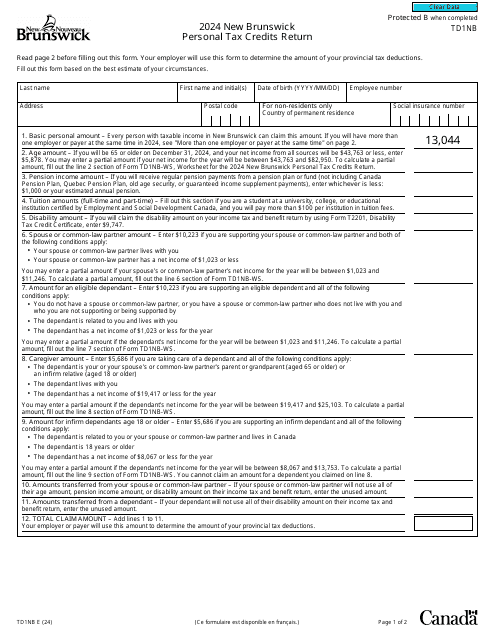

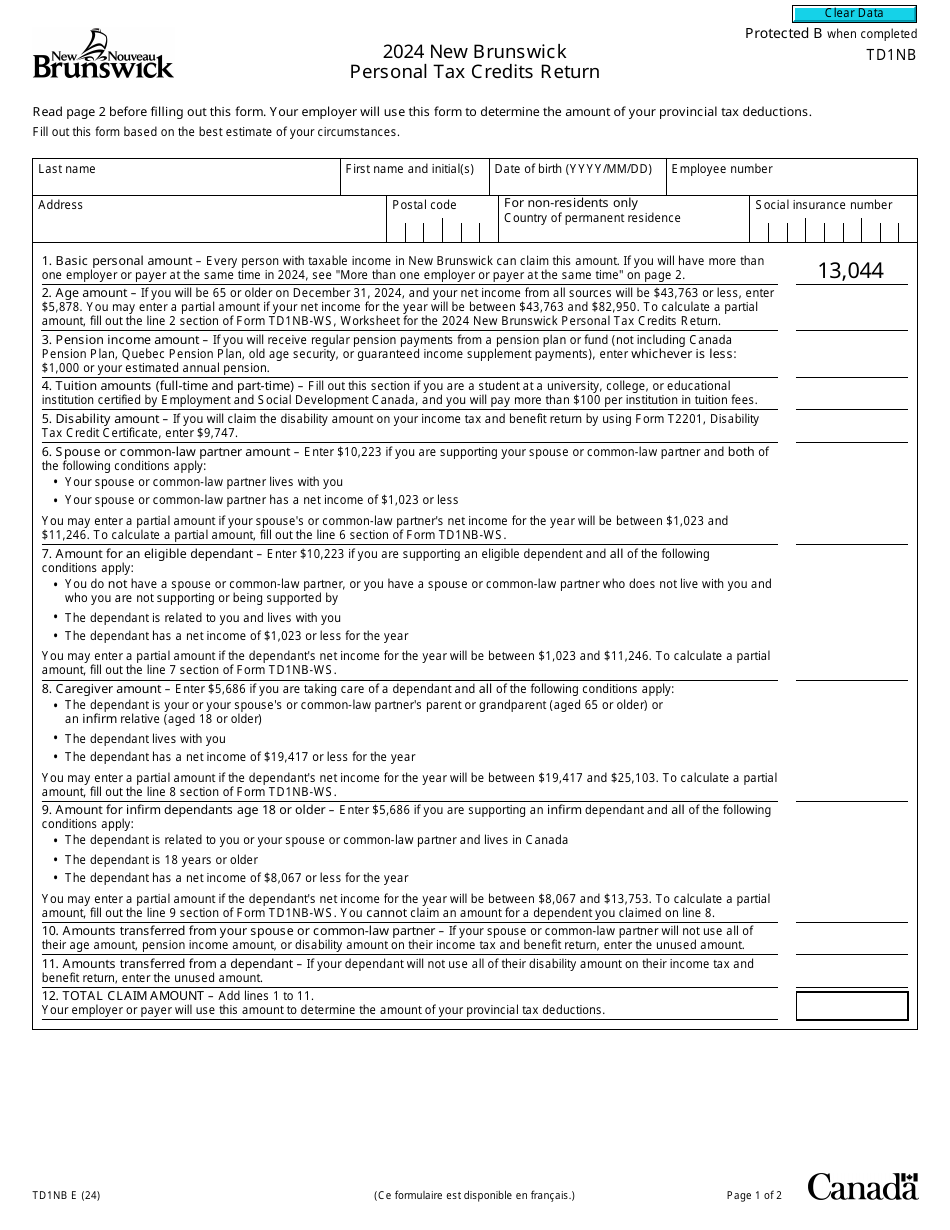

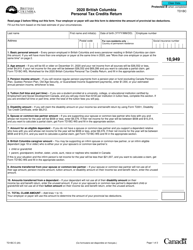

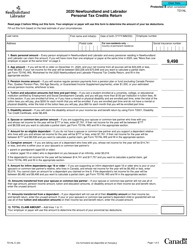

Form TD1NB New Brunswick Personal Tax Credits Return - Canada

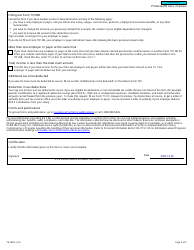

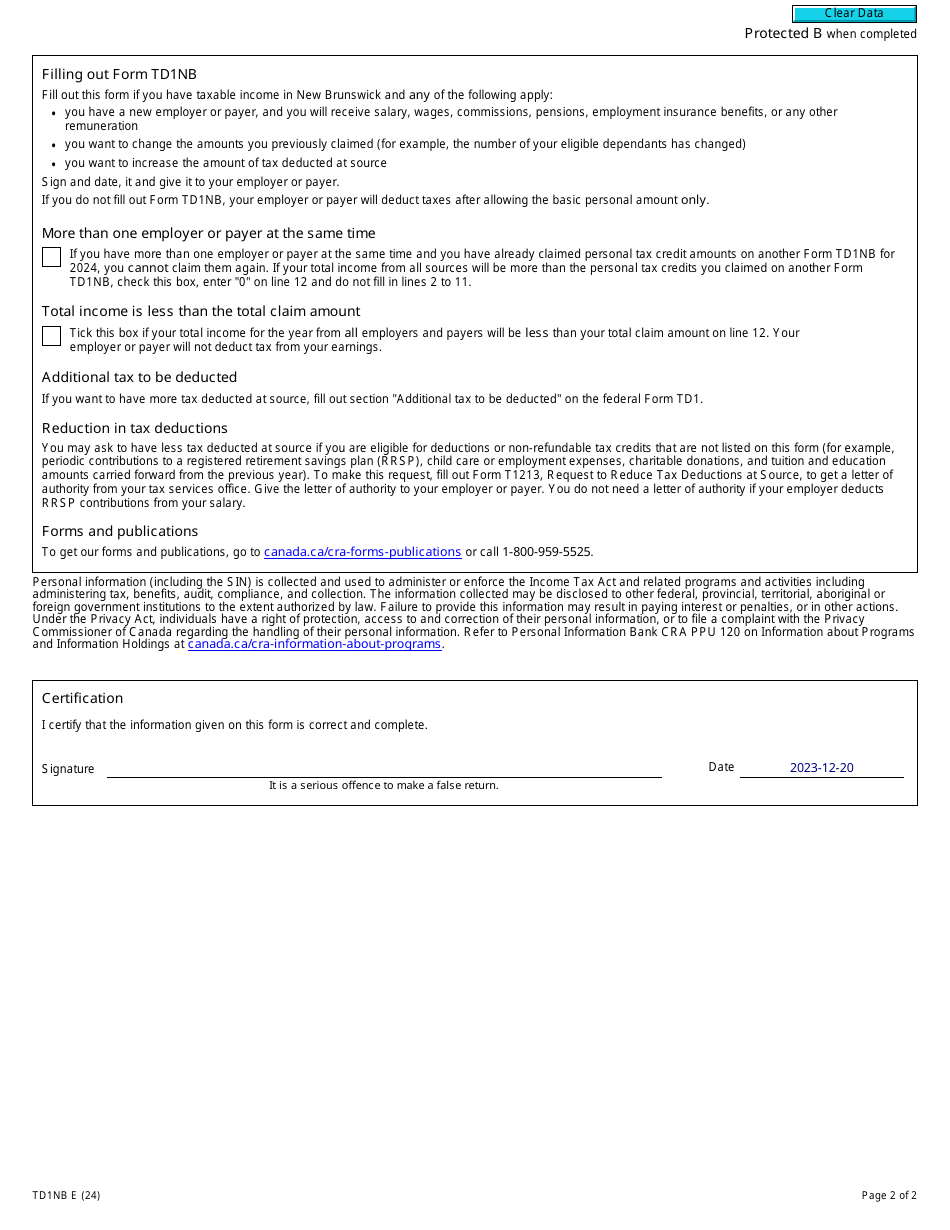

Form TD1NB, New Brunswick Personal Tax Credits Return, is used by individuals who reside in the province of New Brunswick, Canada, to calculate the amount of provincial tax credits that can be claimed on their income tax return. This form helps determine the amount of tax to be deducted from their paycheques by their employers, based on their personal and financial circumstances in New Brunswick.

The Form TD1NB New Brunswick Personal Tax Credits Return in Canada is typically filed by individuals who are residents of New Brunswick for income tax purposes.

Form TD1NB New Brunswick Personal Tax Credits Return - Canada - Frequently Asked Questions (FAQ)

Q: What is Form TD1NB?

A: Form TD1NB is the New Brunswick Personal Tax Credits Return.

Q: What is the purpose of Form TD1NB?

A: The purpose of Form TD1NB is to determine the amount of tax to be deducted from an individual's income in New Brunswick.

Q: Who needs to fill out Form TD1NB?

A: Residents of New Brunswick who want more accurate tax deductions from their income need to fill out Form TD1NB.

Q: Are there any deadlines for submitting Form TD1NB?

A: Form TD1NB should be filled out and given to your employer as soon as possible, preferably at the beginning of the tax year.