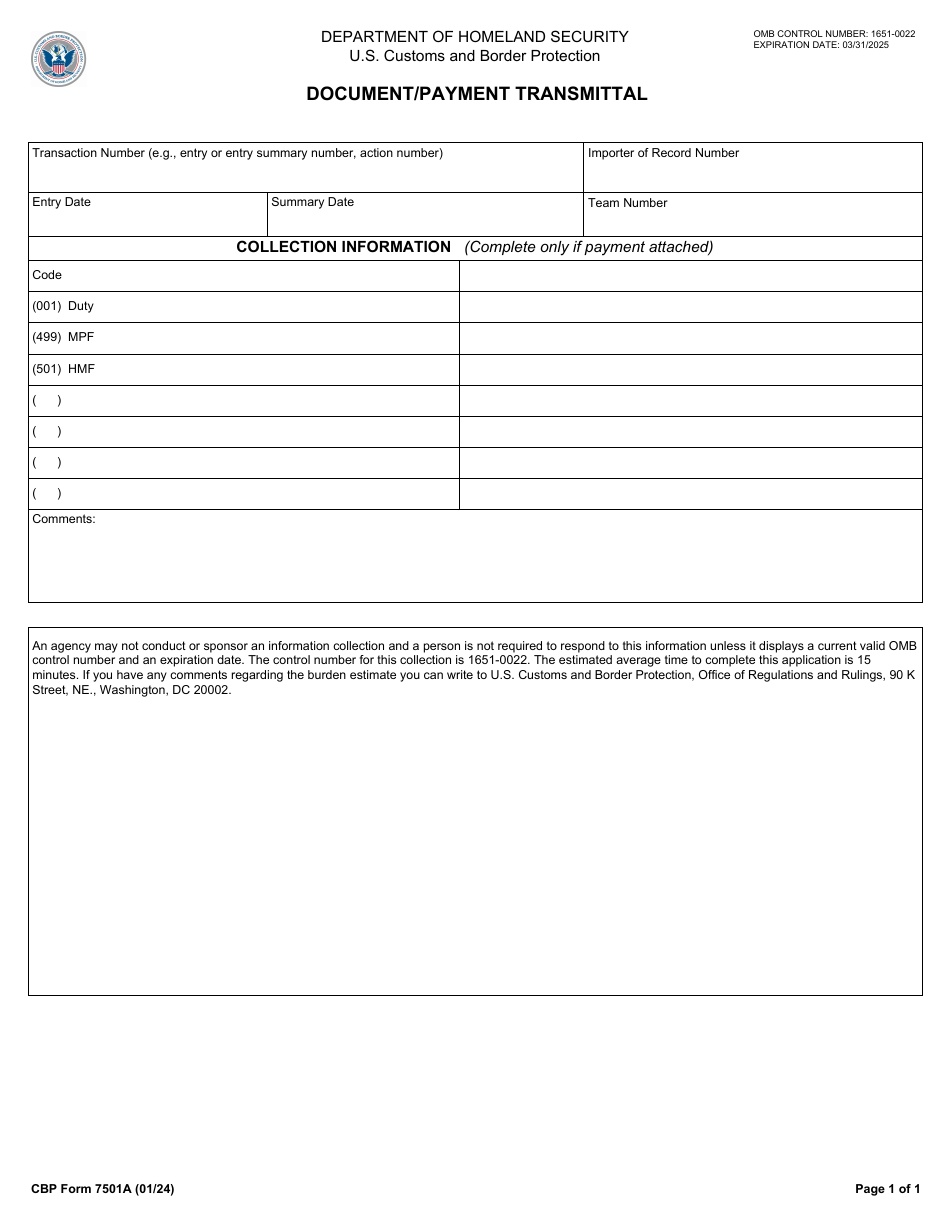

CBP Form 7501A Document / Payment Transmittal

What Is CBP Form 7501A?

CBP Form 7501A, Document/Payment Transmittal , is a form used to reconcile a supplemental payment after an initial automated clearing house (electronic network for financial transactions) payment with the associated entry. It gives proper credit to the respondent's account.

The latest version of the form was released by Customs and Border Protection (CBP) on January 1, 2024 , with all previous editions obsolete. A fillable CBP Form 7501A is available for download below.

CBP Form 7501, Entry Summary, is a related form used by the CBP to determine relevant information (for example, origin, classification, appraisement) relating to the imported commodity. It identifies merchandise entering the commerce of the United States and documents the amount of tax and/or duty paid.

CBP Form 7501A Instructions

This form requires to provide information already submitted on CBP Form 7501, so you need to have it completed to transfer the data. It may be used to submit documents or money due related to an Automated Commercial Environment (ACE) entry summary.

Record all estimated charges and fees (duty, internal revenue tax, anti-dumping/countervailing duties) calculated by applying the rate times the dutiable quantity or value. If you have questions or comments relating to the burden estimate, you may contact the CBP Office of Regulations and Rulings.

How to Complete CBP Form 7501A?

- Write down the transaction number. It may be an entry or entry summary number, or an action number. The entry number is indicated on the top of the first page of the entry summary form. It consists of the three-digit filer code, the seven-digit entry number, and the one-digit check digit. The entry number is assigned by the filer in any manner convenient. You can find the formula for calculating the check digit in CBP Form 7501 instructions.

- Record the Employee Identification Number (EIN), Social Security Number (SSN), or the CBP-assigned number to identify the importer of record. The importer of record may at the same time be a consignee.

- State the month, day, and year on which the merchandise is released, except for quota goods, immediate delivery, or when the filer requests another date prior to release. Use the following format: MM/DD/YYYY. The filer bears the responsibility to ensure that the entry date indicated for entry/entry summaries is the date of the presentation, that is, the time stamp date. The entry date for a warehouse withdrawal is considered to be a date of withdrawal.

- Indicate the date on which the entry summary is to be filed with the CBP. Record the proper team number designation (three-character code). It is supplied by the CBP's automated system.

- If the payment is attached, complete the collection information. Write down the codes of the fees paid, including merchandise processing fee (MPF), harbor maintenance fee (HMF), duty, honey fee, cotton fee, pork fee, etc.

- If you want to add remarks, you can write them down in the "Comments" section.