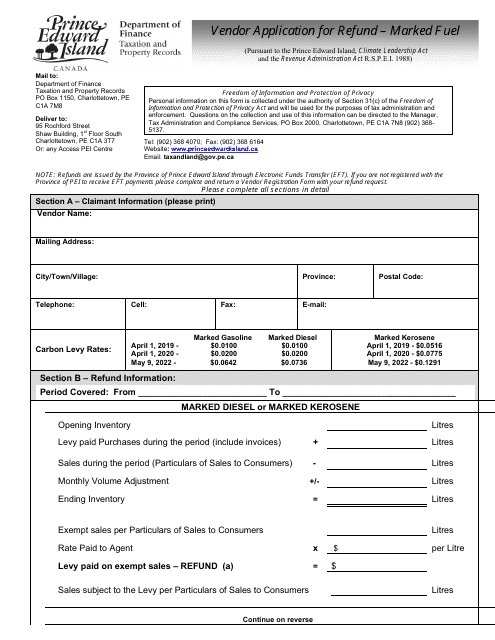

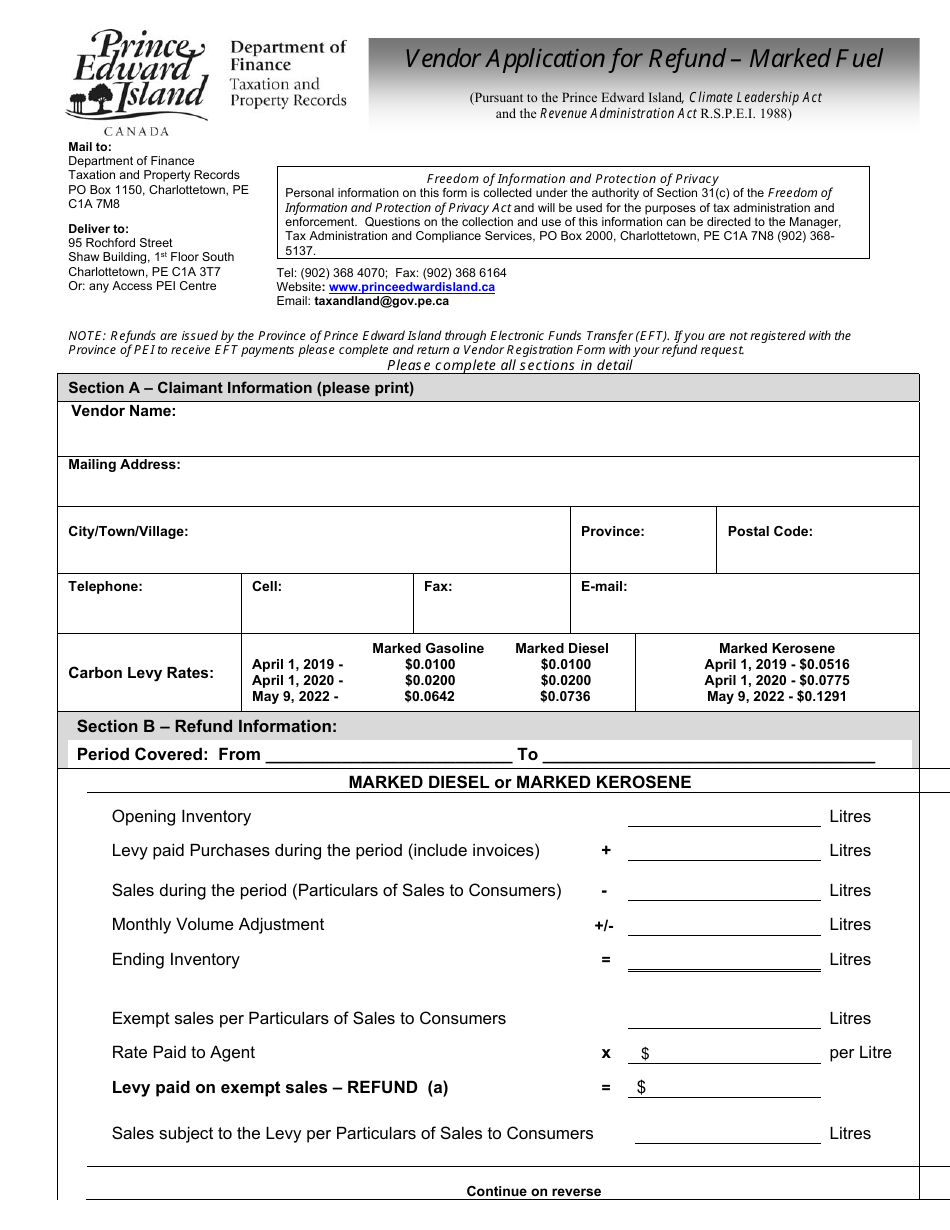

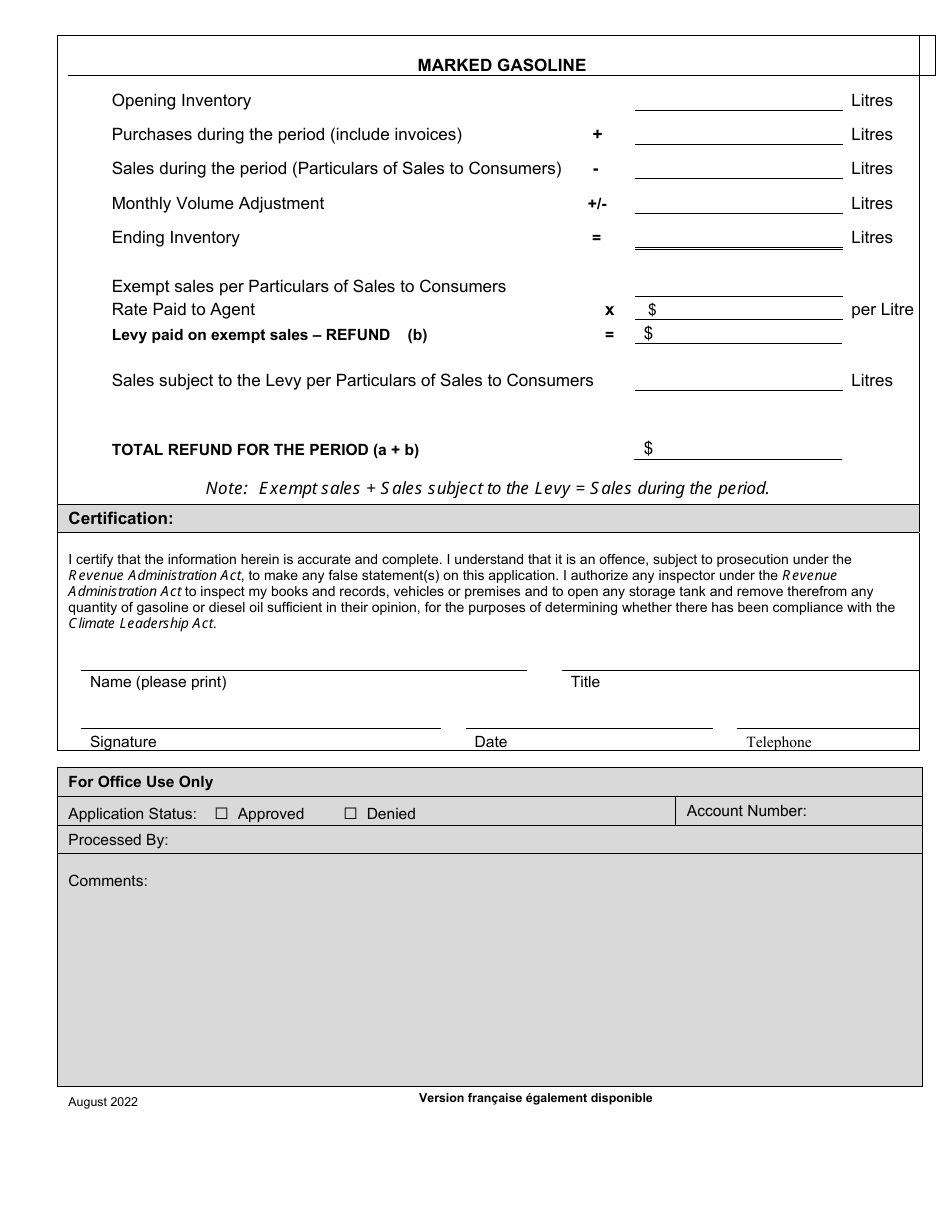

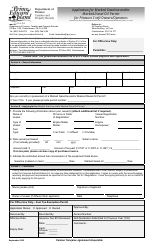

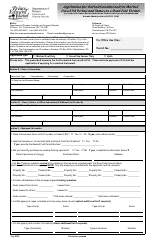

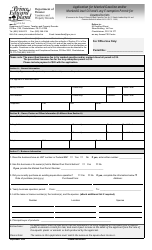

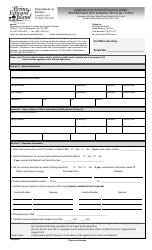

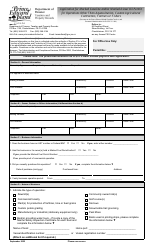

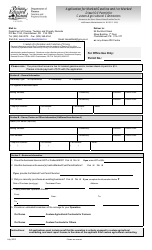

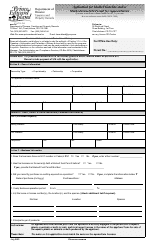

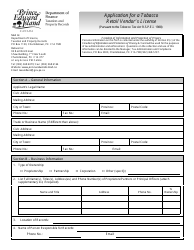

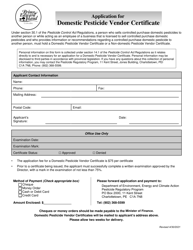

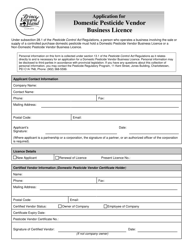

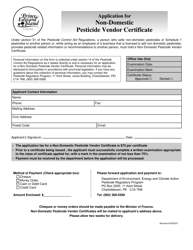

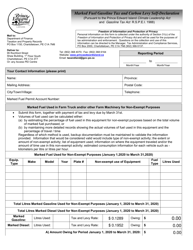

Vendor Application for Refund - Marked Fuel - Prince Edward Island, Canada

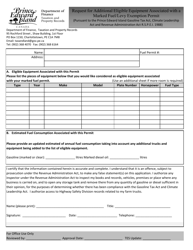

The Vendor Application for Refund - Marked Fuel in Prince Edward Island, Canada is for vendors who wish to claim a refund on the tax paid for marked or dyed fuel that was used for non-taxable purposes, such as farming or fishing.

The vendor would typically file the application for refund on marked fuel in Prince Edward Island, Canada. However, it is always advisable to consult the local tax authorities or relevant government agencies for specific filing requirements.

Vendor Application for Refund - Marked Fuel - Prince Edward Island, Canada - Frequently Asked Questions (FAQ)

Q: What is a Vendor Application for Refund?

A: A Vendor Application for Refund is a form to request a refund for marked fuel in Prince Edward Island, Canada.

Q: What is marked fuel?

A: Marked fuel is fuel that has been dyed or otherwise marked for specific purposes, such as tax exemptions.

Q: Who can apply for a refund?

A: Vendors who have purchased and used marked fuel in Prince Edward Island can apply for a refund.

Q: How can I apply for a refund?

A: You can apply for a refund by completing and submitting a Vendor Application for Refund form.

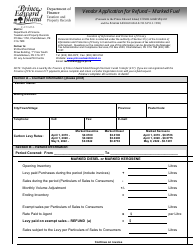

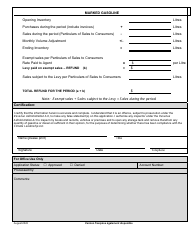

Q: What information do I need to provide on the form?

A: You will need to provide details about your business, the amount of marked fuel purchased, and supporting documentation.

Q: Is there a deadline to submit the refund application?

A: Yes, the refund application must be submitted within one year from the date of purchase of the marked fuel.

Q: How long does it take to process the refund?

A: Processing times may vary, but it generally takes about 30 days for the refund to be processed.

Q: Can I apply for a refund if I have already sold the marked fuel?

A: No, you are not eligible for a refund if you have sold or transferred the marked fuel to another party.

Q: What happens if my refund application is approved?

A: If your refund application is approved, you will receive the refund amount via cheque or direct deposit.