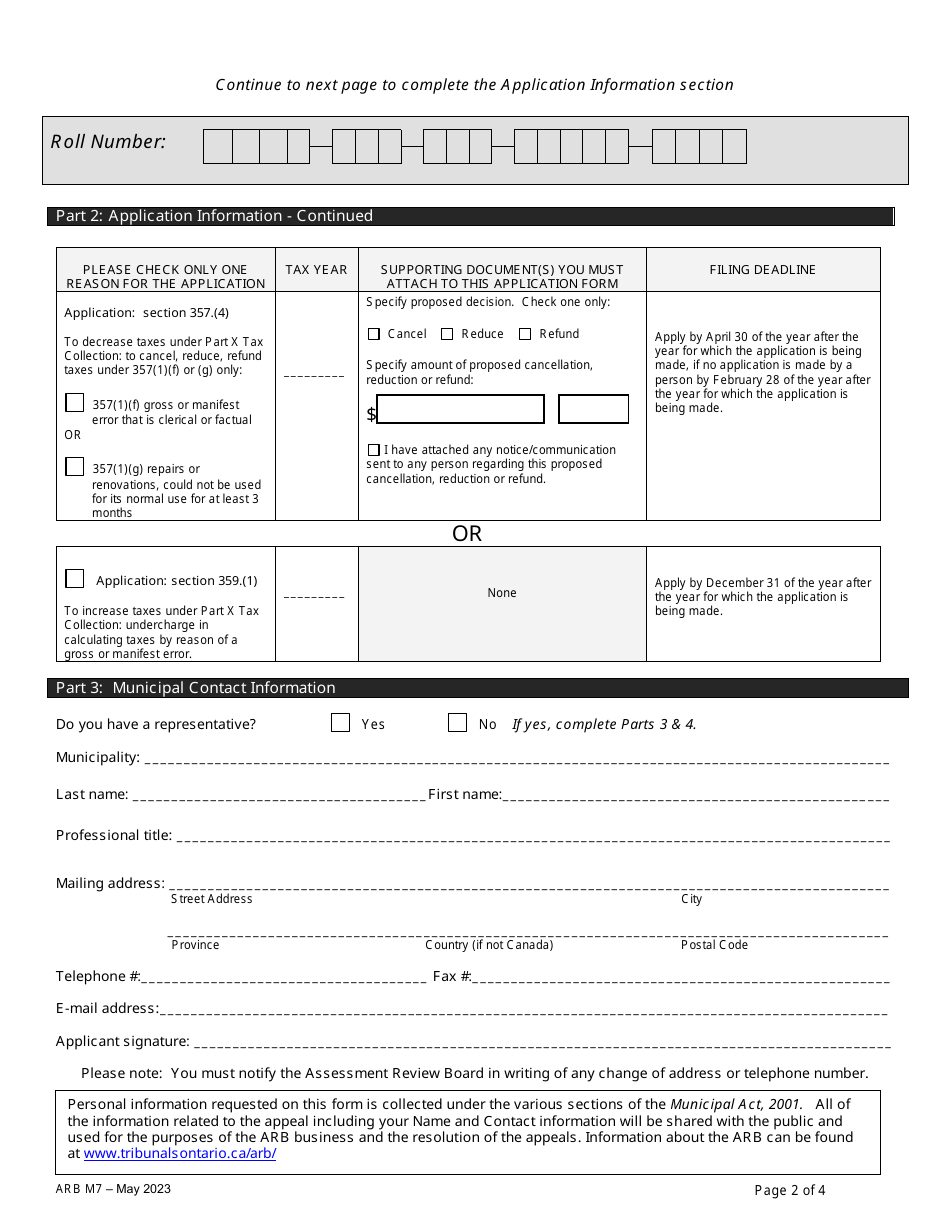

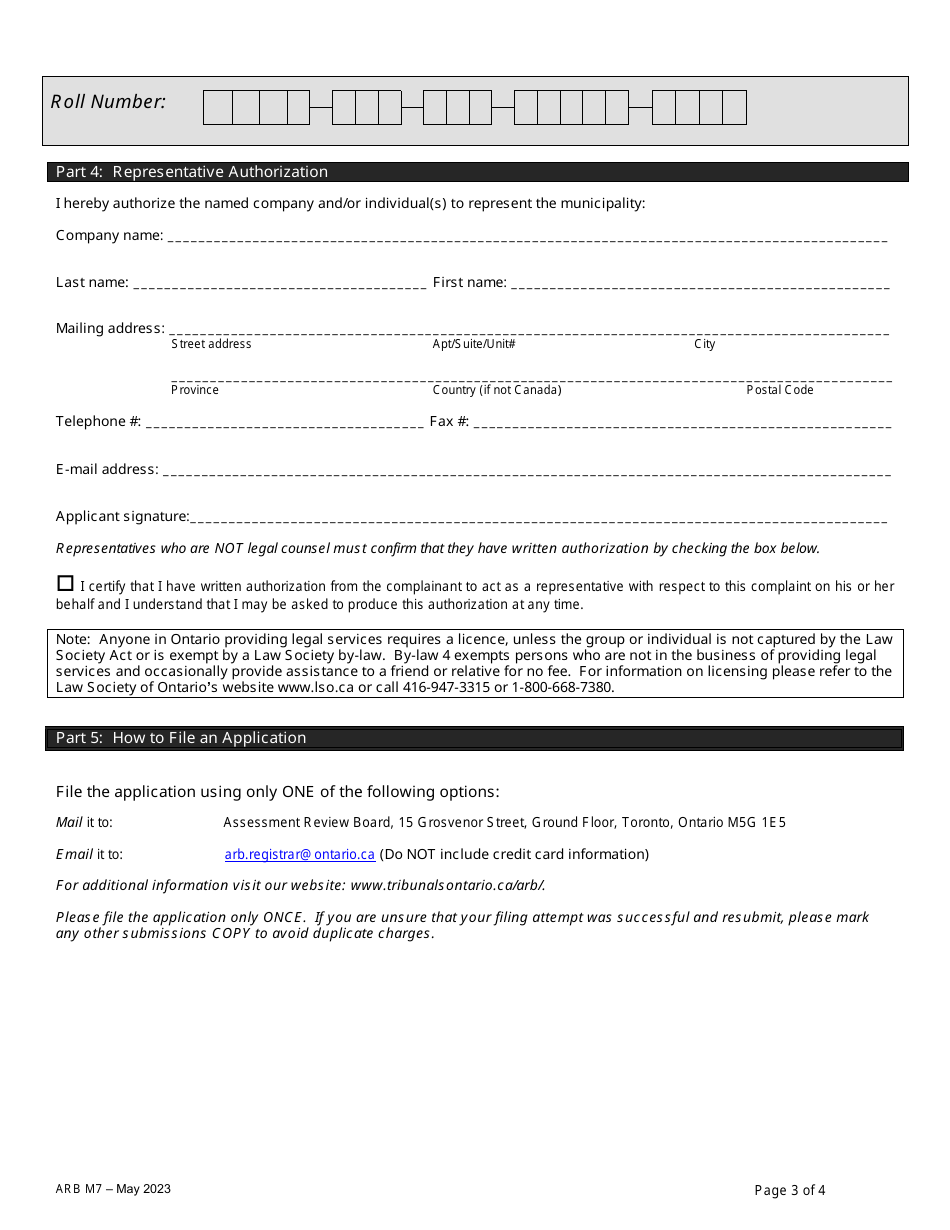

Q: What information is required on the ARB-M7 Municipal Act Application?

A: The form generally requires information related to the property being appealed, the grounds for the appeal, and details about the appellant.

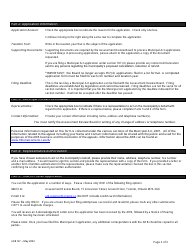

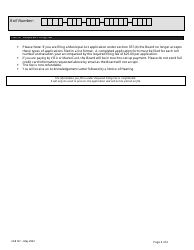

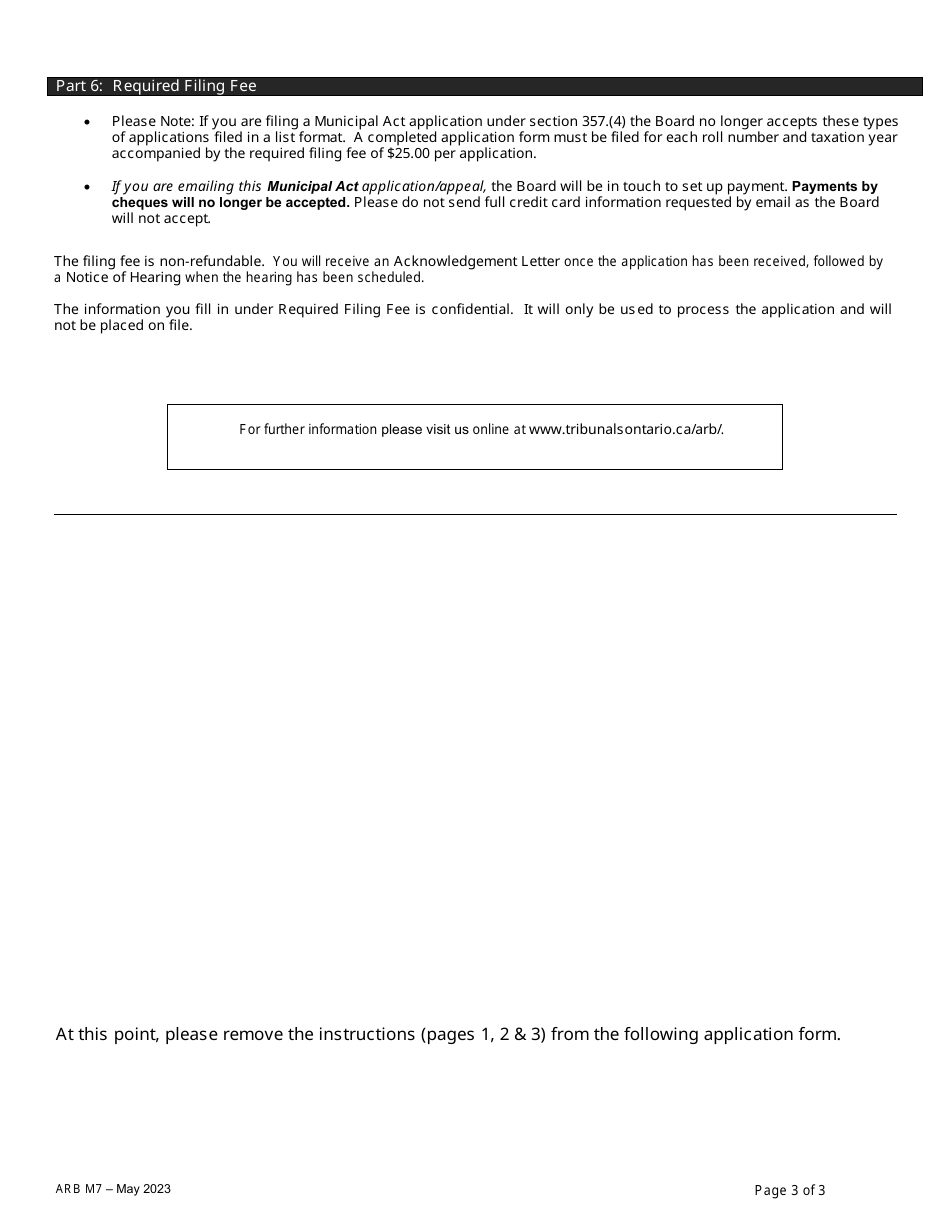

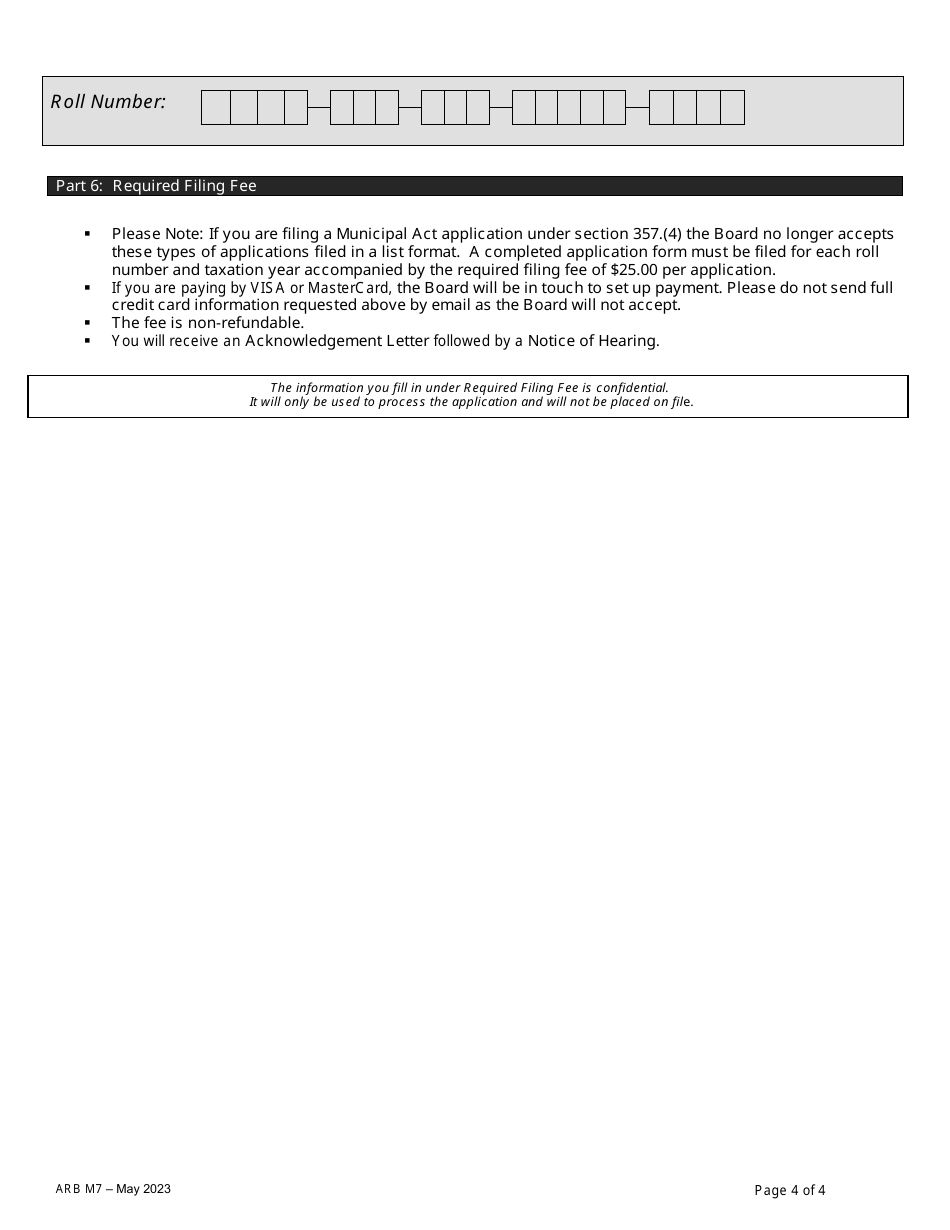

Q: Are there any fees associated with filing the ARB-M7 Municipal Act Application?

A: Yes, there may be fees associated with filing the application. The specific fees and payment methods can vary depending on the municipality.

Q: Can I get assistance or guidance in filling out the ARB-M7 Municipal Act Application form?

A: Yes, it is advisable to seek guidance from the relevant municipality or the Assessment Review Board to ensure accurate completion of the form.

Q: What is the deadline for submitting the ARB-M7 Municipal Act Application?

A: The deadline for submitting the application may vary. It is recommended to check with the municipality or the Assessment Review Board for the specific deadline.

Q: What happens after I submit the ARB-M7 Municipal Act Application?

A: After submitting the application, it will be reviewed by the Assessment Review Board. They will assess the appeal and make a decision regarding the municipal taxes based on the information provided.